SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

DAX

S&P 500 Есть ли жизнь на Марсе?

- 06 октября 2013, 16:51

- |

Всех нас интересует вопрос, а есть ли жизнь на Марсе, но как мы уже давно знаем — науке пока это не известно.

Более того с учетом прекращения работы NASA («Due to the lapse in federal government funding, this website is not available. We sincerely regret this inconvenience.» notice.usa.gov) мы это можем и не узнать в ближайшем будущем, хотя поговаривают, что программа Curiosity не приостановлена ввиду, того, что финансируется так же из частных источников. Однако на сайт ее попасть так же невозможно, потому что это поддомен NASA.

Страшно только одно в этой ситуации, что если к нам прилетит астероид, или армада инопланетян, то ну ни как мы не спасемся от этой напасти ибо некому будет известить вот этого человека

и он во время не успеет прийти нам на помощь.

( Читать дальше )

Более того с учетом прекращения работы NASA («Due to the lapse in federal government funding, this website is not available. We sincerely regret this inconvenience.» notice.usa.gov) мы это можем и не узнать в ближайшем будущем, хотя поговаривают, что программа Curiosity не приостановлена ввиду, того, что финансируется так же из частных источников. Однако на сайт ее попасть так же невозможно, потому что это поддомен NASA.

Страшно только одно в этой ситуации, что если к нам прилетит астероид, или армада инопланетян, то ну ни как мы не спасемся от этой напасти ибо некому будет известить вот этого человека

и он во время не успеет прийти нам на помощь.

( Читать дальше )

Торопиться с покупками уже поздно

- 17 сентября 2013, 09:42

- |

С волны роста началась эта неделя на мировых фондовых биржах. Самоотвод Л. Саммерса из числа претендентов в гонке на должность главы ФРС поднял вчера фондовые индикаторы Европы и США на новые максимумы. Бывший глава Минфина считался противником программы количественного смягчения, проводимой ФРС. Теперь фаворитом на пост председателя ФРС является Дж. Йеллен, которая поддерживает монетарное стимулирование экономики. Это полностью устраивает биржевых игроков. Надо признать, что полноценного ралли на Уолл-стрит вчера мы так и не увидели. Индекс компаний высоких технологий Nasdaq закрылся в минусе из-за падения «тяжеловесных» акций Apple (-3,12%). В отличие от США, панъевропейский индекс Stoxx Europe 600 вырос до максимальных отметок с июня 2008 года. Германский DAX накануне предстоящих в стране выборов, зафиксировал новый исторический максимум (8626 п.).

Во вторник мы ожидаем открытия торгов на наших биржах в зоне незначительного снижения. С учетом того, что вчера индекс ММВБ закрывал сессию на новом полугодовом максимуме (1471 п.), сегодня в первой половине дня стоит ждать инерционного продолжения движения вверх. Как мы указывали ранее, вероятная цель подъема индекса ММВБ находится на отметке 1480 п. Возможно нам удастся добраться и до 1495 п., чтобы закрыть памятный гэп вниз от 18 марта этого года. Локомотивом роста сейчас очевидно будут акции Сбербанка в купе с отдельными ликвидными бумагами из числа нефтяников и металлургов. Подключаться инвесторам ли к росту на этих уровнях? С учетом недостаточно уверенного закрытия торгов в Америке, краснеющих азиатских фондовых индексов и снижения цен на нефть (Brent $109,6/барр), заход нашего рынка наверх может быть не слишком долгим. Напротив, заложив позитивные ожидания на предстоящее заседание ФРС, по его итогам на западных биржах может произойти коррекция. Поэтому до четверга неискушенным игрокам лучше побыть вне рынка, зафиксировав сегодня днем прибыль от роста. В случае пробоя вниз уровня 142 тыс. п. по фьючерсу РТС – можно пробовать открыть короткие позиции с ближайшей целью 138 тыс. п.

Во вторник мы ожидаем открытия торгов на наших биржах в зоне незначительного снижения. С учетом того, что вчера индекс ММВБ закрывал сессию на новом полугодовом максимуме (1471 п.), сегодня в первой половине дня стоит ждать инерционного продолжения движения вверх. Как мы указывали ранее, вероятная цель подъема индекса ММВБ находится на отметке 1480 п. Возможно нам удастся добраться и до 1495 п., чтобы закрыть памятный гэп вниз от 18 марта этого года. Локомотивом роста сейчас очевидно будут акции Сбербанка в купе с отдельными ликвидными бумагами из числа нефтяников и металлургов. Подключаться инвесторам ли к росту на этих уровнях? С учетом недостаточно уверенного закрытия торгов в Америке, краснеющих азиатских фондовых индексов и снижения цен на нефть (Brent $109,6/барр), заход нашего рынка наверх может быть не слишком долгим. Напротив, заложив позитивные ожидания на предстоящее заседание ФРС, по его итогам на западных биржах может произойти коррекция. Поэтому до четверга неискушенным игрокам лучше побыть вне рынка, зафиксировав сегодня днем прибыль от роста. В случае пробоя вниз уровня 142 тыс. п. по фьючерсу РТС – можно пробовать открыть короткие позиции с ближайшей целью 138 тыс. п.

Сильные данные по Германии подняли европейские рынки

- 22 августа 2013, 11:37

- |

Германия — сегодня вышли сильные данные:

Индекс деловой активности PMI в секторе услуг в августе 52.4 п. против прогноза 51.7 п.

Индекс деловой активности PMI в обрабатывающей промышленности в августе 52.0 п. против прогноза 51.1 п.

На этом фоне индекс DAX уже показывает рост на 1,1%. Нефть марки Brent ($109,9/барр) тоже уверенно отошла от утренних минимумов.

Как выглядит Армагеддон на рынке

- 16 июля 2013, 12:26

- |

Хотите увидеть Армагеддон на рынке своими глазами? У вас есть уникальная возможность.

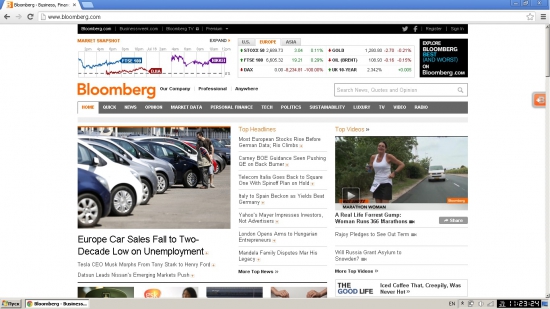

Сегодня в полдвеннадцатого заглянул на Bloomberg — и не поверил глазам. Один из самых авторитетных финансовых порталов показал мне, что немецкой биржи больше нет… Таким индекс DAX я еще не видел никогда. Минус 100%! Да на наших глазах вершится история!!!

( Читать дальше )

Сегодня в полдвеннадцатого заглянул на Bloomberg — и не поверил глазам. Один из самых авторитетных финансовых порталов показал мне, что немецкой биржи больше нет… Таким индекс DAX я еще не видел никогда. Минус 100%! Да на наших глазах вершится история!!!

( Читать дальше )

DAX update

- 25 июня 2013, 12:57

- |

Dax Sept 13 has bounced y/day off the 78,6% retracement of the precceding rally. My system exited short. I remain bearish, and expect the bounce to run out of steam soon. But, objectively, untill the April low of 7422 stays intact, we can not exclude the possibility that the current sell-off is just another deep correction. Price action will clearify, as always.

( Читать дальше )

( Читать дальше )

DAX update

- 20 июня 2013, 23:50

- |

Dax June 13 has been sold off dynamicaly during last two trading sessions, as been anticipated (see my post as of 17th June). Closest target for the downside is 7400/7350 area.

DAX update

- 20 июня 2013, 01:38

- |

After reaching the intra-day high of 8286.5 (Though has not reached the previousely estimated lower target 8350), Dax June 13 reversed downwards. Reversal looks for real and the prop indicators turned into «sell» mode. Likely target for the downside is 7400 as been stipulated before.

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- экономика россии

- юмор

- яндекс

Новости тг-канал

Новости тг-канал