SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

nyse

NYSE - в этом разделе трейдеры пишут о торговле на американском рынке акций и на нью-йорской фондовой бирже в частности. Здесь, трейдеры американского рынка пишут о своих сделках, выкладывают акции для торговли на сегодняшний день, пишут о новостях по американским компаниям, а также дают технический анализ американского рынка. Чтобы ваши записи по американскому рынку попадали в этот раздел, ставьте тег NYSE своим записям.

Аналитика NYSE на 14 августа

- 14 августа 2013, 17:02

- |

Аналитика NYSE на 14 августа

Спайдер снижается перед открытием торгов на NYSE.

SPY (внутридневной график) снижение на премаркете. Сопротивление: 169.40 Поддержка: 169.10

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

Спайдер снижается перед открытием торгов на NYSE.

- Европейские индексы на положительной территории.

SPY (внутридневной график) снижение на премаркете. Сопротивление: 169.40 Поддержка: 169.10

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: BRCD +18.8%, TREE +15.8%, JKS +12.4%, ULTR +10.5%, SVA +9.8%, OPXA +9.4%, FU +9.2%, CHLN +6.8%, SORL +5.5%, GSL +3.7%, DE +3.3%, GPRC +3.2%, AIT +2%.

- M&A news: LVB +4.7% (to be acquired by Paulson & Co for $40 /share).

- Select solar related names showing strength: TSL +2.0%, SUNE +1.9%, CSIQ +1.0%, FSLR +0.7%.

- Select China related names showing strength: CNTF +6.7%, KNDI +4.3%, YY +2.9%, DANG +2.0%, XIN +1.5%.

- Other news: MNKD +15.9% (announces positive clinical data for AFREZZA; both AFFINITY Phase 3 studies meet primary endpoints), AMPE +12.9% (announces 'positive' results for Ampion), OSIR +8.9% (cont strength), TTM +4.8% (reported July sales), BBRY +3.1% (real M&A column profiles view that BBRY could go private), PSTI +3% (reports study indicating Injuries treated with Pluristem's PLX cells demonstrate favorable properties), HL +2.4% (still checking), GNMK +1.8% (prices 7.6 mln shares of common stock at $9.84), AAPL +0.9% ( acquired video co Matcha, according to reports).

( Читать дальше )

- комментировать

- Комментарии ( 0 )

Разоблачение Pump and Dump

- 14 августа 2013, 15:20

- |

Меня часто спрашивают по этой методике. Поэтому в честь международного дня левшей. Я выкладываюимеющиеся материалы по методике Pump and Dump в общий доступ совершенно бесплатно. Теперь их свободно можно скачать вот здесь

yadi.sk/d/b-F1EWhb7u5c

И конечно возникает вопрос, а с чего это такая доброта?

А все просто.

1. Эти материалы и так давно ходят по сети.

2. Я лично их не торгую.

Почему так? А потому что эта методика многими экспертами давно признана абсолютно не пригодной для современного рынка. Они признали ее устаревшей и не пригодной для реальных торгов. А поскольку вопросов по ней много-то принял решение выложить, чтобы каждый мог ознакомиться с ней лично. Только на реальном счете ее даже не вздумайте торговать – ничего кроме отрицательного баланса на счете эта методика гарантировано не даст.

( Читать дальше )

Обзор 5 акций от компании Manhattan Investment Group International

- 13 августа 2013, 20:28

- |

Обзор от компании Manhattan Investment Group International по наиболее интересным акциям на 11:20 утра (New York time) вторника 13.08.2013

Аналитика NYSE на 13 августа

- 13 августа 2013, 16:49

- |

Аналитика NYSE на 13 августа

Спайдер повышается перед открытием торгов на NYSE.

SPY (внутридневной график) рост на премаркете. Сопротивление: 170.00 Поддержка: 169.50

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

Спайдер повышается перед открытием торгов на NYSE.

- Европейские индексы на положительной территории.

SPY (внутридневной график) рост на премаркете. Сопротивление: 170.00 Поддержка: 169.50

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: ARTX +31.8%, NQ +7.5%, SINA +7%, FN +6.6%, SPR +3.9%, IOC +1.2%, NTI +1.1%, HLS +1%, WX +1%, BIOD +0.9%.

- M&A news: DGIT +40.2% (agrees to sell television business in deal valued at $525 mln ), AJG +0.7% (acquires Bollinger for ~$276.5 mln).

- Select mining stocks trading higher: CLF +2.5%, WLT +2.3%, RIO +1.3%, MT +1.3%.

- Other news: AVNR +10% (Avanir Pharmaceuticals announces diabetes co-promotion agreement with Merck), XIN +6.6% (cont strength following yesterday's 7% move higher), TSL +6% (to Supply 345 MW to Copper Mountain Solar 3 in Nevada), RENN +5.5% (in sympathy with SINA), GIVN +5.1% (receives FDA clearance for next generation PillCam SB 3), LLY +5.1% (Phase III Necitumumab study meets primary endpoint of overall survival), MACK +3.7% (MM-111 Granted Orphan Drug Status by FDA For treatment of Advanced Gastric and Esophageal cancers), FBP +2.6% (prices secondary offering by various stockholders of an aggregate of 28 mln shares of the co's common stock at $6.75 per share), SWI +2.6% (Lone Pine Capital disclosed a 7.3% passive stake in a 13G filing out after the close), PERI +2.6% (rebounding from yesterday's downside move), LULU +2.3% (positive MadMoney mention), JCP +1.4% (confirms changes to Board of Directors; William A. Ackman of Pershing Square Capital Management has resigned from the Board effective Aug. 12), GOLD +1.1% (still checking), BBRY +1.1% (cont strength following yesterday's announcement), SBGI +1% (SAC Capital Advisors discloses 5.2% passive stake in 13G filing), GSK +1% ( JV ViiV healthcare receives FDA approval for Tivicay).

( Читать дальше )

Ждем рекордный медвежий рынок за 100 лет. Когда-то же он должен быть

- 12 августа 2013, 20:25

- |

Не хочет Юрий Иванович писать созидательные мысли на смартлаб, поэтому я откопирую его творчество самостоятельно, со ссылкой на первоисточник: http://jc-trader.livejournal.com/1031904.html

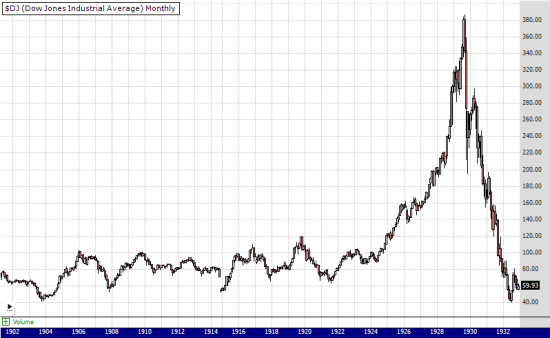

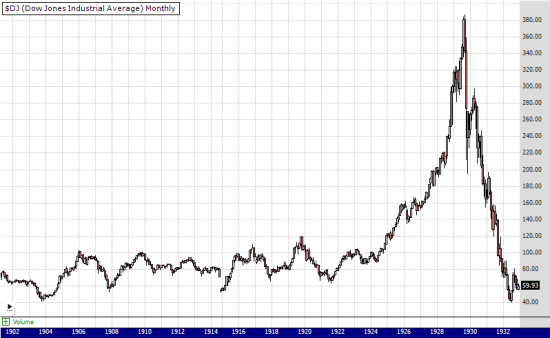

Кто сказал что максимальная просадка была в прошлом и надо ориентироваться на нее? Типа, если по индексу DJ-30 в начале 30-х годов прошлого века была просадка 90%, то большей просадки уже никогда не будет

Более-менее значимых просадок за более чем 100 лет графика было не более пяти-десяти. Это выборка слишком мала чтобы ориентироваться на то что максимальная просадка уже случилась и никогда не повторится. Ведь когда-нибудь случается то чего еще не было, тем более если что что-то похожее было только пять-десять раз. Если было когда-то 90%, то вполне может быть и 99%. Почему бы и нет?

( Читать дальше )

Кто сказал что максимальная просадка была в прошлом и надо ориентироваться на нее? Типа, если по индексу DJ-30 в начале 30-х годов прошлого века была просадка 90%, то большей просадки уже никогда не будет

Более-менее значимых просадок за более чем 100 лет графика было не более пяти-десяти. Это выборка слишком мала чтобы ориентироваться на то что максимальная просадка уже случилась и никогда не повторится. Ведь когда-нибудь случается то чего еще не было, тем более если что что-то похожее было только пять-десять раз. Если было когда-то 90%, то вполне может быть и 99%. Почему бы и нет?

( Читать дальше )

Peabody Energy Corporation, возможен слом нисходящего тренда.

- 12 августа 2013, 19:53

- |

Peabody Energy Corporation – крупнейшая частная угольная компания мира. Штаб-квартира располагается в Сент-Луисе, штат Миссури. Деятельность компании сосредоточена в США, Австралии, Индонезии, Китае, Монголии, Индии. Из угля, добытого компанией, вырабатывается приблизительной 10% электроэнергии в США и около 3% электроэнергии по всему миру.

История компании начинается в 1883 году с создания Peabody, Daniels & Company. Один из основателей компании – Френсис Пибоди, который в 1890 году становится полноправным хозяином компании, выкупив долю своего партнёра. Изначально компания закупала уголь у производителей и продавала его в розницу в Чикаго. Однако, в 1895 году компания обзаводится своей первой шахтой в штате Иллинойс.

( Читать дальше )

Swing позиции в MOS, ACM

- 12 августа 2013, 17:44

- |

Ну вот наконец начал осуществлять задуманные идеи по SWING позициям.

MOS :The Mosaic Company

MOS и POT убили, но такие компании не должны падать. Продержал пару дней.

ACM: AECOM Technology Corporation

Тут было проще, хотя кажется рано покрыл. Можно было дальше посмотреть, что с ней произойдет.

И последняя

И последняя

( Читать дальше )

MOS :The Mosaic Company

MOS и POT убили, но такие компании не должны падать. Продержал пару дней.

ACM: AECOM Technology Corporation

Тут было проще, хотя кажется рано покрыл. Можно было дальше посмотреть, что с ней произойдет.

И последняя

И последняя ( Читать дальше )

Аналитика NYSE на 12 августа

- 12 августа 2013, 16:56

- |

Аналитика NYSE на 12 августа

Спайдер снижается перед открытием торгов на NYSE.

SPY (внутридневной график) снижение на премаркете. Сопротивление: 168.50 Поддержка: 168.00

Премаркет NYSE/NASDAQ:

Gapping up:

( Читать дальше )

Спайдер снижается перед открытием торгов на NYSE.

- Европейские индексы на отрицательной территории.

SPY (внутридневной график) снижение на премаркете. Сопротивление: 168.50 Поддержка: 168.00

Премаркет NYSE/NASDAQ:

Gapping up:

- In reaction to strong earnings/guidance: ENTA +7.5%.

- M&A news: LVB +7.6% (receives superior proposal of $38.00/share from an affiliate of an investment firm), GLCH +2.4% (retains Blackstone to assist with Strategic Alternatives), BBRY +1.1% (reports exploring strategic alternatives, shares halted).

- Select Gold and Silver mining stocks trading higher: HMY +4.0%, EGO +3.7%, IAG +3.6%, AUY +3.4%, HL +3%, GDX +2.6%, KGC +2.5%, SLW +2.4%, ABX +2.2%, SLV +2%, GFI +2%, NEM +1.7%, GLD +1.1%.

- Other news: LDK +8.9% (Bloomberg story suggesting co expects to return to profit following Chinese tariff deal with Europe), MACK +4.4% (rebounding pre-mkt following last week's 17% decline), PBR +0.1% (to install 4 new PLSVs in Brazillian waters).

- Analyst comments: FFIV +2.4% (upgraded to Overweight from Equal Weight at Barclays), TMUS +2.1% (upgraded to Perform from Underperform at Oppenheimer), NTAP +1.7% (upgraded to Neutral at Robert W. Baird), LNKD +1.3% (upgraded to Buy at Needham).

( Читать дальше )

GOOG (Google Inc.) - Что грядущие недели нам готовят?

- 12 августа 2013, 12:28

- |

Компания Гугл в представлении не нуждается, этого поискового гиганта знают во всем мире. Интересная картинка образовалась на графике акции этой компании. После сильного роста до своих максимальных значений, похоже началась раздача акций всем желающм выше уровня 900. Что же ждет нас в ближайшие недели? Я подготовил 3 варианта возможных развитий событий:

( Читать дальше )

( Читать дальше )

When preparation meets opportunity – Long QCOR by Igor D

- 11 августа 2013, 21:57

- |

Небольшая статья на английском о моей самой прибыльной сделке в этом году. Надеюсь вам будет интересно её прочитать.

After QCOR made its new high around 42 back in May and started to decline, I watched it carefully, waiting for pullback to develop and looking for a good entry point in my private account. At the end of May and during the first days of June price started to form a bottom near EMA22 on the daily chart. After the Impulse turned blue on the daily on June 6, I decided to go long the next day, unless the signal reversed. The next day price rallied, and while I was placing my limit order to buy at 34.80, it ran up to 36.50, with my order left unfilled. As I try not to chase prices, I waited for another pullback. I also decided to submit this pick in SpikeTrade.

For my trading plan I wrote: “I would like to see a pullback and the formation of a higher low on intraday charts — this will be my primary entry trigger. The second entry trigger will be breaking above Friday’s high.” On Monday price rallied above previous Friday’s high at the open, allowing me to go long on my secondary entry trigger, but I decided to wait a bit more, in case there will be pullback, because I really wanted to go long on my primary entry trigger. Price did pull back during the next hour, but only very slightly, and started to consolidate in a very tight channel. As hourly EMA22 was rising, and price was holding at highs, I decided to go long if price started moving higher from that consolidation range.

( Читать дальше )

After QCOR made its new high around 42 back in May and started to decline, I watched it carefully, waiting for pullback to develop and looking for a good entry point in my private account. At the end of May and during the first days of June price started to form a bottom near EMA22 on the daily chart. After the Impulse turned blue on the daily on June 6, I decided to go long the next day, unless the signal reversed. The next day price rallied, and while I was placing my limit order to buy at 34.80, it ran up to 36.50, with my order left unfilled. As I try not to chase prices, I waited for another pullback. I also decided to submit this pick in SpikeTrade.

For my trading plan I wrote: “I would like to see a pullback and the formation of a higher low on intraday charts — this will be my primary entry trigger. The second entry trigger will be breaking above Friday’s high.” On Monday price rallied above previous Friday’s high at the open, allowing me to go long on my secondary entry trigger, but I decided to wait a bit more, in case there will be pullback, because I really wanted to go long on my primary entry trigger. Price did pull back during the next hour, but only very slightly, and started to consolidate in a very tight channel. As hourly EMA22 was rising, and price was holding at highs, I decided to go long if price started moving higher from that consolidation range.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал