trader

BTC смотрит вверх

- 02 ноября 2022, 17:05

- |

- комментировать

- 232

- Комментарии ( 4 )

#XRP прорыв вверх

- 28 октября 2022, 19:20

- |

#XRP- делает три касания тренда, остается в в условном канале у нижней границы. Беру покупки указанной зоне!

Цели движения R:R 1\2 1\4

Стоп-2%

Сделка полностью меня устраивает учитывая риск-награду.

Удачи!

From the current imbalances, I want to single out Ultra US treasuries bonds (UB). We have a peculiar divergence of volume and quantitative delta here (CD vs. CDQ)

- 23 октября 2022, 12:59

- |

Hello, Traders! 😀

I am on the road today, so, there will be no video forecast.

From the current imbalances, I want to single out Ultra US treasuries bonds (UB). We have a peculiar divergence of volume and quantitative delta here (CD vs. CDQ).

When the price will fix above the last HFT volumes at 124.875 price level on Monday, we will have a potential move to the 1st target of 127.300 and the second target of 129.000.

Hope you will have a profitable next week! 👍

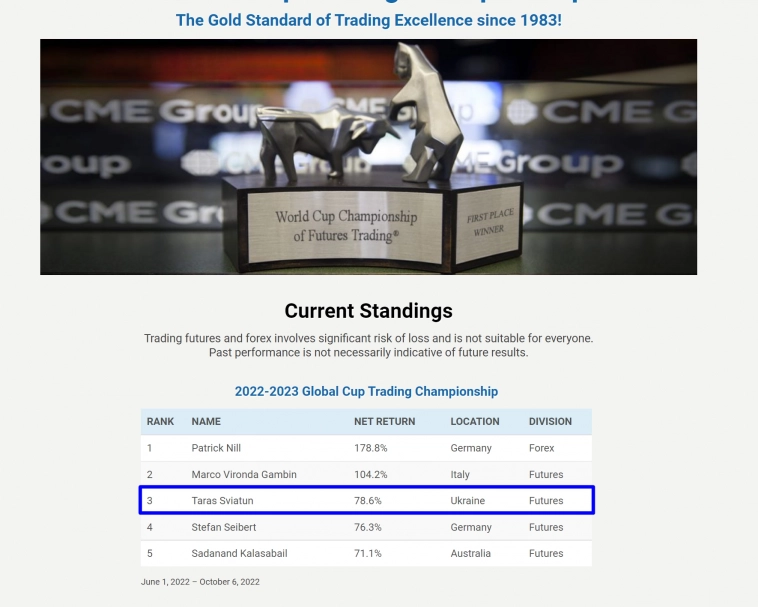

Global Cup 2022 and forecasts in Corn, Sugar, Crude oil

- 09 октября 2022, 16:15

- |

Hello traders, the battle is very exciting, I climbed a level higher, but competitors are running out 😬

All predictions of the previous week showed a very good performance 💪

Today we will observe Corn (ZC) 🌽, Sugar (SB), and Crude oil (CL).

All the details you are able to get from this 13-minute video

( Читать дальше )

XRP - 5 Elliot Wave

- 24 сентября 2022, 13:21

- |

XRP (1H )- цель 5 волны 0.672$

Мы видим этот большой объем на недельном ТФ, он сопоставим (3-й) волне, откуда мы наблюдаем 4 волну коррекционного движение в зону 0.382 .

Считаю, нас ждет еще одна волна роста (5) в зону золотого сечения 0.618

Удачи.

Настоящий Форекс Трейдер 3

- 14 августа 2022, 15:10

- |

Так вот, к чему это все, сегодня выходит эпизод про Россию, если у вас будет свободное время, подключайтесь к чату на ютубе. Время сбора 21:30 мск. А то скучно одному там, среди этих овсянкоедов, словом не с кем перекинуться.

( Читать дальше )

#STORJ - вот как играть в прорывы 3-й волны и прорывы C-волны

- 19 июня 2022, 19:16

- |

СME Futures Analysis 05.06.2022

- 05 июня 2022, 17:14

- |

🔻 Let's discuss Gold (GC). I see here a few strategies entry point in one bottle.

Sell HFTs’ after green delta + limit buyer on top with OI increase on growth and then correction first of all to the direction of market sellers. I expect the movement to the limit buyer level on top and further. (See)

🔻 Also, note that the British pound (6B) is attending 1,25 — the strong support zone now. And if I see selling HFTs’ under this zone it will be interesting to buy this asset to surf another long wave. (See)

( Читать дальше )

CME Futures Analysis 29.05.2022

- 29 мая 2022, 18:41

- |

Hello, traders! Let's look how amazing the second week in raw was with settled priorities and predictions.

🔻 Look at S&P500 (ES)! During 5 days our target was absolutely achieved. The strong imbalance that occurred after the breakdown of the 3850 support level was greatly respected. For now, we observe new ask imbalances, which moved the price higher. I want you to measure the divergence of CD and CDQ on May 17. The quantitative delta +6,5K of market buys but at the same time the volume of CD was -13K shorts. It is often called advance purchases, which work like a magnet for future recovery and the price can go even higher. The second chance to enter longs was after returning to 3900 and stopping HFT volumes and hedging in Put options. The only way to enter with a high risk-reward ratio is to accept the local fear.

🔻 Our next target was 1.07 in Euro (6E) and it was violated no worse than the previous one1.06. And as I told you in my previous video, the levels on which we see huge block trades are very important for the price. And 1.075 was really respected this week. Also now we are in the zone of the least options payouts and the price came here and I think till July 3 it will stay near this zone.

All this movement before was thanks to funds, which accumulated 36K contracts long position, and we — swing traders can use this market inefficiencies to make our profit.

🔻 Only Oil (CL) gives us an opportunity according to the scenario which we predicted before. After the move to the upside we have a very very strong

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал