SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. renat_vv |Судьба доллара в 2013 - some good research on USD in 2013 (in English)

- 15 марта 2013, 12:12

- |

Кому интересно, публикую интересные заметки одного ведущего банка по поводу доллара в 2013. Напомню, с начала 2013 года продолжается рост доллара. Индекс доллара вырос с начала года примерно на 4%.

One very good bank:

We maintain our bullish USD view. We expect 5% DXY gain from 3 to 12 months:

1. Labor market will be improving – > FED more hawkish -> yields to rise

2.US funds are not diversifying like before.

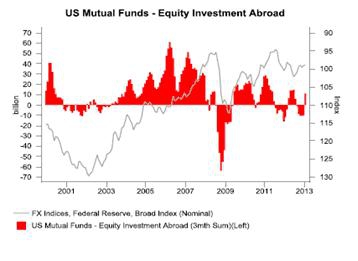

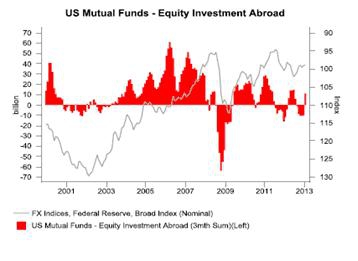

When assessing the performance of the US dollar, the behaviour of US investors is also key. For much the period of dollar depreciation prior to the financial crisis and following the initial policy stapes after, US investors were heavy investors into foreign equities – as evident in Mutual equity investment flows. However, despite favourable market conditions since last summer, US investors have been more inclined to remain at home. If sustained, this should help the dollar.

3. Petroleum deficit is shrinking

There has long been one consistent structural negative factor cited for justifying dollar depreciation – the current account deficit. However, relative change is important here and the outlook for the current account is improving. The ongoing surge in domestic energy production is already starting to impact the US external position. The US petroleum deficit fell from USD 326bn in 2011 to USD 293bn last year, a 10% drop despite no change in crude oil prices and broadly similar levels of real GDP growth. If

( Читать дальше )

One very good bank:

We maintain our bullish USD view. We expect 5% DXY gain from 3 to 12 months:

1. Labor market will be improving – > FED more hawkish -> yields to rise

2.US funds are not diversifying like before.

When assessing the performance of the US dollar, the behaviour of US investors is also key. For much the period of dollar depreciation prior to the financial crisis and following the initial policy stapes after, US investors were heavy investors into foreign equities – as evident in Mutual equity investment flows. However, despite favourable market conditions since last summer, US investors have been more inclined to remain at home. If sustained, this should help the dollar.

3. Petroleum deficit is shrinking

There has long been one consistent structural negative factor cited for justifying dollar depreciation – the current account deficit. However, relative change is important here and the outlook for the current account is improving. The ongoing surge in domestic energy production is already starting to impact the US external position. The US petroleum deficit fell from USD 326bn in 2011 to USD 293bn last year, a 10% drop despite no change in crude oil prices and broadly similar levels of real GDP growth. If

( Читать дальше )

Блог им. renat_vv |Everyday Forex - 22.02.13

- 22 февраля 2013, 11:23

- |

22.02.13

13:00 – Germany IFO

13:00 – Italy CPI

15:00 – Italy retail sales

17:30 – Canada CPI

GBPUSD

Goldman Sachs trading:

“…stay short..it's becoming our core position and the target is realistically 1.45 in the medium term”

BNP:

“… — No sign of bearish GBP sentiment easing yet.”

=> Market perceptions for GBPUSD to go lower…

AUDUSD

+ almost 100 pips in the night, why?

Natixis:

Upbeat Stevens signals RBA done with easing

RBA Governor Stevens' parliamentary testimony today was surprisingly upbeat, so much so that's there's little indication the bank will consider easing ratesagain unless their assumptions prove incorrect. Stevens flagged «reasonableprospects» the economy will eventually make the transition from the mining boom peak — in contrast with the RBA's earlier expressions of concern over its impact on the economy, particularly with the govt in belt-tightening mode.

( Читать дальше )

13:00 – Germany IFO

13:00 – Italy CPI

15:00 – Italy retail sales

17:30 – Canada CPI

GBPUSD

Goldman Sachs trading:

“…stay short..it's becoming our core position and the target is realistically 1.45 in the medium term”

BNP:

“… — No sign of bearish GBP sentiment easing yet.”

=> Market perceptions for GBPUSD to go lower…

AUDUSD

+ almost 100 pips in the night, why?

Natixis:

Upbeat Stevens signals RBA done with easing

RBA Governor Stevens' parliamentary testimony today was surprisingly upbeat, so much so that's there's little indication the bank will consider easing ratesagain unless their assumptions prove incorrect. Stevens flagged «reasonableprospects» the economy will eventually make the transition from the mining boom peak — in contrast with the RBA's earlier expressions of concern over its impact on the economy, particularly with the govt in belt-tightening mode.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс