Копипаст

Копипаст | Chaos Rules at Russian Hedge Fund as Boss Vanishes.... - WSJ

- 06 января 2015, 14:15

- |

Chaos Rules at Russian Hedge Fund as Boss Vanishes

Blackfield Capital Had Ambitious Plans to Expand in U.S.

By

Bradley Hope

Jan. 4, 2015 7:40 p.m. ET

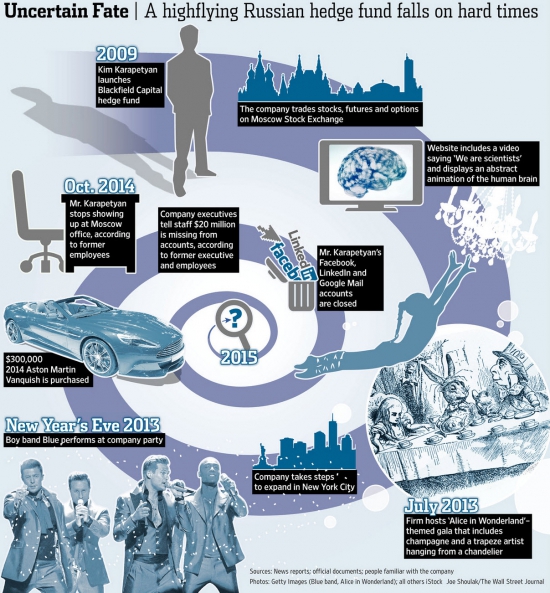

Blackfield Capital CJSC was one of Moscow’s hottest hedge funds, hosting glitzy parties and embarking on ambitious plans to expand to the U.S.

The firm’s founder in 2013 even rented a Manhattan apartment for a record-setting price, according to a real-estate broker, and instructed his U.S. staff to buy a $300,000 sports car.

Now, the founder is missing, allegedly along with all of the firm’s assets, according to former employees, in an international mystery that has captivated Moscow’s investment community.

The firm’s employees didn’t know anything was amiss until mid-October, when three men charged into Blackfield’s offices in an upscale complex along the Moscow River in central Moscow, said people who were there.

The men, who didn’t identify themselves, said they were looking for Blackfield’s 29-year-old founder, Kim Karapetyan, according to the people who were there.

But Mr. Karapetyan wasn’t in the office that day or the next, when senior executives explained to the staff of about 50 that there was no longer any money to pay their salaries, said one former senior executive and ex-employees. The executives disclosed that all the money in the company accounts—some $20 million, including investor cash—was also missing, they said. It couldn’t be determined whether investors were from Russia or other countries.

“Our CEO just…disappeared,” said Sergey Grebenkin, one of the firm’s software developers, in an interview.

Efforts to reach Mr. Karapetyan by phone, email and through associates and friends weren’t successful. Other senior executives didn’t respond to requests for comment.

Mr. Karapetyan hasn’t been accused of any wrongdoing. It couldn’t be determined whether the firm was still operating.

Interviews with more than a dozen former employees and executives at rival investment firms in Russia, as well as documents from the U.S., Russia and the U.K., provide a look at the firm’s demise.

Blackfield was launched in 2009 with plans to be on the cutting edge of modern markets. The firm focused on algorithmic trading, or the use of statistical analysis to detect patterns in the markets, on the Moscow Stock Exchange. By 2013, Blackfield traded as much as 2% of futures and options contracts on the Moscow exchange some days, according to former employees and rival firms. Several former employees said Mr. Karapetyan told them the firm once managed as much as $300 million.

A video on the company’s website showed phrases such as “We are scientists” and “We form stability from chaos” amid abstract animations of the human brain. “Our entirely systematic investment process helps avoid human-factor, cognitive-biases, and emotional-trading errors,” the website read.

As its profile expanded, invitations to Blackfield’s annual parties became sought after among Moscow’s investment community. On New Year’s Eve in 2013, the company flew in the U.K. boy band Blue for a performance. Every employee received a complimentary iPod at the event, former employees said. In July 2013, the firm hosted a gala with an “Alice in Wonderland” theme that included a trapeze artist hanging from a chandelier and filling up flutes of champagne, musical performances and costumed characters from the book.

As recently as October, the company was making plans to start trading on the London Stock Exchange and Chicago Mercantile Exchange, according to former employees. The company also took steps to expand in New York City. Mr. Karapetyan directed employees to form a U.S. company, Blackfield Capital LLC, and rented out 18 offices on the 46th floor of 7 World Trade Center, according to a report in trade publication Real Estate Weekly and people familiar with the matter. The U.S. firm had hired several employees at the time but had no assets under management.

Mr. Karapetyan also rented a 1,625-square-foot penthouse at 15 William St. at a cost of $15,000 a month, then a price-per-square-foot record for the Financial District, according to documents and real-estate broker Adam Mariucci.

“He rented it sight unseen,” said Mr. Mariucci, who represented Mr. Karapetyan. “A check was written, wired and cut. I never saw him in the building once.”

Mr. Karapetyan also had U.S. employees buy a 2014 Aston Martin Vanquish, a car that retails new for nearly $300,000, according to a former employee and documents reviewed by The Wall Street Journal.

Mr. Karapetyan had told employees he previously visited the city while working as a portfolio manager for Morgan Stanley after graduating with a master’s degree in economics from the London School of Economics, according to former employees.

A spokesman for Morgan Stanley said the bank has no record of anyone named Kim Karapetyan working at any of its offices around the world. A spokeswoman for the London School of Economics said the university had no record of anyone with his name obtaining a degree.

The first signs of trouble came in the spring of 2014 soon after the conflict in Ukraine escalated, leading to a raft of international sanctions against Russian businesses and individuals. Not long after that, Blackfield’s U.S. entity ended its lease and laid off all its staff. The employees were told the shutdown came primarily because of a lack of financing related to “the economic slowdown in Russia,” according to a former employee, who heard from staffers in Moscow that several big investors had withdrawn funds.

Garret Filler, former general counsel and chief compliance officer of the U.S.-based Blackfield Capital LLC, declined to comment.

Then in October, Mr. Karapetyan stopped showing up at the firm’s Moscow offices, as did brothers Henry and Haik Mkhitaryan, according to former employees. Henry Mkhitaryan was Blackfield’s chief operating officer and Haik was a senior employee. The Mkhitaryan brothers didn’t respond to a request for comment.

A message briefly posted on the Blackfield website instructed visitors to look for Mr. Karapetyan in the U.S. The message, viewed by The Wall Street Journal, was removed within hours.

A person who said he was Mr. Karapetyan contacted top staff members and investors several days after his disappearance, with a cryptic message from a temporary email address. He wrote that he was on the run because of unspecified threats against him, according to several people who received the message. He also promised to return all funds to investors but gave no means for contacting him again, the people said.

Almost every trace of Mr. Karapetyan vanished from the Internet. His LinkedIn and Facebook accounts were deleted. Gmail bounced back emails to an account he had used only days before, saying it no longer existed. His cellphone number was disconnected.

For Blackfield’s Moscow employees, the events of October came with no warning.

On Oct. 8, Blackfield employee Danil Krivopustov arrived at his desk consumed with thoughts about an application for computerized trading that he had been working on. Later that day, he learned Blackfield was out of cash and that the firm’s founder was missing. “I left at 5 p.m. without money or a job,” Mr. Krivopustov said. “We haven’t heard anything since.”

теги блога Sergio Fedosoni

- 115-фз

- bitcoin

- CNYRUB

- forts

- NG

- quik

- Si

- sibrent

- SiH3

- Siu2

- SIU4

- siz2

- акции

- арбитраж

- асв

- банк

- банки

- биткоин

- БКС

- бонды

- брент

- брокер

- Брокеры

- бэквордация

- Бэнкинг

- Бэнкинг по русски

- бэнкинг по-русски

- валюта

- вклад

- вклады

- Вопрос

- газ

- газпром

- депозиты

- дефолт

- доллар

- Доллар рубль

- ЗОЖ

- золото

- ИИС

- инвестиции

- Инвестиции в недвижимость

- ипотека

- ИФНС

- кипр

- Китай

- конверт

- контанго

- контанго по доллару

- коронавирус

- кризис

- криптовалюта

- Крым

- курс

- Легализация

- Лицензии

- лицензия

- ЛЧИ

- манипуляции

- минфин

- мобильный пост

- мосбиржа

- Мотылев

- мошенничество

- налоги

- Налогообложение на рынке ценных бумаг

- натуральный газ

- Ндс

- НДФЛ

- Нефть

- облигации

- обнал

- опрос

- Опционы

- отзыв

- отзыв лицензии

- Открытие

- отчетность

- офз

- оффтоп

- проблемы

- Путин

- Росфинмониторинг

- санация

- санкции

- Сбербанк

- СИ

- Сибрент

- срочный рынок

- США

- торговые сигналы

- Транспортный

- трейдинг

- Форекс

- ФОРТС

- ЦБ

- ЦБ РФ

- юань

- Югра

- юмор

и собирался купить престижный спортивный автомобиль. !!!

Планам бизнесмена помешали санкции против России, следует из публикации WSJ

бля они там в Пендосии как дети малые — у нас такими машинами половина гаражей чесных обнальщиков заставлено, годами пылятся ;)))

А офисы принято не арендовать а покупать, примо целыми особняками в центре города…

Хотя ж санкции…

Локальная/откэшенная версия статьи тут www.files.co.uk/shared/54abccedbc594/wsj.zip

скрины тут www.files.co.uk/set/54abcdb159c1f

кстати мне можно кстати ;) — я внештаный сотрудник ;)

скрины тут www.files.co.uk/set/54abcdb159c1f

фамилия Карапетян восходит к армянскому мужскому имени Карапет. В переводе на русский язык оно означает Владыка лучей Солнца.

Так один владыка лучей $20М украл — другой владыка статью стибрил. Как жить?