Блог компании DayTraderClub | Америка сегодня. Изменение числа занятых, уровень производительности, запасы на оптовых складах и запасы нефти.

- 08 марта 2017, 16:26

- |

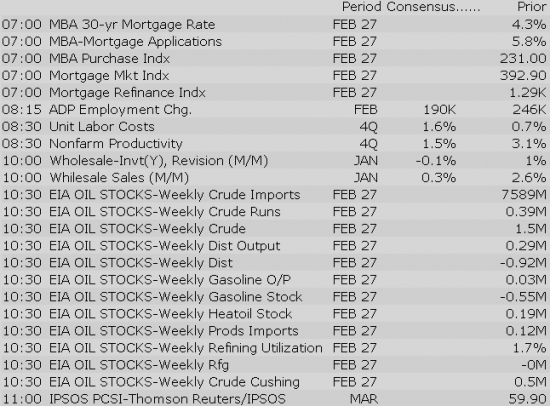

Число занятых вне сельскохозяйственного сектора продолжает прирост на своих максимальных значениях. В этом месяце аналитики более аккуратны в прогнозах и значение ожидают на отметке 190 тысяч:

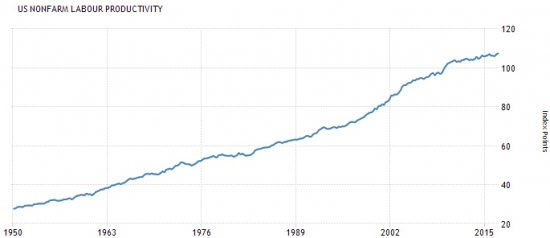

Уровень производительности вне сельскохозяйственного сектора продолжает бить свои максимальные отметки, новое ожидаемое значение +1,3% выведет индекс на отметку выше 108:

На длительной картине производительности идёт непрерывный рост с 1950 года, поэтому аналитики этому факту уделяют небольшое внимание:

Оптовые склады перешли в режим распределения, данные по запасам ожидаются в отрицательной зоне:

Вместе с этим, данные по запасам сырой нефти удержались от этапа распределения и склады продолжают работать в режиме накопления, ожидается прирост +1,7М:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices in the Asia-Pacific region ended the midweek session on a mostly lower note, but losses were limited. In Australia, rate hike expectations were on the rise, but the latest trade data from China disappointed, inviting some concerns about economic strength in the region.

---Equity Markets---

---FX---

BOJA -5% premarket.

Major European indices trade just below their flat lines. In the UK, Finance Minister Philip Hammond is presenting the spring budget. The pound has retreated modestly, trading lower by 0.4% against the dollar at 1.2151. For its part, the euro (1.0560) is down 0.1% versus the greenback. There is growing skepticism that an agreement between Greek and Eurogroup officials will be reached in time for the March 20 deadline. Greek officials remain hopeful that an agreement will be reached.

---Equity Markets---

Gapping down: EXPR -17.6%, HIIQ -13.5%, ARA -10.9%, ALQA -10.3%, HYGS -8.9%, PQ -8.7%, GEO -6.3%, URBN -5.5%, BOJA -4.8%, EDIT -4.6%, CIEN -4.3%, LAND -3.8%, CAT -3.8%, FOXF -3.7%, BOBE -3.6%, LADR -3.4%, SBGL -3.4%, GFI -3.2%, AERI -2.6%, RGNX -2.6%, SHPG -2.5%, KODK -2.5%, FCSC -1.9%, GSK -1.7%, BHP -1.6%, GOLD -1.3%, AZN -1.3%, BUD -1.3%, APC -1.2%, VRX -1.2%, RDS.A -1.1%, RIG -0.6%, ABX -0.6%, TOT -0.6%, BP -0.6%, MRO -0.5%

After initially trading up as much as 6% higher following the release, shares started selling off and were barely above yesterday's close heading into the earnings call. Shares are currently trading down ~5.5% at the 24 level.

Treasuries Continue Lower Ahead of ADP Employment Change

Wall Street is ripe for a relatively flat open on Wednesday as investors lack a clear market-moving catalyst again this morning. The S&P 500 futures trade one point below fair value.

Crude oil has dropped 1.1% following the latest American Petroleum Institute (API) reading on Tuesday evening. The data showed a crude oil inventory build of 11.6 million barrels, which is much higher than the build of 1.6 million that the consensus anticipated. WTI crude trades at $52.57/bbl.

The Treasury market shows a modest loss this morning as investors eye Friday's Employment Situation Report, which is widely considered the last potential barrier to the newly anticipated March rate hike. The benchmark 10-yr yield trades two basis points higher at 2.54%.

The weekly MBA Mortgage Applications Index, which was released earlier this morning, increased 3.3% to follow last week's 5.8% uptick.

Wednesday will also see February ADP Employment Change (Briefing.com consensus 180,000) at 8:15 ET, fourth quarter Productivity (Briefing.com consensus 1.5%) & Unit Labor Costs (Briefing.com consensus 1.6%) at 8:30 ET, and January Wholesale Inventories (Briefing.com consensus -0.1%) at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

The S&P 500 futures trade one point below fair value.

Just in, the ADP National Employment Report showed an increase of 298,000 in February (Briefing.com consensus 180,000) while the January reading was revised to 261,000 from 246,000. The ADP reading precedes Friday's more influential Employment Situation Report for February, which the Briefing.com consensus expects will show the addition of 188,000 nonfarm payrolls. The Employment Situation Report for January indicated that nonfarm payrolls increased by 227,000.

European Sovereign Debt Drops

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial names showing strength:

Other news:

Analyst comments:

The S&P 500 futures trade three points below fair value.

Just in, the revised unit labor costs increased 1.7% during the fourth quarter, which was higher than the 1.6% increase that had been anticipated by the Briefing.com consensus. The preliminary reading also showed an increase of 1.7%.

The revised productivity reading showed an increase of 1.3%. The Briefing.com consensus expected an increase of 1.5% while the preliminary reading showed an uptick of 1.3%.

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade in line with fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a mostly lower note, but losses were limited. In Australia, rate hike expectations were on the rise, but the latest trade data from China disappointed, inviting some concerns about economic strength in the region.

---Equity Markets---

Major European indices trade near their flat lines. In the UK, Finance Minister Philip Hammond is presenting the spring budget. The pound has retreated modestly, trading lower by 0.2% against the dollar at 1.2172. For its part, the euro (1.0550) is down 0.2% versus the greenback. There is growing skepticism that an agreement between Greek and Eurogroup officials will be reached in time for the March 20 deadline. Greek officials remain hopeful that an agreement will be reached.

---Equity Markets---

Filings:

Offerings:

Pricings:

After pointing to a lower open earlier this morning, equity futures now indicate a slightly higher start for the stock market on Wednesday following a hotter than expected ADP National Employment Report. The S&P 500 futures trade one point above fair value.

The ADP National Employment Report showed an increase of 298,000 in February (Briefing.com consensus 180,000) while the January reading was revised to 261,000 from 246,000. The ADP reading precedes Friday's more influential Employment Situation Report for February, which is widely considered the last potential barrier to a rate hike in March.

U.S. Treasuries slipped to fresh overnight lows in the wake of the release. The benchmark 10-yr yield trades five basis points higher at 2.57%.

Crude oil also hovers near its fresh low, down 1.4%, following the latest American Petroleum Institute (API) reading on Tuesday evening. The data showed a crude oil inventory build of 11.6 million barrels, which was much higher than the anticipated build of 1.6 million. WTI crude trades at $52.39/bbl ahead of today's crude oil inventory report from the Energy Information Administration (EIA), which will be released at 10:30 ET.

On the corporate front, Caterpillar (CAT 93.80, -2.13) is down 2.2% in pre-market action following a New York Times article indicating that the company has been accused of tax fraud in a report to federal investigators. Elsewhere, on the earnings front, The Children's Place (PLCE 108.50, +8.60) has spiked 8.6% after reporting better than expected earnings and issuing upbeat guidance. Also of note, the company announced a new stock buyback and a dividend increase.

Today's last economic report will be January Wholesale Inventories (Briefing.com consensus -0.1%). The report will cross the wires at 10:00 ET.

— Shares of APC -0.8% pre-market.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The S&P 500 opened Wednesday's session just above its flat line with a slim gain.

Out of the gate, the financial sector (+1.1%) leads all of its peers by a wide margin. Conversely, the utilities space holds the bottom spot on today's leaderboard with a loss of 1.1%.

The top four sectors by weight--technology, financials, health care, and consumer discretionary--have held at or above their flat lines in early action to keep their peers' losses in check. Together, the four groups comprise over 60.0% of the broader market.

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.85%. Within the SOX index, AMD (+2.67%) outperforms, while INTC (-0.05%) lags. Among other major indices, the SPY is trading 0.22% higher, while the QQQ +0.30% and the NASDAQ +0.25% trade modestly higher on the session. Among tech bellwethers, AMX (+0.75%) is showing relative strength, while VZ (-0.77%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Production: U.S. crude oil refinery inputs avgd 15.5 mln barrels per day during the week ending March 3, 2017, 172,000 barrels per day less than the previous week's avg. Refineries operated at 85.9% of their operable capacity last week. Gasoline production increased last week, averaging over 9.8 mln barrels per day. Distillate fuel production increased last week, averaging 4.8 mln barrels per day.

Imports: U.S. crude oil imports avgd just about 8.2 mln barrels per day last week, up by 561,000 barrels per day from the previous week. Over the last four weeks, crude oil imports avgd 7.9 mln barrels per day, 1.7% below the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week avgd 242,000 barrels per day. Distillate fuel imports avgd 266,000 barrels per day last week.

Inventory: U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.2 mln barrels from the previous week. At 528.4 mln barrels, U.S. crude oil inventories are above the upper limit of the avg range for this time of year. Total motor gasoline inventories decreased by 6.6 mln barrels last week, but are near the upper limit of the avg range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 2.7 mln barrels last week but are near the upper limit of the avg range for this time of year. Propane/propylene inventories fell 4.1 mln barrels last week but are in the middle of the avg range. Total commercial petroleum inventories decreased by 2.4 mln barrels last week.

Demand: Total products supplied over the last four-week period avgd 19.6 mln barrels per day, down by 1.3% from the same period last year. Over the last four weeks, motor gasoline product supplied avgd about 8.8 mln barrels per day, down by 6.1% from the same period last year. Distillate fuel product supplied avgd over 4.0 mln barrels per day over the last four weeks, up by 12.6% from the same period last year. Jet fuel product supplied is down 7.7% compared to the same four-week period last year.

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.96… VIX: (11.41, -0.04, -0.4%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Rumor Activity was active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Treasury Auction Preview

- Ocera Therapeutics (OCRX +73.13%) says will report additional 'encouraging results' from its Phase 2b STOP-HE study of intravenous OCR-002 in hospitalized patients with Hepatic Encephalopathy at the Cowen and Company 37th Annual Healthcare Conference today

- Capnia (CAPN +20%) closes merger w/ Essentialis; concurrently, prior investors in Essentialis, as well as new investors, invested $10 mln in newly-issued Capnia shares of common stock at $0.96/share

- Fibrocell Science (FCSC +14.68%) entered into securities purchase agreement with existing investors for sale of $8.0 mln Series A Convertible Preferred Stock and accompanying warrants

Decliners on news:- Health Insurance Innovations (HIIQ -10.66%) prices 3 mln common stock offering by selling stockholders at $14.00/share

Gainers on earnings:- Sucampo Pharma (SCMP +12%) beats by $0.20, beats on revs; reaffirms FY17 EPS guidance, revs guidance; CFO leaving the company

- Rigel Pharma (RIGL +9.58%) beats by $0.01, misses on revs

- Teligent (TLGT +7.79%) beats by $0.01, reports revs in-line; guides FY17 revs in-line

Decliners on earnings:- Alliqua (ALQA -22.92%) beats by $0.01, misses on revs; guides FY17 revs below consensus

- Flex Pharma (FLKS -13.96%) reports Q4 EPS of ($0.48) vs ($0.74) Capital IQ Consensus Estimate; revs $291K vs zero last year

- Natera (NTRA -14.79%) misses by $0.18, misses on revs; guides FY17 revs below consensus

Upgrades/Downgrades:Biggest point losers: TISI 28.4(-3.3), TECD 90.95(-2.85), DLR 105.13(-2.35), GOLD 84.95(-2.31), FANG 102.37(-2.21), THO 101.81(-2.2), CIEN 24.06(-2.12), SPG 175.41(-1.88), HIIQ 15.53(-1.83), GEO 43(-1.73), BUD 106.07(-1.62), REN 41.08(-1.57), BOJA 18.23(-1.52), O 58.34(-1.5), EOG 98.08(-1.45), CRC 16.06(-1.45), REG 64.27(-1.45), NSM 16.5(-1.44), ACIA 50.42(-1.4), PNW 81.18(-1.36), ETR 73.67(-1.33), EGN 51.98(-1.31), VTR 61.39(-1.29), AMT 113.43(-1.27), RSPP 39.44(-1.25)

Stocks that traded to 52 week lows: ADPT, AKR, ANFI, AZO, BBG, BKE, BPTH, BRX, CATO, CDR, CERC, CERS, CHMA, CIE, CNIT, DAC, DCTH, DDR, DRWI, ESND, EXPR, FI, FRT, FTR, GBSN, GEC, GGP, GLF, GMAN, HGGGQ, HK, KIM, KRG, LFVN, MAC, MAT, MAV, MHI, MPVD, NADL, NDLS, NQP, ORPN, OXY, PEI, PMF, PN, QUMU, RAD, REG, RPAI, RPT, RRD, RWLK, SBH, SKT, SMRT, SNAK, SPH, SPRT, SPWH, SRNE, SUNW, TANH, TCO, TDW, TRIB, TROV, TRVN, TUES, UAA, ULTRQ, URBN, VGSH, VNCE, VNRSQ, VRA, WIN, WMIH, WPG, WRI, XCOMQ, XNET, YGE

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ACV, ASMB, BCBP, CHMG, CLCT, CMFN, GCH, HEQ, MRLN, MSBF, NBN, OFED, PBNC, SGF, SMCP, TUTT

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AEMD, ALJJ, BUR, CNTF, CSS, DHXM, FMN, GNMA, NTC, PNI, RAND, SGOC, SRSC, TNH, TWMC

ETFs that traded to 52 week highs: EZU, ITB

ETFs that traded to 52 week lows: USCI

Today's top 20 % gainers

- Healthcare: BLCM (13.8 +16.06%), GBT (31.9 +12.72%), PBYI (40 +12.36%), SCMP (12.63 +12.22%), TLGT (7.14 +9.05%), NTLA (14.14 +8.52%), LXRX (17.44 +8.43%), NKTR (15.45 +8.35%), CYTK (12.38 +7.61%), CLLS (22.91 +6.91%), IMMU (5.08 +6.72%)

- Industrials: RPXC (12.43 +12.79%)

- Consumer Discretionary: PLCE (116.55 +16.67%), HRB (24 +15.16%)

- Information Technology: EXTR (7.03 +15.25%), MOMO (32.34 +7.81%), BITA (23.64 +7.07%), HIMX (7.57 +6.87%)

- Energy: SDRL (1.26 +13.51%)

- Consumer Staples: MGPI (48 +7.43%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (9.49 mln -0.26%), PFE (8.44 mln -0.1%)

- Materials: VALE (12.5 mln -3.83%), GGB (11.92 mln -7.26%)

- Consumer Discretionary: F (13.86 mln +0.88%), URBN (9.04 mln -4.88%)

- Information Technology: AMD (33.14 mln +2.41%), TSL (24.56 mln +5.8%), CIEN (9.15 mln -8.64%), INTC (9.02 mln -0.39%), MU (8.89 mln -0.11%)

- Financials: BAC (54.72 mln +0.62%), C (17.43 mln +2.16%)

- Energy: WFT (20.21 mln -1.73%), CHK (16.36 mln -2.85%), SDRL (11.72 mln +13.51%), WLL (9.51 mln -6.91%), PBR (8.63 mln -5.04%)

- Consumer Staples: RAD (22.36 mln -5.59%)

- Telecommunication Services: FTR (10.81 mln -1.68%)

Today's top relative volume (current volume to 1-month average daily volume)The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The following are 11 highly shorted stocks that may be susceptible to a short squeeze tomorrow. These cos are reporting earnings after the bell today or before the market opens tomorrow.

The broader market is split at this point in the session, with only the Nasdaq Composite, which gains 11 points (+0.18%)% to 5844 holding about flat lines; the Dow Jones Industrial Average is the worst performer, down about 23 (-0.11%) to 20901, and the S&P 500 sheds less than a point (-0.03%) to 2367. Action has come on mixed average volume (NYSE 308 vs. avg. of 307; NASDAQ 783 mln vs. avg. of 785), with decliners outpacing advancers (NYSE 1027/1942, NASDAQ 1354/1356) and mixed new highs and new lows (NYSE 40/61, NASDAQ 56/38).

Relative Strength:

US Nat Gas-UNG +3.7%, Coffee-JO +1.4%, Biotech-IBB +1.2%, US Home Constr.-ITB +0.8%, Homebuilders-XHB +0.8%, Social Media-SOCL +0.7%, Retail-XRT +0.6%, Greece-GREK +0.5%, Hong Kong-EWH +0.3%, Chinese Yuan-CYB +0.2%, Indian Rupee-ICN +0.1%, Austria-EWO +0.1%, Spain-EWP +0.1%.

Relative Weakness:

Turkey-TUR -3.8%, US Oil-USO -2.9%, Brazil-EWZ -2.7%, Oil&Gas E&P-XOP -2.6%, Latin Am. 40-ILF -2.1%, S. Africa-EZA -1.8%, Oil Svcs.-OIH -1.8%, Rare Earth Metals-REMX -1.8%, Short-Term Futures-VXX -1.7%, Steel-SLX -1.7%, Russia-RSX -1.4%, US Energy-IYE -1.4%, Colombia-GXG -1.1%.

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Bridgepoint Education (BPI -4%) is leading for profit education names lower: STRA -1.4%, APEI -1.2%, CECO -0.5%, NORD -0.5%, CPLA -0.4%, EDU -0.4%, DV -0.3%

- Carter's, Inc. (CRI +1.2%) higher following Childrens Place Inc (PLCE) earnings.

In the news:- Leaders: RCL 1.2% (Royal Caribbean commits to a multi-year agreement with the island nation of The Bahamas; financial details not disclosed), TWX 0.5% (Time Warner's Turner and Warner Bros. partnered with standalone domestic premium video subscription service Boomerang — subscription video service will launch in the Spring), NUS 0.2% (appoints Mark Lawrence as CFO), OMC 1.1% (upgraded to Outperform at RBC Capital Mkts), DKS 2.4% (rebounding from yesterday's earnings related decline; also getting boost from upside Adidas earnings/guidance), LGIH +2.2% (continued strength)

- Laggards: RYCEY -1.4% (announces investment in Research & Development for Ship Intelligence), HST -0.4% (acquires the W Hollywood for $219 million), BID -1.6% (adopts Rule 10b5-1 plan for the purpose of repurchasing shares of its Common Stock to offset shares recently granted by the Company as equity compensation for executive and other officers), NFLX -0.6% (Time Warner's Turner and Warner Bros. partnered with standalone domestic premium video subscription service Boomerang — subscription video service will launch in the Spring), BWLD -0.5% (5.6% holder Marcato Capital released a detailed presentation highlighting 'the fact that not a single executive and only one director on one occasion have ever executed an open-market purchase of BWLD stock')

- Nearly unchanged: TACO (Del Taco is continuing to build brand presence while aggressively driving unit growth in the Southeastern U.S.), HAIN (UK's CMA says investigating the anticipated acquisition by Hain Frozen Foods UK Limited of the Yorkshire Provender)

- M&A related:

- RH 1.7% and WSM 2.1% (UK Betaville blogger suggests Williams-Sonoma is 'stalking Restoration Hardware')

- HSY 0.3% (M&A speculation)

- RAD -5.6%, FRED -2.1% (after closing near lows amid ongoing FTC concerns regarding WBA/RAD merger; also Fred's shareholder Alden Global responds to Fred's appointment of new directors; expresses 'concerns with the Company's unacceptable operating performance, unwarranted dilutive equity issuance to A.T. Kearney')

Other notable trends:Looking ahead:

Investors have remained cautious in the first half of Wednesday's range-bound session, leaving the major averages near their unchanged marks at midday. The S&P 500 (unch) and the Dow (-0.1%) trade relatively flat while the Nasdaq (+0.3%) holds a modest gain.

The latest ADP National Employment Report gave equity futures a little bump this morning after clobbering consensus estimates. The reading showed that a whopping 298,000 private-sector jobs were added in February (Briefing.com consensus 180,000).

In light of the hotter than expected reading, economists will surely readjust their estimates for nonfarm payroll gains (Briefing.com consensus 188,000) in Friday's Employment Situation Report for February, which is regarded as the last potential barrier for a rate hike in March.

The CME Fed Watch Tool now assigns an implied probability of 86.4% to a March rate hike, up from 81.9% on Tuesday. The U.S. Dollar Index (102.13, +0.32) has responded accordingly, up 0.3%, as traders prepare for higher U.S. interest rates.

In the same breath, Treasuries saw an uptick in selling interest following the latest ADP reading. U.S. sovereign debt hovers near its session low with the benchmark 10-yr yield trading five basis points higher at 2.57%.

The energy space (-1.7%) has plunged alongside crude oil, which is down by 3.4% following the latest inventory report from the Energy Information Administration (EIA). The reading far surpassed consensus estimates (+2.0 million) by showing a build of 8.2 million barrels. The energy component trades at $51.32/bbl, its lowest level in a month.

Just above the energy group are the rate-sensitive utilities (-1.3%) and real estate (-1.2%) sectors. The two spaces are suffering amid today's jump in interest rates. On the flip side, the financial (+0.5%), health care (+0.5%), consumer discretionary (+0.3%), and technology (+0.2%) sectors outperform.

Retailers have added 0.6% to the SPDR S&P Retail ETF (XRT 42.20, +0.25) after the latest batch of earnings reports. Most notably, The Children's Place (PLCE 118.00, +18.10) has surged 18.0% after reporting better than expected earnings and issuing upbeat guidance earlier this morning. The company also announced a new stock buyback and a dividend increase.

Aside from earnings, corporate news has been relatively light. However, Caterpillar (CAT 94.34, -1.59) has generated some buzz following a NewYorkTimes article indicating that the company has been accused of tax fraud in a report to federal investigators. CAT's 1.7% tumble has put a lid on the industrial sector's (+0.1%) advance.

Today's economic data included February ADP Employment Change, fourth quarter Productivity & Unit Labor Costs, January Wholesale Inventories, and the weekly MBA Mortgage Index:

Treasury Auction Results

The Industrials sector (XLI) is trading flat today, lower than the broader market (SPY +0.1%). In the Industrial Sector, Caterpillar (CAT -1.8%) shares fall following NY Times article discussing the allegations of tax fraud, and Air France (AFLYY +3%) reports February traffic.

Earnings/Guidance

Expects the recent weather challenges on the western part of its network to reduce earnings in Q1 by approximately three to four cents per share through a combination of lost revenue and increased operating expense.

Additional Industrials reporting earnings/guidance: GFSZY +7.3% ABM +5.5% NCS +1.4% TISI -11.2% AVAV +4.7% PKOH -8.6% BBSI -9.4% TAX +5.6% HYGS -6.9% OPTT -8.6%

News

Caterpillar NY Times Article

Broker Research

Upgrades

Other

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.99… VIX: (11.30, -0.15, -1.3%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest for tomorrow, March 9th include:

Conference in progress:

The Energy Sector (XLE, -2.0%) drops while the broader market (SPY, +0.1%) rallies in afternoon trading. Crude oil (USO, -4.0%) futures plummet to fresh lows of 2017 after EIA reported a notably larger-than-expected build in crude oil inventories, bringing US crude inventories to a fresh-all time high for the second week in a row (data summarized below). Lastly, natural gas (UNG, +3.2%) futures see a notable rally ahead of tomorrow's inventory number, which is expected to show a draw of about -59 bcf, vs last week's unseasonable +7 bcf build.

EIA petroleum data highlights:

Other contributing factors affecting the price of oil:

Contributing factors affecting the price of natural gas:

Upcoming data reminder:

Notable Gainers:

Notable Laggards:

In current trade:

Earnings/News

Broker Calls

Dollar Rallies on Strong ADP Data; Oil Plunges