cl

🛢Мысли по нефти 📉

- 01 августа 2023, 18:23

- |

🛢 Нефть (BRU3):

Сейчас самый подходящий момент шортануть жижу с целями 79,50-80$.

4х-часовик уже готов к походу вниз, дневка уже делает второй виток роста в перекупленности и тоже готова сорваться вниз, недельный таймфрейм уже «кричит» о развороте/коррекции, как ни как растём с 73$ и в самый раз немного тряхануть расслабленных бычков, мечтающих о 88-90$ за баррель.

Приглашаю посетить/подписаться на мои Telegram-ресурсы, чтобы не пропускать полезную информацию по рынку:

▪️ Telegram📊канал

▪️ Чат для трейдеров💭инвесторов

▪️ Новостной📺агрегатор

- комментировать

- 517

- Комментарии ( 4 )

🛢Мысли по нефти 📉

- 17 июля 2023, 09:26

- |

Нефть (BRQ3):

Сразу с открытия нарисовали гэп около 30 центов, это будет ориентиром на будущее, его могут закрыть как и сегодня, так и устроить ловушку для интрадейных лонгистов, которые могут начать сейчас покупать с целью закрытия гэпа. Мои мысли, что падение по нефти только начинается, и в скором времени мы увидим отметки 77-75$. Далее уже надо будет осмотреться, вполне возможно, что можем пойти тестить 3-й раз лои года 71,50-72$.

▪️ Telegram📊канал

▪️ Чат для трейдеров💭инвесторов

New imbalances in Oil markets 🛢

- 11 июня 2023, 18:55

- |

Today I made a video review on the British Pound (6B), Japanese Yen (6J), and Australian dollar (6A), and forecasts in Crude Oil (CL), Brent Oil (BR) , and Natural Gas (NG).

This 9 — minutes video is for you

Thank you very much for watching!

Have a good week.

🛢Мысли по нефти 🚀

- 08 июня 2023, 18:05

- |

Шортим до 75,60 примерно, потом лонг до 79,50. Могут даже дневку к потолку потом приструнить и в ход пойдёт недельный тайм, там стох будет супер-лонговый:

( Читать дальше )

🛢Мысли по нефти 📉

- 08 июня 2023, 10:31

- |

Не мог пройти мимо нефти (BRN3), та самая мною любимая ситуация по 1Н, 2Н, 4Н и дневке — все стохи наверху, пора безжалостно шортить чёрное золото, 1-я цель — это закрыть микрогэп по 75,81, далее работаем по ситуации, дополнения по жиже напишу как достигнем вышеуказанную отметку.

Приглашаю посетить и подписаться на мои Телеграм-ресурсы, чтобы не пропустить важную и актуальную информацию по срочному рынку, а так же полезные вью на различные инструменты:

▪️ Telegram канал

▪️ Чат для трейдеров и инвесторов

ES и CL 01.06

- 01 июня 2023, 22:20

- |

SP500

ES, cme, День.

( Читать дальше )

BP good buy, нефть buy.

- 28 мая 2023, 21:20

- |

Здравствуйте, коллеги!

Пользовался долгое время отчётами BP Statistical Review of World Energy, с этого года данные будут выходить в Energy Institute (EI) первая ласточка уже скоро: 26 июня 2023 года.

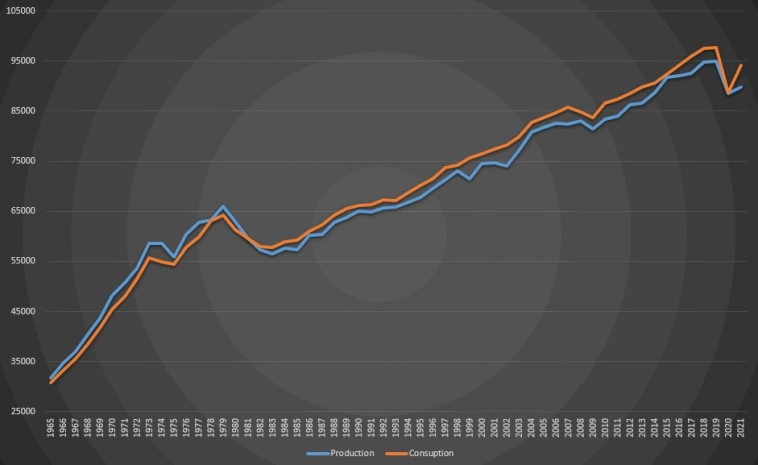

Мировое производство и потребление нефти с 1965 года (thousand barrels daily):

Заявление Александра Новака 13.10.2022 г.

«На хайпе перехода к зеленой повестке дня случилась такая история. В итоге мы наблюдаем, что у нас на сегодняшний день больше чем в два раза снижен объем инвестиций в мировую нефтяную отрасль. Если раньше это было около $700 млрд в год, то сегодня инвестиции – примерно $300 млрд в год»

Выступление в Хьюстоне Amin H. Nasser, Saudi Aramco President & CEO на World Petroleum Council Congress 2021

Здесь и далее Crude Oil WTI — NYMEX

На годовом плане ласт бар обозначил экстремум и образовался пин бар, после окончания коррекции, сценарий возобновления тренда:

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал