SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. renat_vv

Судьба доллара в 2013 - some good research on USD in 2013 (in English)

- 15 марта 2013, 12:12

- |

Кому интересно, публикую интересные заметки одного ведущего банка по поводу доллара в 2013. Напомню, с начала 2013 года продолжается рост доллара. Индекс доллара вырос с начала года примерно на 4%.

One very good bank:

We maintain our bullish USD view. We expect 5% DXY gain from 3 to 12 months:

1. Labor market will be improving – > FED more hawkish -> yields to rise

2.US funds are not diversifying like before.

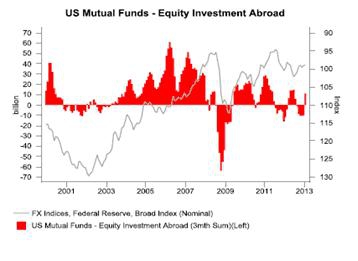

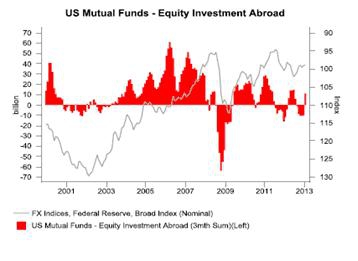

When assessing the performance of the US dollar, the behaviour of US investors is also key. For much the period of dollar depreciation prior to the financial crisis and following the initial policy stapes after, US investors were heavy investors into foreign equities – as evident in Mutual equity investment flows. However, despite favourable market conditions since last summer, US investors have been more inclined to remain at home. If sustained, this should help the dollar.

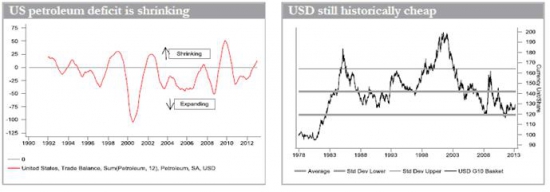

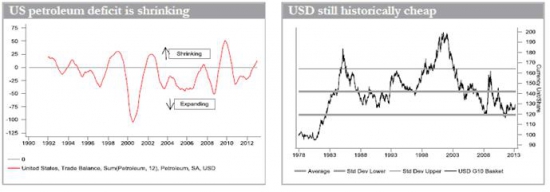

3. Petroleum deficit is shrinking

There has long been one consistent structural negative factor cited for justifying dollar depreciation – the current account deficit. However, relative change is important here and the outlook for the current account is improving. The ongoing surge in domestic energy production is already starting to impact the US external position. The US petroleum deficit fell from USD 326bn in 2011 to USD 293bn last year, a 10% drop despite no change in crude oil prices and broadly similar levels of real GDP growth. If

the 2012 development is replicated through to 2017, the petroleum deficit will shrink by a further USD 120bn. The EIA predicts that net energy imports as a percentage of total energy consumption in the US will fall from 16.6% last year to 13.2% in 2017.

4. Net FDI deficit should start to shrink

The advantage of increased energy production in the US is cheaper energy for US-based companies. The WTI crude oil price has been at a discount for two years now and looks here to stay for some time while natural gas prices in 2012 averaged the lowest price since 2002. This will inevitably start to attract inward investment to the US as energy-intensive industries look to take advantage of this energy production boon and cheaper prices. The net FDI deficit in the US has been a constant and substantial deficit, but the outlook appears a lot brighter now. Data today revealed that the US net FDI deficit shrunk from USD 190bn on a four-quarter sum basis in Q3 to USD 177bn in Q4. The deficit peaked in Q1 2012 at a record USD 207bn. The Q4 annualised current account deficit equated to 2.8% of GDP, considerably below the 6.5% peak back in 2005.

One very good bank:

We maintain our bullish USD view. We expect 5% DXY gain from 3 to 12 months:

1. Labor market will be improving – > FED more hawkish -> yields to rise

2.US funds are not diversifying like before.

When assessing the performance of the US dollar, the behaviour of US investors is also key. For much the period of dollar depreciation prior to the financial crisis and following the initial policy stapes after, US investors were heavy investors into foreign equities – as evident in Mutual equity investment flows. However, despite favourable market conditions since last summer, US investors have been more inclined to remain at home. If sustained, this should help the dollar.

3. Petroleum deficit is shrinking

There has long been one consistent structural negative factor cited for justifying dollar depreciation – the current account deficit. However, relative change is important here and the outlook for the current account is improving. The ongoing surge in domestic energy production is already starting to impact the US external position. The US petroleum deficit fell from USD 326bn in 2011 to USD 293bn last year, a 10% drop despite no change in crude oil prices and broadly similar levels of real GDP growth. If

the 2012 development is replicated through to 2017, the petroleum deficit will shrink by a further USD 120bn. The EIA predicts that net energy imports as a percentage of total energy consumption in the US will fall from 16.6% last year to 13.2% in 2017.

4. Net FDI deficit should start to shrink

The advantage of increased energy production in the US is cheaper energy for US-based companies. The WTI crude oil price has been at a discount for two years now and looks here to stay for some time while natural gas prices in 2012 averaged the lowest price since 2002. This will inevitably start to attract inward investment to the US as energy-intensive industries look to take advantage of this energy production boon and cheaper prices. The net FDI deficit in the US has been a constant and substantial deficit, but the outlook appears a lot brighter now. Data today revealed that the US net FDI deficit shrunk from USD 190bn on a four-quarter sum basis in Q3 to USD 177bn in Q4. The deficit peaked in Q1 2012 at a record USD 207bn. The Q4 annualised current account deficit equated to 2.8% of GDP, considerably below the 6.5% peak back in 2005.

118 |

Читайте на SMART-LAB:

Скидка 15% на нашу аналитику — только 72 часа!

Увеличь доходность своего портфеля с профессиональной командой аналитиков. Наши идеи уже принесли клиентам прибыль с начала года. Ты мог...

10:04

GBP/JPY: прощай, север? «Дракон» готовит эпичное погружение

Кросс-курс GBP/JPY сформировал разворотную модель «двойная вершина» и пробил горизонтальный уровень 209.61, выступающий линией шеи. Сейчас...

15:24

теги блога Ренат Валеев

- Apple

- audusd

- DXY

- EURGBP

- eurusd

- forex

- gbpjpy

- GBPUSD

- Gold

- IMOEX

- IPO

- S&P

- S&P500

- S&P500 фьючерс

- Sber

- tesla

- usdjpy

- USDRUB

- акции

- Акции РФ

- акции США

- банковский кризис

- биткоин

- братиш

- Веселье

- вью

- Газпром

- геополитика

- грааль

- Джим Роджерс

- диверсификация

- дисциплина

- доллар

- Доллар Рубль

- Евро

- золото

- идеи

- инвестиции

- Индекс МБ

- инфляция

- инфляция в США

- Кипр

- Китай

- книга

- книга о трейдерах

- Книги

- книги о трейдинге

- коронавирус

- кризис

- криптовалюта

- Ливермор

- маги рынка

- нефть

- Новости

- обзор книги

- обзор рынка

- облигации

- опрос

- оффтоп

- Пауэлл

- правила

- прогноз

- психология

- психология трейдинга

- рекомендации

- ренат валеев

- рецензия на книгу

- российские акции

- Российский рынок

- российский рынок акций

- Россия

- рубль

- рынки

- рынок

- рынок США

- Рэй Далио

- Сбербанк

- сделка

- Сирия

- ставка ФРС

- стоп лосс

- стратегия

- США

- текущая ситуация

- технический анализ

- торговые сигналы

- торговый сигнал

- трейд

- трейдинг

- фондовый рынок

- фондовый рынок

- форекс

- ФРС

- фундаментальный анализ

- Фунт

- фьючерс РТС

- фьючерс mix

- фьючерс РТС

- экономика

- юмор