SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

dr-mart

ЕЦБ станет банкротом в случае реструктуризации долга Греции:

- 11 июня 2011, 23:45

- |

http://www.ecb.int/press/pr/wfs/2011/html/fs110607.en.html

Capital and reserves 81,199

Total assets 1,898,989

Gold and gold receivables 350,669

Revaluation accounts 305,890

leverage = (1,898,989-350,669+305,890)/81,199 = 22.8354

* * *

http://www.zerohedge.com/article/ecb-has-%E2%82%AC444-billion-piigs-exposure-425-drop-asset-values-would-bankrupt-european-central-ba

Should Greece restructure half of its debt – which is needed to bring down the country’s debt to sustainable levels – the ECB is set to face losses of between €44.5bn and €65.8bn on the government bonds it has purchased and the collateral it is holding from Greek banks. This is equal to between 2.35% and 3.47% of assets, meaning it comes close to wiping out the ECB’s capital base.

— A loss of this magnitude would effectively leave the ECB insolvent and in need of recapitalisation. It would then have to either start printing money to cover the losses or ask eurozone governments to send it more cash (via a capital call to national central banks).

* * *

44.5b*22.8354 = 1,016 (minimum, best-case scenario, Greek restructuring only)

65.8b*22.8354 = 1,503 (maximum, worst-case scenario, Greek restructuring only)

assets: 1,891 + 359 — 1,016 = 1,234 (best-case scenario, Greek restructuring only)

assets: 1,891 + 359 — 1,503 = 747 (worst-case scenario, Greek restructuring only)

Banknotes in circulation (before) 843b

Banknotes in circulation (after) 843 + (1,891-1,234) = 1,500 (best-case scenario, Greek restructuring only)

Banknotes in circulation (after) 843 + (1,891-747) = 1,987 (worst-case scenario, Greek restructuring only)

1 euro before = 1,500/843 = 1.7794 euro after (best-case scenario, Greek restructuring only)

1 euro before = 1,987/843 = 2.3571 euro after (worst-case scenario, Greek restructuring only)

* * *

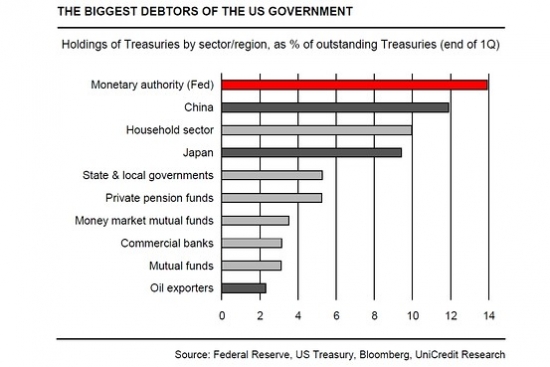

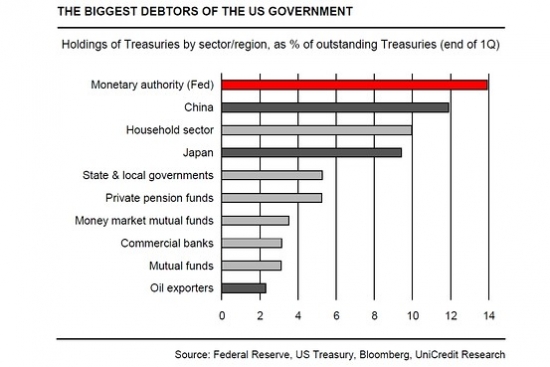

http://blogs.wsj.com/marketbeat/2011/06/09/the-fed-is-the-biggest-holder-of-us-debt/

Взял из ЖЖ: uzhas-sovka.livejournal.com/2175631.html

Capital and reserves 81,199

Total assets 1,898,989

Gold and gold receivables 350,669

Revaluation accounts 305,890

leverage = (1,898,989-350,669+305,890)/81,199 = 22.8354

* * *

http://www.zerohedge.com/article/ecb-has-%E2%82%AC444-billion-piigs-exposure-425-drop-asset-values-would-bankrupt-european-central-ba

Should Greece restructure half of its debt – which is needed to bring down the country’s debt to sustainable levels – the ECB is set to face losses of between €44.5bn and €65.8bn on the government bonds it has purchased and the collateral it is holding from Greek banks. This is equal to between 2.35% and 3.47% of assets, meaning it comes close to wiping out the ECB’s capital base.

— A loss of this magnitude would effectively leave the ECB insolvent and in need of recapitalisation. It would then have to either start printing money to cover the losses or ask eurozone governments to send it more cash (via a capital call to national central banks).

* * *

44.5b*22.8354 = 1,016 (minimum, best-case scenario, Greek restructuring only)

65.8b*22.8354 = 1,503 (maximum, worst-case scenario, Greek restructuring only)

assets: 1,891 + 359 — 1,016 = 1,234 (best-case scenario, Greek restructuring only)

assets: 1,891 + 359 — 1,503 = 747 (worst-case scenario, Greek restructuring only)

Banknotes in circulation (before) 843b

Banknotes in circulation (after) 843 + (1,891-1,234) = 1,500 (best-case scenario, Greek restructuring only)

Banknotes in circulation (after) 843 + (1,891-747) = 1,987 (worst-case scenario, Greek restructuring only)

1 euro before = 1,500/843 = 1.7794 euro after (best-case scenario, Greek restructuring only)

1 euro before = 1,987/843 = 2.3571 euro after (worst-case scenario, Greek restructuring only)

* * *

http://blogs.wsj.com/marketbeat/2011/06/09/the-fed-is-the-biggest-holder-of-us-debt/

Взял из ЖЖ: uzhas-sovka.livejournal.com/2175631.html

25

7 комментариев

Негатив.Европе будет..., а будет ли Европа?

- 11 июня 2011, 23:51

ну бля начилосььььь

- 12 июня 2011, 00:14

Да хотя бы пару Русских букв ну хотя бы А (извени за глум не удержался).

- 12 июня 2011, 00:19

вроде как центробанки могут спокойно работать и с негативным капиталом и им необязательно рекапитализироваться… хотя я в этом ни бум-бум…

- 12 июня 2011, 00:20

karapuz, Согласен!

- 12 июня 2011, 00:46

я думаю что банковскому сектору на следующей неделе не поздоровится, посмотрим как в понедельник отработают рынки и банковский сектор, от туда и будем плясать, но скорей всего будет неготив.

- 12 июня 2011, 00:26

Константин Матросов, В понедельник: Швейцария, Франция, Германия, Австралия выходной.

- 12 июня 2011, 03:39

Читайте на SMART-LAB:

EUR/USD: Пан или пропал? Ретест треугольника ставит ультиматум

Европейская валюта, протестировав сопротивление 1.1918, повторно устремилась вниз для ретеста пробитой границы треугольника. На этот раз касание...

07:24

Портфель Акции / Деньги (4,5% за 12 мес). Рынка нет и нет дохода

Эффект низкой базы в прошлом, и, сравнивая февраль 2026 с февралем 2025, получаем 12-месячный результат от наших вложений в акции всего лишь...

06:39

теги блога Тимофей Мартынов

- FAQ

- forex

- IMOEX

- IPO

- NYSE

- QE

- S&P500

- S&P500 фьючерс

- smart-lab

- smartlabonline

- tradingview

- акции

- антикризис

- банки

- бизнес

- брокеры

- вебинар

- видео

- вопрос

- встреча smart-lab

- ВТБ

- Газпром

- Греция

- дивиденды

- доллар рубль

- ЕЦБ

- золото

- инвестиции

- Индекс МБ

- Инфляция

- Китай

- книга

- Книги

- комментарий

- комментарий по рынку

- конференция смартлаба

- конференция трейдеров

- кризис

- криптовалюта

- Лукойл

- ЛЧИ

- Магнит

- Максим Орловский

- ММВБ

- мобильный пост

- мозговик

- Московская биржа

- недвижимость

- Нефть

- нищетрейдинг

- Новости

- обзор рынка

- облигации

- объявление

- опрос

- опционная конференция

- опционы

- отчетность

- отчеты МСФО

- Причины падения акций

- прогноз

- прогноз по акциям

- психология

- Путин

- работа над ошибками

- рассылка

- реакция рынка

- рецензия на книгу

- роснефть

- Россия

- рубль

- Русагро

- рынок

- санкции

- Сбербанк

- смартлаб

- смартлаб конкурс

- смартлаб премиум

- статистика

- стратегия

- сша

- технический анализ

- Тимофей Мартынов

- торговые роботы

- трейдинг

- Украина

- Уоррен Баффет

- уровень

- философия

- форекс

- ФРС

- фундаментальный анализ

- фьючерс mix

- фьючерс на индекс РТС

- фьючерс ртс

- ЦБ РФ

- экономика

- экономика США

- Яндекс