Блог им. st-travich |⚡️ ASK imbalances on currencies

- 09 июля 2023, 15:33

- |

Good evening traders ☀️

One week passed and today I see interesting ASK imbalances in such currencies as British Pound (6B), Canadian Dollar (6C), Mexican Peso (6M), and they can be realized as shorting opportunities during the next week. Also, I see BID imbalance and potential buying opportunity in Natural Gas (NG) if the price will fix above HFTs’.

I won’t take much time, I managed to talk about everything in 5 minutes

- комментировать

- Комментарии ( 0 )

Торговые сигналы! |New imbalances in Oil markets 🛢

- 11 июня 2023, 18:55

- |

Today I made a video review on the British Pound (6B), Japanese Yen (6J), and Australian dollar (6A), and forecasts in Crude Oil (CL), Brent Oil (BR) , and Natural Gas (NG).

This 9 — minutes video is for you

Thank you very much for watching!

Have a good week.

Блог им. st-travich |Today I want to show you some interesting situations in the commodities market

- 16 апреля 2023, 18:38

- |

Good evening, dear traders!

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances. (Watch)

▪️ In Crude oil (CL) the market made several Ask imbalances, and for now, is ready to make a correction to the 80.5 price level. (Watch)

( Читать дальше )

Блог им. st-travich |We still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated

- 12 февраля 2023, 22:47

- |

Good day traders, we still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated.

Multiple reporting firms continue to experience technical issues that prevent submission of timely and accurate data to the CFTC. As a result, the weekly CFTC Commitments of Traders report will continue to be delayed until the receipt and validation of all reportable data is completed.

I already started to miss this data, as it really gives a better market understanding.

Nevertheless, I want to share with you with few engaging scenarios which may realize in the next week.

Natural Gas (NG) has a chance to reach 3$ target per MMBtu (watch)

We see that all the cumulative delta is negative, but the price grows and fixed above 2.5 technical and round number structure.

But to my mind everything is too sweet, that's why I think that the market will activate the liquidity under the level and only then will go to fair value. (watch)

Such enforcement of QD on Friday is not an empty sound.

( Читать дальше )

Блог им. st-travich |⚡️ Fresh volume view on Coffee, Corn, Oil, SP500, Gas, Pound

- 11 декабря 2022, 01:50

- |

Today I finally made a short but very intense review of the most interesting current imbalances on the most liquid instruments of commodities, currencies and indices. 🤩

A fresh view on Coffee (KC), Corn (ZW), Crude Oil (CL), Brent (BR), S&P500 (ES), Natural Gas (NG), British Pound (6B), Euro (6E), Mexican peso (6M).

Really a lot of peculiar market pictures to workout the following week 💪

This 10 minutes video is ready for your attention! 👇

( Читать дальше )

Блог им. st-travich |Great workout in Platinum and Swiss frank! The next movements in Gas (NG) , Wheat (ZW) and US treasures (UB)

- 13 сентября 2022, 20:51

- |

Good evening, traders!

One week passed and in a row that was really amazing forecasts. Platinum and Swiss frank went perfectly to their targets. Gold also proceed with its bullish behavior.

Only the Japanese yen did not live up to expectations, who is going to move stop after this?

Who proceeds to trade martingale? Managing risks is most important for us, traders.

This week I take your attention on Wheat (ZW), Natural Gas (NG), and US treasuries (UB).

This 12-minute video is for you today

( Читать дальше )

Блог им. st-travich |DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

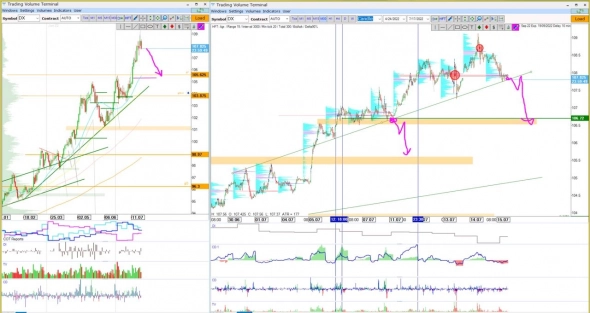

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

Блог им. st-travich |⚡️ Дивергенция дельт + HFT объемы, примеры на разных активах

- 27 апреля 2021, 10:59

- |

На каких активах товарного, валютного рынка, а также индексах, работает стратегия дивергенции кумулятивной дельты по объему КД и агрегированной дельты по количеству тиков (сделок) КДК?

Практически на всех, лучше дождаться своего рынка и своей ТВХ, которую видно невооруженным увеличительными приборами глазом.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс