6E

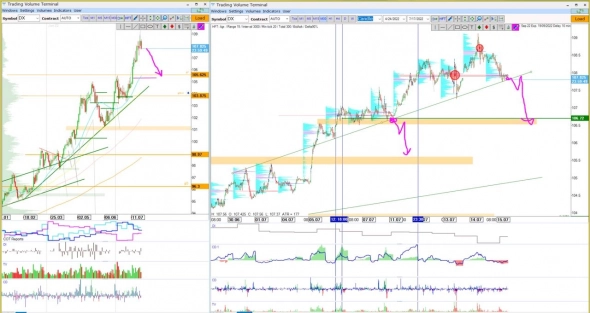

EURUSD (Фьюч 6Е). Будут ронять к зоне покупателя.

- 29 января 2024, 18:35

- |

Разберу фьючерс на Евро-Доллар, анализ биржи CME.

Сквозной анализ всех таймфреймов:

▫️долгосрочно - после кульминации покупок формируют боковик на Д1, двигаются к зоне покупателя 1,079

▫️среднесрочно - Н1 в боковике, идет попытка ухода в SELL тренд, вероятнее сломают его вниз и будут снижаться к зоне 1,079 — 1,07685, оттуда ожидаю покупателя.

▫️внутридня - М5 в SELL тренде, вероятнее дальше будут снижаться

Вход от зон покупок или продаж можно осуществлять на ретесте.

Зоны поиска продаж указал на графике

#6E (EURUSD) MOEX. (контракт 03-24)

✅ Телеграм, больше инструментов и ранняя аналитика — t.me/cashalot_trading

- комментировать

- Комментарии ( 0 )

⚡️ Hedgefunds made a big bet against the dollar

- 24 июля 2023, 00:41

- |

Good day traders 👋

I dedicate this review to the big changings in COT positions of hedge funds in the Euro (6E), British Pound (6B), and Silver (SI).

⚡️ Let's measure the market situation after this volatile week.

- 19 марта 2023, 15:53

- |

Good Sunday, traders!

Let's measure the market situation after this volatile week.

▪️ Last time we expected falling in Euro. This occurred not on Monday-Tuesday, but on Wednesday we had a downside reaction on 400 futures points. But then the market again returned to balance and returned almost all weekly losses. (Watch)

I think that it will continue falling, but of course Till FED by the 22 of March the market will be in a state of uncertainty and low liquidity.

▪️ Opinion about the grain market, particularly Corn (ZC) (Watch)

( Читать дальше )

According to the latest news, next week will be hot for sure. 🔥

- 12 марта 2023, 17:27

- |

Hello, traders!

According to the latest news, next week will be hot for sure. 🔥

On Thursday we received on Euro (6E) the incredible uprising of open interest (+18K contracts) in “Put” options strike 1.04 (Watch prnt.sc/n_GEI456fpjG)

Amazing, before the technical support! 🤪

That was a big hedge before the bankruptcy of Silicon Valley Bank, someone understood that the time would come to withdraw dollar liquidity from the market.

All currencies, except the dollar DXY, will feel strong pressure from sellers and Indices of course next week.

Stronger, to my mind, will be the Grain market.

In continuation of the previous downside forecast for Сorn (ZC) (Watch prnt.sc/HHsH8uCit3sm)

( Читать дальше )

⚡️ Fresh volume view on Coffee, Corn, Oil, SP500, Gas, Pound

- 11 декабря 2022, 01:50

- |

Today I finally made a short but very intense review of the most interesting current imbalances on the most liquid instruments of commodities, currencies and indices. 🤩

A fresh view on Coffee (KC), Corn (ZW), Crude Oil (CL), Brent (BR), S&P500 (ES), Natural Gas (NG), British Pound (6B), Euro (6E), Mexican peso (6M).

Really a lot of peculiar market pictures to workout the following week 💪

This 10 minutes video is ready for your attention! 👇

( Читать дальше )

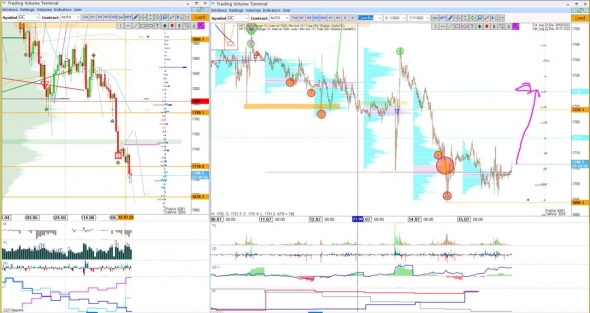

Bullish DXY and very Bearish S&P 500!

- 28 августа 2022, 15:12

- |

Bullish DXY and very Bearish S&P500!

Good day, Traders, NEW video analysis is ready!

The majority of ideas worked out that week. Today we will try to predict further movements and speak about Dollar Index (DX), Euro (6E), New Zealand dollar (6N), and Mexican peso (6M).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

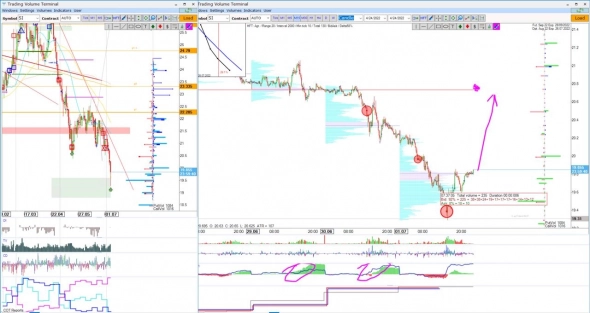

DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

СME Futures Analysis 03.07.2022 + video

- 03 июля 2022, 21:08

- |

Good evening, Traders!

Let's observe the market and prepare for the next week!

🔻 Gold (GC) showed entry points 3 times in a row that week, and honestly, I participated in each one. I expected this scenario before, you can see it in my previous reviews. Now I see that it is necessary to be patient and not react to local imbalances. Hier timeframes are in the game. Huge stop-losses were collected and there is enough fuel to go higher. It will be not a surprise if the price will go to 2000 from here. (See)

🔻 Silver (Si) is the same. The first magnet is volume level 20.8 and then we can go even higher. (See)

( Читать дальше )

CME Futures Analysis 29.05.2022

- 29 мая 2022, 18:41

- |

Hello, traders! Let's look how amazing the second week in raw was with settled priorities and predictions.

🔻 Look at S&P500 (ES)! During 5 days our target was absolutely achieved. The strong imbalance that occurred after the breakdown of the 3850 support level was greatly respected. For now, we observe new ask imbalances, which moved the price higher. I want you to measure the divergence of CD and CDQ on May 17. The quantitative delta +6,5K of market buys but at the same time the volume of CD was -13K shorts. It is often called advance purchases, which work like a magnet for future recovery and the price can go even higher. The second chance to enter longs was after returning to 3900 and stopping HFT volumes and hedging in Put options. The only way to enter with a high risk-reward ratio is to accept the local fear.

🔻 Our next target was 1.07 in Euro (6E) and it was violated no worse than the previous one1.06. And as I told you in my previous video, the levels on which we see huge block trades are very important for the price. And 1.075 was really respected this week. Also now we are in the zone of the least options payouts and the price came here and I think till July 3 it will stay near this zone.

All this movement before was thanks to funds, which accumulated 36K contracts long position, and we — swing traders can use this market inefficiencies to make our profit.

🔻 Only Oil (CL) gives us an opportunity according to the scenario which we predicted before. After the move to the upside we have a very very strong

( Читать дальше )

Неудобный ЛП по евродоллару 21.04

- 21 апреля 2022, 11:52

- |

Часовой график, CME. Цена дошла до нижней границы, и стал формироваться ложный пробой.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал