SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

dax

Подскажите обозначение индекса DAX и FTSE для thinkorswim

- 12 июня 2013, 23:40

- |

Друзья, не могу найти как обозначается дакс с футси в платформе thinkorswim. Кто знает, подскажите пожалуйста. Заранее спасибо!

- комментировать

- 75

- Комментарии ( 2 )

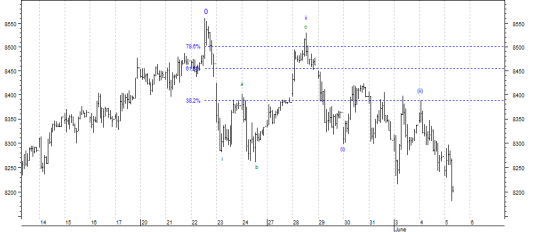

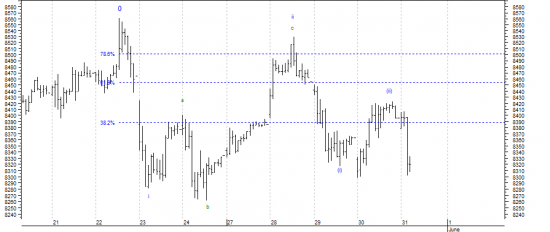

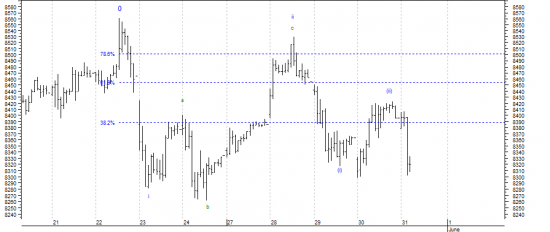

DAX update

- 11 июня 2013, 23:08

- |

Well, it was damn hard to make money during recent days — market isn't trending — a bad time for any guy with a trend seeking system:) I refuse to make directional call at this stage, and would rely solely on system's signals. Overall, the rally from 2009 lasted more than enough, sentiment readings are toppish to say at least. But the price action remains muted, and the price action is the ultimate judge…

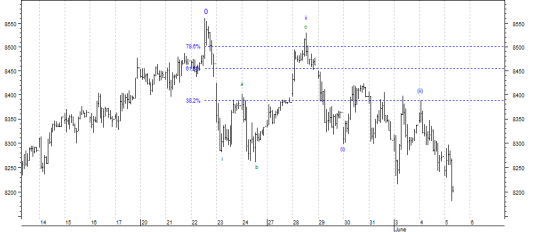

DAX update

- 07 июня 2013, 20:16

- |

Price action has screwed my bearish expectations (not the first time and not last). My system turned Up right after market had reached day lows and is firmly long across the board now. If today's spike will not be retraced down immediately today/Monday — price structure becomes bullish.

DAX update

- 06 июня 2013, 20:36

- |

Dax June 13 procceds sharply lower, as expected. Lower levels are due in days ahead.

DAX update

- 06 июня 2013, 00:00

- |

Market (Dax June 13) is trading at day's low by closing. Which is bearish ceteris paribus. Market remains open for significant downside, with 7800 as probable target level for immediate future.

DAX update

- 05 июня 2013, 15:24

- |

After a choppy deceptive trading in the first two days of the week, Dax June 13 is falling down dynamicaly. This implies a lot of downside right ahead. The risk to this view is if the market return trading back above 8300.

DAX update

- 03 июня 2013, 15:05

- |

After the brief penetration of previous low, Dax June 13 has quickly reversed to the upside. My indicators turned long across the board. Now I shall entertain the possibility that market is going to make new recovery high before the downtrend will finally kick-off.

«Ego is how you lose money in this business. I put a trade on, and if it doesn’t start working straightaway, I respect the price action and cut it fast.” Michael Platt, founder of Blue Crest Capital Management

«Ego is how you lose money in this business. I put a trade on, and if it doesn’t start working straightaway, I respect the price action and cut it fast.” Michael Platt, founder of Blue Crest Capital Management

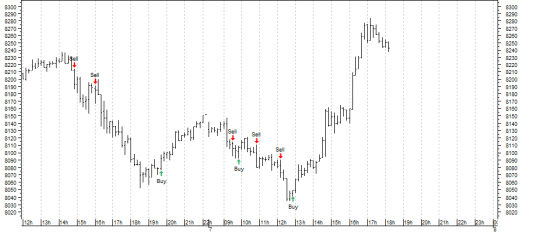

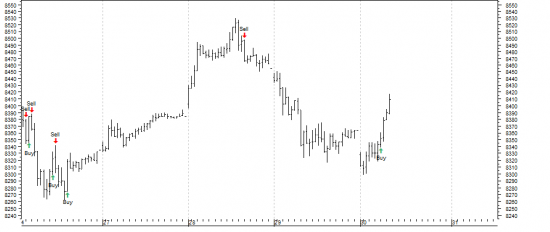

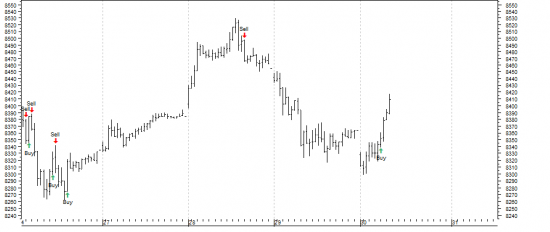

DAX update

- 31 мая 2013, 12:27

- |

Dax June 13 has sold-off dynamicaly, thus reinforcing the outright bearish scenario. My prop indicators turned «sell» by late evening yesterday on smaller TFs, and larger TFs are turning into «sell» mode now. More downside from here would imply the immediate decline into 7400 area. Stay tuned.

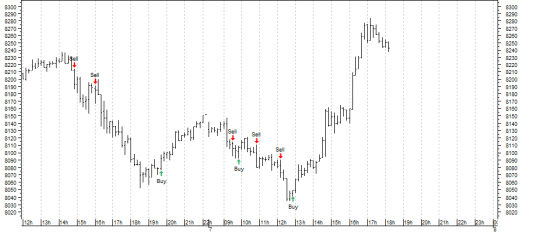

DAX update

- 30 мая 2013, 15:15

- |

Pattern in Dax June 13 becomes messy. There are several possibilities to interprete last swings. But my prop indicators turned long across the TFs. I move with the flow.

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал