traders

Ufavorable market predictions, how to avoid losses ☝️

- 15 июля 2023, 22:00

- |

Good evening, traders!

This week was good for trend following strategies, but bad for reversals. Trends make up 20-30% of market movements and exist only on historical charts, so it is very difficult to predict when they will occur.

Today I want to overview my unfavorable predictions and take your attention to the topic of how to avoid losses on the examples of the previous week.

- комментировать

- 620

- Комментарии ( 0 )

So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

- 28 мая 2023, 16:59

- |

Hello dear traders!

● So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

● What will be next? now it is difficult to predict.

Nasdaq made an impudent bullish workout of the support 👏

( Читать дальше )

⚡️ Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL)

- 23 апреля 2023, 18:11

- |

Good evening, TVT traders!

Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL).

🔹 Swiss Frank (6S) has enough information to make a forecast that the price will go to test the zone 1.1150, where liquidity is concentrated. Despite we see that the price closed above commercial resistance, where hedge funds added their long position by 30% for the third week in a row. OI increased by +6,7%. Also, the trading week closed above technical resistances on the 15M charts. But no energy for further rising, and in such case downside movement is more probable. (Watch)

🔹 As for Dow Jones (YM) (Watch)

( Читать дальше )

⚡️ Today I want to measure a Canadian Dollar (6C)

- 26 февраля 2023, 21:23

- |

Good evening, traders!👋

Today I want to measure a Canadian Dollar (6C).

▪️ So we see how the price came to the solid technical support on the daily chart. (watch)

But look at significant block trades on the options market passed on strike 0,74.

▪️ Moreover, on the 15M chart, we also came to double strong volumetric support zone. (watch)

( Читать дальше )

According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

- 19 февраля 2023, 15:40

- |

Good Sunday, traders!

According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

Until then they will recover for unreleased reports.

“Following the ION cyber-related incident, reporting firms are continuing to experience some issues submitting timely and accurate data to the CFTC. As a result, the weekly Commitments of Traders (CoT) report that normally would have been published on Friday, February 17, will be postponed.

“CFTC staff intends to resume publishing the CoT report as early as Friday, February 24, 2023. Staff will begin with the CoT report that was originally scheduled to be published on Friday, February 3, 2023. Thereafter, staff intends to sequentially issue the missed CoT reports in an expedited manner, subject to reporting firms submitting accurate and complete data. Staff anticipates that, pending the timely, accurate and complete submission of backlogged data by reporting firms to the CFTC, these missed CoT reports will be published by mid-March. After that, CoT report publication will resume its usual weekly schedule.”

For the next week, I don’t see some exciting pictures for today. Moreover, on Sunday we have Holyday in US and Canada.

Only Cocoa (CC) shows us interesting backgrounds for correction. (Watch)

We need more movements to discover something interesting the next week.

Have a good Sunday!

Today I have no possibility to make a video forecast, but I want to measure some ideas for you.

- 29 января 2023, 20:30

- |

Good afternoon, traders!

The price closed below the huge Ask tick chain near 4100, not achieved to the supply zone, and made a fast pullback. I see shorting opportunity, that the price will reach the 4020 price level.

Silver (SI)

On Silver vice-versa we see a Bid tick imbalance and some accurate algorithmic purchases on Friday according to the cumulative delta quantitative (CDQ) which diverges with the volume delta (CD). The price is coiling in the long-range during last 2 months and has a high probability to move toward the upper boundary and break it.

Copper (HG)

Copper made a peculiar squeeze of buyers, created a Bid tick imbalance, and bounced back from a commercial level into the range. Hedge funds continue aggressively buying the asset, increasing their longs by 18% with the OI increase by 6%.

We see a very strong divergence between CDQ and CD, clear absorption of stoploss liquidity with algorithms.

( Читать дальше )

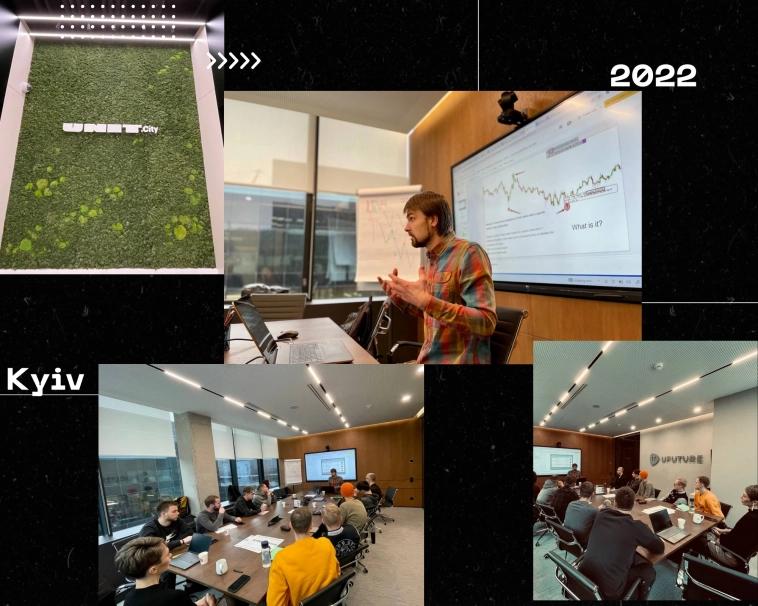

💻 Organize your workspace

- 27 ноября 2022, 18:31

- |

Добрый вечер, трейдеры! ✨

В эти выходные я возвращаюсь из Киева, где проводил вебинар для криптофонда «Ufuture» в Unit.City. У меня нет времени делать воскресный утренний обзор, но вместо этого я хочу поделиться с вами 1-м видео из моего нового образовательного курса (англоязычного), над которым я сейчас работаю.

💻 Как я организую свое рабочее пространство

( Читать дальше )

⚡️ Very strong actitvity in Crude oil and Precious metals

- 20 ноября 2022, 04:01

- |

Hallo, Traders! ☀️

This week I want to focus on Crude oil, Precious metals, also Agricultural products.

We see a significant increase in open interest, which means good opportunities for us. ☝️

Watch this 13 minutes video and be prepared

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал