Блог компании DayTraderClub | Америка сегодня. Занятость, безработица и деловая активность.

- 03 февраля 2017, 17:43

- |

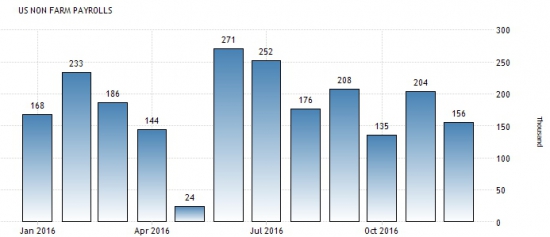

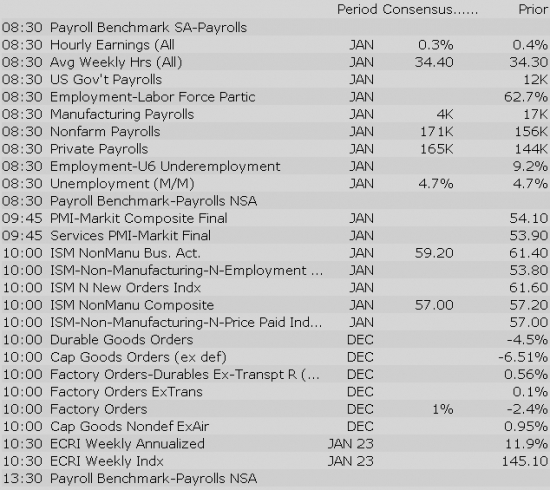

Первая пятница месяца данными по занятости вне сельскохозяйственного сектора традиционно создает колебания на рынке. Аналитики верили в положительное развитие, увеличение числа рабочих мест, ожидаюния были на 161 тысяче за январь 2017, на 3% больше, чем в прошлом месяце:

Уровень безработицы при этом ожидался без изменений на отметке 4.7%, так же, как и в предыдущем месяце:

Новости вышли ещё более оптимистичными, чем ожидали аналитики, произошло увеличение до 227 тыс рабочих мест, но при этом немного огорчили данные по безработице, увеличившись до 4.8%.

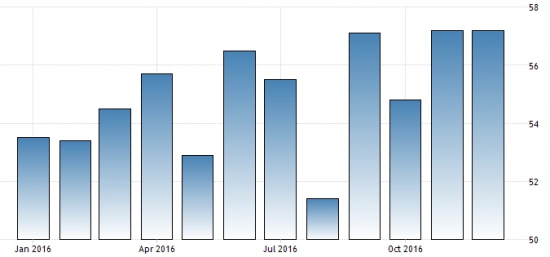

Вдобавок ко всему ожидается интрига в индексе деловой активности, маленький прорыв выше уровня 57.2 перебьёт все значения 2016 года, но аналитики остаются осторожны в своих оценках и ждут небольшое снижение к отметке 56.9:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

The employment picture is one of the most important guides for the Federal Reserve in setting its monetary policy and for the market in driving growth expectations. That's why the Employment Situation Report for January will be the market's focal point on Friday.

Why it's important?

What's expected by Briefing.com consensus?

The report will be released at 8:30 a.m. ET

Major European indices trade in the green with France's CAC (+0.9%) showing relative strength. A pair of European Central Bank members, Peter Praet and Benoit Coeure, spoke about monetary policy, but neither gave much thought to the recent uptick in inflation. The euro (1.0732) and the pound (1.2489) are both down about 0.3% against the dollar.

---Equity Markets---

Gapping down: DECK -22.2%, IDXG -19%, FEYE -16.7%, GIMO -16.5%, GPRO -13.2%, XGTI -12.7%, NEOS -12.1%, HBI -9.7%, ELY -8.9%, ATHN -7.6%, RUBI -6.3%, SBGL -5.5%, ACET -5.2%, AMZN -4%, MWA -3.9%, VALE -3.6%, BBL -3.4%, RIO -3.4%, BHP -2.9%, GFI -2.8%, AMBA -2.6%, PMT -2.5%, VR -1.9%, PSX -1.9%, CLF -1.8%, MT -1.7%, HIG -1.7%, RTEC -1.5%, X -1.4%, AG -1.3%, FCX -1.2%, VOD -1%, GOLD -1%, GDX -1%, SLW -0.9%, PAAS -0.9%, SLV -0.9%, BRS -0.9%, ABX -0.7%, SYMC -0.5%, CMG -0.5%

Treasuries Slip Ahead of Jobs Report, China Manufacturing Activity Slows

Equity futures are modestly higher this morning as investors eye the release of the January Employment Situation Report (Briefing.com consensus 170k), which will cross the wires at 8:30 am ET. The S&P 500 futures trade two points above fair value.

Banks are up in pre-market trade after a Wall Street Journal report that President Trump plans to sign an executive action to scale back the Dodd-Frank Act today. The action is part of a broader plan to dismantle much of the regulatory system put in place following the financial crisis.

U.S. Treasuries are currently under modest pressure after finishing yesterday's session flat. The benchmark 10-yr yield is one basis point higher at 2.48%.

Crude oil holds a slim gain this morning, up 0.3% at $53.68/bbl. The energy component's uptick may be attributed to, at least in part, the possibility of new sanctions on Iran after the country's latest missile test launch.

In addition to the Employment Situation Report for January, Friday's economic data will include December Factory Orders (Briefing.com consensus 1.4%) and ISM Services (Briefing.com consensus 57.0). Both reports will be released at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Eurozone Service Sector Growth Revised Upward

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial names showing strength amid headlines that President Trump will begin acting today on plans to reduce regulatory burdens on the financial sector, with the review review Dodd-Frank and reversal of the Fiduciary Rule:

Other news:

Analyst comments:

— Shares of GIMO -13% pre-market.

Shares of FEYE are down approx 19% in reaction to earnings.

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

The S&P 500 futures trade two points above fair value.

Just in, January nonfarm payrolls came in at 227,000 while the Briefing.com consensus expected a reading of 170,000. The prior month's reading was revised to 157,000 from 156,000. Nonfarm private payrolls added 237,000 while the Briefing.com consensus expected an increase of 175,000. The unemployment rate increased to 4.8% (Briefing.com consensus 4.7%).

Average hourly earnings increased 0.1% (Briefing.com consensus +0.3%), while the previous month's reading was revised to 0.2% (from 0.4%). The average workweek was reported at 34.4 while the Briefing.com consensus expected a reading of 34.3. The previous month's reading was revised to 34.4 (from 34.3).

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial names showing strength amid headlines that President Trump will begin acting today on plans to reduce regulatory burdens on the financial sector, with the review Dodd-Frank and reversal of the Fiduciary Rule:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

The S&P 500 futures trade eight points above fair value.

Equity indices in the Asia-Pacific region ended the week on a mixed note. The overnight session was fairly quiet, but the yen slumped to 113.15 against the dollar after the Bank of Japan intervened in the bond market to keep the 10-yr Japanese Government Bond yield below 0.11%. This marked the first intervention since the central bank stated its desire to keep the 10-yr yield around 0.0%. In China, the People's Bank of China raised short-term interest rates at the conclusion of the Chinese Lunar New Year Golden Week.

---Equity Markets---

Major European indices trade in the green with France's CAC (+1.0%) showing relative strength. A pair of European Central Bank members, Peter Praet and Benoit Coeure, spoke about monetary policy, but neither gave much thought to the recent uptick in inflation. The euro (1.0742) and the pound (1.2490) are down 0.2% and 0.3%, respectively, against the dollar.

---Equity Markets---

Withdrawn IPOs:

Postponed IPOs:

The stock market is poised for a higher open as the S&P 500 futures trade eight points (0.4%) above fair value.

The Employment Situation Report for January was released this morning and it was mixed as nonfarm payrolls beat consensus estimates, but average hourly earnings fell short of expectations.

Nonfarm payrolls came in at 227,000 while the Briefing.com consensus expected a reading of 170,000. The prior month's reading was revised to 157,000 from 156,000. Nonfarm private payrolls added 237,000 while the Briefing.com consensus expected an increase of 175,000. The unemployment rate increased to 4.8% (Briefing.com consensus 4.7%).

Additionally, average hourly earnings increased 0.1% (Briefing.com consensus +0.3%), while the previous month's reading was revised to 0.2% (from 0.4%). The average workweek was reported at 34.4 while the Briefing.com consensus expected a reading of 34.3. The previous month's reading was revised to 34.4 (from 34.3).

U.S. Treasuries have ticked up following the jobs report, while the U.S. Dollar Index (99.71, -0.12) has slipped 0.1%. The benchmark 10-yr yield is down four basis points at 2.43%.

On the earnings front, Amazon (AMZN 806.20, -33.75) has headlined this morning's earnings activity after the company reported worse than expected earnings per share results and issued disappointing guidance after yesterday's close. Shares of AMZN have retreated 3.8% in pre-market trade.

Conversely, banks are ticking up this morning after The Wall Street Journal reported that President Trump plans to sign an executive order to scale back the Dodd-Frank Act today. The action is part of a broader plan to reduce some of the regulations put in place following the financial crisis. JPMorgan Chase (JPM 86.23, +1.64), Wells Fargo (WFC 56.75, +1.00), and Bank of America (BAC 23.18, +0.46) are all up between 1.8% and 2.0%.

Friday's economic data will also include December Factory Orders (Briefing.com consensus 1.4%) and ISM Services (Briefing.com consensus 57.0). Both reports will be released at 10:00 am ET.

The stock market opened Friday's session higher with all three major averages posting gains. The S&P 500 is up 0.5%.

Financials (+1.3%) are the early leader, by a sizable margin, following reports that President Trump will be issuing an executive action to scale back the Dodd-Frank Act today. The move is expected to increase the earnings prospects for companies in the financial space.

Conversely, the consumer discretionary sector is at the bottom of the leaderboard after a negative reaction to Amazon's (AMZN 812.99, -26.85) quarterly earnings report. The company, which is the sector's largest component by weight, is down 3.2% in early action.

U.S. Treasuries are higher this morning following the release of the Employment Situation Report for January. The benchmark 10-yr yield is down three basis points at 2.45%.

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.06… VIX: (11.16, -0.77, -6.4%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.35%. Within the SOX index, MSCC (+1.57%) outperforms, while NVDA (-0.43%) lags. Among other major indices, the SPY is trading 0.58% higher, while the QQQ +0.22% and the NASDAQ -0.33% trade opposite on the session. Among tech bellwethers, HPE (+3.53%) is showing relative strength, while AMX (-1.01%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings Monday morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Stocks that traded to 52 week lows: ACUR, BPTH, BSTG, CBIO, CORI, COSIQ, CRI, DCTH, DRNA, DRWI, DXLG, FCEL, FEYE, FRO, GBSN, GEC, GIII, HBI, ICLD, KIM, KIRK, NAO, NEOS, OHRP, OXM, RL, RRTS, RT, SMRT, SOL, SPWH, TUES, TVIX, UAA, VFC, VMEMQ, VNR, VRA, VSTO, WKHS, XNET

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: AIQ, ASRV, BANX, BBGI, BYBK, CEE, CIVB, CLBH, CLCT, CVV, CWBC, CZFC, DAIO, DNBF, ENFC, ESXB, EWZS, FBZ, FEMS, FSZ, FUND, HBK, IROQ, JMP, KMDA, LAND, LGI, MBCN, MMAC, MNDO, MSON, MTLS, NWFL, OCIP, PBNC, PLSE, PLUS, SBBX, SBCP, SBFG, SEV, SGF, SHI, SRV, SYNL, TRCB, TSBK, UBFO

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AXSM, JMU, LUB, SRSC, VTGN

ETFs that traded to 52 week highs: AMJ, EPP, EWA, EWO, IGV, KIE, OEF, REMX, SOXX

ETFs that traded to 52 week lows: NIB, VXX

Today's top 20 % gainers

- Healthcare: MDCO (44.57 +17.29%), CBM (59.35 +16.37%), AXON (13.04 +9.03%), MTD (466.34 +7.54%), ACAD (37.69 +6.98%)

- Industrials: MTZ (38.9 +9.58%), HUBG (47.98 +8.66%)

- Consumer Discretionary: M (33.31 +8.43%)

- Information Technology: PCTY (35.27 +17.88%), DATA (56.4 +17%), FTNT (37.5 +13.02%), CSC (68.89 +9.44%), CY (12.83 +8.27%)

- Financials: PFSI (19 +11.76%), ENVA (15.35 +10.04%), MTU (6.96 +7.41%)

- Energy: BRS (20.36 +19.34%), WFT (6.2 +7.45%), SDLP (4.47 +7.16%), PES (6.38 +7.14%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: PFE (11.62 mln +0.72%)

- Materials: FCX (21.97 mln -3.78%), VALE (14.54 mln -5.28%), CLF (12.53 mln -6.47%), AKS (10.76 mln +2.15%)

- Industrials: GE (10.95 mln -0.29%)

- Consumer Discretionary: M (23.53 mln +8.43%), HBI (19.95 mln -14.91%), F (18.82 mln +2.28%), JCP (10.63 mln +1.71%)

- Information Technology: AMD (26.63 mln -1.18%), V (16.23 mln +5.15%), FEYE (14.35 mln -16.42%), FB (12.61 mln +0.67%), CY (11.21 mln +8.27%), MSFT (9.88 mln +0.2%)

- Financials: BAC (59.88 mln +2.29%)

- Energy: WFT (22.58 mln +7.45%), CHK (12.45 mln +1.4%)

- Consumer Staples: RAD (9.94 mln +2%)

Today's top relative volume (current volume to 1-month average daily volume)- The Medicines Co (MDCO +18.29%) positive Repatha data from Amgen last night

- Axovant Sciences (AXON +8.7%) enters into a $55.0 million debt financing agreement; in connection, the co issued Hercules Capital (HTGC) a warrant to purchase up to 274,086 of its common shares at an exercise price of $12.04/share

- ACADIA Pharma (ACAD +3.16%) vague speculation of interest from AstraZeneca (AZN)

Decliners on news:- Neos Therapeutics (NEOS -13.79%) provides corporate update in conjunction with today's common stock offering; co sees Q4 revs just short of estimates

- Pernix Therapeutics (PTX -17.11%) provides an update on the Company's arbitration with GlaxoSmithKline (GSK); the arbitration tribunal issued opinions in favor of GSK, awarding it damages and fees in the amount of approximately $35 million

Gainers on earnings:- Cambrex (CBM +17.94%) beats by $0.19, beats on revs; issues 2017 guidance

- Amgen (AMGN +3.65%) beats by $0.10, beats on revs; guides FY17 EPS in-line, revs below consensus

Decliners on earnings:- athenaHealth (ATHN -10.6%) beats by $0.11, misses on revs; guides FY17 revs in-line

- PerkinElmer (PKI -3.83%) reports Q4 (Dec) results, guides FY17 excluding the Medical Imaging business being divested

- Pacific Biosciences (PACB -3.49%) beats by $0.02, beats on revs; announces intention to offer and sell up to an aggregate offering price of $60 mln of shares of its common stock from time to time, through an 'at the market offering'

Upgrades/Downgrades:Biggest point losers: ATHN 112.81(-13.83), CMG 409.92(-13.38), DECK 46.14(-9.41), ESS 222.93(-3.41), HBI 19.31(-3.4), SRCL 73.77(-3.03), ADNT 62.12(-2.99), CRI 79.61(-2.84), REGN 357.84(-2.72), SAFM 92.02(-2.51), CLVS 62.96(-2.4), ALV 104.48(-2.32), ACET 16.65(-2.22), PKI 51.65(-2.2), FEYE 10.79(-2.18), SKYW 34.8(-2), KIRK 11.6(-2), LCI 19.83(-1.88), PRXL 62.07(-1.86), RIO 42.75(-1.86), VREX 28.54(-1.71), GIMO 30.43(-1.68), BHP 39.38(-1.56), ILMN 161.38(-1.51), ACIA 55.84(-1.5)

ETFC, AMTD

Rumor Activity was active to close out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The broader market is trading toward ending the week on a positive note, led higher today by the Dow Jones Industrial Average which is up 171 points (+0.86%) to 20055, the S&P 500 gains 15 (+0.68%) to 2296, and the Nasdaq Composite adds about 21 (+0.37%) to 5656. Action has come on higher than average volume (NYSE 330 vs. avg. of 323; NASDAQ 777 mln vs. avg. of 770), with advancers outpacing decliners (NYSE 2445/537, NASDAQ 2005/733) and new highs outpacing new lows (NYSE 147/15, NASDAQ 133/22).

Relative Strength:

Sugar-SGG +2.6%, US Fincl. Svcs.-IYG +2.5%, Banking-KBE +2.4%, Reg. Banking-KRE +2.4%, US Broker/Dealers-IAI +2.3%, Turkey-TUR +2.2%, Greece-GREK +1.8%, Financials-XLF +1.8%, New Zealand-ENZL +1.5%, Colombia-GXG +1.5%, Oil Svcs.-OIH +1.5%, Italy-EWI +1.4%, Thailand-THD +1.3%, S. Africa-EZA +1.3%.

Relative Weakness:

US Nat Gas-UNG -3.9%, Copper-JJC -2.9%, Steel-SLX -2.2%, Short-Term Futures-VXX -2.0%, Copper Miners-COPX -1.9%, Base Metals-DBB -1.6%, Cocoa-NIB -0.6%, British Pound-FXB -0.2%, Emrg. Mkts. M. East&Africa-GAF -0.2%, Peru-EPU -0.1%.

The Industrials sector (XLI) is trading +0.6% today, higher than the broader market (SPY +0.7%). In the Industrial Sector, Int'l Consolidated Airlines (ICAGY -0.2%) and Ryanair Hldgs (RYAAY +0.8%) report January traffic.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: SKYW -4.8% HUBG +9.2% SAIA +0.5% SXI +0.7% RAVN +1.2% GRC +2.9% ACET -14.8% GENC +3.0%

News

Broker Research

Upgrades

Downgrades

Other

The Energy Sector (XLE, +0.9%) outpaces the broader market (SPY, +0.7%) in afternoon trading. Crude oil (USO, +0.1%) futures reverse their initial morning losses & are trading higher ahead of rig count data scheduled to be released in about 11 minutes. Lastly, natural gas (UNG, -3.5%) futures snapped their 3-session streak, on track to end pit trading at a fresh multi-month low.

Baker Hughes (BHI, -1.5%) rig count data will be released today at 1 pm ET.

Color on this week's price action in crude:

Crude futures reversed initial morning losses and are trading near session highs ahead of today's rig count data. This latest move can be attributed to the US announcing sanctions related to Iran's missile test two days ago, adding geopolitical support to oil prices.

Notable Gainers:

Notable Laggards:

In Current Trade:

Earnings/News

Broker Calls

The market has forged solid gains in the first half of Friday's session on the foundation of appeasing economic data and strong sector leadership. The S&P 500 holds a 0.7% gain at midday.

The Employment Situation Report, which was released at 8:30 am ET this morning, came in just right; strong enough to keep participants thinking good things about the economy, but not strong enough to convince the market that the Fed is now going to be in a hurry to raise the fed funds rate. The 227,000 additions to nonfarm paryrolls (Briefing.com consensus 170,000) and the slight 0.1% uptick in average hourly earnings (Briefing.com consensus +0.3%) were the two main metrics driving the optimistic sentiment.

U.S. Treasuries ticked up immediately following report's release and still hold those gains this afternoon. The benchmark 10-yr yield is three basis points lower at 2.45%.

The financial sector (+1.9%) continues to provide solid sector leadership. The space's advance has stemmed from reports suggesting that President Trump will be acting on plans to reduce regulatory burdens on the financial sector today. Specifically, the movement will be aimed at scaling back the Dodd-Frank Act and reversing the Fiduciary Rule. This combination should improve the earnings prospects of the influential sector.

Conversely, the consumer discretionary sector sits at the bottom of today's leaderboard in the wake of a tough stretch of reports. The first blow came yesterday evening after Amazon (AMZN 814.46, -25.56), the sector's biggest component by market cap, reported worse than expected revenues and issued downbeat guidance. Elsewhere in the sector, Hanesbrands (HBI 19.30, -3.41), Chipotle (CMG 406.28, -17.01), and AutoNation (AN 50.77, -0.99) have also seen negative reactions to their latest earnings reports, while Macy's (M 32.50, +1.81) has spiked 5.9% on reports that Canada's Hudson's Bay has approached the company about a possible takeover.

The top-weighted technology sector has performed in line with the broader market thus far. Visa (V 86.34, +4.07) represented the sector on the earnings front last night, beating on the top and bottom lines. The company's shares have added 4.9% on the above-consensus results. The tech sector is fighting to end the week above its flat line, as the space currently holds a 0.1% week-to-date loss.

Today's economic data included January Employment Situation Report, January ISM Services, and December Factory Orders:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.97… VIX: (10.95, -0.98, -8.2%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Monday

Tuesday

Wednesday

Thursday

Friday

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Deckers earnings/guidance related weakness is weighing on footwear names: BOOT -6.7%, WWW -6.3%, GCO -0.7%, NKE -0.4%, DSW -0.2%

- For profit education names are underperforming following DV earnings: UTI -1.8%, EDU -1.7%, DV -0.8%, CECO -0.4%, CPLA -0.4%, BPI -0.1%

In the news:- M 5.6% (reports of a potential approach from Hudson's Bay)

- LZB 2% (to invest approx. $26 mln over a three-year period in its largest U.S. manufacturing facility, located in Dayton, TN)

- SAM 1% (CEO/President to retire in 2018)

- HTZ 2.9% and CAR 0.8% (AutoNation commentary regarding improvement in used-car margins is boosting auto rental names)

Analyst related:Looking ahead:

Как будто никто америку на смартлабе вообще не торгует