SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

NASDAQ

Торговля премаркета и стоп-ордера

- 17 июля 2013, 20:08

- |

Торговля премаркета и стоп-ордера

Сейчас для многих трейдеров становится актуальной торговля премаркета, поскольку многие движения начинаются и иногда заканчиваются еще до открытия регулярной торговой сессии на NYSE, в первую очередь это относится к новостным акциям. У нерегулярной сессии есть несколько особенностей:- Невыская ликвидность

- Большие спреды

- Потенциальный риск выхода новостей и, как следствие, есть вероятность сильного движения против открытой позиции

- Работают только лимитные ордера

( Читать дальше )

- комментировать

- 598 | ★14

- Комментарии ( 0 )

Аналитика на 17 июля

- 17 июля 2013, 16:50

- |

Спайдер повышается перед открытием торгов на NYSE.

- Европейские индексы на положительной территории.

SPY (внутридневной график) рост на премаркете. Сопротивление: 168.00 Поддержка: 167.50

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: NTRS +5.2%, IGTE +4.5%, FBRC +4.1%, PKG +3.2%, ASML +2.1%, RLGY +2%, (following spike higher into the close, also Realogy announces that certain funds affiliated with Apollo Global Management (APO) have agreed to sell 25,125,070 shares of Realogy common stock in a secondary public offering), YHOO +1.9%, BK +1.8%, CSX +1.5%, WNS +1.5%, STJ +1.4%, BAC +1.3%, BHP +1.1%.

M&A news: MEAD +14.8% (terminates JOC merger agreement, announces merger agreement with affiliates of Ningbo Sunny Electronic for $4.21 Per Share).

( Читать дальше )

Эпоха алчности"(Мочилово на Уолл стрит)

- 17 июля 2013, 01:23

- |

Друзья! Вышел новый фильм Эпоха алчности!

http://rutracker.org/forum/viewtopic.php?t=4484931

На тему стоит ли покупать акции… Кто смотрел поделитесь как относитесь к близкой Вам теме!

http://rutracker.org/forum/viewtopic.php?t=4484931

На тему стоит ли покупать акции… Кто смотрел поделитесь как относитесь к близкой Вам теме!

Перспективы канадского рынка телекоммуникаций.

- 16 июля 2013, 18:34

- |

Rogers Communications Inc. (RCIAF.PK) и Telus Corporation (TU) являются двумя крупнейшими операторами мобильной связи Канады с 9,3 млн. и 7,7 млн. абонентов соответственно. Вместе они обслуживают более 60% канадского рынка, состоящего из 27 миллионов абонентов, и получают средний доход на одного абонента $ 59,68 и $ 60,02 соответственно.

Вероятно, ситуация на рынке скоро изменится. Компания Verizon Communications Inc. (VZ) якобы сделала предложение о приобретении канадскому оператору беспроводной связи Wind Mobile, имеющему 1 или 2 процента рынка. В то время как Wind обслуживает лишь несколько сотен тысяч абонентов, эта покупка нужна Verizon, скорее всего, для того, чтобы оперативно войти в рынок и начать быстро расширяться. Verizon является крупнейшим телекоммуникационным оператором США с рыночной капитализацией в $ 115 млрд. и обслуживает примерно 34% из 325 миллионов пользователей беспроводного рынка Соединенных Штатов. Она обладает достаточными ресурсами, чтобы конкурировать с канадскими компаниями, и может создать им такую жесткую конкуренцию, с которой те не сталкивались до этого момента.

( Читать дальше )

Вероятно, ситуация на рынке скоро изменится. Компания Verizon Communications Inc. (VZ) якобы сделала предложение о приобретении канадскому оператору беспроводной связи Wind Mobile, имеющему 1 или 2 процента рынка. В то время как Wind обслуживает лишь несколько сотен тысяч абонентов, эта покупка нужна Verizon, скорее всего, для того, чтобы оперативно войти в рынок и начать быстро расширяться. Verizon является крупнейшим телекоммуникационным оператором США с рыночной капитализацией в $ 115 млрд. и обслуживает примерно 34% из 325 миллионов пользователей беспроводного рынка Соединенных Штатов. Она обладает достаточными ресурсами, чтобы конкурировать с канадскими компаниями, и может создать им такую жесткую конкуренцию, с которой те не сталкивались до этого момента.

( Читать дальше )

Обзор рынка США - 16.07.2013

- 16 июля 2013, 18:31

- |

Биржевой канал от 16.07.2013

В эфире: Владимир Волков

В эфире: Владимир Волков

Аналитика на 16 июля

- 16 июля 2013, 17:10

- |

Спайдер снижается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: SOL +21.8%, NQ +8.1%, RIO +3.4%, ( reports Q2 operations results; Q2 global iron ore shipments +1% YoY ), BYI +1.9%, BRO +1.8%, WLL +1.3%, ( closes sale of Postle assets for $859.8 mln; updates Q2S guidance), JNJ +1%, GS +0.9%.

M&A news: SHFL +22% (to be acquired by BYI for 23.25).

( Читать дальше )

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: SOL +21.8%, NQ +8.1%, RIO +3.4%, ( reports Q2 operations results; Q2 global iron ore shipments +1% YoY ), BYI +1.9%, BRO +1.8%, WLL +1.3%, ( closes sale of Postle assets for $859.8 mln; updates Q2S guidance), JNJ +1%, GS +0.9%.

M&A news: SHFL +22% (to be acquired by BYI for 23.25).

( Читать дальше )

Аналитика на 15 июля

- 15 июля 2013, 17:06

- |

Спайдер повышается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: POWI +10.6%, IQNT +7.7%, C +1.9%.

M&A news: LEAP +118.4% (AT&T (T) to acquire Leap Wireless for $15 per share).

Select LEAP peers showing strength: NIHD +12.8%, S +4%, DISH +1.3%.

Select solar stocks trading higher: YGE +7%, CSIQ +4.9%, EMKR +3.9%, SOL +3.8%, JKS +3.7%, JASO +3.5%, FSLR +2.1%.

Other news: ACUR +8.1% (to develop improved NEXAFED), BWEN +6.6% (announced $87 mln in tower orders from a U.S. wind turbine manufacturer), ONVO +6.5% (still checking), GTI +6.5% (still checking, light volume), GIVN +6.1% (PillCam COLON cleared in Japan), CRIS +4.5% (announces the Conditional Approval of Erivedge in the European Union), PTNR +4.5% (still checking), REFR +4.1% (files patent infringement lawsuit against Amazon, Barnes & Noble, E Ink, and Sony), IMMU +2.8% (still checking), CGEN +2.6% (receives Issue Notification from the USPTO for a patent application covering the co's drug candidate CGEN-25009), GORO +2.1% (provides comments on trading volume from Friday), BA +1.3% (rebounding from Friday's weakness following articles on issues have been ruled out as cause of London and airlines indicating that they will stick with the 787), TSEM +1.2% (announced the extension of its business relationship with International Rectifier), RIO +1.1% (Reuters discusses that RIO has received offers for its French aluminum plant, according to reports, CET +1.1% (announces a sale of shares of Plymouth Rock for $92.75 mln).

( Читать дальше )

- Европейские индексы на положительной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: POWI +10.6%, IQNT +7.7%, C +1.9%.

M&A news: LEAP +118.4% (AT&T (T) to acquire Leap Wireless for $15 per share).

Select LEAP peers showing strength: NIHD +12.8%, S +4%, DISH +1.3%.

Select solar stocks trading higher: YGE +7%, CSIQ +4.9%, EMKR +3.9%, SOL +3.8%, JKS +3.7%, JASO +3.5%, FSLR +2.1%.

Other news: ACUR +8.1% (to develop improved NEXAFED), BWEN +6.6% (announced $87 mln in tower orders from a U.S. wind turbine manufacturer), ONVO +6.5% (still checking), GTI +6.5% (still checking, light volume), GIVN +6.1% (PillCam COLON cleared in Japan), CRIS +4.5% (announces the Conditional Approval of Erivedge in the European Union), PTNR +4.5% (still checking), REFR +4.1% (files patent infringement lawsuit against Amazon, Barnes & Noble, E Ink, and Sony), IMMU +2.8% (still checking), CGEN +2.6% (receives Issue Notification from the USPTO for a patent application covering the co's drug candidate CGEN-25009), GORO +2.1% (provides comments on trading volume from Friday), BA +1.3% (rebounding from Friday's weakness following articles on issues have been ruled out as cause of London and airlines indicating that they will stick with the 787), TSEM +1.2% (announced the extension of its business relationship with International Rectifier), RIO +1.1% (Reuters discusses that RIO has received offers for its French aluminum plant, according to reports, CET +1.1% (announces a sale of shares of Plymouth Rock for $92.75 mln).

( Читать дальше )

C чем едят ECN дейтрейдеры?

- 12 июля 2013, 19:35

- |

Решил немного осветить тему американских электронных торговых систем. В интернете уже достаточно много всевозможной информации на эту тему, но она достаточно поверхностная и зачастую не дает понимания функционирования ECN, как части инфраструктуры рынков NYSE, NASDAQ и AMEX. Еще большую путаницу в голову трейдеров вносят псевдо ECN форекс-брокеров.

Что же представляет из себя американский фондовый рынок?

Грубо говоря, американские рынки состоят из множества электронных торговых площадок, на которых идет торговля акциями. Например, возьмем акцию INTC (Intel Corp.) которая имеет листинг на бирже NASDAQ. Торговля же данной акцией проходит не только на NSDQ, но и на других площадках (ARCA, BATS, Direct Edge, NYSE) и биржах, таких как BOSX, PASX, PHLX. В зависимости от наличия заявок на покупку и на продажу на разных площадках цена акции может быть разной. Для того, чтобы покупатель или продавец получал лучшую цену при покупке или продаже акций существует правило NBBO (National Best Bid and Offer) или по-русски правило лучшего бида и оффера. Именно это правило связывает все разрозненные ECN воедино и позволяет получить лучшую цену за счет раутинга заявок при отправке маркет ордера.

( Читать дальше )

Аналитика на 12 июля

- 12 июля 2013, 17:02

- |

Спайдер незначительно изменяется перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: WBMD +18.2%, INFY +8.6%, GPS +1.6%, WFC +1.3%, JPM +0.9%..

M&A news: IGOI +42.4% (iGo (thinly traded) announces Steel Excel will acquire up to 44% of outstanding shares at $3.95 per share), SPRD +11.2% (Spreadtrum Comms enters into merger agreement to be acquired by Tsinghua Unigroup for $31.00 per share), EVC +7.9% (in sympathy with SPRD takeover), CETV +1.5% (in sympathy with SPRD takeover), DELL +1% (Icahn on Bloomberg TV says he will raise his DELL bid tmrw morning; Dell: Special Committee cautions Dell stockholders regarding Carl Icahn's 'misleading statements).

( Читать дальше )

- Европейские индексы на положительной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

In reaction to strong earnings/guidance: WBMD +18.2%, INFY +8.6%, GPS +1.6%, WFC +1.3%, JPM +0.9%..

M&A news: IGOI +42.4% (iGo (thinly traded) announces Steel Excel will acquire up to 44% of outstanding shares at $3.95 per share), SPRD +11.2% (Spreadtrum Comms enters into merger agreement to be acquired by Tsinghua Unigroup for $31.00 per share), EVC +7.9% (in sympathy with SPRD takeover), CETV +1.5% (in sympathy with SPRD takeover), DELL +1% (Icahn on Bloomberg TV says he will raise his DELL bid tmrw morning; Dell: Special Committee cautions Dell stockholders regarding Carl Icahn's 'misleading statements).

( Читать дальше )

Nyse , рассуждения и точки входа 7 ( как делать домашку дэй трейдеру ) .

- 12 июля 2013, 12:42

- |

Данный отбор акций торгуется восновном по 1min граффику. почему? — стаки которые ходят более 1-1.5 пункта в день очень редко дают маленькие стопы по 5 min граффику, а ставить стоп в акции более 15-20 центов — это убийство ( для меня ).

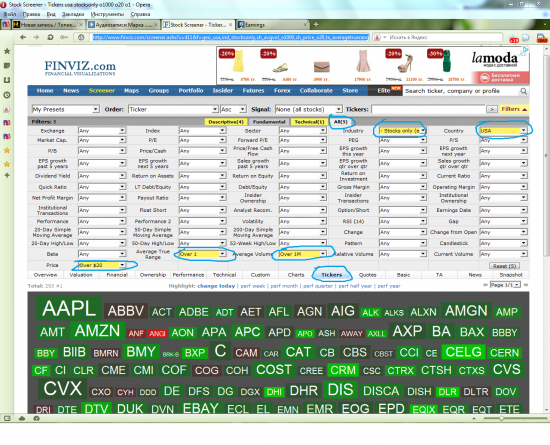

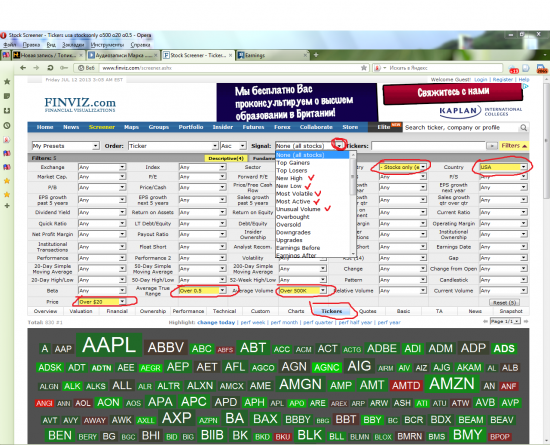

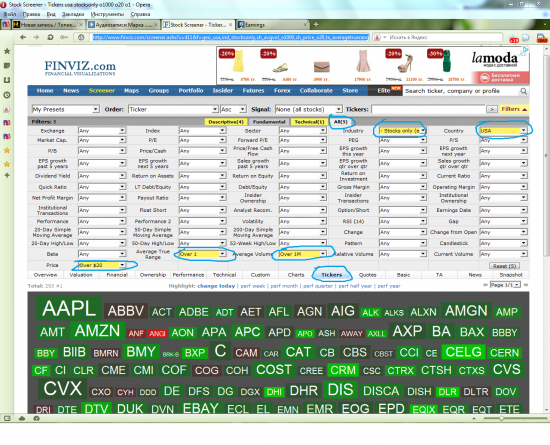

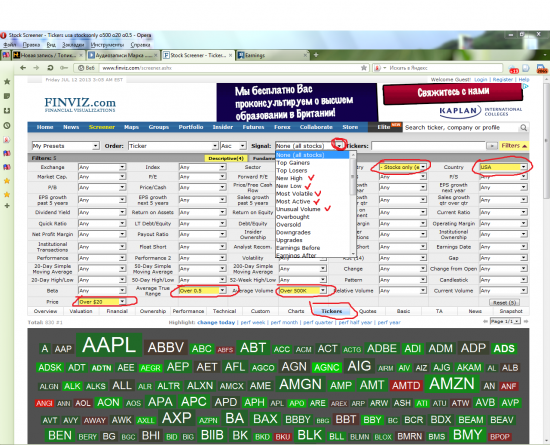

Первым делом создаем фундамент т.е отбираем стаки по фильтрам ( я пользуюсь 2 сайтами : 1) www.finviz.com 2) www.briefing.com .

На этом сайте сначало заходим в " Screener " ( в левом верхнем углу ) , затем нажимаем на " All " - ставим параметры в кружках по порядку сверху-вниз ( остальное не трогаем, даже если, что то появится дополнительное ). Снизу появятся акции — их просто выделяем и нажимаем на копировать, далее вставляем в ваш лист в программе ( у меня tos ) .

Далее опять заходим на финвиз и делаем такие настройки ( все акции добовляем в первый лист который вы создали ) .

( Читать дальше )

Первым делом создаем фундамент т.е отбираем стаки по фильтрам ( я пользуюсь 2 сайтами : 1) www.finviz.com 2) www.briefing.com .

На этом сайте сначало заходим в " Screener " ( в левом верхнем углу ) , затем нажимаем на " All " - ставим параметры в кружках по порядку сверху-вниз ( остальное не трогаем, даже если, что то появится дополнительное ). Снизу появятся акции — их просто выделяем и нажимаем на копировать, далее вставляем в ваш лист в программе ( у меня tos ) .

Далее опять заходим на финвиз и делаем такие настройки ( все акции добовляем в первый лист который вы создали ) .

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал