Блог компании DayTraderClub | Америка сегодня. Данные по рынку труда.

- 02 февраля 2017, 16:49

- |

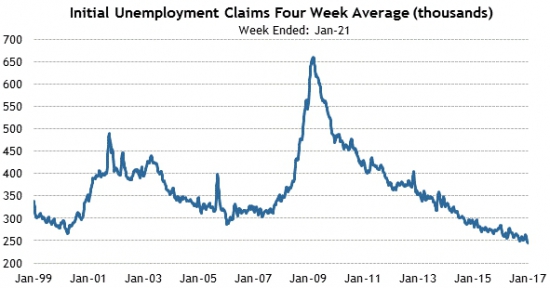

Рынок труда в Америке продолжает демонстрировать затяжную положительную динамику. Первичных заявок на пособие становится всё меньше:

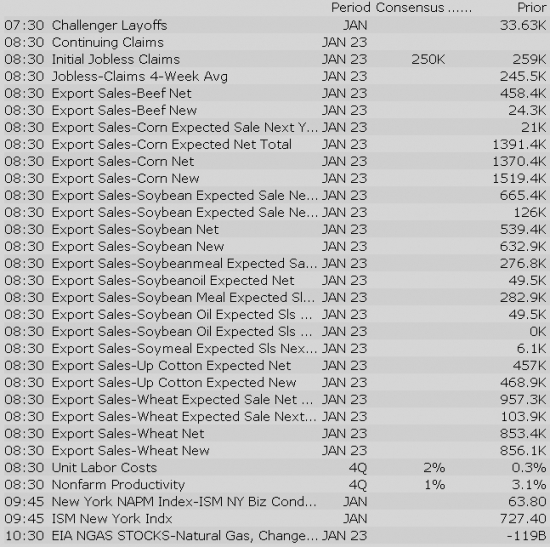

Данные по рынку труда сегодня привлекают к себе внимание накануне пятничного показателя занятости вне сельскохозяйственного сектора, где аналитики ожидают повышение около 3%. Эти показатели должны подтвердиться данными по первичным заявкам на пособия, прогноз по которым находится на уровне 247 тысяч против предыдущего показателя 259 тысяч:

И так же оптимизм должен найтись в общем числе заявок на пособия, выход которого ожидается в негативной зоне относительно прошлого показателя, 2.15 млн. против 2.10 млн.:

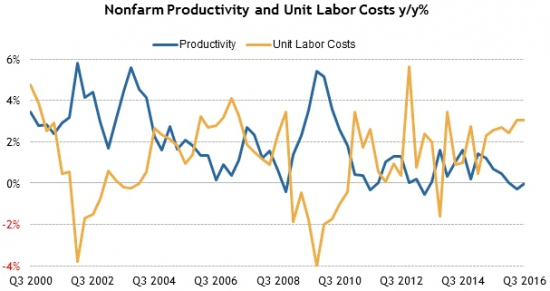

На фоне позитивной динамики по рынку труда, наблюдается понижающийся тренд в показателе продуктивности и небольшой рост в стоимости рабочей силы в годовых исчислениях:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

After Hours Gainers:

Companies trading higher in after hours in reaction to earnings/guidance: ESIO +11.7%, WFT +6.6% (also Weatherford and Nabors form alliance for integrated drilling solutions to oil and gas land market in the lower 48 states of the United States), CACI +5.5%, BRKS +4.3%, LCI +4.3%, ACLS +4.2%, ALL +3.7%, TSCO +3.6%, CAVM +3.1%, CDNS +3% (ticking higher), ZUMZ +2% (reports January comps of +9.4% vs -4.6% year ago and -3.4% last month; sees Q4 EPS at or slightly above high end of $0.60-0.66 prior guidance vs $0.64 consensus), EXTR +1.3%, FB +1%

Companies trading higher in after hours in reaction to news: MJN +19.5% (WSJ reporting that Reckitt Benckiser (RBGLY) may acquire the company), ETRM +4.4% (after closing at highs — up more than 30% on the day), PULM +4% (after surging 80% higher on Wed), X +1.5% (modestly rebounding from earnings related weakness; hearing analyst upgrade also behind the move)

After Hours Losers:

Companies trading lower in after hours in reaction to earnings/guidance: SFLY -18.1% (also updates strategic plan / restructuring in 2017; expects to incur 2017 restructuring charges of $15-20 mln), EGOV -16.7%, MLNX -15.4%, CRUS -10.3%, QRVO -7.2%, MTW -6.7%, LM -4.7% (light volume), SYMC -3.8% (also announces its intention to offer $1.0 bln aggregate principal amount of senior unsecured notes due 2025), MET -1.7%, HOLX -1.4%, EW -1%, AGNC -0.8% (also announces a $750 mln at-the-market offering of common stock)

Companies trading lower in after hours in reaction to news: AVIR -22% (announces top-line data from its double-blind, placebo-controlled Phase 2a study of BTA585 in adults challenged intranasally with respiratory syncytial virus; data indicate there was not a significant reduction in the primary endpoint), MNKD -16.2% (lower in extend trading after filing a proxy statement for upcoming special meeting of stockholders under which it will seek approval to effect a reverse stock split), CBAY -13.5% (to offer and sell shares of its common stock; size not disclosed), CVEO -11.4% (commences offering of 20 mln common shares), FBP -4.5% (commences 20 mln common stock offering — 10 mln shares by funds affiliated with Thomas H. Lee Partners and 10 mln by Oaktree Capital), CORI -3.8% (to offer shares of its common stock in an underwritten public offering)

Major European indices trade near their flat lines while Italy's MIB (+1.4%) outperforms. The Bank of England kept its key rate and purchase program unchanged at their respective 0.25% and GBP435 billion, but did raise its growth outlook for 2017 to 2.0% from 1.4%. The central bank's inflation forecast was little changed, calling for CPI of 2.7%.

---Equity Markets---

Gapping down: VNR -65.6%, AVIR -19.5%, SFLY -19.4%, CVEO -19.2%, EGOV -16.7%, MLNX -14.2%, CBAY -12%, MNKD -11.4%, CRUS -10.5%, FBP -8%, NVO -7.7%, QRVO -7.3%, MTW -6.7%, SDRL -5.6%, LM -4.7%, BBD -4.3%, DB -4.1%, XEL -4%, CORI -3.8%, SYMC -3.8%, KEX -3.8%, AZN -3.3%, CS -2.4%, HOLX -2%, CSTM -1.8%, TEVA -1.7%, AMD -1.3%, RIO -1.2%, LYG -1.2%, MDU -1.2%, EL -1.2%, MET -1.1%, AGNC -1.1%, VOD -1.1%, CFX -1.1%, EW -1%

Treasuries Tick Higher as Bank of England Revises up Growth Forecast

Crude futures are on track to close higher for a 3rd consecutive pit trading session, currently up about $0.15 (+0.5%) around the $54.04/barrel level. This morning, Russian energy minister Novak stated Russian companies may cut oil output quicker than previously thought, adding that Russia is fully committed to the global agreement.

After closing flat following yesterday's Fed statement, U.S. equity futures are pointing to a modestly lower open this morning. The S&P 500 futures trade five points below fair value, indicating a 0.2% decline at the open.

U.S. Treasuries currently hold slim gains, trading near their overnight highs. The benchmark 10-yr yield is one basis point lower at 2.47%.

Crude oil posts a modest gain this morning, looking for its third consecutive win. The energy component is currently up 0.3% at $54.07/bbl as the latest crude oil narrative suggests that OPEC/non-OPEC supply cuts have outweighed an uptick in U.S. production.

Today's economic data will include Initial Claims (Briefing.com consensus 250k) and fourth quarter Productivity (Briefing.com consensus 1.0%). Both reports will cross the wires at 8:30 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Postponed IPOs:

Upcoming IPOs:

BoE Leaves Rates on Hold, Revises up Growth Forecast

Gapping up

In reaction to strong earnings/guidance/SSS:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance/SSS:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade six points below fair value.

Equity indices in the Asia-Pacific region ended Thursday on a mixed note with Japan's Nikkei (-1.2%) showing relative weakness. Yen strength contributed to the relative weakness in equities, as the Japanese currency returned into the neighborhood of this year's high against the dollar (112.34). Furthermore, yesterday's FOMC statement was not particularly hawkish, allowing the dollar to take a step back. The Australian dollar has outperformed, climbing 1.3% to 0.7687 against the greenback, on the back of strong trade data.

---Equity Markets---

Major European indices trade mixed while Italy's MIB (+1.3%) outperforms. The Bank of England kept its key rate and purchase program unchanged at their respective 0.25% and GBP435 billion, but did raise its growth outlook for 2017 to 2.0% from 1.4%. The central bank's inflation forecast was little changed, calling for CPI of 2.7%.

---Equity Markets---

Stocks with favorable mention: AAPL, ACM, AMZN, CHKP, CYBR, FB, GOOGL, HRB, MXIM, NFLX, NXST, SN, TTWO

Stocks with unfavorable mention: CARA, FEYE

Filings:

Offerings:

Pricings: