SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

ES E-mini

ES зона 2320

- 27 декабря 2018, 20:20

- |

Этот уровень обязательно закроют, вопрос до НГ или после?

- комментировать

- 419

- Комментарии ( 1 )

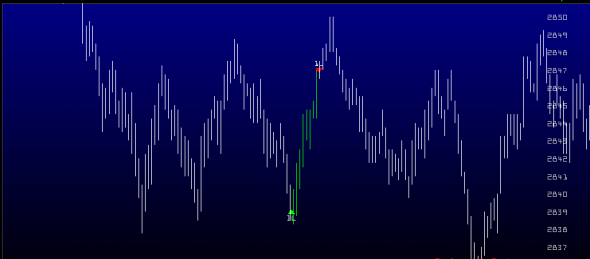

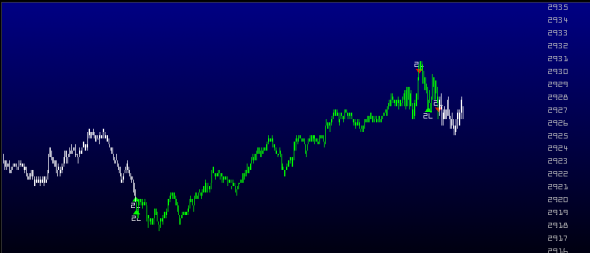

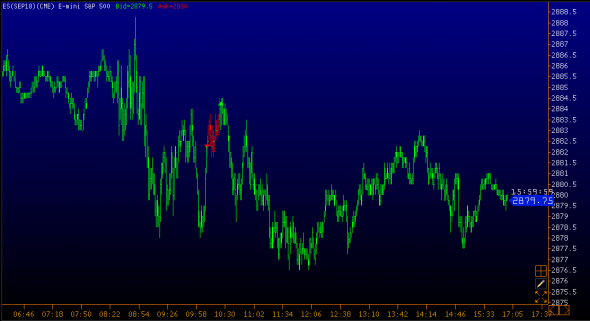

Вопрос Знатокам TA: Как называется такая красивая фигура или формация сегодня на ESZ2018 ?

- 19 декабря 2018, 23:05

- |

Вопрос Знатокам TA:

Как называется такая красивая фигура или формация сегодня на ESZ2018 ?

Или Как бы Вы ее назвали, если названия нет?

Как называется такая красивая фигура или формация сегодня на ESZ2018 ?

Или Как бы Вы ее назвали, если названия нет?

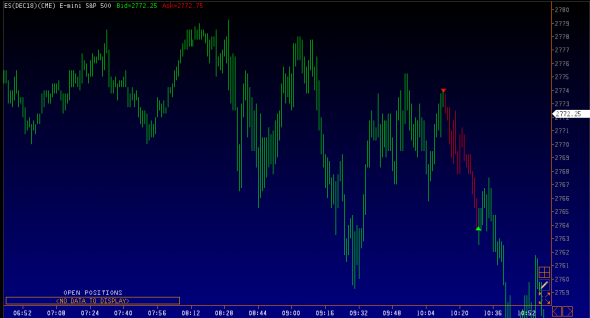

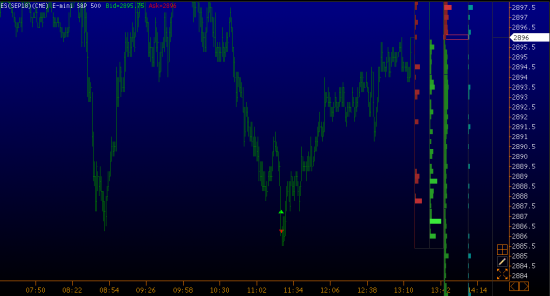

trading CME long ES итог дня

- 19 октября 2018, 18:01

- |

На этом моя торговая неделя закончилась. +16 пипс двумя контрактами 12,5$ один пипс

Трейдинг рум где я под настроение озвучиваю сигналы и логику трейдов. t.me/Trading_CME

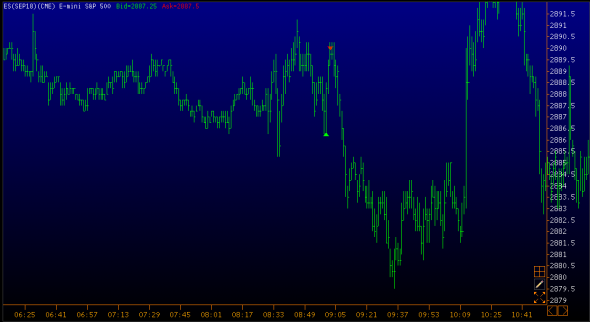

FOMC Meeting Minutes - через 15 мин.

- 17 октября 2018, 20:44

- |

(US) Preview: FOMC Meeting Minutes expected at 14:00 ET (21:00 MSK)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал