SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

nyse

NYSE - в этом разделе трейдеры пишут о торговле на американском рынке акций и на нью-йорской фондовой бирже в частности. Здесь, трейдеры американского рынка пишут о своих сделках, выкладывают акции для торговли на сегодняшний день, пишут о новостях по американским компаниям, а также дают технический анализ американского рынка. Чтобы ваши записи по американскому рынку попадали в этот раздел, ставьте тег NYSE своим записям.

Акции бросало вверх и вниз, пришлось INFA закрыть в б/у (+5пп)

- 12 сентября 2014, 09:18

- |

Пока ничего не поменялось: идет флэт на СиПи500 причем с общим настроением вниз. Акция INFA была продана в шорт еще день назад и оставалась на ночь.

Но на открытиt она не показала своего устойчивого желания слетать вниз, поэтому пришлось передвинуть стоп на б/у, которыq с успехом закрылся.

Общий фон остается в целом нестабильный. Многие аналитики в США призывают раскрыть глаза на хорошие экономические данные и настаивют на росте. Многие наооборот заявляют о тяжелых проблемах в Европе, которые докатятся и до США, стерев все то положительное, о чем заявляют первые.

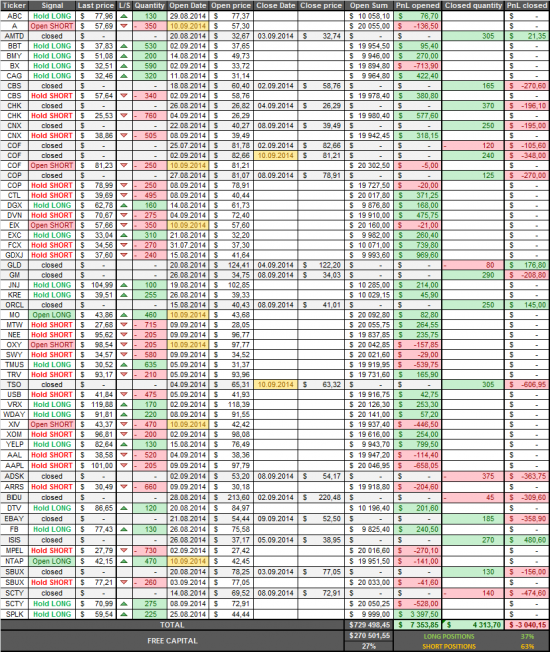

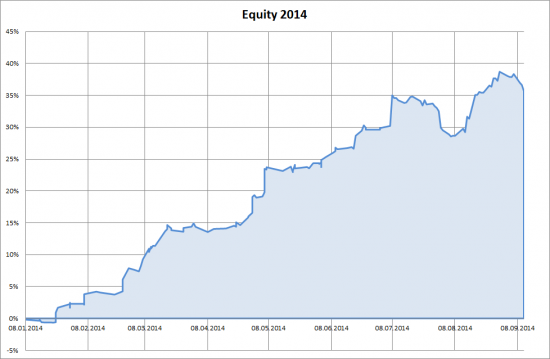

Мы же пока видим устойчивый рост распродаж топ-менеджерами. В течение недели количество проданных ими акций подскочило в очередной раз. Будет ли адекватным ответ рынка, покажет следующая неделя. В сделках у нас в основном преобладают шорт позиции. Есть и лонги, но они в ндексах волатильности.

(подробнее об отборе подобных компаний)

Но на открытиt она не показала своего устойчивого желания слетать вниз, поэтому пришлось передвинуть стоп на б/у, которыq с успехом закрылся.

Общий фон остается в целом нестабильный. Многие аналитики в США призывают раскрыть глаза на хорошие экономические данные и настаивют на росте. Многие наооборот заявляют о тяжелых проблемах в Европе, которые докатятся и до США, стерев все то положительное, о чем заявляют первые.

Мы же пока видим устойчивый рост распродаж топ-менеджерами. В течение недели количество проданных ими акций подскочило в очередной раз. Будет ли адекватным ответ рынка, покажет следующая неделя. В сделках у нас в основном преобладают шорт позиции. Есть и лонги, но они в ндексах волатильности.

(подробнее об отборе подобных компаний)

- комментировать

- Комментарии ( 0 )

SPY падает на премаркете

- 11 сентября 2014, 17:14

- |

Ближайший уровень поддержки по SPY – 199.00 уровень сопротивления – 199.70

LE продажа от 40

EMES покупка выше 130

SLCA покупка выше 70

UTHR продажа от 122

GPRO покупка выше 69

Gapping up/down: JDSU +14% after guidance/spin-off announcement, LULU +14% after earnings, GPRO +3% after gt raise; RH -4% after earnings, energy and metals tradind lower, CROX -3% after dg

Gapping up

In reaction to strong earnings/guidance: GRO +19.4%, JDSU +14%, (reaffirms; to Separate into Two Industry-Leading Public Companies), LULU +13.6%, SIGM +10%, LFVN +8%, WTSL +5.9%, MBUU +5.1%, BRC +3.1%, RSH +2.2%

M&A news: RAX +0.9% (cont M&A spec)

Other news: IMRS +19.7% (neurosurgical HFD rocker arm receives FDA clearance), DGLY +12.8% (to introduce 'Bullet Camera' option for FirstVU HD body camera system at IACP conference), LAND +7.7% (announces REIT Election), GOGO +5.4% (Gogo and T-Mobile (TMUS) to deliver free in-flight texting and voicemail to T-Mobile customers), RXII +4.5% (presented an update on the company's dermatology and ophthalmology franchises), PT +3.8% (still checking), FNSR +3.6% (following JDSU news/guidance), GPRO +3.3% (favorable commentary on Wednesday's Mad Money), SOL +2.1% (to supply 10MW DCR solar modules to Utility-Scale project in India), POWR +1.9% (disclosed it acquired the electrical contracting business of Apex Controls), MDVN +1.4% (FDA approves new indication for the use of XTANDI (enzalutamide) capsules for patients with metastatic castration-resistant prostate cancer), MBLY +1.4% (still checking), EXXI +1.2% (Energy XXI late spike attributed to speculation of Gulf of Mexico asset sale), GTAT +1.2% (modestly rebounding), EMC +1.2% (reports of VMW stake sale), TWX +0.9% (does not have plans for HBO spin off, 'seriously' looked at Fox (FOXA) offer, CEO said, according to reports)

( Читать дальше )

LE продажа от 40

EMES покупка выше 130

SLCA покупка выше 70

UTHR продажа от 122

GPRO покупка выше 69

Gapping up/down: JDSU +14% after guidance/spin-off announcement, LULU +14% after earnings, GPRO +3% after gt raise; RH -4% after earnings, energy and metals tradind lower, CROX -3% after dg

Gapping up

In reaction to strong earnings/guidance: GRO +19.4%, JDSU +14%, (reaffirms; to Separate into Two Industry-Leading Public Companies), LULU +13.6%, SIGM +10%, LFVN +8%, WTSL +5.9%, MBUU +5.1%, BRC +3.1%, RSH +2.2%

M&A news: RAX +0.9% (cont M&A spec)

Other news: IMRS +19.7% (neurosurgical HFD rocker arm receives FDA clearance), DGLY +12.8% (to introduce 'Bullet Camera' option for FirstVU HD body camera system at IACP conference), LAND +7.7% (announces REIT Election), GOGO +5.4% (Gogo and T-Mobile (TMUS) to deliver free in-flight texting and voicemail to T-Mobile customers), RXII +4.5% (presented an update on the company's dermatology and ophthalmology franchises), PT +3.8% (still checking), FNSR +3.6% (following JDSU news/guidance), GPRO +3.3% (favorable commentary on Wednesday's Mad Money), SOL +2.1% (to supply 10MW DCR solar modules to Utility-Scale project in India), POWR +1.9% (disclosed it acquired the electrical contracting business of Apex Controls), MDVN +1.4% (FDA approves new indication for the use of XTANDI (enzalutamide) capsules for patients with metastatic castration-resistant prostate cancer), MBLY +1.4% (still checking), EXXI +1.2% (Energy XXI late spike attributed to speculation of Gulf of Mexico asset sale), GTAT +1.2% (modestly rebounding), EMC +1.2% (reports of VMW stake sale), TWX +0.9% (does not have plans for HBO spin off, 'seriously' looked at Fox (FOXA) offer, CEO said, according to reports)

( Читать дальше )

Что такое фондовая биржа?

- 11 сентября 2014, 15:08

- |

Фондовая биржа — это площадка для взаимодействия покупателей и продавцов акци, облигаций, а также их производных: фьючерсов и опционов.

Как торговать акциями прямо на бирже?

Что, казалось бы, проще, чем торговать на бирже акциями? Но ключевые роли здесь давно расписаны. На нью-йоркской фондовой бирже (Nyse) работают 443 специалиста, обеспечивающих ликвидность по акциям двух тысяч восьмисот компаний.

Помимо специалистов, на бирже можно встретить журналистов, менеджеров по продажам, руководство крупных компаний. Как правило, все они, а вернее их компании, так или иначе, оплатили место под Солнцем.

Место на нью-йоркской фондовой бирже можно арендовать. Для этого достаточно заплатить 12 тысяч долларов. Это только за присутствие на бирже, без учёта оборудования. Если арендовать на несколько лет, освобождаетесь от части накладных расходов, на которые уходит ещё около тысячи долларов.

При аренде места на Nyse всё равно работать через специалиста. Непрофессионалов на бирже не любят и стараются не пускать. Конечно, там довольно много обслуги. Но под предлогом борьбы с терроризмом вход строго по пропускам. Даже журналисты стараются никого не отвлекать.

( Читать дальше )

Началось перетягивание каната. Были в шорт по BHI (+5пп) и ROVI (+35пп)

- 11 сентября 2014, 08:22

- |

Наконец-то начинается настоящее перетягивание каната, если судить по статьям американских таблоидов. Те осторожные бычьи и медвежьи голоса тамошних аналитиков переросли в настойчивые утверждения, куда именно пойдет рынок. Их примерно поровну. Куда же на самом деле он рванет?

Похоже, что сначала по принципу «шаг вперед, два назад», а затем «шаг назад и два вперед». И пока горит красный аларм коррекционного движения — сделки преимущественно совершаются в шорт.

Так и вчера, не смотря на отобранный список и в лонг и в шорт, были выбраны две компании BHI ROVI, которые обе рассматривались для короткой позиции.

В течение первых пол-часа осуществился вход в сделки, и довольно быстро минут через 15 были установлены следящие стопы уже с прибылью. Но если ROVI до конца дня показывало устойчивое снижение (как днем ранее TEX), то BHI не смотря на нисходящую нефть пошла с рынком и закрыла позицию с +5пп.

( Читать дальше )

Похоже, что сначала по принципу «шаг вперед, два назад», а затем «шаг назад и два вперед». И пока горит красный аларм коррекционного движения — сделки преимущественно совершаются в шорт.

Так и вчера, не смотря на отобранный список и в лонг и в шорт, были выбраны две компании BHI ROVI, которые обе рассматривались для короткой позиции.

В течение первых пол-часа осуществился вход в сделки, и довольно быстро минут через 15 были установлены следящие стопы уже с прибылью. Но если ROVI до конца дня показывало устойчивое снижение (как днем ранее TEX), то BHI не смотря на нисходящую нефть пошла с рынком и закрыла позицию с +5пп.

( Читать дальше )

SPY топчется на месте

- 10 сентября 2014, 16:59

- |

Ближайший уровень поддержки по SPY – 199.25 уровень сопротивления – 199.75

THC продажа ниже 61

BITA покупка при удержании 82

NPSP продажа от 30

Gapping up/down: PANW +5% after earnings, CLF +2% on amended credit facility, TWTR +3% after upgrade; KKD -5% after earnings, AU -12% on restructuring announcement, GTAT -6% on dg at GS

Gapping up

In reaction to strong earnings/guidance: MNDL +10.2%, LMNR +8.1%, DIOD +6.8%, PANW +5.3%, LE +5%, UNIS +4.6%, PPHM +3.2%, PDLI +3.1%, SIRI +1.1%, IHT +1%, SAIC +0.5%.

M&A news: IMPV +2.8% (Imperva, TIBX, TDC among possible takeover targets by HP (HPQ), according to reports), EXPR +1.2% (Barron's mentions name as M&A target), FDO +0.3% (Dollar General (DG) commences cash tender offer to acquire FDO at $80 per share).

Select EU bell weather names showing strength: BP +1.7%, ING +1.2%, DB +0.9%, RDS.A +0.9%, ALU +0.6%.

Select Biotech stocks trading higher: MNOV +13.3%, NPSP +13% (following FDA briefing docs), TKMR +3.2%, SPPI +2.4%, ACHN +1%.

Other news: DRL +12.4% (announces the sale of ~$430 mln in assets), PVCT +7.5% (still checking), BDBD +6.8% (favorable commentary on Tuesday's Mad Money), SUPN +6.2% (Orchard Hill Capital Management files amended 13D; request that the Board hires a strategic advisor to consider selling the Company), BWEN +4.1% (announced $14 million in new tower orders from a U.S. wind turbine manufacturer), RADA +3.9% (cont momentum), SUNE +3.6% (Google (GOOG) executes $145 million investment in SunEdison and TerraForm Power's (TERP) largest solar plant in North America), GPRO +3% (still checking), CLF +1.8% (amended revolving credit facility to allow for $200 mln share repurchase program), FEYE +1.5% (in sympathy with PANW earnings), LTM +1.2% (favorable commentary on Tuesday's Mad Money), TFSL +1.1% (authorizes the purchase of up to 10,000,000 shares of the Company's outstanding common stock), THOR +1.1% (announced start of Heartmate III U.S. clinical trial) CRM +1% (signs agreement to establish new european data centre in France; selects Interxion (INXN) as service provider), HAIN +1% (favorable commentary on Tuesday's Mad Money), TSL +1% (to supply 70MW high efficiency modules to a large-scale solar power project in Chile), KFRC +1% (announces increase to board share buyback authorization by $70 mln).

( Читать дальше )

THC продажа ниже 61

BITA покупка при удержании 82

NPSP продажа от 30

Gapping up/down: PANW +5% after earnings, CLF +2% on amended credit facility, TWTR +3% after upgrade; KKD -5% after earnings, AU -12% on restructuring announcement, GTAT -6% on dg at GS

Gapping up

In reaction to strong earnings/guidance: MNDL +10.2%, LMNR +8.1%, DIOD +6.8%, PANW +5.3%, LE +5%, UNIS +4.6%, PPHM +3.2%, PDLI +3.1%, SIRI +1.1%, IHT +1%, SAIC +0.5%.

M&A news: IMPV +2.8% (Imperva, TIBX, TDC among possible takeover targets by HP (HPQ), according to reports), EXPR +1.2% (Barron's mentions name as M&A target), FDO +0.3% (Dollar General (DG) commences cash tender offer to acquire FDO at $80 per share).

Select EU bell weather names showing strength: BP +1.7%, ING +1.2%, DB +0.9%, RDS.A +0.9%, ALU +0.6%.

Select Biotech stocks trading higher: MNOV +13.3%, NPSP +13% (following FDA briefing docs), TKMR +3.2%, SPPI +2.4%, ACHN +1%.

Other news: DRL +12.4% (announces the sale of ~$430 mln in assets), PVCT +7.5% (still checking), BDBD +6.8% (favorable commentary on Tuesday's Mad Money), SUPN +6.2% (Orchard Hill Capital Management files amended 13D; request that the Board hires a strategic advisor to consider selling the Company), BWEN +4.1% (announced $14 million in new tower orders from a U.S. wind turbine manufacturer), RADA +3.9% (cont momentum), SUNE +3.6% (Google (GOOG) executes $145 million investment in SunEdison and TerraForm Power's (TERP) largest solar plant in North America), GPRO +3% (still checking), CLF +1.8% (amended revolving credit facility to allow for $200 mln share repurchase program), FEYE +1.5% (in sympathy with PANW earnings), LTM +1.2% (favorable commentary on Tuesday's Mad Money), TFSL +1.1% (authorizes the purchase of up to 10,000,000 shares of the Company's outstanding common stock), THOR +1.1% (announced start of Heartmate III U.S. clinical trial) CRM +1% (signs agreement to establish new european data centre in France; selects Interxion (INXN) as service provider), HAIN +1% (favorable commentary on Tuesday's Mad Money), TSL +1% (to supply 70MW high efficiency modules to a large-scale solar power project in Chile), KFRC +1% (announces increase to board share buyback authorization by $70 mln).

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал