SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

volume trade

EUR - история повторяется 2.

- 05 июня 2014, 18:16

- |

Добрый день!

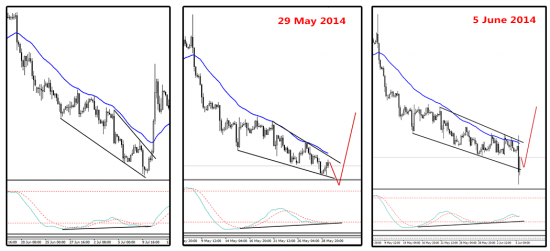

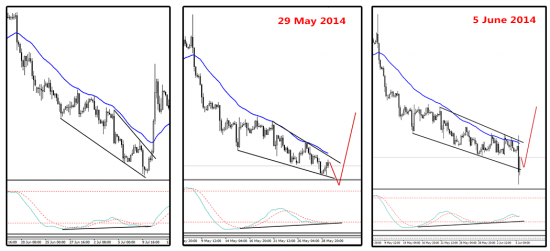

29 мая я уже выкладывал график EUR H4. Мы ждали хода к 1.3560 и появления там крупных объемов. Первая часть исполнилась. Ждем вторую.

Сравнение прошлого (июнь-июль 2013) и настоящего (май-июнь 2014). График с учетом объемов и без, но с учетом дивергенции и средней.

( Читать дальше )

29 мая я уже выкладывал график EUR H4. Мы ждали хода к 1.3560 и появления там крупных объемов. Первая часть исполнилась. Ждем вторую.

Сравнение прошлого (июнь-июль 2013) и настоящего (май-июнь 2014). График с учетом объемов и без, но с учетом дивергенции и средней.

( Читать дальше )

- комментировать

- 7 | ★1

- Комментарии ( 7 )

Volumes after the news E6

- 19 мая 2014, 18:30

- |

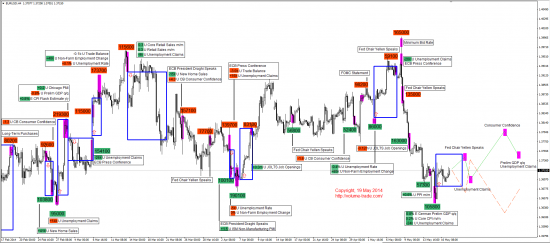

All who read the previous article (Volumes after the news.) already have an idea how to interpret the futures volume after the news. So, I will not repeat and will write directly on the current subject.

As the this theme was interesting to our readers, I decided to review the key events in futures 6E before June 1. So first, I select important days and news which are worth paying attention:

Wed May 21: USD Fed Chair Yellen Speaks, USD FOMC Meeting Minutes;

Thu May 22: USD Unemployment Claims, USD Existing Home Sales;

Tue May 27: USD CB Consumer Confidence;

Thu May 29: Prelim GDP q/q, Unemployment Claims, Pending Home Sales m/m.

I'll wait for the accumulation of volume after the news. And I will select the key points that will be at the maximum or minimum of the market at the time of accumulation of volumes.

( Читать дальше )

Article: Volumes after the news.

- 05 мая 2014, 14:06

- |

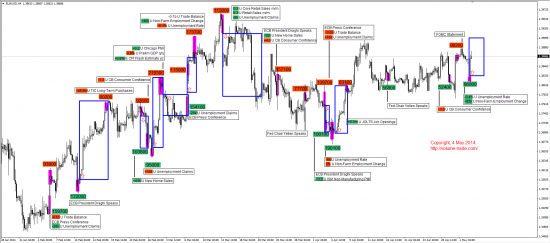

Today's article focuses on how to interpret the volume futures after the news. The trend is formed when large volume goes the market. Most often, strong accumulation of large volumes place after release of important news, as well as news releases, when current value is very different from the previous value. I do not consider the specific values published news and speech at the meetings.

MM (market maker) — is a major dealer or the player who support liquidity and regulates the prices of a trading floor in agreement with the exchange. After the release of the news MM often have to provide liquidity to the market, so I will consider that these volume accumulations are the true. Because the number of bulls and bears is the highest on the highs and lows of the market, so MM forced to participate, providing liquidity all market participants. It proves that MM present at the extremums of the market. Therefore, the price goes in the opposite direction, when liquidity is fully provided to all participants, that is, the market is saturated and there are not willing market participants, which want to buy or sell at the disadvantageous prices. But there are situations when the price goes above / below the extremum, again showing large amounts. In this case, we can expect when the price will return to the previous level of accumulation of large volumes.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал