SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. QCAP |Для тех кто планирует торговать Micro E-mini Futures. Сообщение от одного из моих брокеров.

- 04 мая 2019, 00:07

- |

As the CME prepares to launch their Micro Emini Futures contracts this Sunday night May 5th, below are some common questions we wanted to address. Please feel free to contact your broker with any additional questions.

- Will Stage 5 Trading have these contracts ready to trade Sunday night May 5th

- Unfortunately due to vendor restrictions we are not able to test the contract until that Sunday night’s live open. As we know the high interest in this contract, we will be testing as soon as the market opens with the intention of making trading available some time on Monday the 6th.

- The symbols on the platform are the same as the exchange symbols. Though they have been added to the platform, they will not be available for trading until the testing is complete and the contracts are added to production.

Index Futures Contracts |

CME Globex |

Micro E-mini S&P 500 Futures |

MES |

Micro E-mini Nasdaq-100 Futures |

MNQ |

Micro E-mini Dow Futures |

MYM |

( Читать дальше )

- комментировать

- Комментарии ( 2 )

Блог им. QCAP |Биржа - CME вводит микро контракты на S&P500, Nasdaq, RUSSEL 2000 и DJIA.!

- 11 марта 2019, 16:49

- |

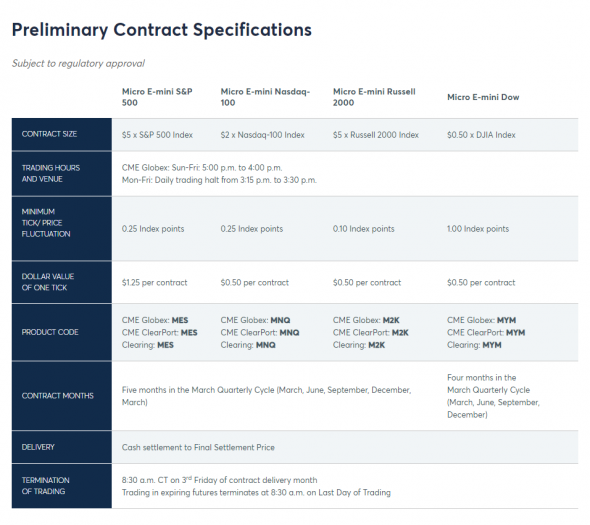

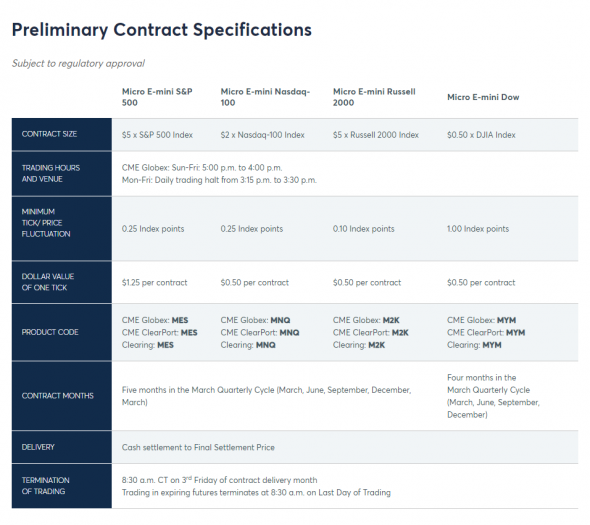

CME вводит микро контракты на S&P500, Nasdaq, RUSSEL 2000 и DJIA.

Микро контракты будут доступны для торговли в мае 2019 года.

Подробнее читайте на сайте биржи: https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

youtu.be/eze9siYGDwM

Микро контракты будут доступны для торговли в мае 2019 года.

Подробнее читайте на сайте биржи: https://www.cmegroup.com/cme-group-futures-exchange/micro-futures.html

youtu.be/eze9siYGDwM

Блог им. QCAP |FOMC Meeting Minutes - через 15 мин.

- 17 октября 2018, 20:44

- |

(US) Preview: FOMC Meeting Minutes expected at 14:00 ET (21:00 MSK)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

At the Sept 26 FOMC meeting the committee raised rates another 25 bps, as expected, taking the target range up to 2.00-2.25%.

The vote was unanimous and the «dot plot» indicated that the Fed was forecasting another rate hike in Dec, followed by three more in 2019 and capped by one last hike in 2020.

The other big move in the Sept FOMC statement was the deletion of the phrase «the stance of monetary policy remains accommodative.» In his press conference Chair Powell explained that it was the right time to remove this language, but that Fed policy is still accommodative, as rates are still below the 'neutral' rate.

An area of contention at the Fed is determining where 'neutral' is and whether the Fed should pause at neutral or continue raising rates modestly above neutral (to slightly 'restrictive').

The recent equity market selloff was at least partially attributed to Powell saying in early Oct that «We are a long way from neutral at this point, probably,» which chipped away at the idea that the neutral rate is relatively low. The minutes may shed some light on the Fed's deliberations on this point and what factors could take rate policy off its track of gradual hikes (e.g. higher inflation, trade war heating up, greater market volatility)

Блог им. QCAP |Коментарии Трампа по рынку

- 11 октября 2018, 00:34

- |

(US) Pres Trump: I think the Fed has «gone crazy» and is too tight; the Fed is making a mistake — Market selloff is a correction that we've been waiting for, for a long time**

NOTE: 10/09 (US) President Trump: Reiterates view that doesn't like what the Fed is doing; I think we don't have to go as fast on rates-

NOTE: 10/09 (US) President Trump: Reiterates view that doesn't like what the Fed is doing; I think we don't have to go as fast on rates-

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- анализ

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- ецб

- золото

- инвестиции

- инфляция

- китай

- коронавирус

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опек+

- опрос

- опционы

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- финансы

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- шорт

- экономика

- юмор

- яндекс