SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

dr-mart

Коротко по отчету VK

- 28 апреля 2022, 11:39

- |

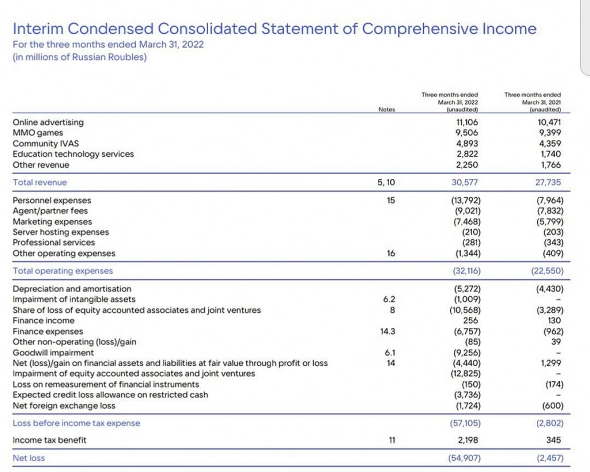

#vkco Первое что обращает внимание в отчёте: рост расходов на персонал за год на 70%. Это как так????

Выручка от интернет-рекламы рост всего 6%. Слезы, печаль

4.1К |

Читайте на SMART-LAB:

🔔 День инвестора ДОМ.РФ – уже завтра!

Уже завтра, 18 февраля , подведём финансовые итоги 2025 года и поделимся планами на будущее.

Будем вести трансляцию в VK , Rutube и на...

13:08

🐎🧧 Как использовать юань в портфеле

Китайский Новый год — хороший повод проверить, всё ли у вас в порядке с валютной диверсификацией.

Юань по-прежнему остаётся частью многих...

13:40

теги блога Тимофей Мартынов

- FAQ

- forex

- IMOEX

- IPO

- NYSE

- QE

- S&P500

- S&P500 фьючерс

- smart-lab

- smartlabonline

- tradingview

- акции

- антикризис

- банки

- бизнес

- брокеры

- вебинар

- видео

- вопрос

- встреча smart-lab

- ВТБ

- Газпром

- Греция

- дивиденды

- доллар рубль

- ЕЦБ

- золото

- инвестиции

- Индекс МБ

- Инфляция

- Китай

- книга

- Книги

- комментарий

- комментарий по рынку

- конференция смартлаба

- конференция трейдеров

- кризис

- криптовалюта

- Лукойл

- ЛЧИ

- Магнит

- Максим Орловский

- ММВБ

- мобильный пост

- мозговик

- Московская биржа

- недвижимость

- Нефть

- нищетрейдинг

- Новости

- обзор рынка

- облигации

- объявление

- опрос

- опционная конференция

- опционы

- отчетность

- отчеты МСФО

- Причины падения акций

- прогноз

- прогноз по акциям

- психология

- Путин

- работа над ошибками

- рассылка

- реакция рынка

- рецензия на книгу

- роснефть

- Россия

- рубль

- Русагро

- рынок

- санкции

- Сбербанк

- смартлаб

- смартлаб конкурс

- смартлаб премиум

- статистика

- стратегия

- сша

- технический анализ

- Тимофей Мартынов

- торговые роботы

- трейдинг

- Украина

- Уоррен Баффет

- уровень

- философия

- форекс

- ФРС

- фундаментальный анализ

- фьючерс mix

- фьючерс на индекс РТС

- фьючерс ртс

- ЦБ РФ

- экономика

- экономика США

- Яндекс

З.п. выросли по рынку

In March 2022, the Group decided to make a replacement award offer to its employees holding RSUs or PSUs over the shares of the Company. The Group offered to replace RSUs/PSUs vesting in 2022 with rights to receive cash in the amount of RUB 2,581. The Group recognised RUB 1,981 expenses related to these replacement awards during three-month period ended March 31, 2022. In addition, the Group recognised RUB 1,824 expenses related to equitysettled share-based payment for the three months ended March 31, 2022. Based on IFRS 2 requirements, the Group has reclassified the fair value of PSUs/RSUs and options modification from equity settled to cash settled, total amount was RUB 600 for the three months ended March 31, 2022 (for the three months ended March 31, 2021: nil).