CORN

⚡️ Let's measure the market situation after this volatile week.

- 19 марта 2023, 15:53

- |

Good Sunday, traders!

Let's measure the market situation after this volatile week.

▪️ Last time we expected falling in Euro. This occurred not on Monday-Tuesday, but on Wednesday we had a downside reaction on 400 futures points. But then the market again returned to balance and returned almost all weekly losses. (Watch)

I think that it will continue falling, but of course Till FED by the 22 of March the market will be in a state of uncertainty and low liquidity.

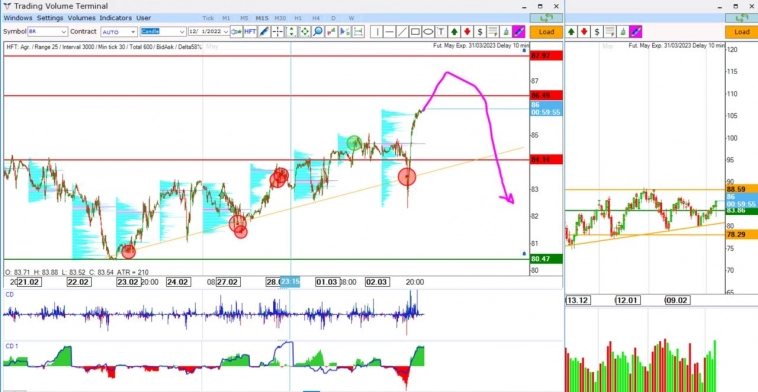

▪️ Opinion about the grain market, particularly Corn (ZC) (Watch)

( Читать дальше )

- комментировать

- 240

- Комментарии ( 2 )

⚡️ Interesting forecasts were that week, and I am also shocked that the market shows everything according to plan. Is it chaotic⁉️

- 09 марта 2023, 12:44

- |

⚡️ Today I want to justify about 3 interesting pictures on the futures market.

- 05 марта 2023, 22:02

- |

Good evening, traders! 👋

Today I want to justify about 3 interesting pictures on the futures market.

▪️ Japanese yen (6J) shows preparations to break the demand zone.

The quantitative cumulative delta was negative several times before the support. Bid HFTs were created near the level, and afterward, we can observe the involvement in buys. It is necessary to collect liquidity and then, break the demand level. If after the current Ask tick chain, the price stops growing it will be a good selling opportunity.

▪️ Brent Oil (BR) created a new uptrend line with the help of fast tick chains on it. Very often price return to such trendlines and break them.

( Читать дальше )

Ум не в бороде, а в голове

- 16 декабря 2022, 12:34

- |

📰Прогноз рынка по приоритетам на ➡️ пятница, 16 декабря 2022

Каждый день я использую вот эти данные, чтобы понимать в какую сторону лучше торговать сегодня и среднесрочно. Сохранять объективную картину рынка помогают #приоритеты рассчитанные на основании опционных данных.

Буду благодарен за 👍 лайки и комментарии 💬

——-🫥——-

Сигналы для открытия позиций в несколько дней/недель со stop-loss равным двойному дневному ATR (

( Читать дальше )

⚡️ Fresh volume view on Coffee, Corn, Oil, SP500, Gas, Pound

- 11 декабря 2022, 01:50

- |

Today I finally made a short but very intense review of the most interesting current imbalances on the most liquid instruments of commodities, currencies and indices. 🤩

A fresh view on Coffee (KC), Corn (ZW), Crude Oil (CL), Brent (BR), S&P500 (ES), Natural Gas (NG), British Pound (6B), Euro (6E), Mexican peso (6M).

Really a lot of peculiar market pictures to workout the following week 💪

This 10 minutes video is ready for your attention! 👇

( Читать дальше )

⚡️ Very strong actitvity in Crude oil and Precious metals

- 20 ноября 2022, 04:01

- |

Hallo, Traders! ☀️

This week I want to focus on Crude oil, Precious metals, also Agricultural products.

We see a significant increase in open interest, which means good opportunities for us. ☝️

Watch this 13 minutes video and be prepared

( Читать дальше )

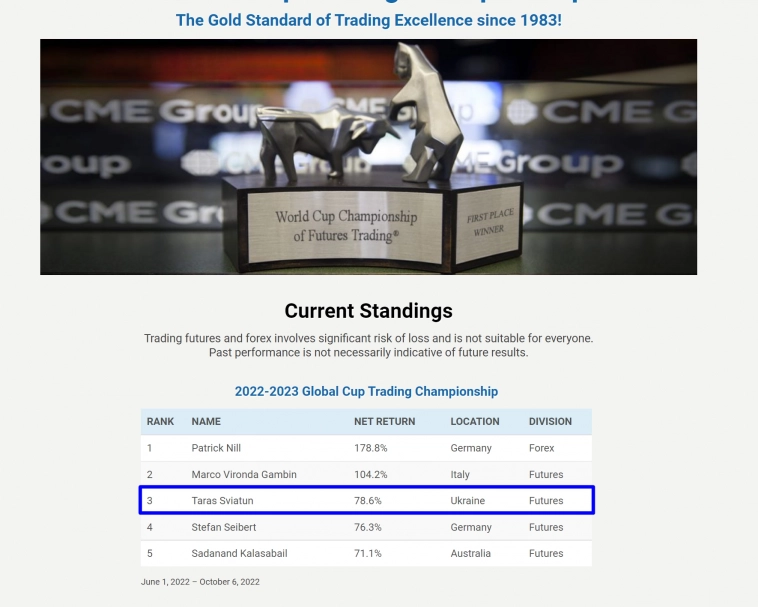

Global Cup 2022 and forecasts in Corn, Sugar, Crude oil

- 09 октября 2022, 16:15

- |

Hello traders, the battle is very exciting, I climbed a level higher, but competitors are running out 😬

All predictions of the previous week showed a very good performance 💪

Today we will observe Corn (ZC) 🌽, Sugar (SB), and Crude oil (CL).

All the details you are able to get from this 13-minute video

( Читать дальше )

NEW buying opportunities in 6N, 6C, 6A and Corn

- 21 августа 2022, 18:03

- |

Good day, Traders, NEW video analysis is ready!

Today we will speak about Corn (ZC) and buying opportunities in the New Zealand dollar (6N), Canadian dollar (6C), and Australian dollar (6A).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал