Блог им. st-travich |⚡️ Today I want to measure a Canadian Dollar (6C)

- 26 февраля 2023, 21:23

- |

Good evening, traders!👋

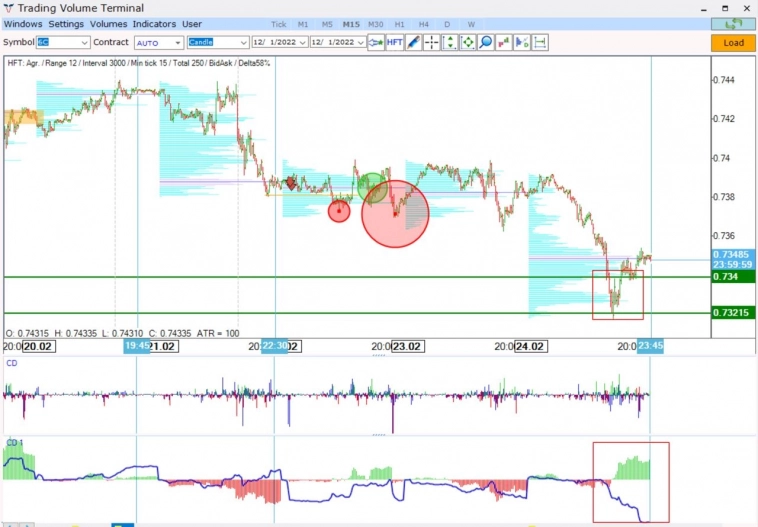

Today I want to measure a Canadian Dollar (6C).

▪️ So we see how the price came to the solid technical support on the daily chart. (watch)

But look at significant block trades on the options market passed on strike 0,74.

▪️ Moreover, on the 15M chart, we also came to double strong volumetric support zone. (watch)

( Читать дальше )

- комментировать

- ★1

- Комментарии ( 2 )

Блог им. st-travich |According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

- 19 февраля 2023, 15:40

- |

Good Sunday, traders!

According to the latest news from CFTC, fresh reports on a regular 3 days delay basis we will receive only after the middle of March. ((

Until then they will recover for unreleased reports.

“Following the ION cyber-related incident, reporting firms are continuing to experience some issues submitting timely and accurate data to the CFTC. As a result, the weekly Commitments of Traders (CoT) report that normally would have been published on Friday, February 17, will be postponed.

“CFTC staff intends to resume publishing the CoT report as early as Friday, February 24, 2023. Staff will begin with the CoT report that was originally scheduled to be published on Friday, February 3, 2023. Thereafter, staff intends to sequentially issue the missed CoT reports in an expedited manner, subject to reporting firms submitting accurate and complete data. Staff anticipates that, pending the timely, accurate and complete submission of backlogged data by reporting firms to the CFTC, these missed CoT reports will be published by mid-March. After that, CoT report publication will resume its usual weekly schedule.”

For the next week, I don’t see some exciting pictures for today. Moreover, on Sunday we have Holyday in US and Canada.

Only Cocoa (CC) shows us interesting backgrounds for correction. (Watch)

We need more movements to discover something interesting the next week.

Have a good Sunday!

Блог им. st-travich |We still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated

- 12 февраля 2023, 22:47

- |

Good day traders, we still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated.

Multiple reporting firms continue to experience technical issues that prevent submission of timely and accurate data to the CFTC. As a result, the weekly CFTC Commitments of Traders report will continue to be delayed until the receipt and validation of all reportable data is completed.

I already started to miss this data, as it really gives a better market understanding.

Nevertheless, I want to share with you with few engaging scenarios which may realize in the next week.

Natural Gas (NG) has a chance to reach 3$ target per MMBtu (watch)

We see that all the cumulative delta is negative, but the price grows and fixed above 2.5 technical and round number structure.

But to my mind everything is too sweet, that's why I think that the market will activate the liquidity under the level and only then will go to fair value. (watch)

Such enforcement of QD on Friday is not an empty sound.

( Читать дальше )

Блог им. st-travich |Today I have no possibility to make a video forecast, but I want to measure some ideas for you.

- 29 января 2023, 20:30

- |

Good afternoon, traders!

The price closed below the huge Ask tick chain near 4100, not achieved to the supply zone, and made a fast pullback. I see shorting opportunity, that the price will reach the 4020 price level.

Silver (SI)

On Silver vice-versa we see a Bid tick imbalance and some accurate algorithmic purchases on Friday according to the cumulative delta quantitative (CDQ) which diverges with the volume delta (CD). The price is coiling in the long-range during last 2 months and has a high probability to move toward the upper boundary and break it.

Copper (HG)

Copper made a peculiar squeeze of buyers, created a Bid tick imbalance, and bounced back from a commercial level into the range. Hedge funds continue aggressively buying the asset, increasing their longs by 18% with the OI increase by 6%.

We see a very strong divergence between CDQ and CD, clear absorption of stoploss liquidity with algorithms.

( Читать дальше )

Блог им. st-travich |💻 Organize your workspace

- 27 ноября 2022, 18:31

- |

Добрый вечер, трейдеры! ✨

В эти выходные я возвращаюсь из Киева, где проводил вебинар для криптофонда «Ufuture» в Unit.City. У меня нет времени делать воскресный утренний обзор, но вместо этого я хочу поделиться с вами 1-м видео из моего нового образовательного курса (англоязычного), над которым я сейчас работаю.

💻 Как я организую свое рабочее пространство

( Читать дальше )

Блог им. st-travich |⚡️ Very strong actitvity in Crude oil and Precious metals

- 20 ноября 2022, 04:01

- |

Hallo, Traders! ☀️

This week I want to focus on Crude oil, Precious metals, also Agricultural products.

We see a significant increase in open interest, which means good opportunities for us. ☝️

Watch this 13 minutes video and be prepared

( Читать дальше )

Блог им. st-travich |⚡️ Is the market chaos or it is possible to predict it with pure accuracy?!

- 13 ноября 2022, 17:41

- |

Good day, traders! 👋

Is the market chaos or it is possible to predict it with pure accuracy?!

There are a lot of discussions around this topic. And there is a very big amount of people who say that market is a casino and it is impossible to take advantage here if you are not an insider trader.

Really most of the time it is so, but the trick is that you don’t have to trade most of the time.

When you always supervise real-time data, you can objectively see and feel, when imbalance is critical and the boat is ready to reverse.

It is not some magic, happenstance, or second sight.

As an example, I wrote about the global Dollar index reversal on September 28 when the ask was 114,205 after which the price no longer reached this value. Also that day a new high of a global trend was established.

So, I want to make a conclusion, that it is possible to predict markets. The biggest difficulty is to be patient and not to trade chaos. It sounds simple, but in practice, you need to train your psyche long enough not to do what is not necessary.

( Читать дальше )

Блог им. st-travich |From the current imbalances, I want to single out Ultra US treasuries bonds (UB). We have a peculiar divergence of volume and quantitative delta here (CD vs. CDQ)

- 23 октября 2022, 12:59

- |

Hello, Traders! 😀

I am on the road today, so, there will be no video forecast.

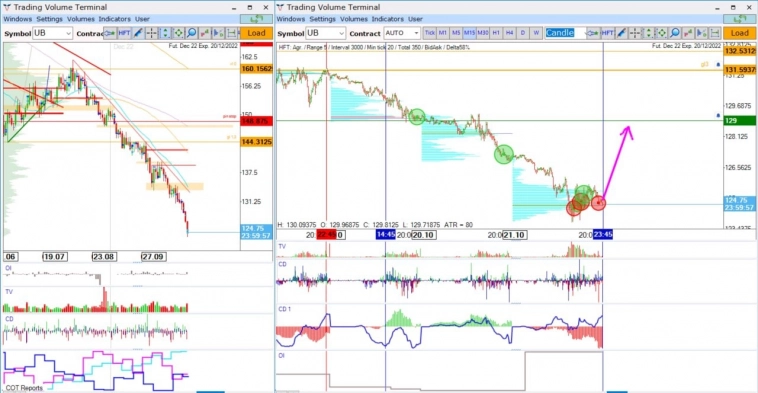

From the current imbalances, I want to single out Ultra US treasuries bonds (UB). We have a peculiar divergence of volume and quantitative delta here (CD vs. CDQ).

When the price will fix above the last HFT volumes at 124.875 price level on Monday, we will have a potential move to the 1st target of 127.300 and the second target of 129.000.

Hope you will have a profitable next week! 👍

Блог им. st-travich |Global Cup 2022 and forecasts in Corn, Sugar, Crude oil

- 09 октября 2022, 16:15

- |

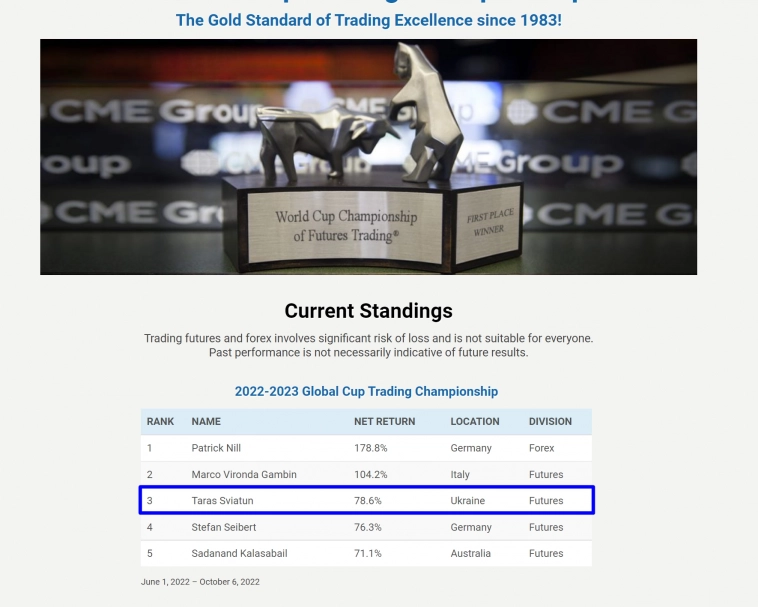

Hello traders, the battle is very exciting, I climbed a level higher, but competitors are running out 😬

All predictions of the previous week showed a very good performance 💪

Today we will observe Corn (ZC) 🌽, Sugar (SB), and Crude oil (CL).

All the details you are able to get from this 13-minute video

( Читать дальше )

Блог им. st-travich |Great workout in Platinum and Swiss frank! The next movements in Gas (NG) , Wheat (ZW) and US treasures (UB)

- 13 сентября 2022, 20:51

- |

Good evening, traders!

One week passed and in a row that was really amazing forecasts. Platinum and Swiss frank went perfectly to their targets. Gold also proceed with its bullish behavior.

Only the Japanese yen did not live up to expectations, who is going to move stop after this?

Who proceeds to trade martingale? Managing risks is most important for us, traders.

This week I take your attention on Wheat (ZW), Natural Gas (NG), and US treasuries (UB).

This 12-minute video is for you today

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс