SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Копипаст

Копипаст | Volume trade. Provocation.

- 28 мая 2014, 01:22

- |

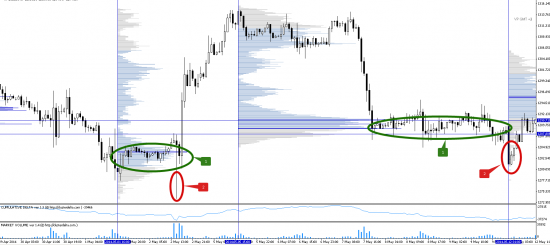

Often we can see, that after a volume is being accumulated for beginning a new trend, the price updates sharply a local high or low, collects all trader's stoplosses, then returns, and a trend emerges.

We need to realize that market-makers specially push a price to the level of order's aggregation. This level enables the market-maker to open large volume positions and at the same time all small traders get stoplosses. Indeed, stoploss is the order, which closes position BY MARKET. And the market-maker has a possibility to open it's own trade.

As soon as market-maker completely satisfies own demand, and all small traders lose money, market turns, because all who wanted to sell already has selled, and there is no sellers else. I call this situation the price's provocation.

There are always zones on the chart, that are of particular interest to the market players. The most prevalent areas of interest is the previous high or low, that is clearly visible on the chart.

In order to prevent this, we need to understand WHERE the market-maker enters the trade. And the volume analysis and, of course, correct interpretation of accumulated volume show it.

A price's provocation differs from true movement in that after a provocation was shown without large volume, price always goes above the previous accumulated volume. And I like to open trades when the price tests this volume.

Of course, you need to understand that market-makers doesn't open trades at all highs. And it's need to know market logic, how the market works and where a possibility of the market reversal is. — Mark Fisher

Источник: volume-trade.com/education/articles/956-volume-trade-prices-provocation.html

22

Читайте на SMART-LAB:

BRENT: цена мечется между геополитическими страхами и плохой статистикой

Нефть после скачка к локальным максимумам продолжила колебаться вблизи вершины, где удерживалась под влиянием геополитической премии за риск....

14:46

Выше ключевой ставки: две облигации с фиксированным купоном

На ближайшем заседании Банка России в пятницу, 13 февраля, с высокой долей вероятности уровень ключевой ставки останется без изменений на...

16:50

теги блога De As

- 6B

- 6E

- AUD

- CAD

- CHF

- DAX

- DAX30

- E6

- EUR

- GBP

- Gbp Usd

- JPY

- NASDAQ

- nasdaq100

- news

- NG

- NZD

- Nzd Usd

- RUB

- S&P500

- Silver

- volume trade

- volume trade international

- VolumeTrade

- VolumeTradeInternational

- VTI

- WTI

- XAG

- XAU

- анализ объемов

- Аэрофлот

- газпром

- Мечел ао

- Объемы

- оффтоп

- Ростел ао

- РусГидро

- Сбербанк

- торговля по объемам