Блог им. st-travich

We still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated

- 12 февраля 2023, 22:47

- |

Good day traders, we still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated.

Multiple reporting firms continue to experience technical issues that prevent submission of timely and accurate data to the CFTC. As a result, the weekly CFTC Commitments of Traders report will continue to be delayed until the receipt and validation of all reportable data is completed.

I already started to miss this data, as it really gives a better market understanding.

Nevertheless, I want to share with you with few engaging scenarios which may realize in the next week.

Natural Gas (NG) has a chance to reach 3$ target per MMBtu (watch)

We see that all the cumulative delta is negative, but the price grows and fixed above 2.5 technical and round number structure.

But to my mind everything is too sweet, that's why I think that the market will activate the liquidity under the level and only then will go to fair value. (watch)

Such enforcement of QD on Friday is not an empty sound.

For Oil (CL) I expect a negative scenario for the next week (watch)

the price with high probability will achieve the zone of 76 price level. The activity of algorithmic selling according to CDQ on Friday informed us about the potential squeeze of buyers in future.

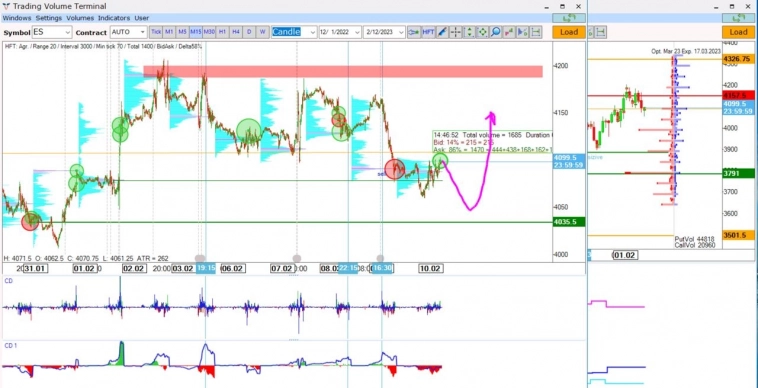

S&P500 (ES) can probably make such a movement (watch)

first of all, after Ask HFTs will go to the downside, break 4050, catch the liquidity there, and then will bounce back to 4150 price level.

I wish you a good Sunday and a productive week! ☀️💪

Previously published in TVT School)

Sincerely, Taras Sviatun

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ