Блог им. st-travich |So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

- 28 мая 2023, 16:59

- |

Hello dear traders!

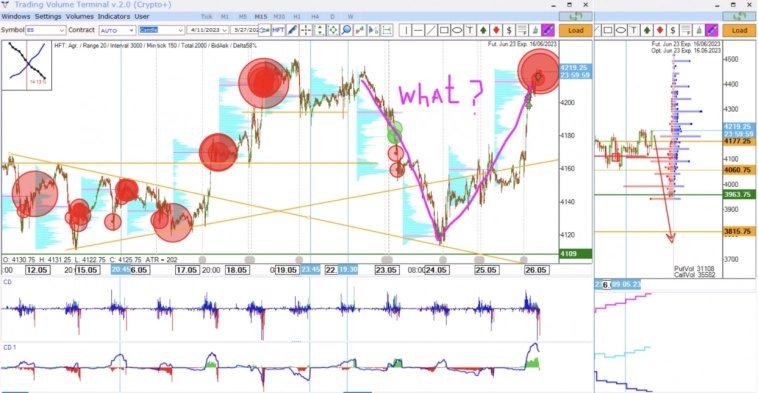

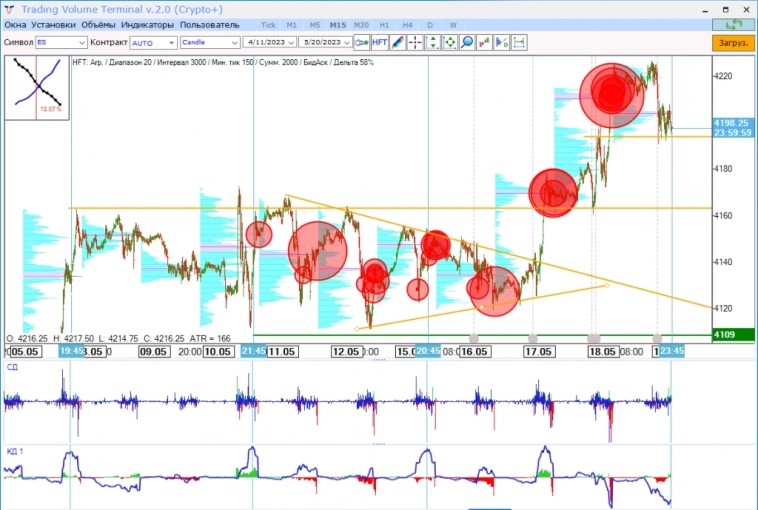

● So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

● What will be next? now it is difficult to predict.

Nasdaq made an impudent bullish workout of the support 👏

( Читать дальше )

- комментировать

- Комментарии ( 1 )

Блог им. st-travich |The time has come! Sell in May and RUN away. 🏃♂️

- 21 мая 2023, 15:09

- |

Hello traders!

The time has come! Sell in May and RUN away. 🏃♂️

Today I want to give you a long-term forecast.

I have a Bearish view on all American Indices S&P500 (ES), Nasdaq (NQ), and Dow Jones (YM).

● I never saw such a big amount of Bid HFTs with no one ASK, even a little!!! 😱

● The market made a breakout of the important resistance level on the daily chart and all the Bear passengers are exhausted to wait falling

( Читать дальше )

Блог им. st-travich |⚡️ Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL)

- 23 апреля 2023, 18:11

- |

Good evening, TVT traders!

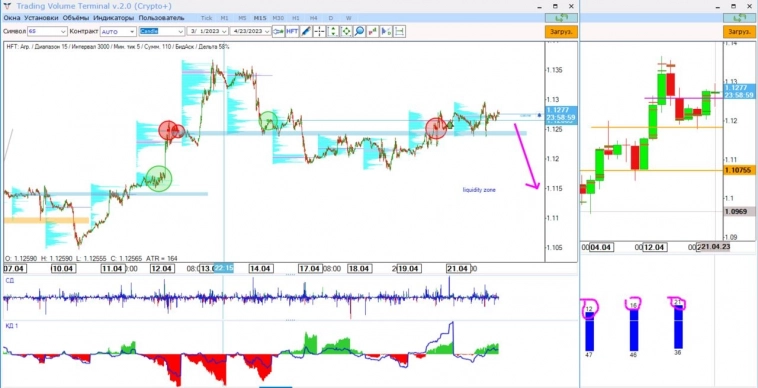

Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL).

🔹 Swiss Frank (6S) has enough information to make a forecast that the price will go to test the zone 1.1150, where liquidity is concentrated. Despite we see that the price closed above commercial resistance, where hedge funds added their long position by 30% for the third week in a row. OI increased by +6,7%. Also, the trading week closed above technical resistances on the 15M charts. But no energy for further rising, and in such case downside movement is more probable. (Watch)

🔹 As for Dow Jones (YM) (Watch)

( Читать дальше )

Блог им. st-travich |⚡️ Дивергенция дельт + HFT объемы, примеры на разных активах

- 27 апреля 2021, 10:59

- |

На каких активах товарного, валютного рынка, а также индексах, работает стратегия дивергенции кумулятивной дельты по объему КД и агрегированной дельты по количеству тиков (сделок) КДК?

Практически на всех, лучше дождаться своего рынка и своей ТВХ, которую видно невооруженным увеличительными приборами глазом.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс