Торговые сигналы! |⚡️ My first prediction in Bitcoin

- 25 июня 2023, 18:45

- |

Good Sunday traders! 👋

Today I have a very short market review, explaining two forecasts of the previous week that did not realize according to my plan in New Zealand dollar (6N) and Copper (HG).

Also made my first forecast in Bitcoin (BTC) and analyzed Soybeans (ZS).

This 7 minutes video is for you today

If you have any questions, you can leave them in the comment section! Have a nice day. ☀️

- комментировать

- Комментарии ( 0 )

Блог им. st-travich |Today I want to show you some interesting situations in the commodities market

- 16 апреля 2023, 18:38

- |

Good evening, dear traders!

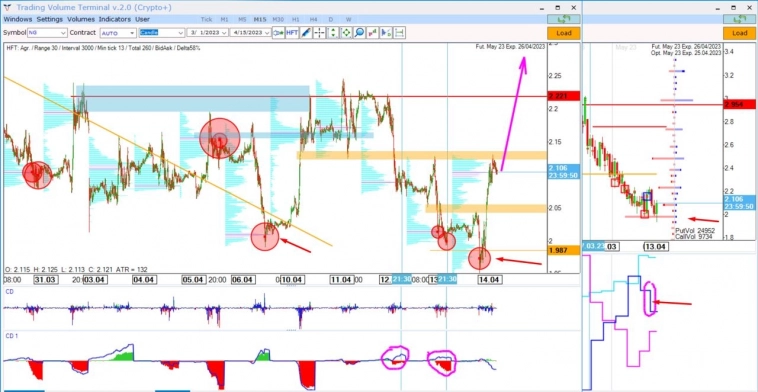

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances. (Watch)

▪️ In Crude oil (CL) the market made several Ask imbalances, and for now, is ready to make a correction to the 80.5 price level. (Watch)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 12.06.2022

- 13 июня 2022, 01:22

- |

Hello Traders!

🔻 I see a very peculiar picture in Platinum (PL). As always: stops — rejection — involvement — rejection. And here we have 2 targets: 1020 — short term target on the 15M chart and 1060 target on the daily chart. We see how OI decrease during the last down wave. Sellers and buyers close their positions. But from the previous COT report Funds even doubled their longs from 3K to almost 7K longs, and I hope they will continue to do this at this discount. (See)

🔻Next, I expect a short continuation in Soybeans (ZS). 1770 was a beautiful sell entry point under the stopping HFT volumes level. But according to the strong effort and the low result of the delta, it was necessary to ensure who will win in this battle and somehow join the winner. Honestly, I could not do it, but it was worth it. The peak of growth in volatility and purchases of call options has already been passed and traders will continue to close their hedges. (See)

( Читать дальше )

Блог им. st-travich |⚡️ Дивергенция дельт + HFT объемы, примеры на разных активах

- 27 апреля 2021, 10:59

- |

На каких активах товарного, валютного рынка, а также индексах, работает стратегия дивергенции кумулятивной дельты по объему КД и агрегированной дельты по количеству тиков (сделок) КДК?

Практически на всех, лучше дождаться своего рынка и своей ТВХ, которую видно невооруженным увеличительными приборами глазом.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс