Торговые сигналы! |⚡️ My first prediction in Bitcoin

- 25 июня 2023, 18:45

- |

Good Sunday traders! 👋

Today I have a very short market review, explaining two forecasts of the previous week that did not realize according to my plan in New Zealand dollar (6N) and Copper (HG).

Also made my first forecast in Bitcoin (BTC) and analyzed Soybeans (ZS).

This 7 minutes video is for you today

If you have any questions, you can leave them in the comment section! Have a nice day. ☀️

- комментировать

- Комментарии ( 0 )

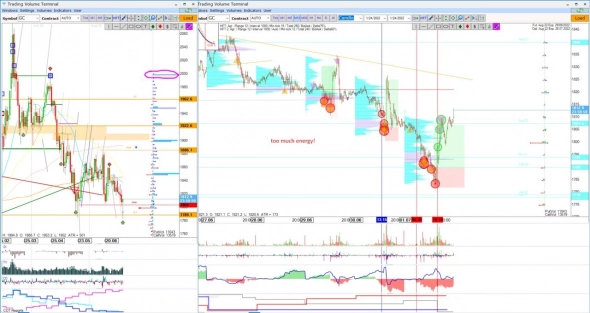

Блог им. st-travich |⚡️ New opportunities in Copper, Cocoa and NZD

- 18 июня 2023, 23:51

- |

Hello traders! My congratulations to you on Father's Day!

What happened in Crude Oil and natural gas that week? We will discuss in this short video.

And I want to make new forecasts in Copper (HG), Cocoa (CC), and New Zealand dollar (6N) according to new imbalances which happened that week.

Thank you very much for watching! And wish you a perfect week.

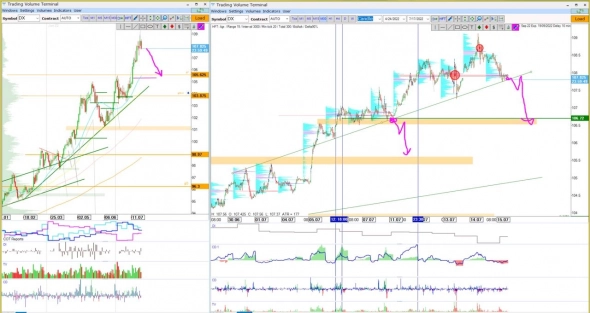

Блог им. st-travich |Bullish DXY and very Bearish S&P 500!

- 28 августа 2022, 15:12

- |

Bullish DXY and very Bearish S&P500!

Good day, Traders, NEW video analysis is ready!

The majority of ideas worked out that week. Today we will try to predict further movements and speak about Dollar Index (DX), Euro (6E), New Zealand dollar (6N), and Mexican peso (6M).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

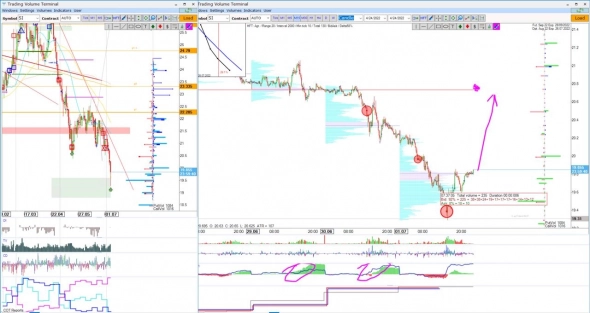

Блог им. st-travich |NEW buying opportunities in 6N, 6C, 6A and Corn

- 21 августа 2022, 18:03

- |

Good day, Traders, NEW video analysis is ready!

Today we will speak about Corn (ZC) and buying opportunities in the New Zealand dollar (6N), Canadian dollar (6C), and Australian dollar (6A).

Hope this information will be very helpful for you!

This time it’s a 10-minute video to watch

( Читать дальше )

Блог им. st-travich |DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 03.07.2022 + video

- 03 июля 2022, 21:08

- |

Good evening, Traders!

Let's observe the market and prepare for the next week!

🔻 Gold (GC) showed entry points 3 times in a row that week, and honestly, I participated in each one. I expected this scenario before, you can see it in my previous reviews. Now I see that it is necessary to be patient and not react to local imbalances. Hier timeframes are in the game. Huge stop-losses were collected and there is enough fuel to go higher. It will be not a surprise if the price will go to 2000 from here. (See)

🔻 Silver (Si) is the same. The first magnet is volume level 20.8 and then we can go even higher. (See)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 26.06.2022 + video

- 26 июня 2022, 15:13

- |

🔻 In the previous analysis, we made a bet to follow shorts in Gold (GC), but for now, I see local buying opportunities according to the last HFTs’ bid imbalances. Ask delta on bid HFTs’ and close below this descending triangle is comfortable for bears but can be used by market makers to accumulate a bigger long position. For me the key level is volume level Feb21, if the price will break this level, it will be a bukkish signal for buyers. (See)

🔻 While if we look at Swiss frank (6S) it can still bounce back. As you remember I said if the price break this HFTs’ level, it will go down. It did not, but now the magnet zone is on the 1.025 price level. (See)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 05.06.2022

- 05 июня 2022, 17:14

- |

🔻 Let's discuss Gold (GC). I see here a few strategies entry point in one bottle.

Sell HFTs’ after green delta + limit buyer on top with OI increase on growth and then correction first of all to the direction of market sellers. I expect the movement to the limit buyer level on top and further. (See)

🔻 Also, note that the British pound (6B) is attending 1,25 — the strong support zone now. And if I see selling HFTs’ under this zone it will be interesting to buy this asset to surf another long wave. (See)

( Читать дальше )

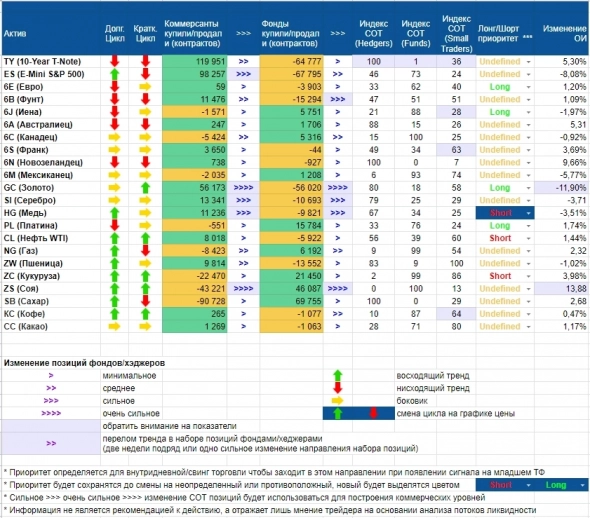

Блог им. st-travich |СОТ отчёты

- 07 февраля 2022, 20:19

- |

Представляю вашему вниманию табличку по СОТ, которая дает возможность быстро просканировать и обратить внимание на ключевые изменения по самым ликвидным активам биржи СМЕ.

Постараюсь делать на еженедельной основе, если понравится то подписывайтесь!

*** Информация по СОТ содержит сделки фьючерсы+опционы

**** не смотрите на линии на графике и не пытайтесь их интерпретировать, только стрелки соответствуют поставленному приоритету ранее или сегодня.

Евро (6E) сильно отработало свой лонг приоритет, такого быстрого роста на 700 тиков не было уже очень давно. (cм. предыдущ.) Произошло снятие стопов участников старших таймфреймов. Сейчас вновь пробили нисходящий тренд, сформировали более волатильній диапазон. Думаю глобально тенденция продолжиться, уже нет оснований или топлива для возобновления минимумов на дневке. (

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- экономика

- юмор

- яндекс