Блог им. st-travich

⚡️ Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL)

- 23 апреля 2023, 18:11

- |

Good evening, TVT traders!

Today I have a few forecasts for you in Swiss Frank (6S), Dow Jones (YM), and Crude Oil (CL).

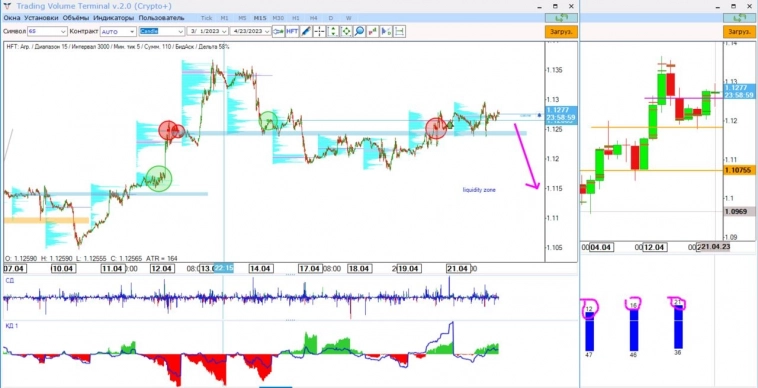

🔹 Swiss Frank (6S) has enough information to make a forecast that the price will go to test the zone 1.1150, where liquidity is concentrated. Despite we see that the price closed above commercial resistance, where hedge funds added their long position by 30% for the third week in a row. OI increased by +6,7%. Also, the trading week closed above technical resistances on the 15M charts. But no energy for further rising, and in such case downside movement is more probable. (Watch)

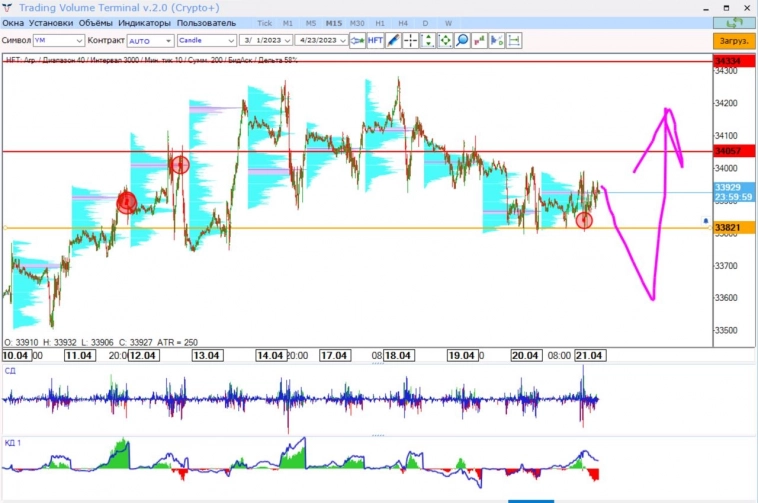

🔹 As for Dow Jones (YM) (Watch)

the price is stuck between two levels. On the one hand, this is the commercial level of sales by hedge funds 34000, on the other hand, the highest volume of the volume profile over the past 2 years. I assume, that first of all the level of support will be broken, we will make some movement to the downside, but then one more attempt to the current maximums (Watch)

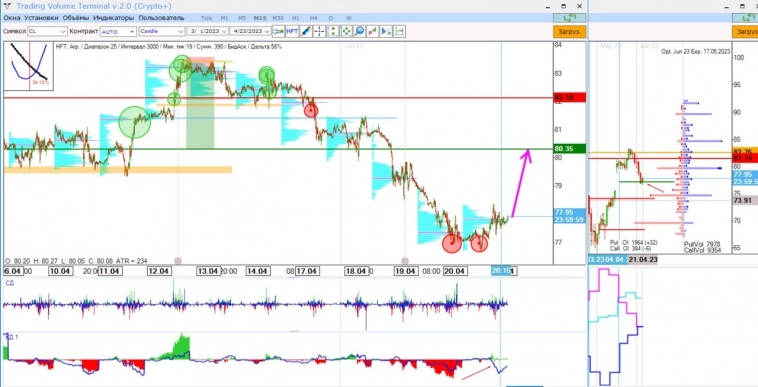

🔹 Crude Oil (CL) after valuable falling is ready for the upside movement (Watch)

Again imbalance was achieved and we saw divergences of delta during the week. Also, take attention to the response at the commercial level 77,45$. Huge Bid tick chains passed on the market bottom and for now, the path of least resistance is to return to 80.5$ price level.

🔹 From the previous market analysis, only Cocoa (CC) did not react to imbalance. On Friday we got a new one. I don’t expect a strong correction, but a 2875 price level can be achieved (Watch)

Thank you for reading and I wish you a good day and the next week!

- 23 апреля 2023, 20:53

- 25 апреля 2023, 12:44

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ