Hft

Как российские разработчики заставили GPT предсказывать биржевые котировки

- 27 ноября 2024, 20:39

- |

18 мая 2024 на конференции «Тюльпаномания» Тихон Павлов, количественный аналитик «Финансовой компании Викинг» раскрыл секрет использования GPT-4 для прогнозирования биржевых котировок. Тема разделила аудиторию на скептиков и энтузиастов, породив жаркие дебаты о будущем трейдинга. Никто не остался равнодушным.

18 мая 2024 на конференции «Тюльпаномания» Тихон Павлов, количественный аналитик «Финансовой компании Викинг» раскрыл секрет использования GPT-4 для прогнозирования биржевых котировок. Тема разделила аудиторию на скептиков и энтузиастов, породив жаркие дебаты о будущем трейдинга. Никто не остался равнодушным.В статье расскажем про эксперимент, как нам удалось заставить языковую модель принимать числовые данные и предсказывать биржевые котировки.

Мы в Викинге занимаемся разработкой ПО для алгоритмической торговли на российских и зарубежных биржах. Более 20 лет помогаем трейдерам, брокерам и инвестиционным компаниям зарабатывать на финансовых рынках при помощи арбитража.

Прежде чем начнем погружаться в алхимию XXI века (где вместо превращения свинца в золото, мы превращаем массивы данных в профит), мы хотим пригласить вас на следующую конференцию ФК Викинг «Профессиональные инвестиции 2024: Визионерство», которая пройдет 14 декабря 2024 в Москве. На ней Тихон и другие спикеры продолжат удивлять вас актуальными докладами. Регистрация на мероприятие по ссылке fkviking.com/profinvest24.

( Читать дальше )

- комментировать

- 803

- Комментарии ( 10 )

Кто-нибудь пробовал тиковые данные из финама прогнать через нейросеть?

- 06 ноября 2024, 15:19

- |

Почему FAST и SBE не дружит с VPN. От технаря OSA Engine

- 25 июля 2024, 20:44

- |

В мире высокочастотной торговли (HFT) и других финансовых стратегий, где каждая микросекунда имеет значение, передача данных и задержки могут значительно влиять на результаты. FAST (FIX Adapted for STreaming) и SBE (Simple Binary Encoding) протоколы были разработаны для минимизации задержек и оптимизации передачи данных. Однако их использование вне зоны коллокации или через VPN на виртуальных серверах может существенно ухудшить их эффективность.

Зона коллокации и её преимущества

Зона коллокации (colocation) представляет собой специальное место, где сервера брокеров и трейдеров размещены в непосредственной близости к серверам биржи. Это позволяет минимизировать задержки при передаче данных благодаря высокоскоростным и надежным соединениям. Основные преимущества зоны коллокации включают:

- Минимальные задержки: Время передачи данных сокращается до нескольких микросекунд.

- Стабильность соединения: Высококачественное оборудование и инфраструктура обеспечивают стабильное соединение без потерь пакетов.

( Читать дальше )

Прощание OSA Engine с FIX/FAST и приветствие SBE: Технарь рекомендует

- 12 июля 2024, 12:22

- |

Привет, друзья!

И снова с вами OSAEngine.ru. Сегодня мы рассмотрим, почему FAST-протокол, который долгое время использовался для передачи данных на финансовых рынках, устарел и был заменен более современными и эффективными решениями, такими как SBE (Simple Binary Encoding). Подробности о протоколе SBE я расскажу в следующей статье, так что не переключайтесь и готовьтесь к увлекательному путешествию в мир бинарного кодирования!

Почему стоит избегать FAST-протокол

Если вы только начинаете рассматривать вопрос прямого рыночного доступа (DMA) и подключения к торговым системам, важно ориентироваться на современные стандарты и технологии. Протокол FAST (FIX Adapted for STreaming) на сегодняшний день устарел и имеет ряд ограничений, которые делают его менее подходящим для высокочастотной торговли и современных торговых решений.

Недостатки FAST

Сложность обработки данных:

- FAST использует сложные методы сжатия, такие как удаление избыточности и кодирование длин повторов (RLE). Это требует значительных вычислительных ресурсов для кодирования и декодирования данных, что может увеличивать задержки.

( Читать дальше )

Протокол FIX/FAST: От Технаря OSA Engines

- 08 июля 2024, 14:19

- |

Внимание! Пожалуйста, уберите от экранов всех программистов в финансовой области с опытом менее 15 лет — мы будем обсуждать настоящие чудеса инженерии.

Введение

Протокол FAST (FIX Adapter for STreaming) — это международный стандарт, используемый для обмена данными в реальном времени на финансовых рынках. Этот протокол был разработан для повышения эффективности и скорости обмена информацией между различными участниками рынка, такими как брокеры, биржи, банки и другие финансовые учреждения. Протокол FAST является ключевым элементом в инфраструктуре высокочастотной торговли (HFT) и продолжает оставаться актуальным, несмотря на его «почтенный» возраст.

История и Развитие

Протокол FAST был разработан организацией FIX Protocol Limited (FPL) в начале 2000-х годов как улучшенная версия протокола FIX (Financial Information eXchange). Основная цель разработки FAST заключалась в снижении объема передаваемых данных и увеличении скорости их передачи, что стало критически важным с ростом объемов торгов и появлением высокочастотной торговли (HFT).

( Читать дальше )

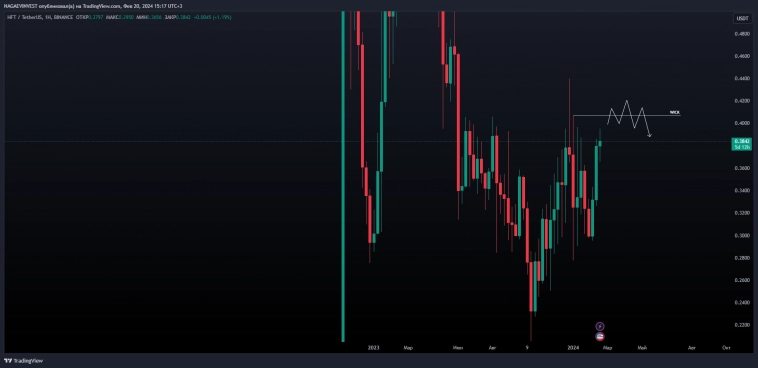

HASHFLOW

- 28 апреля 2024, 11:19

- |

• Тест WICK на дальнейшую наценку будет хорошей возможностью для входа

• Stop Loss за минимум и держать позицию можно будет до FVG

Не исключено что увидим паттерн AMD

источник t.me/nagaevinvest/4897

Статистика, графики, новости - 22.04.2024 - 2,7 млрд $ прибыли за квартал! Трейдинг - топ!

- 22 апреля 2024, 06:25

- |

— Подробно про американское образование. Цифры.

— Профицит отечественного платёжного баланса

— Какая стоимость нефти нужна саудитам?

— Как дела у TSMC?

Доброе утро, всем привет!

( Читать дальше )

Разбор HFT компаний с российскими корнями

- 13 марта 2024, 23:58

- |

Времена, когда HFT были загадочными канули в лету, и сейчас многие из компаний имеют за спиной опыт, и даже некую репутацию. Прошло уже даже больше, чем лет десять, после их бума и самое время посмотреть на то, что сейчас там происходит, тем более, что Jane Street объявила, что за первые девять месяцев прошлого года чистая выручка от трейдинга у них была больше семи миллиардов долларов.

Давайте сегодня посмотрим на ключевых игроков сложного и закрытого рынка высокочастотного трейдинга, у истоков которых стоят российские основатели.

XTX Markets

Один из крупнейших алгоритмических маркетмейкеров в мире. Компанию основал Александр Герко — в прошлом трейдер Deutsche Bank, который имел гражданство России и с 2016 года — Великобритании. На 2023 год Герко принадлежит не меньше 75% в компании.Имеет офисы Нью-Йорке, Париже, Сингапуре, Мумбаи и Ереване, активно занимаются благотворительностью и поддерживают математическое образование.Сам Герко стал широко известен после того, как стал крупнейшим налогоплательщиком в Великобритании по итогам 2022 и 2023 годов.

( Читать дальше )

HASHFLOW

- 20 февраля 2024, 17:13

- |

Источник t.me/nagaevinvest/4473

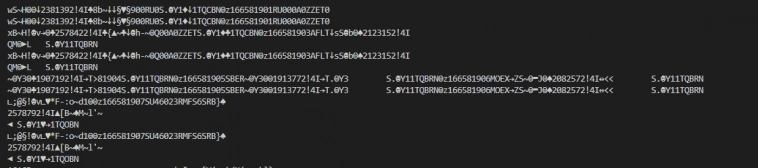

Декодирование пакетов от тестового FAST UDP Multicast MOEX

- 26 января 2024, 14:14

- |

Всем добрый день!

Подключился к тестовому контуру FAST от MOEX и возникли трудности с декодированием UDP пакетов, поэтому решил обратиться за помощью к сообществу.

Написал небольшой скрипт на NodeJS для получения данных от сервера FAST.

При попытке вывода получаемых сообщений в консоль вылезают нечитабельные символы (декодирую в ASCII, также проверял UTF8 — там тоже есть проблемы с читабельностью):

Пробую перехватывать эти же пакеты с помощью Wireshark и вижу следующее:

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал