SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Рынок труда.

- 02 марта 2017, 16:38

- |

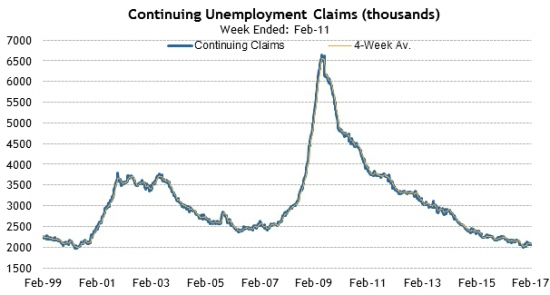

После насыщенной новостями среды, четверг ожидается спокойный. Регулярные новости на укрепляющемся рынке труда ожидаются в таком же оптимистичном свете. Количество заявок на первичные пособия на большом масштабе планово продолжает своё снижение:

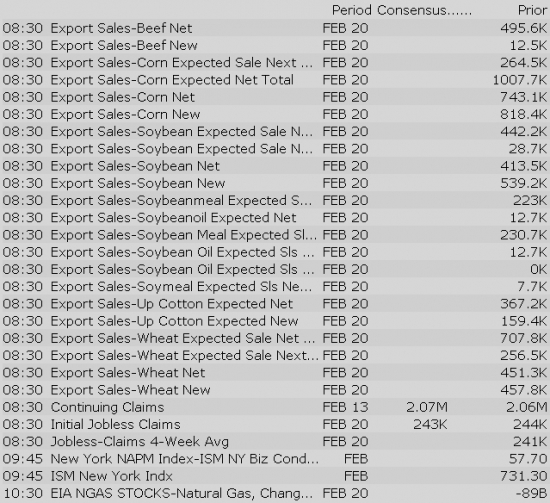

За последнюю неделю ожидается показатель на уровне 243 тысячи заявок:

Общее число получающих пособия находится на границе 2 миллиона человек и прорыв ниже этого значения будет психологической отметкой:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

27

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Major European indices are mixed, cooling their jets somewhat following big gains on Wednesday. A focal point this morning is the eurozone's CPI report for February, which showed consumer prices up 2.0% year-over-year, which is ahead of the ECB's target of below, but close to, 2.0%. Energy played a large part in driving up headline inflation as core CPI was up a tamer 0.9% year-over-year. Nevertheless, some consternation over the potential implications for the ECB's monetary policy have helped temper some of Wednesday's trading enthusiasm. The euro, however, has not followed the CPI print higher. It is down 0.4% against the dollar at 1.0513.

---Equity Markets---

Equity indices in the Asia-Pacific region ended on Thursday with strength in Japan and weakness across China. Macro data was fairly light in the region, with just Australia releasing anything of note. Japanese equities hit level not seen since January of 2016, echoing the robust move seen in yesterday's US session, leading to a 0.9% gain in the Nikkei on Thursday. The dollar continued to gain ground against the yen, pushing to the USDJPY solidly back over the 114 level.

---Equity Markets---

---FX---

Upgrades:

Downgrades:

Miscellaneous:

Gapping down: SSI -34.5%, PBYI -29%, AXTI -12.7%, TDOC -10.5%, MEI -9.8%, ARES -9.1%, RTRX -8.3%, PSTG -6.9%, JUNO -6.8%, JUNO -6.8%, AHP -6.7%, PLNT -5.7%, PDLI -5.7%, OPK -5.6%, KITE -5%, NKTR -4.8%, SHAK -4%, BUD -3.9%, ADPT -3.8%, HMY -3.5%, MTL -3%, AG -3%, VGR -2.9%, CIO -2.8%, SAN -2.1%, GDX -1.7%, PRTK -1.7%, GFI -1.6%, AU -1.5%, PBR -1.5%, ABX -1.5%, SLW -1.4%, NVS -1.4%, FSIC -1.4%, NEM -1.3%, ATHM -1.3%, GCP -1.3%, PRGO -1.2%, GOLD -1.2%, PFMT -1.1%, AKS -1%, KIN -1%

Treasuries Slip as Brainard Sounds a More Hawkish Note

Shares are currently trading ~12.6% higher in the pre-market

Investors are taking a breather this morning after escalating the major averages to new record highs on Wednesday. The S&P 500 futures trade three points below fair value, indicating a slightly lower open on Wall Street.

The Treasury market remains under water this morning, extending yesterday's hefty loss, after Fed Governor Brainard said on Wednesday that it will be «appropriate soon» for the U.S. central bank to raise interest rates. The benchmark 10-yr yield trades higher by two basis points at 2.48%.

Crude oil is also under pressure in early action after the Energy Information Administration (EIA) reported a build of 1.5 million barrels on Wednesday, which extends U.S. inventories to a new all-time high. WTI crude is currently down 0.9% at $53.37/bbl.

Thursday's economic data will be light with the only notable report being Initial Claims, which will cross the wires at 8:30 am ET.

In U.S. corporate news:

Reviewing overnight developments:

SHAK is currently down ~4% around the 35 level in pre-market trading.

For phosphate producers, 2017 is off to a good start. Prices and margins have moved up sharply during what typically is a seasonally slow period, and fundamentals continue to look positive heading into the upcoming application season.

Several developments are driving up prices.

Global shipments of the leading products are projected to post solid gains this year as a result of much leaner channel inventories as well as strong agronomic and economic demand drivers.

Sales are off to a fast start this year because distributors who deferred purchases as prices declined last year are now scrambling to cover large commitments as prices rise this year. At the same time, Chinese export availability has declined due to a take-off of domestic shipments as well as a drop in industry output. More recently, rain storms and large swells have delayed peak shipments out of the large Jorf Lasfar facility in Morocco. Finally, it looks like new capacity will not deliver material tonnage until later this year or in 2018. These developments have brought the global phosphate market into a much tighter balance and have quickly turned sentiment.

Mosaic expects that the recent price momentum will continue through the upcoming application season. Momentum could even accelerate if shipping delays worsen, the application season breaks early, Chinese export availability remains limited, and agricultural commodity prices hold up.

The outlook for the second half of this year looks less certain. At this point, however, the key swing factors — Chinese exports, global shipments, and the start-up of new capacity — look like they are tilting in favor of a continued tight supply/demand balance through the end of this year>

A little background:

The S&P 500 futures trade two points below fair value.

Just in, the latest weekly initial jobless claims count totaled 223,000 while the Briefing.com consensus expected a reading of 244,000. Today's tally was below the revised prior week count of 242,000 (from 244,000). As for continuing claims, they rose to 2.066 million from the revised count of 2.063 million (from 2.060 million).

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Eurozone Headline Inflation Hits 2.0%, Core Rate Steady at 0.9%

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

The S&P 500 futures trade one point below fair value.

Equity indices in the Asia-Pacific region ended on Thursday with strength in Japan and weakness across China. Macro data was fairly light in the region, with just Australia releasing anything of note. Japanese equities hit level not seen since January of 2016, echoing the robust move seen in yesterday's US session, leading to a 0.9% gain in the Nikkei on Thursday. The dollar continued to gain ground against the yen, pushing to the USD/JPY solidly back over the 114 level.

---Equity Markets---

Major European indices are mixed, cooling their jets somewhat following big gains on Wednesday. A focal point this morning is the eurozone's CPI report for February, which showed consumer prices up 2.0% year-over-year, which is ahead of the ECB's target of below, but close to, 2.0%. Energy played a large part in driving up headline inflation as core CPI was up a tamer 0.9% year-over-year. Nevertheless, some consternation over the potential implications for the ECB's monetary policy have helped temper some of Wednesday's trading enthusiasm. The euro, however, has not followed the CPI print higher. It is down 0.4% against the dollar at 1.0513.

---Equity Markets---

Stocks with favorable mention: AGN, CRM, CSCO, EME, KBR, LLY, LOW, MRK, MTZ, PFE, VEEV

Stocks with unfavorable mention: FEYE, OPK, TGT

Filings:

Offerings:

Pricings:

Equity futures are taking a breather this morning after Wednesday's stellar stock market performance, which left the major averages at new record highs. The S&P 500 futures currently trade three points below fair value.

The Treasury market has seen an uptick in selling interest after Fed Governor Brainard said on Wednesday that it will be «appropriate soon» for the U.S. central bank to raise interest rates. Ms. Brainard's comments fall in line with recent hawkish remarks from a handful of other Fed officials. As a result, the market has recently shifted the next rate hike projection up to March from June, according to the CME FedWatch Tool.

The benchmark 10-yr yield trades two basis points higher at 2.47%. Meanwhile, the U.S. Dollar Index (102.14, +0.40) is up 0.4% and currently trades at its highest level since early November.

In corporate news, Snap, the parent company of the popular messaging app Snapchat, will be launching its much anticipated initial public offering today. The company will trade on the New York Stock Exchange under the ticker 'SNAP'.

On the earnings front, Kroger (KR 30.74, -1.32) has dropped 4.1% in pre-market trade despite beating top and bottom-line estimates. Conversely, Monster Beverage (MNST 47.65, +5.64) has spiked 13.4% after reporting strong sales growth in Q4 2016 and January 2017.

The latest weekly initial jobless claims count totaled 223,000 while the Briefing.com consensus expected a reading of 244,000. Today's tally was below the revised prior week count of 242,000 (from 244,000) and marks the lowest reading since March 31, 1973. As for continuing claims, they rose to 2.066 million from the revised count of 2.063 million (from 2.060 million).

Investors will not receive any more economic data on Thursday.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The S&P 500 opens Thursday's session with a modest loss of 0.2%.

All sectors trade lower in early action. Telecom services (-0.3%) have shown relative weakness while consumer discretionary (-0.1%) has demonstrated relative strength. The consumer discretionary space has been helped by retailers, which have pushed the SPDR S&P 500 Retail ETF (XRT 43.15, +0.26) higher by 0.6%.

Energy trades 0.3% lower amid crude oil's 1.8% tumble. The energy component currently trades at $52.86/bbl.

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.07%. Within the SOX index, CY (+2.27%) outperforms, while TSM (-2.12%) lags. Among other major indices, the SPY is trading 0.23% lower, while the QQQ -0.16% and the NASDAQ -0.54% trade modestly lower on the session. Among tech bellwethers, JD (+4.08%) is showing relative strength, while NTES (-4.72%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.94… VIX: (11.91, -0.63, -5.2%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Notable earnings/guidance:

Earnings/guidance secondary plays:

In the news:

- Leaders: BBY 5.3% (Best Buy recovering after after missing sales estimates yesterday morning; HHGregg to close three distribution facilities and 88 store locations in order to reallocate resources to align more closely with its strategic goals to improve liquidity and return to profitability), RLH 1.4% (Red Lion Hotels appoints Douglas L. Ludwig as its new CFO and Treasurer)

- Laggards: FIT -1.4% (Fitbit received another subpoena from the U.S. Attorney's Office in the Northern District of California), HGGG -3% (HHGregg to close three distribution facilities and 88 store locations in order to reallocate resources to align more closely with its strategic goals to improve liquidity and return to profitability)

Analyst related:Looking ahead:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Rumor Activity was slow today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term