Блог компании DayTraderClub | Америка сегодня. Занятость вне сельского хозяйства (пейролы).

- 10 марта 2017, 16:20

- |

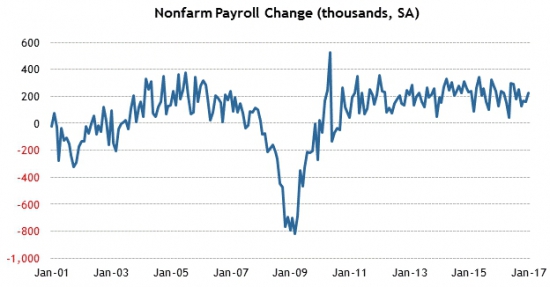

Темп прироста занятых вне сельского хозяйства продолжает показывать позитивную динамику и сегодняшние данные ожидаются на столь же высоком уровне. Но учитывая небольшой всплеск во вчерашних данных по заявкам на пособия, всё ещё под отметкой 250 тысяч:

В январе наибольший прирост занятых наблюдался в сферах розничной торговли, производстве и финансовой деятельности. Общее количество занятых находится выше кризиса 2008 года и продолжает плавный рост:

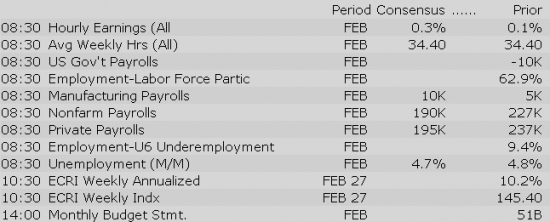

Уровень безработицы прогнозируется на предыдущей отметке 4,8%:

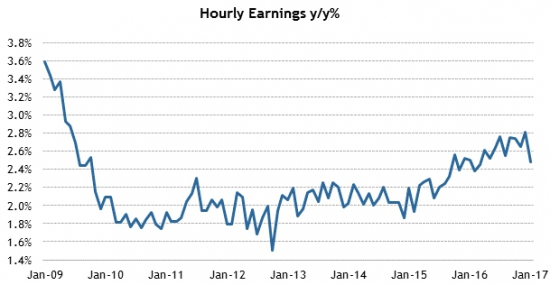

Прирост в среднечасовой зарплате в прошлом месяце показал уменьшение в годовом измерении, не повторив успех 2016 года. В этом месяце ожидается продолжение плавной динамики и увеличение на 0.2%:

Продолжительность рабочей недели также ожидается без изменений на уровне 34.4 часа:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market Updates:

US Econ Data

February Jobs Report (8:30am)Equity indices in the Asia-Pacific region ended the week on a mixed note with Japan's Nikkei (+1.5%) showing relative strength as the yen retreated 0.4% against the dollar to 115.40. Elsewhere, South Korea's Constitutional Court has upheld President Park Geun-hye's impeachment, which should lead to elections within 60 days. Elsewhere, the People's Bank of China defended the use of foreign currency reserves in order to prop up the yuan.

---Equity Markets---

---FX---

Gapping down: SMSI -23.6%, FNSR -15.7%, XTNT -14.8%, ZUMZ -14.3%, CARA -10.2%, SGRY -9.8%, BVX -7.9%, MED -7.8%, MEET -7.6%, FRPT -6.1%, RGSE -5.9%, ARE -5.2%, LOCO -4.4%, ULTA -4.3%, FN -4%, LITE -3.5%, SBGL -3.5%, MTL -3.4%, ALR -3.2%, OCRX -2.6%, ROKA -2.5%, WMK -2.5%, ACIA -2.3%, AAOI -2.2%, AU -2.1%, OCLR -2%, OOMA -1.7%, LUV -1.6%, SAND -1.3%, AQXP -1%, GOLD -0.8%, ATHX -0.8%, HIBB -0.8%, TRIL -0.8%, INFN -0.7%, IIVI -0.7%, PAY -0.7%, ABX -0.6%

Major European indices trade higher across the board, looking for a strong finish to a generally positive week. Yesterday afternoon, Donald Tusk was elected for a second term as European council president. Mr. Tusk held his spot for another two years, even though the ruling Law and Justice party (PiS) in his native Poland opposed his re-election. The opposition was due to the fact Mr. Tusk is the former leader of the Civic Platform (PO) party and is viewed as a German puppet by the Polish government. Elsewhere, IMF chief Christine Lagarde said France would face a period of grave uncertainty and end up poorer if it chooses to exit the euro. Recall that presidential candidate Marine Le Pen has threatened to re-introduce a national currency in the event of her victory.

---Equity Markets---

Treasuries Tread Water Ahead of Jobs Report

Stocks with favorable mention: ALK, ANET, COLM, CWH, MRVL, NFLX, REGN, TECD, URI, WYN

Stocks with unfavorable mention: M, NLY, SWIR

The energy sector's rebound yesterday afternoon has fostered some bullish excitement this morning as equity futures point to a solidly higher open for Friday's session. The S&P 500 futures trade 12 points (0.5%) above fair value.

The much anticipated Employment Situation Report for February will be released shortly at 8:30 am ET. Investors will be particularly focused on nonfarm payrolls (Briefing.com consensus 188,000) and average hourly earnings (Briefing.com consensus +0.2%) as a poor reading in these categories is about the only thing that could deter the Fed from tightening policy at next week's FOMC meeting.

U.S. Treasuries trade flat ahead of the latest Jobs Report reading. The benchmark 10-yr yield is unchanged at 2.61%.

After plunging 5.3% on Wednesday and then 2.1% on Thursday in reaction to a bearish EIA inventory report, crude oil has rebounded this morning to trade 0.7% higher at $49.61/bbl. The uptick leaves the energy component just a step above its lowest level since OPEC announced its supply cut agreement back on November 30.

In addition to the Jobs Report for February, investors will also receive the February Treasury Budget at 14:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Other news:

Analyst comments:

Bund Yields Push Higher

Gapping down

In reaction to disappointing earnings/guidance:

Select FNSR peers/related names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select FNSR peers/related names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

ZUMZ shares are currently down ~13% around the 18.35 level in pre-market trading.

The S&P 500 futures trade 14 points (0.6%) above fair value.

Just in, February nonfarm payrolls came in at 235,000 while the Briefing.com consensus expected a reading of 188,000. The prior month's reading was revised to 238,000 from 227,000. Nonfarm private payrolls added 227,000 while the Briefing.com consensus expected an increase of 185,000. The unemployment rate decreased to 4.7% (Briefing.com consensus 4.7%).

Average hourly earnings increased 0.2% (Briefing.com consensus +0.2%), while the previous month's reading was revised to 0.2% (from +0.1%). The average workweek was reported at 34.4 while the Briefing.com consensus expected a reading of 34.4. The previous month's reading was left unrevised at 34.4.

Ahead of the report, copper was already higher, while precious metals were in the red.

In current trade...

Filings:

Offerings:

Pricings:

The S&P 500 futures trade 17 points (0.7%) above fair value.

Equity indices in the Asia-Pacific region ended the week on a mixed note with Japan's Nikkei (+1.5%) showing relative strength. Elsewhere, South Korea's Constitutional Court has upheld President Park Geun-hye's impeachment, which should lead to elections within 60 days. Elsewhere, the People's Bank of China defended the use of foreign currency reserves in order to prop up the yuan.

---Equity Markets---

Major European indices trade higher across the board, looking for a strong finish to a generally positive week. Yesterday afternoon, Donald Tusk was elected for a second term as European council president. Mr. Tusk held his spot for another two years, even though the ruling Law and Justice party (PiS) in his native Poland opposed his re-election. The opposition was due to the fact Mr. Tusk is the former leader of the Civic Platform (PO) party and is viewed as a German puppet by the Polish government. Elsewhere, IMF chief Christine Lagarde said France would face a period of grave uncertainty and end up poorer if it chooses to exit the euro. Recall that presidential candidate Marine Le Pen has threatened to re-introduce a national currency in the event of her victory.

---Equity Markets---

Upgrades:

Downgrades:

Miscellaneous:

Equity futures indicate a solidly higher open for the stock market on Friday as investors look to build off the positive momentum generated by yesterday's afternoon rally in energy stocks. The S&P 500 futures trade 14 points, or 0.6%, above fair value.

The Employment Situation Report for February, which was released earlier this morning, effectively guaranteed a rate hike in March after beating consensus estimates. Most notably, the report showed that February nonfarm payrolls increased by 235,000 (Briefing.com consensus 188,000) and average hourly earnings rose 0.2% (Briefing.com consensus +0.2%).

U.S. Treasuries have seen an uptick in buying interest following the latest jobs report with the benchmark 10-yr yield trading two basis points lower at 2.59%. Meanwhile, the U.S. Dollar Index (101.51, -0.47) has extended its modest loss to 0.5% in the wake of the report.

Crude oil has rebounded this morning after suffering heavy losses in the past two sessions following a bearish EIA inventory report on Wednesday. WTI crude currently trades 0.7% higher at $49.67/bbl.

Corporate news has been relatively light this morning with only a handful of notable companies reporting their quarterly results. Of these names, Buckle (BKE 17.05, -0.25) is worth noting considering retailers have suffered this week in reaction to disappointing results. The company has continued that trend, dropping 1.5% in pre-market action, after missing both top and bottom line estimates.

Also of note, investors will receive the February Treasury Budget this afternoon at 14:00 ET.

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

The S&P 500 opens Friday's session with a gain of 0.4%.

All sectors trade in the green with the lightly-weighted real estate (+0.8%) and materials (+0.6%) sectors leading the charge. The energy space (+0.2%) underperforms as crude oil retreats from its overnight high. WTI crude currently trades just above its flat line at $49.35/bbl.

Like energy, the health care group (+0.1%) has also failed to keep pace with the benchmark index in early action as the sector's largest component by weight, Johnson & Johnson (JNJ 125.56, -0.39), shows a loss of 0.3%.

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.57… VIX: (11.17, -0.53, -4.3%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The tech sector — XLK — trades ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +1.28%. Within the SOX index, ON (+2.76%) outperforms, while NXPI (+0.13%) lags the sector yet still trades above flat lines. Among other major indices, the SPY is trading 0.35% higher, while the QQQ +0.50% and the NASDAQ +0.31% also trade slightly higher on the session. Among tech bellwethers, ORAN (+1.75%) is showing relative strength, while HPE (-0.62%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings Monday morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Discount/off-price retailers are higher with CTRN leading the way: SMRT +1.1%, BURL +0.8%, ROST +0.5%, SSI +2.2%

In the news:- Leaders:

- BPI 4.8% (Bridgepoint Education enters into agreement with Warburg Pincus Private Equity VIII, L.P. to repurchase 18,072,289 shares of common stock in a private transaction at $8.30/share)

- RCKY 1.2% (appoints Thomas Robertson as CFO and announces new $7.5 mln share repurchase program)

- CL 0.9% (increases quarterly dividend to $0.40/share from $0.39/share)

- SNAK 1.3% (schedules Q4 earnings release, expects it will not be able to timely file its Annual Report on Form 10-K for its fiscal year ended December 31, 2016)

- DIN 1.3% (announces 25-year industry veteran and former Applebee's Chief Marketing Officer John Cywinski returns as President of Applebee's effective today)

- EL 3.5% (Ulta Beauty also confirmed the addition of the Estée Lauder's MAC brand — will launch on Ulta.com and begin to roll out to stores this spring)

- HOG 3.8% (strength being attributed to favorable sell side checks for Q1 sales)

- Laggards:

- BBY -0.2% (Boy Genius Report suggests BBY's Geek Squad may have conspired with the FBI to execute warrantless searches)

- M&A related: LGF.A 0.2% and VIAB -0.8% (Viacom and Lionsgate may sell stakes in Epix to MGM — Reuters sources)

Other notable trends:- Homebuilders are notably higher across the board: TPH +3.8%, MHO +3%, LEN +3%, CHCI +2.8%, TOL +2.3%, PHM +2.1%, UCP +2%, BZH +2%, CAA +1.8%, DHI +1.8%, MTH +1.8%, TMHC +1.6%, ITB +1.5%, KBH +1.4%, HOV +1.4%, CSTE +1.4%, WLH +1.3%, XHB +1.2%, MDC +0.9%, LGIH +0.3%

- Casino/gaming names are mostly higher today: CNTY +6.7%, PENN +2.2%, IGT +1.8%, ISLE +1.4%, BYD +1.3%, BJK +1.1%, WBAI +0.8%, LVS +0.8%, WYNN +0.7%,

Analyst related:Looking ahead:

- CytomX Therapeutics (CTMX +11.19%) files for approx 10.9 mln share common stock offering by selling shareholders

- Prothena (PRTA +6.79%) will present results from its Phase 1b Multiple Ascending Dose Study of PRX002/RG7935 in Patients with Parkinson's Disease in an webcast on April 2, 2017 at 9:00 AM ET

- IsoRay (ISR +1.96%) announces that the previously announced Stipulation of Settlement has been approved by the U.S. District Court for the Eastern District of Washington

Decliners on news:- Radius Health (RDUS -10.84%) receives FDA notification of PDUFA extension for Abaloparatide-SC until June 30, 2017

- Argos Therapeutics (ARGS -10%) approves workforce action plan designed to streamline operations and reduce the Company's operating expenses

- BioCryst Pharma (BCRX -1.72%) prices offering of 5,294,118 shares of its common stock at $8.50 per share

Gainers on earnings:- Tetraphase Pharma (TTPH +16.45%) misses by $0.01, misses on revs

- Zafgen (ZFGN +15.44%) beats by $0.12, reports no revenue

- Providence Service Corp (PRSC +11.9%) misses by $0.12, misses on revs

Decliners on earnings:- Ocera Therapeutics (OCRX -21.22%) reports Q4 EPS of ($0.22) vs ($0.33) Capital IQ Consensus; revs 512K versus 24K last year.

- TearLab (TEAR -17.2%) beats by $0.09, misses on revs; to explore strategic alternatives

- Second Sight Medical Products (EYES -10.32%) misses by $0.07, misses on revs

Upgrades/Downgrades:Biggest point losers: TDG 233.5(-8.13), FNSR 27.83(-7.07), IONS 40.06(-5.74), ARE 108.96(-4.74), RDUS 38.53(-4.58), SAM 148.4(-3.4), ZUMZ 18.03(-2.98), NTES 288.36(-2.92), TSRO 170.49(-2.57), FN 40.46(-2.04), PXD 185.77(-1.98), SBGI 41.02(-1.89), WGO 29.03(-1.88), AAOI 50.79(-1.87), UHS 122.08(-1.86), SGRY 19.15(-1.8), TD 50.04(-1.73), BA 178.84(-1.73), ACIA 50.91(-1.72), CECE 10.13(-1.63), ACOR 28.63(-1.53), KRC 70.61(-1.41), LUV 55.01(-1.35), PAY 19.09(-1.26), BIIB 291.89(-1.17)

Stocks that traded to 52 week lows: ACET, ADPT, AFH, AFSI, AKR, ASNA, BFZ, BKE, BKN, BKS, BRX, BW, CDR, CERC, CHKE, DCTH, DRWI, ECOM, EPRSQ, EYES, FNCX, FRT, GBSN, GEC, GLF, IMNP, KIM, KRG, MAC, MAV, MEMP, MHI, MN, MRIN, MUI, NADL, NAO, NEV, NH, NIHD, NLST, NQP, NVIV, PEI, PMF, PPP, QUMU, RDY, REG, RELY, RPAI, RPT, RRD, SBH, SHIP, SHOS, SKT, SMSI, SOL, SPG, SPH, SRC, STOR, SVU, TAHO, TANH, TLT, TOPS, TTI, ULTRQ, VGLT, WAIR, WPG, WRI, XCOMQ

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: BBC, CHMG, CWAY, CYRX, DXJS, ESGD, FEUZ, FSZ, GCH, ICBK, ISTR, MLP, NSSC, NVR, PBNC, RFDI, RFEU, SCKT, SGF, SPLP, TRCB

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AKP, BBK, BSD, DFBG, FMN, LKOR, LUB, MBSD, MNE, MYC, MYJ, NTC, NUM, REIS, SGOC, TEAR, VJET

ETFs that traded to 52 week highs: EWG, EWN, EWO, EWQ, EZU, ITB, IYH, SMH, SOXX, XHB, XLK, XLV

ETFs that traded to 52 week lows: MBB, TLT, USCI

The Energy Sector (XLE, -0.2%) continues its slide while the broader market (SPY, +0.2%) rallies in early afternoon trading. Crude oil (USO, -1.6%) futures remain on track to close at a fresh low of 2017 for the 3rd day in a row ahead of today's rig count data. The significant drop over the past 3 days comes on the heels of Wednesday's EIA data, which showed that US crude oil inventories have swelled to fresh all-time highs for the second week in a row. Lastly, natural gas (UNG, +0.7%) futures extend yesterday's post-EIA gains & remain on track to close the week +5.7%, compared to last Friday's pit trading close level.

Factors weighing on the price of oil this week:

Reminder: Baker Hughes (BHI, -0.4%) rig count data will be released today at 1 pm ET.

Notable Gainers:

Notable Laggards:

In current trade:

Earnings/News

Broker Calls

Today's top 20 % gainers

- Healthcare: EPZM (16.5 +8.55%), ATRA (20.25 +8%), CFMS (5.29 +7.52%), PRTA (53.94 +6.54%), CORT (10.57 +6.23%), BPMC (38.29 +5.69%)

- Materials: GORO (4.46 +6.44%)

- Industrials: SALT (7.68 +10.43%)

- Consumer Discretionary: SHLD (9.16 +14.39%), GCO (61.78 +9.53%), HIBB (29.7 +8.3%), PIR (7.04 +7.57%), MTN (193.17 +7.05%), VRA (9.42 +5.84%)

- Information Technology: CMCM (10.74 +6.23%), CYOU (31.25 +6.04%)

- Energy: BPT (17.65 +12.42%), RMP (25.62 +6.75%)

- Consumer Staples: FRPT (10.98 +11.42%), FIZZ (70.37 +6.09%)

Today's top 20 % losersToday's top 20 volume

- Materials: MT (12.18 mln -0.77%), VALE (11.44 mln +0.9%), FCX (10.92 mln -0.73%), X (9.44 mln -1.95%)

- Consumer Discretionary: F (12.98 mln +0.16%), SIRI (9.19 mln +0.29%)

- Information Technology: AMD (26.98 mln +2.03%), FNSR (17.17 mln -20.37%), MU (12.99 mln -0.83%), INTC (9.91 mln +0.28%), FB (8.96 mln +0.39%), OCLR (8.83 mln -6.23%)

- Financials: BAC (43.44 mln -0.1%)

- Energy: CHK (16.79 mln -0.78%), MRO (11.81 mln -1.9%), BP (11.61 mln +2.79%), WFT (9.29 mln +1.34%)

- Consumer Staples: ABEV (10.58 mln +1.68%), RAD (9.45 mln +3.11%)

- Telecommunication Services: FTR (16.23 mln +3.08%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market is fitting to close the week with modest gains on Friday, as the three major averages all hover slightly above flat lines at the moment; leading the modestly higher bias, the Nasdaq Composite adds about 17 points (+0.28%) to 5855, the S&P 500 is up about 6 (+0.23%) to 2370, and the Dow Jones Industrial Average gains 23 (+0.11%) to 20880. Action has come on mixed average volume (NYSE 289 vs. avg. of 312; NASDAQ 837 mln vs. avg. of 792), with advancers outpacing decliners (NYSE 1743/1216, NASDAQ 1636/1102) and new highs outpacing new lows (NYSE 65/59, NASDAQ 83/30).

Relative Strength:

Indian Rupee-ICN +6.6%, S. Africa-EZA +2.3%, Egypt-EGPT +2.1%, Cocoa-NIB +2.1%, Brazil-EWZ +1.8%, Turkey-TUR +1.8%, Netherlands-EWN +1.6%, Poland-EPOL +1.4%, US Home Constr.-ITB +1.2%, Jr. Gold Miners-GDXJ +1.1%, Copper Miners-COPX +1.0%, Homebuilders-XHB +1.0%, Retail-XRT +1.0%, Gold Miners-GDX +0.9%.

Relative Weakness:

US Diesel/Heating Oil-UHN -2.2%, US Oil-USO -1.5%, US Gasoline-UGA -1.4%, Short-Term Futures-VXX -1.2%, Grains-JJG -0.9%, Corn-CORN -0.9%, Cotton-BAL -0.8%, Reg. Banking-KRE -0.7%, Banking-KBE -0.6%, Philippines-EPHE -0.6%, Thailand-THD -0.3%, India-INP -0.2%, British Pound-FXB -0.1%, Japanese Yen-FXY -0.1%.

Rumor Activity was active today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

The Industrials sector (XLI) is trading 0.2% higher today, in-line with the broader market (SPY +0.2%). In the Industrial Sector, Southwest (LUV -2.2%) lowers Q1 operating revenue per ASM guidance, and JetBlue (JBLU +4.6%) and Alaska Air (ALK +1.2%) report February Traffic.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: MYRG +14.4% NVEE +4.3% WLDN +18.7% ACTG -10.9% ERI -0.3% BOOM +0.8% CVGI -1.2%

News

Broker Research

Upgrades

Downgrades

Other