SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

currency

>>> WALL STREET on-line

- 28 февраля 2014, 22:17

- |

Чтобы не смотреть весь аналитический обзор, Вы можете выбрать рубрику из списка ниже по интересной Вам категории и видео откроется c нужной минуты.

- Новости (важно)

- Рейтинг публичных трейдеров ( Вождь — порвал Евро )

- S&P 500 ( ОИ немного спал )

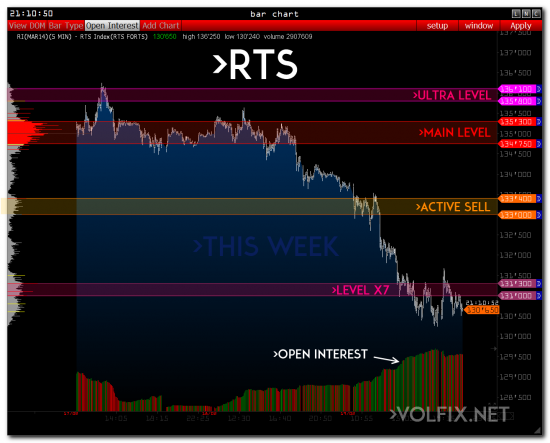

- RTS ( продавцы еще не отступили )

- Euro ( еще движение не закончилось )

- Pound ( сиьная локация )

- Рубль ( не хватает спроса )

- Золото ( ждет нефть )

- Нефть ( замечены локации на продажу )

- комментировать

- 9

- Комментарии ( 1 )

Почему объем?

- 26 февраля 2014, 20:50

- |

Анализируя котировку можно получить определенную информацию исходя из которой происходит просчет определенных сценариев, которые могут произойти. Наиболее вероятный берется во внимание и в случаи подтверждающих алертов, заключается сделка. Есть различные модели, а так же уровни, которые являются ключевыми, например уровень поддержки или сопротивления.

Если добавить к этой информации уровень ликвидности на определенных ценах. По каким ценам в той или иной модели происходили сделки сверх обычной ликвидности. Где размещались более крупные и проинформированные участники торгов.

( Читать дальше )

>>> RTS

- 19 февраля 2014, 22:22

- |

Сценарий на продажу прошел удачно. Моменты, которые были рассмотреть вчера, были выполнены. Тем, кто сегодня полез покупать, советуем немного успокоиться и убрать ошибки в просчете возможных сценариев потому, что неправильно выбранные цели и задачи на завтра дезинформируют, а это дополнительные риски и ошибки.

( Читать дальше )

>>> RTS

- 18 февраля 2014, 20:28

- |

Добрый вечер друзья, коллеги.

Рассмотрим ситуация по индексу РТС на сегодняшнюю торговую сессию.

Первое, что необходимо отметить — это неспособность покупателей расширить ценовые границы за пределы объемного сопротивления. Именно объемного потому, что 17-го числа действительно крупные сделки проходили в ценовом диапазоне 135700 по 136200.

Те, кто применяют объемный анализ рынка — сегодня заметили объемную отработку этого уровня и слабость покупателей, которую отчетливо видно по рыночной Delta (слайд №3).

( Читать дальше )

>>> КОММЕНТАРИИ ( Currency )

- 12 февраля 2014, 22:19

- |

Этот обзор будет полезен тем, кто торгует валютные фьючерсы.

Рассмотрим: EURO, POUND, CAN DOLLAR, RUB.

> EURO

Сегодня фьючерс показал неспособность расширить границы за пределы значимого диапазона 1.366 – 1.368. Именно этот диапазон на этой неделе был ключевой фигурой. Так же стоит отметить, что котировка не поддерживалась на уровне 1.36 – там сосредоточена локация поддержки, которая сформировала недавно восходящий импульс на неплохом объеме. Теперь стоит мониторить единственный уровень поддержки, который был на прошлой неделе – это 1.356 по 1.3570. Именно данный диапазон пока остановил продавцов. Завтра может произойти продолжение расширения границ за пределы этого уровня, если во время американской сессии не смогут закрепиться выше 1.36.

( Читать дальше )

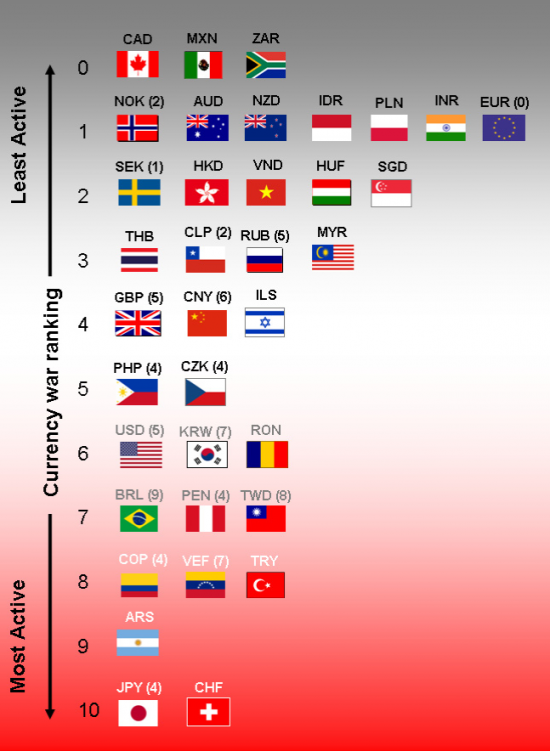

Forex (in english): Currency war?

- 20 февраля 2013, 11:07

- |

Is there currency war? (source: HSBC)

Not everyone subscribes to the currency war theme. For example, the IMF’s chief economist believes talkof a global currency war is “overblown” while Bank of Canada’s governor said there is “no sign of a currency war globally”. The previous governor of the SNB argues that currency weakness is often just a side-effect of central banks seeking to meet their policy mandates. One could have some sympathy for their view. After all, manipulation of currencies by policymakers is hardly a new phenomenon, be it in emerging markets or G10, and currency weakness may simply be a side-effect of the new era of zero interest rates and unconventional easing.

While some of the world is engaged in a currency war, Russia and Chinaare pushing in the opposite direction.The CBR maintains an exchange rate target, but it is being liberalised with a target of a free floating currency by2015. In China, the PBOC has become increasingly ‘hands off’, and the FX regime is becoming more market driven and liberalised. Less activist currencies, notably the EUR, may be the ‘safety valve’ for depreciations elsewhere.

Who are the most active in currency war?

Not everyone subscribes to the currency war theme. For example, the IMF’s chief economist believes talkof a global currency war is “overblown” while Bank of Canada’s governor said there is “no sign of a currency war globally”. The previous governor of the SNB argues that currency weakness is often just a side-effect of central banks seeking to meet their policy mandates. One could have some sympathy for their view. After all, manipulation of currencies by policymakers is hardly a new phenomenon, be it in emerging markets or G10, and currency weakness may simply be a side-effect of the new era of zero interest rates and unconventional easing.

While some of the world is engaged in a currency war, Russia and Chinaare pushing in the opposite direction.The CBR maintains an exchange rate target, but it is being liberalised with a target of a free floating currency by2015. In China, the PBOC has become increasingly ‘hands off’, and the FX regime is becoming more market driven and liberalised. Less activist currencies, notably the EUR, may be the ‘safety valve’ for depreciations elsewhere.

Who are the most active in currency war?

Анализ секторов и финансовых показателей

- 14 ноября 2011, 20:59

- |

Аналитик компании United Traders, Рафаэль Григорян представляет Вашему вниманию свежий выпуск авторского аналитического обзора о фондовых рынках США. Выпуск от 14 ноября 2011. Специальный гость — трейдер United Traders, Сергей Майоров.

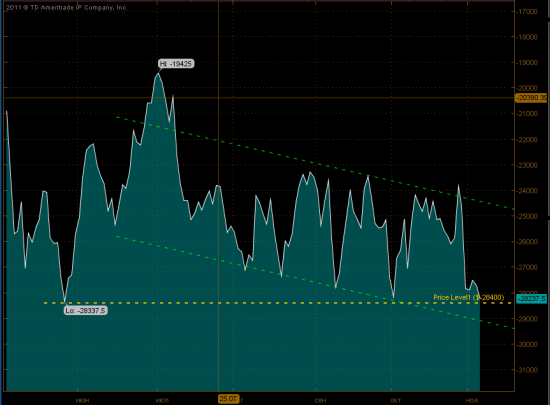

Currency spread: Euro FX vs. British Pound

- 04 ноября 2011, 23:09

- |

Валютный спред — 1 контракт евро (СМЕ: /6Е) против 2 фунтов (СМЕ: /6В).

Подошел к нижней границе канала и, заодно, к 6-месячному минимуму.

Т.ч. как вариант — в лонг по евро и в шорт по фунту.

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал