SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Отбор Акций

Аналитика NYSE на 4 октября

- 04 октября 2013, 16:47

- |

Спайдер незначительно повышается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на положительной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: CMTL +11.2%.

- Select financial related names showing strength: NBG +4.8%, IRE +3.3%, SAN +1.6%, DB +0.7%.

- Other news: DSCO +52.3% (announced FDA has agreed to the Co's updated product specifications for SURFAXIN), FST +10.2% (announces sale of Texas Panhandle Area assets for proceeds of $1.0 bln), STXS +5.8% (may be related to medical device news yesterday, still checking), NOAH +6.3% (light volume, Noah Holdings States that its policy is not to comment on unusual market activity or rumors), FI +4.5% (positive MadMoney mention), TSLA +2.1% (Tesla Motors and Samsung (SSNLF) are in talks over battery supplies deal, according to reports), TTM +2% (Tata Motors trading 2% higher premarket following strength in overseas trading), FFIV +1.6% (positive MadMoney mention), RAD +1.4% (continued strength following comps), STJ +1.1% (continued strength on reports that some Dems support repeal of medical device tax), JCP +1.1% (still checking), FB +0.9% (following Twitter news, Facebook's Instagram set to introduce ads over the next few months, according to the company's blog), AAPL +0.5% (Apple buys Cue for over $40 mln to compete with Google Now, according to reports).

( Читать дальше )

- комментировать

- 10 | ★1

- Комментарии ( 0 )

Обзор на 04.10.2013 – NYSE/NASDAQ

- 04 октября 2013, 14:32

- |

Обзор на 04.10.2013 – NYSE/NASDAQ

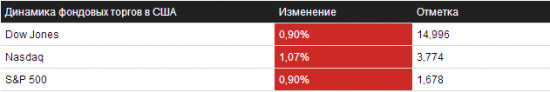

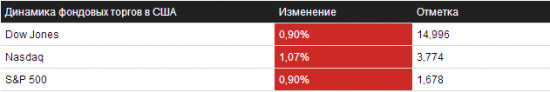

Американский рынок акций скатился в минус

Американские фондовые биржи завершили четверг в минусе на фоне заявления со стороны Минфина США об угрозе дефолта.Работа американского правительства приостановлена уже третий день, так как республиканцы и демократы не смогли договориться по бюджету.

Индекс деловой активности в сфере услуг США в сентябре снизился до 54,4 пункта с 58,6 пункта месяцем ранее. Об этом сообщается в отчете Института управления поставками (ISM).

Число заявок на пособие по безработице в США на прошлой неделе выросло на 1 тыс. и составило 308 тыс. Об этом говорится в отчете Министерства труда США.

Ипотечные ставки в США упали на фоне частичной приостановки работы правительства США и падения индекса потребительского доверия.

Объем запланированных увольнений в США в сентябре сократился до минимальных значений за три месяца, отмечают эксперты консалтинговой компании Challenger Gray & Christmas.

( Читать дальше )

Американский рынок акций скатился в минус

Американские фондовые биржи завершили четверг в минусе на фоне заявления со стороны Минфина США об угрозе дефолта.Работа американского правительства приостановлена уже третий день, так как республиканцы и демократы не смогли договориться по бюджету.

Индекс деловой активности в сфере услуг США в сентябре снизился до 54,4 пункта с 58,6 пункта месяцем ранее. Об этом сообщается в отчете Института управления поставками (ISM).

Число заявок на пособие по безработице в США на прошлой неделе выросло на 1 тыс. и составило 308 тыс. Об этом говорится в отчете Министерства труда США.

Ипотечные ставки в США упали на фоне частичной приостановки работы правительства США и падения индекса потребительского доверия.

Объем запланированных увольнений в США в сентябре сократился до минимальных значений за три месяца, отмечают эксперты консалтинговой компании Challenger Gray & Christmas.

( Читать дальше )

Аналитика NYSE на 3 октября

- 03 октября 2013, 16:46

- |

Спайдер повышается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: CAMP +9.7%, EVAC +3.3%, STZ +2.1%, PVH +1.2% (sells GH Bass business to GIII; updates Q3 EPS guidance above consensus; reaffirms FY13 EPS ).

- M&A news: MNTG +8.5% ( Jacobs Entertainment, 18.14% active holder, submits a formal proposal for an Agreement and Plan of Merger).

- Select drug/pharma related names showing strength: GSK +1.4%, TEVA +0.8%, VRX +0.5% ( announces approval Of Jublia for the treatment of onychomycosis in Canada; Bausch + Lomb Receives FDA Clearance For Novel Monthly Disposable Contact Lens), SNY +0.2% (Sanofi-Aventis unit Genzyme reports Aubagio significantly reduced risk of new clinical relapse or MRI lesion in multiple sclerosis study).

- Other news: OCZ +5% (announces settlement of consolidated shareholder class action litigation; settlement of $7.5 mln will be funded by the co's D&O liability insurance), SQNM +4.9% (files premarket 510(k) notification with FDA for IMPACT Dx system), GALE +4.8% (Galena Biopharma launches Abstral (fentanyl) Sublingual Tablets for the treatment of breakthrough cancer pain), HIMX +3.6% (still checking), AAT +3.2% (AAT to replace FIRE in the S&P SmallCap 600), OMER +3.2% (Omeros unlocks six additional Class A orphan GPCRs and identifies small molecules targeting two commercially validated Class B GPCRs; also Settles Insurance Litigation), CHU +2.8% (China Unicom gapping up following strength in overseas trading), TTM +2.2% (following strength in overseas trading), GST +1.8% (announced earlier funding of sale of East Texas property), VIPS +1.6% (following yesterday's 8% move higher), NBG +1.4% (Natl Bank of Greece and other Greek lenders have put some loans into 'bad banks', according to reports), HLF +1.2% (Bill Ackman's Pershing Square provides portfolio update in Q3 letter to investors), BP +1.2% (BP confirms ruling by U.S. Court of Appeals for the Fifth Circuit.), CSIQ +1.1% ( announces the sale of two utility scale solar power plants to a fund managed by BlackRock), VOD +0.8% (announced that its Group CFO, Andy Halford, has informed the Board that he intends to leave the Group at the end of March 2014 ), LCC +0.8% (US Airways Sept RPMs +3.5% YoY; ASM +3.8%), MODN +0.7% (light volume, disclosed earlier a reduction in the size of its workforce, primarily in professional services ), .

( Читать дальше )

Аналитика NYSE на 2 октября

- 02 октября 2013, 17:12

- |

Спайдер понижается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: GPN +6.9%, ADSK +1.3%.

- M&A news: OIBR +14.8% and PT +14.3% (Portugal Telecom and Oi SA announce MOU for merger of activities).

- Select metals/mining stocks trading higher: MT +0.9%, GDX +0.8%, CDE +0.7%, NEM +0.6%, GG +0.6%, SLV +0.4%, GLD +0.2%.

- Other news: DCTH +49.3% (FDA grants orphan drug designation to Delcath Systems for use of melphalan hydrochloride in HCC), ALVR +7.7% (continued strength), MCP +5.4% (announced mechanical completion and the start of commissioning of both the Chloralkali plant and the final unit of multi-stage cracking at mountain pass ), ALLT +5.3% (Allot Comms receives multimillion dollar order from major U.S. based cloud provider), PEIX +3.9% (to use sugar to further diversify its feedstock ), ALU +3.5% (still checking), TWGP +2.7% (announces it has entered into agreements with three reinsurers to enhance the company's financial flexibility ), LEE +2.3% (Lee Enterprises debt reduction two years ahead of plan), PSTI +1.7% (receives Israeli Ministry of Health approval to expand its Phase II clinical trial in intermittent claudication to Israel), NOK +1.2% (still checking), ETP +1.1% (announces project development agreement).

( Читать дальше )

Аналитика NYSE на 1 октября

- 01 октября 2013, 16:48

- |

Спайдер повышается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на положительной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: MRK +1.7% (announces global initiative to sharpen commercial and R&D Focus; Co reaffirms 2013 full-year non-GAAP EPS target of $3.45-3.55).

- M&A news: EDG +56.6% (discloses Agreement and Plan of Merger, each issued and outstanding share of Class A common stock will be converted into the right to receive $12.00 in cash).

- Select financial related names showing strength: CS +2.5%, ING +2.2%, BCS +2.1%, IBN +2%, PUK +1.8%, HBC +1.1%.

- Select solar stocks trading higher: SFUN +3.2%, SOL +2.6%, STP +2.4%, SPWR +2.4%, FSLR +2.2%.

- Other news: LXRX +24.5% (achieves 'positive' Results in Type 2 Diabetes Patients with Renal Impairment; LX4211 provided clinically meaningful and statistically significant reductions), ALVR +13.6% (thinly traded, continued strength), MYGN +8.5% (following late sell-off that was being attributed to analyst comments on pricing for BRCA test; disclosed and confirmed that the Centers for Medicare & Medicaid Services released finalized pricing for the new molecular pathology codes for 2014, upgraded to Buy at Ladenburg Thalmann), HCI +3.8% (to replace MFB in the S&P SmallCap 600), PSTI +3.6% (PLX Cells demonstrate efficacy in preclinical study for graft versus host disease), ALU +3.4% (Alcatel-Lucent outlines the Shift Plan strategy to accelerate telecommunications to the cloud), RAD +2.3% (following WAG results), SI +2.1% and TEF +1.4% (still checking), JCP +1% ( discloses its proceeds before expenses from offering of 84 mln shares of common stock was $786.24 mln ), AMZN +0.6% (Amazon Creating 70,000 Full-Time Seasonal Jobs in the U.S. to Fulfill Holiday Orders with Thousands Expected to Become Permanent Employees), FB +0.1% (plans to expand Graph Search, according to reports), .

( Читать дальше )

Аналитика NYSE на 26 сентября

- 26 сентября 2013, 16:54

- |

Спайдер незначительно повышается перед открытием торгов на NYSE.

SPY (внутридневной график) рост на премаркете. Сопротивление: 170.00 Поддержка: 169.00

ПремаркетNYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на отрицательной территории.

SPY (внутридневной график) рост на премаркете. Сопротивление: 170.00 Поддержка: 169.00

ПремаркетNYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: FUL +6.4%, BBBY +5.9%, NEO +5.1%, PRGS +3.9%, SNX +3.1%, MKC +0.5%.

- M&A news: USAK +35.1% (Knight Transportation (KNX) Proposes to Acquire USA Truck for $9.00 Per Share in Cash), FLOW +7% (o be acquired by American Industrial Partners for $4.05 per share), ALU +2.2% (Follow up to Nokia (NOK) is considering combination with ALU's mobile phone networks unit), BBRY +1.1% (Fairfax's CEO Prem Watsa confident Blackberry bid will succeed, according to reports).

- Select metals/mining stocks trading higher: AU +1.9%, ABX +1.4%, HMY +1.1%, NEM +1%, GOLD +0.9%, GFI +0.6%.

- Select solar related names showing strength: HSOL +3.3%, SOL +2.3%, YGE +2.2%, SCTY +1.2%, FSLR +1%, SPWR +0.9%.

( Читать дальше )

Аналитика NYSE на 25 сентября

- 25 сентября 2013, 16:57

- |

Спайдер незначительно повышается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: ASNA +13.3%.

- M&A news: MAKO +82.4% (acquired by Stryker (SYK) for $30/share in cash).

- Select EU Telecomrelated names showing strength: ORAN +3.2%, VOD +1.3%, ALU +0.9%.

- Select metals/mining stocks trading higher: RIO +2.3%, AU +2.2%, IAG +1.6%, BHP +1.2%.

- Other news: ONTY +21.7% ( announces Merck Serono, unit of Merck KGaA (MKGAY.PK), decision to continue the development of tecemotide in stage III non-small cell lung cancer), CTIC +11.3% (cont strength; potentially related to MYGN news — see below), PRTS +6.2% (Maguire Asset Management seeks to purchase Oak Investment Partners' approximate 28% ownership in U.S. Auto Parts), DVAX +5.9% (announced that positive Phase 3 data on HEPLISAV in adults aged 40-70 and patients with chronic kKidney disease was published in the journal VACCINE), SZYM +5.9% (and Unilever (UL) sign commercial supply agreement for Tailored Algal Oil), NTLS +3.8% (settled open dispute with Sprint related to their Strategic Network Alliance; raised FY13 EBITDA guidance), MYGN +3.7% (myPlan Lung Cancer test meets primary clinical endpoint), NE +2.8% (announced plan to create independent standard specific drilling company), BRCD +2.8% ( increases the authorization to repurchase its common stock from $308 mln to $1 bln), OPXA +2.1% (announces the conversion of the co's outstanding 12% convertible secured promissory notes into shares of common stock), SUNE +2% (S.A.C. Capital Advisors disclosed 5.1% passive stake) ANW +1.4% (signed $1 bln secured borrowing base multicurrency revolving credit facility), WR +1% (prices 8 mln shares of common stock at $31.15 per share), BERY +1% (appeared on Mad Money yesterday), .

( Читать дальше )

Аналитика NYSE на 24 сентября

- 24 сентября 2013, 17:05

- |

Спайдер незначительно понижается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на положительной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: KMX +5.5%, LEN +1.3%.

- M&A news: JNY +7.8% (reports suggesting co may be acquired for $17-18 per share), AMAT +6.4% (co and Tokyo Electron (TOELY) to merge; creating a new company as a merger of equals with combined market capitalization of ~$29 bln).

- Other news: GWAY +18.3% (co and Vitera Healthcare Solutions to combine), INO +7.9% (announces publication of a peer-reviewed paper demonstrating the success of its new DNA plasmid technology), OCN +4.4% (announces credit facility amendment and repurchase from WL Ross & Co), BNNY +3.1% (to replace CBST in the S&P SmallCap 600), NOV +2.5% (announces plan to pursue spin-off of distribution business into separate publicly traded company), MCP +2.1% (China will most likely increase its purchase of rare earth reserves next month, according to reports), SQNM +1.8% (announced review of strategic alternatives for its Genetic Analysis business segment), TI +1.7% (Telefonica (TEF) paid out a capital increase in Telco), ELX +1.4% (Elliot disclosed 6.4% activist stake in amended 13D filing), IGT +0.9% (and Caesars Entertainment ink video poker deal to supply 7,000 AVP video poker terminals).

( Читать дальше )

Аналитика NYSE на 23 сентября

- 23 сентября 2013, 17:20

- |

Спайдер понижается перед открытием торгов на NYSE.

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

- Европейские индексы на отрицательной территории.

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: AAPL +3.3% (announces it has sold 9 mln new iPhone 5s and iPhone 5c models), .

- M&A news: YONG +4% (enters into definitive merger agreement, shares will be converted into the right to receive $6.69 in cash without interest), .

- Other news: VGZ +10.4% (provides strategic update), MXC +5.4% (announces additional development of properties), GIVN +5% (receives clearance for the third generation PillCam SB System in Japan), SKH +3.2% (announces initial HUD loan funding), DRYS +2.6% (cont volatility), TTWO +2.3% (reports of strong GTA 5 sales over weekend), TSEM +1.8% (co and DMB Technology announced volume production and shipping results), SWIR +1.8% (still checking), CWH +1.5% (announces restructuring of management agreement with RMR and significant governance enhancements), OMC +1.2% (still checking), GE +0.9% (co and Sonelgaz affiliate, SPE, sign contracts valued at $2.7 bln to help power Algeria), LNG +0.8% (announces filing of Registration Statement for Cheniere Energy Partners LP IPO).

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- rts

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал