Блог им. st-travich |⚡️ Today found a potential opportunity in the Australian dollar (6A)

- 29 октября 2023, 21:06

- |

Good evening, traders

I returned from vacation and today found a potential opportunity in the Australian dollar (6A).

On Frіday the price rejected the strong level of resistance on the daily chart and big volumes went short according to delta and HFTs’ Bid imbalance. But a bit earlier we saw algorithmic purchases in the South direction which we can observe with the help of quantitative cumulative delta (CDQ), and they expected that the daily level of resistance would be broken. To my mind, after the last involvement of sellers, we can really see a breakout attempt of those levels. But for now, It is not allowed for the price to go lower than 0,63375 as that definitely will mean that current limit support is not strong enough to protect our stop-loss. If it is strong, the target I expect on 0,6407 price level.

In the last big tick chain which was absorbed by Marketmaker, we have a duration of 4 seconds 581 milliseconds and 86% preponderance of trades by market sellers. (Watch)

( Читать дальше )

- комментировать

- 540

- Комментарии ( 1 )

Блог им. st-travich |⚡️ Is it possible to predict the future?

- 02 октября 2023, 00:44

- |

Sometimes chaos on the market dissipates and the future seems to be rather clear.

When I see the results of my predictions like it was in Corn (ZC) it seems to me that I know what's around the corner.

Before everything happened I wrote, that

‘’I assume that we will reach the 467,75 price level and touch all the liquidity that is concentrated under the demand zone (473-475). And I put my alert there. (Watch)

And only then the price will go to the upside, as hedgers are very active in buying wheat from trend-following hedge funds for such a cheap opportunity.”

The most amazing thing is that it happened tick by tick in accordance with the forecast.

Moreover, there was a tick chain Bids imbalance, which could be used as an entry point. (Watch)

Plus additional imbalance of options put block trades (D1), which often happen in reversal points, especially in commodity markets.

The logical target where the market maker could totally unload this position was also achieved with accuracy dollar to dollar.

( Читать дальше )

Блог им. st-travich |⚡️ After a difficult week in Wheat (ZW), my attention is attracted to Corn (ZC)

- 17 сентября 2023, 22:17

- |

We have the ultimate bearish sentiment here. Just look at the imbalance in the volume of put options, which is twice as much as in calls. On Tuesday we got big trades in options block trades, Bid imbalance of order flow and so rejection. But on Friday the pressure of sellers continued to increase and we closed before the the last frontier.

As you remember, bid HFTs’ on the level of support means that with a high probability, it will be broken, as smart money and market makers more often sell in levels of support, than buy from them as we used to.

I assume that we will reach the 467,75 price level and touch all the liquidity that is concentrated under the demand zone. And I put my alert there. (Watch)

And only then the price will go to the upside, as hedgers are very active in buying wheat from trend-following hedge funds for such a cheap opportunity.

I am sure that we are on the verge of a big upside movement in grains, but it is impossible to provide it without the kicking of the passengers.

( Читать дальше )

Блог им. st-travich |☝🏻 Today I want to highlight a Canadian dollar (6C)

- 27 августа 2023, 12:00

- |

Good day, traders!

Today I want to highlight a Canadian dollar (6C). On Friday, it closed above the strong volumetric and technical support according to the Daily chart. But hedge funds continue to accumulate their shorts. (Watch)

A large quantity of buyers are going to buy cheap. We see that call volumes are also more preferred. Moreover ask HFTt’s imbalance was created, but met a limit seller. (Watch)

I assume that despite the strong level of support we have more chances to break the level 0,7350 than to bounce from it. The target of the downside movement is at a 0,73 price level.

Have a nice week and a pleasant Sunday!

Блог им. st-travich |⚡️ New opportunities in Copper, Cocoa and NZD

- 18 июня 2023, 23:51

- |

Hello traders! My congratulations to you on Father's Day!

What happened in Crude Oil and natural gas that week? We will discuss in this short video.

And I want to make new forecasts in Copper (HG), Cocoa (CC), and New Zealand dollar (6N) according to new imbalances which happened that week.

Thank you very much for watching! And wish you a perfect week.

Блог им. st-travich |The time has come! Sell in May and RUN away. 🏃♂️

- 21 мая 2023, 15:09

- |

Hello traders!

The time has come! Sell in May and RUN away. 🏃♂️

Today I want to give you a long-term forecast.

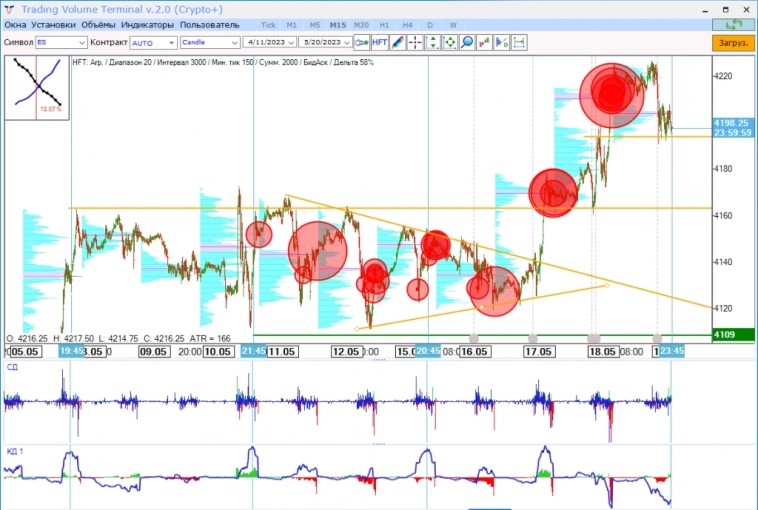

I have a Bearish view on all American Indices S&P500 (ES), Nasdaq (NQ), and Dow Jones (YM).

● I never saw such a big amount of Bid HFTs with no one ASK, even a little!!! 😱

● The market made a breakout of the important resistance level on the daily chart and all the Bear passengers are exhausted to wait falling

( Читать дальше )

Блог им. st-travich |⚡️ Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

- 14 мая 2023, 20:13

- |

Good evening, traders!

Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

🔹 British pound this week showed us how amazing involvement in buys looks like. (Watch)

How long does it take for the pattern to be created and how quickly should a decision be made on it, — only 15 minutes after the formation of HFT volumes. So fast reaction from the market makers limit orders.

Our mind is rather inert and in good situations, he especially begins to hesitate “Can we wait a little more, maybe a little more to see what will be around the corner?” As a result, the next 15-minute candle already changes the risk-reward ratio by 2 times! Not in our favor...

An excellent quote by Linda Raschke fits here: “In trading, as in fencing, there are either quick or dead.”

Markets operations are based more on psychology than on fundamentals, says El Weiss in Jack Schwager's book “The New Market Wizards”. “Markets are completely based on human psychology, and by charting markets, you are only converting human psychology into graphical form.”

( Читать дальше )

Блог им. st-travich |Hot forecasts in Pound, Aussi, Oil, Coffee 🔥

- 01 мая 2023, 00:10

- |

Good evening, traders! 👋

Today I decided to make a video market forecast highlighting situations in British Pound (6B), Aussi (6A), Coffee (KC), Crude and Brent Oil (CL, BR).

Also measured possible continuations of scenarios that I executed in my previous Sunday forecast.

This 11-minute video is for you today

Thank you very much for watching.

Have a good week!

Рецензии на книги |“Unknown Market Wizards” Jack Shwager review about ***Peter Brandt***

- 28 марта 2023, 12:49

- |

Hello traders 👋

Today I want to share with you a review of the first trader from the last book of Jack Schwager “Unknown Market Wizards”

His name is ***Peter Brandt***

27 years of trading experience till 2020 (when the book was published for the first time)

14 and 13 years in a row with 11 years of pause between 😱

Settled in this business as a trainee for a commodity broker in the year 1972. Started his own trading around 1976, and from 1981 had a track record.

His average annual return is 58% 🏋️

Sharp ratio = 1.11, Sortino ratio = 3.00 Gain to pain ratio = 2.81

Succeeds nonetheless because his average gain is much larger than his average loss.

He is a breakout trader.

Bad years 1988 🆘 (After nine good years I got sloppy. I would enter chart patterns too early. I would chase markets. I didn’t have orders where I should have.)

And in 2013 🆘 when he decided to accept other people's money (That messed up his trading. I was out of sync with my approach. I am not being disciplined. I am not being patient. I’m jumping the gun on trades. I am taking positions before the market confirms them. I am taking trades on inferior patterns.)

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nyse

- s&p500

- si

- usdrub

- акции

- алготрейдинг

- алроса

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновая разметка

- волновой анализ

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- дональд трамп

- евро

- золото

- инвестиции

- инвестиции в недвижимость

- индекс мб

- инфляция

- китай

- ключевая ставка цб рф

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс