Es

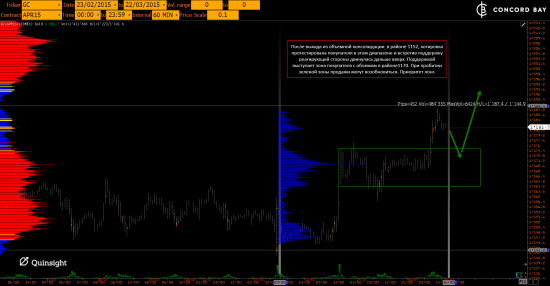

ES (E-mini S&P 500) @ GC - Gold (XAUUSD) @ CL (Нефть) @ 6B (GBP/USD) @ 6Е (EUR/USD)

- 24 марта 2015, 17:42

- |

ES

Котировка сформировала объемную зону в районе 2095-2108 после импульса в конце прошлой недели. Этот объем может послужить разворотной точкой в случае пробоя зеленой поддержки. Приоритет покупки от зеленой зоны, или после импульса из красной зоны вверх

( Читать дальше )

- комментировать

- 16

- Комментарии ( 0 )

ES (E-mini S&P 500) @ GC - Gold (XAUUSD) @ CL (Нефть) @ 6B (GBP/USD) @ 6Е (EUR/USD)

- 23 марта 2015, 05:07

- |

ES

Котировка продолжила рост после выхода новостей в среду. Последняя зона покупателя находиться в районе 2080 и пока эта зона не пробита продажи максимум коррекционные и краткосрочные. Так же нужно учитывать то, что мы находимся в зоне продавца и исторического хая прошлого контракта. Локально можно пробовать открывать покупки от синей зоны после импульса вверх краткосрочно.

( Читать дальше )

Динамика E-mini S&P 500 - VANGUJU.

- 21 марта 2015, 11:36

- |

Всем, день добрый!

Мысли по ближайшей динамике.

На мой взгляд, вероятность дальнейшего движения сейчас перераспределилась примерно на равные шансы:

а) с текущих на 2018, затем на НН года (до целей 2170, 2220);

б) сначала минимальный (5-7 пунктов) годовой НН, далее по сценарию а).

В обоих случаях в ближайшие день-два вероятен флет с минимумом не ниже 2082(84). Если действительно будет флет, стоит обратить внимание на лоу вторника.

Если во вторник относительно понедельника будет НL, то после дальнейшего роста к хаю этой недели, приоритет получит вариант а).

Если во вторник относительно понедельника увидим LL, то шансов больше станет у реализации варианта б).

В текущем моменте моё предпочтение за вариантом б) через LL (вторник/понедельник), но(!)..

Чем ближе к 2082(84) спустится ES в понедельник, тем больше становится вероятность реализации варианта а).

( Читать дальше )

Динамика E-mini S&P 500 - VANGUJU. Перспектива: месяц/квартал/год.

- 19 марта 2015, 15:07

- |

Надеюсь, все живы-здоровы после заявлений FOMC(?) :)

Поделюсь мыслями, если оно кому интересно.

1. На ближайшие пару недель-месяц.

Думаю, что набор лонга «сильными руками» ещё не закончился. Посему считаю, что:

а) HH в ESH уже, безусловно, не будет;

б) ESM до НН обновит лоу прошлой недели (цель ~2018);

в) цель ~2018 будет достигнута на следующей неделе;

г) март закроется ~2060+;

д) апрель (май?) рост до целей 2170+, 2220+(?).

2. Мысли шире двух недель.

а) в июньском контракте хорошего трендового движения не будет (у игроков «вынут всю печень»);

б) вряд ли увидим сильно выше 2220+ (дойти бы до этих цифр);

в) боюсь, что закрытие контракта вообще сильно разочарует многих.

3. Мысли в перспективе текущего года.

а) сентябрьский контракт покажет хороший рост (25-30%);

б) возможно, он будет последним трендоворастущим контрактом на горизонте 2015-2017 гг;

( Читать дальше )

FOMC Statement

- 18 марта 2015, 21:01

- |

For immediate release

Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow and export growth has weakened. Inflation has declined further below the Committee's longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

( Читать дальше )

Динамика E-mini S&P 500 - VANGUJU.

- 12 марта 2015, 22:43

- |

Приближаемся к зоне планируемого перезахода в шорт — 66(68). Идеальным, конечно, было бы зайти ближе к верхней границе зоны, т.е. 68+(если дадут, то даже 69+), чтобы по возможности минимизировать размер стопа. В любом случае, ордера на sell 66(1/4), 68(1/4), 69(1/2), sl 72,75 (на всю позу), tp 32-34. Цель шорта надеюсь увидеть завтра в основную. На тех же уровнях буду присматривать лонг на новый НН года.

Всем удачи.

ПС. Если предполагаемый сценарий будет реализовываться в намеченный срок, т.е. если цель 32-34 будет достигнута именно завтра, то, на мой взгляд, актуальность достижения более низкой цели (http://smart-lab.ru/blog/241584.php#comment3666061) резко снижается.

Динамика E-mini S&P 500 - VANGUJU.

- 10 марта 2015, 20:08

- |

Полагаю, что лоу сегодняшнего дня «где-то рядом». Пару часов «потрамбуют» в ренже 48-58. После 22:00 мск возможен слабый LL в район 47(46) и отскок на 64-66 к закрытию сессии. Завтра, вероятно, попилит, но завтра-послезавтра жду возврат к 86(88). В четверг ещё один заход на 44(42). Там вижу лоу недели и текущей мини-коррекции. С пятницы (либо уже на следующей неделе) вновь рост на НН февраля.

ПС. Поскольку вчера ушли в отскок не закрыв остатки оставленной овервик позы (62 и 58), но и до целей отката (83-86) не дотянули, то шортовая поза была восстановлена лишь до 3/4 (79 sell 1/4). В текущем моменте уже без поз — 52 closed 1/2, 48 closed 1/4.

ES

- 10 марта 2015, 18:57

- |

clip2net.com/s/3dVAZkn

ES

- 09 марта 2015, 19:58

- |

clip2net.com/s/3dRNqjl

ES

- 05 марта 2015, 18:37

- |

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал