SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Опционы

Здесь вы найдете самую полную в российском интернете коллекцию актуальных записей по торговле опционными контрактами, опционных стратегиях, вопросах по опционам.

Тех.Анализ, фьючерсы, опционы РИ.

- 30 ноября 2017, 09:12

- |

Всем привет Друзья! знатно вчера нефть всем наваляла, прямо как по учебнику, показала движение вниз, потом резко вверх за стопами новоиспеченных мишек, обновила хаи за почти три последние недели, собрала всех кто перевернулся вверх и махом ушла вниз обновив лои за последние 5 дней… сорвав стопы бычков… скорее всего некоторые бычки переоделись в мишек, а нефть и им дала под дых вернувшись к среднему значению )) КЛАССИКА! но ведь кто то же попадается на такое разводилово ((

и немного о нашем фонде в конце

******************

Индексы: RI, ММВБ, S&P500;

Валюта: USDRUB (Si);

Товары: Золото, Нефть BRENT.

( Читать дальше )

- комментировать

- Комментарии ( 527 )

Добрый вечер смартлаб, вопрос к опционщикам, подскажите пожалуйста, почему сегодня индекс волатильности RVI начал припадать с 17:30 при продолжении снижения индекса РТС?

- 29 ноября 2017, 20:21

- |

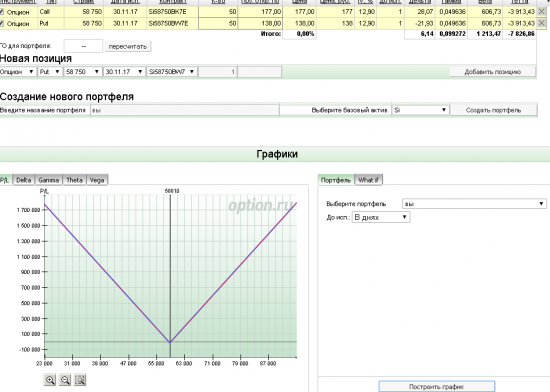

Доллар/рубль. Попытка заработать на опционах

- 29 ноября 2017, 20:07

- |

Доллар/рубль уже длительное время консолидируется в очень узком диапазоне, а завтра у нас как раз заседание ОПЕК, на котором может прозвучать очень много всего интересного, способного поднять волатильность.

Учитывая также, что уже завтра экспирация на доллар/рубль и опционы стоят крайне дешево попробую заработать на выходе из данного диапазона, купив обычный стреддл (что уже благополучно сделал). Движение даже чуть более чем на 1% по паре мне вполне хватит, чтобы закрыть позицию в хороший плюс. Пример стреддла ниже… (про другие опционные стратегии много полезного можно узнать здесь).

( Читать дальше )

Полезные штуки-1: Книги по алготрейдингу.

- 29 ноября 2017, 15:08

- |

Привожу пожалуй лучший в мире список книг на английском по финансовой математике (по квонтам, Quants):

quantivity.wordpress.com/2010/01/12/how-to-learn-algorithmic-trading-part-3/

-------------------------------------------------------------------------------------

Begin with standard introductory financial time series asset dynamics, volatility, and forecast modeling:

Analysis of Financial Time Series, by Tsay: standard applied time series text for financial econometrics

Market Models: A Guide to Financial Data Analysis, by Alexander: excellent introduction to financial modeling and forecast

Asset Price Dynamics, Volatility, and Prediction, by Taylor: classic text on financial modeling and forecast

Proceed to modern portfolio theory and financial engineering:

Modern Portfolio Theory and Investment Analysis, by Elton et al.: standard text on modern portfolio theory

Options, Futures and Other Derivatives, by Hull: standard reference for introductory financial engineering

Active Portfolio Management, by Grinold & Kahn: standard introduction to quantitative portfolio management by the BGI guys who invented it

Principles of Financial Engineering, by Neftci: intermediate financial engineering

Continue on to volatility for options and correlation / dispersion for arb:

Volatility and Correlation, by Rebonato: excellent coverage of volatility and correlation

Volatility Trading, by Sinclair: volatility arbitrage by a retail practitioner

( Читать дальше )

quantivity.wordpress.com/2010/01/12/how-to-learn-algorithmic-trading-part-3/

-------------------------------------------------------------------------------------

Begin with standard introductory financial time series asset dynamics, volatility, and forecast modeling:

Analysis of Financial Time Series, by Tsay: standard applied time series text for financial econometrics

Market Models: A Guide to Financial Data Analysis, by Alexander: excellent introduction to financial modeling and forecast

Asset Price Dynamics, Volatility, and Prediction, by Taylor: classic text on financial modeling and forecast

Proceed to modern portfolio theory and financial engineering:

Modern Portfolio Theory and Investment Analysis, by Elton et al.: standard text on modern portfolio theory

Options, Futures and Other Derivatives, by Hull: standard reference for introductory financial engineering

Active Portfolio Management, by Grinold & Kahn: standard introduction to quantitative portfolio management by the BGI guys who invented it

Principles of Financial Engineering, by Neftci: intermediate financial engineering

Continue on to volatility for options and correlation / dispersion for arb:

Volatility and Correlation, by Rebonato: excellent coverage of volatility and correlation

Volatility Trading, by Sinclair: volatility arbitrage by a retail practitioner

( Читать дальше )

Как почувствовать относительность времени.

- 29 ноября 2017, 13:06

- |

Купите опцион и время пуститься вскачь, глотая временную стоимость вашей покупки.

Подпишите опцион и время до экспирации вам покажется вечностью.

Подпишите опцион и время до экспирации вам покажется вечностью.

Тех.Анализ, фьючерсы, опционы РИ.

- 29 ноября 2017, 09:12

- |

всем привет Друзья! все случилось ночью — Брент опять подружился с «Витей» ))

ниже — много скринов по американскому рынку — достаточно занимательные ))

*********************

Индексы: RI, ММВБ, S&P500;

Валюта: USDRUB (Si);

Товары: Золото, Нефть BRENT.

обращаю ваше внимание на:

1 — технические индикаторы работают в МТ4 и анализ делается на котировках не от самой биржи.

2 — данные с утра уровни, уже в обед будут смещены, поэтому для принятия торговых решений — уточняйте уровни вопросом в чате.

( Читать дальше )

Как кидать криптофанатов на деньги :) +12000$ . В коллекцию хороших трейдов #2 SHORT MARA

- 28 ноября 2017, 14:49

- |

Помешательство на блокчейн технологиях не имеет границ :)

И это замечательно ибо на этом можно неплохо заработать!

Прошлая неделя ознаменовалась серией очередного нашествия голодных на крипту шакалов, которое привело к росту нескольких стаков на сотни процентов. XNET, MARA, RIOT, SRAX.... Список можно долго продолжать, но сейчас остановимся на MARA.

В конторе сидит 6 сотрудников. Капитализация конторы до нашествия была меньше 10 млн :). В начале месяца Marathon Patent Group, Inc. полностью выкупила 100% Global Bit Ventures Inc.

Global Bit занимается майнингом крипты.

Как вы думаете, что решаила толпа лудоманов? )) Ну конечно! Они тарили MARA десятками миллионов загнав цены за 3 дня с 1,5$ до 10$ за акцию! :) p.s. походу ожидали диких профитов от майнинга… ха!

Грех было не проехатся на их шкурах :) Трейд и его описание в коротком видео.

Кстати рекомендую очень наблюдать за твиттером, когда акция летит вниз и инвестора теряют миллионы баксов. Какие там вопли в твитах… Сколько горя и страдания ))

( Читать дальше )

И это замечательно ибо на этом можно неплохо заработать!

Прошлая неделя ознаменовалась серией очередного нашествия голодных на крипту шакалов, которое привело к росту нескольких стаков на сотни процентов. XNET, MARA, RIOT, SRAX.... Список можно долго продолжать, но сейчас остановимся на MARA.

В конторе сидит 6 сотрудников. Капитализация конторы до нашествия была меньше 10 млн :). В начале месяца Marathon Patent Group, Inc. полностью выкупила 100% Global Bit Ventures Inc.

Global Bit занимается майнингом крипты.

Как вы думаете, что решаила толпа лудоманов? )) Ну конечно! Они тарили MARA десятками миллионов загнав цены за 3 дня с 1,5$ до 10$ за акцию! :) p.s. походу ожидали диких профитов от майнинга… ха!

Грех было не проехатся на их шкурах :) Трейд и его описание в коротком видео.

Кстати рекомендую очень наблюдать за твиттером, когда акция летит вниз и инвестора теряют миллионы баксов. Какие там вопли в твитах… Сколько горя и страдания ))

( Читать дальше )

Тех.Анализ, фьючерсы, опционы РИ.

- 28 ноября 2017, 09:23

- |

Всем привет друзья, сегодня уделим все внимание нефти!

********************

Индексы: RI, ММВБ, S&P500;

Валюта: USDRUB (Si);

Товары: Золото, Нефть BRENT.

обращаю ваше внимание на:

1 — технические индикаторы работают в МТ4 и анализ делается на котировках не от самой биржи.

2 — данные с утра уровни, уже в обед будут смещены, поэтому для принятия торговых решений — уточняйте уровни вопросом в чате.

3 — чат создан для общения а не для продажи индикаторов и/или обучения.

4 — графики не являются торговой рекомендацией! если я что то буду рекомендовать, то размещаться это будет в специальном разделе —

( Читать дальше )

Тех.Анализ, фьючерсы, опционы РИ.

- 27 ноября 2017, 09:21

- |

Всем привет друзья… практически ничего и не менял в шапке )) всем надоело ждать и ситуация никак не поменялась из за 2х подряд праздников в США, разве что золото судя по всему выбрало направление. и еще немного о пехоте...

***********************

Индексы: RI, ММВБ, S&P500;

Валюта: USDRUB (Si);

Товары: Золото, Нефть BRENT.

обращаю ваше внимание на:

1 — технические индикаторы работают в МТ4 и анализ делается на котировках не от самой биржи.

2 — данные с утра уровни, уже в обед будут смещены, поэтому для принятия торговых решений — уточняйте уровни вопросом в чате.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал