SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

dr-mart

American Stock Market Trading. Day 2.

- 09 января 2012, 11:17

- |

Hi there. I've decided to write in english about my american stock market research, so many sorries about my language. I would be very thankful who will point to me for my mistakes:)

I've excluded from watchlist

KFT (due to low volatility)

FCX (the same cause)

SODA,STX,FTK,LIZ (due to low liquidity in these stocks)

So, I began my Friday with Citi(C)

Citi is very liquid, still seem good to enter with a short stop and have about $0,50 of profit.

Bank of America (BAC) is the next stock from my previous day's watchlist. Despite strong thursday's 9% run it didn't look interesting with daily range $0,25 on friday.

Goldman Sachs (GS) is the next object, that was newly added to my watchlist because of a weak performance on premarket.

I was looking also atAlcoa (AA) because of report due on 9th january and anounce about 12% capacity reduction, but I wasn't satisfied with this illiquid bluechip with the quite narrow daily range.

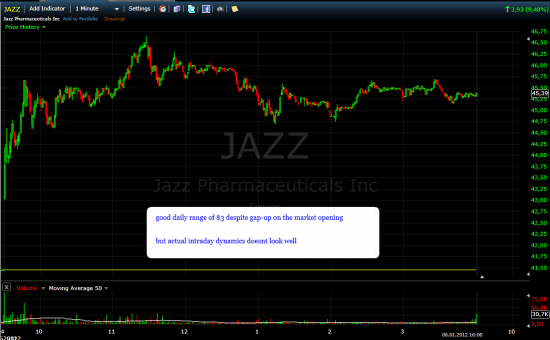

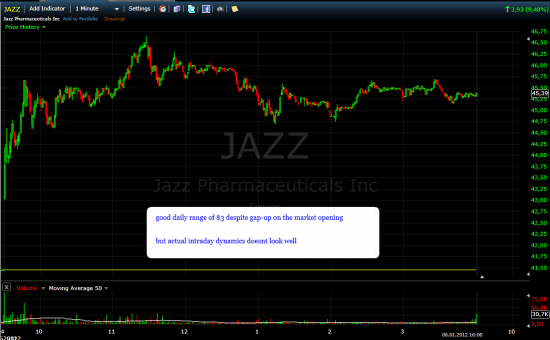

Jazz Farmaceuticals (JAZZ) has reported good earnings forecast and was +5% on premarket. Let's look at the friday's stock's performance:

I don't like it much.

The similar story was in Apollo Group Inc (APOL) with daily range $1,75.

Anatoliy Radchenko has pointed my attention to UAL but I didn't find it interesting at all with illiquid jigsaw intraday performance.

So, I am looking for new stocks for today and waiting for your advices. Now, it's seem to be too early to choose stocks, so I will try to make my little premarket today close around 17:00msk.

I've excluded from watchlist

KFT (due to low volatility)

FCX (the same cause)

SODA,STX,FTK,LIZ (due to low liquidity in these stocks)

So, I began my Friday with Citi(C)

Citi is very liquid, still seem good to enter with a short stop and have about $0,50 of profit.

Bank of America (BAC) is the next stock from my previous day's watchlist. Despite strong thursday's 9% run it didn't look interesting with daily range $0,25 on friday.

Goldman Sachs (GS) is the next object, that was newly added to my watchlist because of a weak performance on premarket.

I was looking also atAlcoa (AA) because of report due on 9th january and anounce about 12% capacity reduction, but I wasn't satisfied with this illiquid bluechip with the quite narrow daily range.

Jazz Farmaceuticals (JAZZ) has reported good earnings forecast and was +5% on premarket. Let's look at the friday's stock's performance:

I don't like it much.

The similar story was in Apollo Group Inc (APOL) with daily range $1,75.

Anatoliy Radchenko has pointed my attention to UAL but I didn't find it interesting at all with illiquid jigsaw intraday performance.

So, I am looking for new stocks for today and waiting for your advices. Now, it's seem to be too early to choose stocks, so I will try to make my little premarket today close around 17:00msk.

26

16 комментариев

+17

Как хорошо, что на смартлабе никто не торгует Азию, а то читать было бы крайне не удобно… :)

- 09 января 2012, 11:44

+1

Александр Горбунов, +500 ))))))))))))))

- 09 января 2012, 11:47

-1

Тимофей, креативно конечно, но я 50% так и не смог перевести…

- 09 января 2012, 11:45

+3

Правильно написал! Заодно и английский всем смарт-лабом подтянем)))

- 09 января 2012, 11:50

+3

какие то буквы не русские

- 09 января 2012, 11:55

Тимофей о нас или слишком хорошего мнения или слишком плохого:)

- 09 января 2012, 11:59

it's OK!

- 09 января 2012, 12:07

0

йес йес, герла!!!

- 09 января 2012, 12:10

неделя английского на Смарт-лабе)

- 09 января 2012, 12:14

don't waste our time…

- 09 января 2012, 12:28

+1

Kosovar, я не заставляю никого читать. Я просто начинаю изучать рынок этот и выкладываю свои маленькие скромные наблюдения публично

- 09 января 2012, 12:33

Тимофей Мартынов, я молча завидую… ты молодец

- 09 января 2012, 12:48

Kosovar, чему завидовать то???

- 09 января 2012, 16:34

Даешь на Тайском!

- 09 января 2012, 12:53

Спасибо за этот пост. Буду с интересом читать продожение.

- 09 января 2012, 18:57

Читайте на SMART-LAB:

USD/CHF: Доллар не тянет "долгую игру" — затяжная война гонит инвесторов в Альпы

После бурных выходных валютная пара USD/CHF показала рост на сигналах о том, что конфликт в Персидском заливе будет ограничен по времени. Однако...

22:51

Какие инвестидеи открывает война в Иране: видеообзор аналитика Т-Инвестиций

Какие инвестидеи открывает война в Иране: видеообзор аналитика Т-Инвестиций

Новая война на Ближнем Востоке может пойти по разным...

13:17

теги блога Тимофей Мартынов

- FAQ

- forex

- IMOEX

- IPO

- NYSE

- QE

- S&P500

- S&P500 фьючерс

- smart-lab

- smartlabonline

- tradingview

- акции

- антикризис

- банки

- бизнес

- брокеры

- вебинар

- видео

- вопрос

- встреча smart-lab

- ВТБ

- Газпром

- Греция

- дивиденды

- доллар рубль

- ЕЦБ

- золото

- инвестиции

- Индекс МБ

- Инфляция

- Китай

- книга

- Книги

- комментарий

- комментарий по рынку

- конференция смартлаба

- конференция трейдеров

- кризис

- криптовалюта

- Лукойл

- ЛЧИ

- Магнит

- Максим Орловский

- ММВБ

- мобильный пост

- мозговик

- Московская биржа

- недвижимость

- Нефть

- нищетрейдинг

- Новости

- обзор рынка

- облигации

- объявление

- опрос

- опционная конференция

- опционы

- отчетность

- отчеты МСФО

- Причины падения акций

- прогноз

- прогноз по акциям

- психология

- Путин

- работа над ошибками

- рассылка

- реакция рынка

- рецензия на книгу

- роснефть

- Россия

- рубль

- Русагро

- рынок

- санкции

- Сбербанк

- смартлаб

- смартлаб конкурс

- смартлаб премиум

- статистика

- стратегия

- сша

- технический анализ

- Тимофей Мартынов

- торговые роботы

- трейдинг

- Украина

- Уоррен Баффет

- уровень

- философия

- форекс

- ФРС

- фундаментальный анализ

- фьючерс mix

- фьючерс на индекс РТС

- фьючерс ртс

- ЦБ РФ

- экономика

- экономика США

- Яндекс