SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. ВВП, деловая активность и доверие потребителей.

- 28 февраля 2017, 17:31

- |

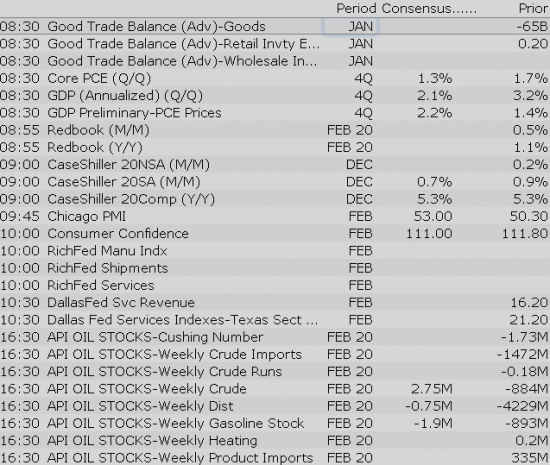

В данных за четвертый квартал 2016 ВВП прогнозируется аналитиками на уровне 2.1%:

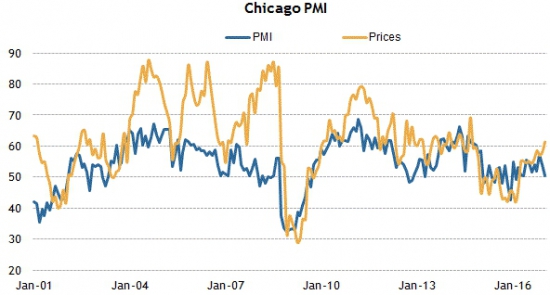

В индексе деловой активности после разочаровывающих данных снова ожидается всплеск к значению 54, которое находится на максимальных отметках за последние пару лет:

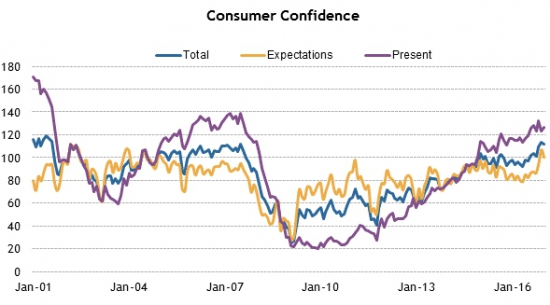

Индекс доверия потребителей продолжает устанавливать новые рекорды и этот месяц по прогнозам тоже не станет исключением и покажет отметку 112.1:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

41

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Gapping down: FRGI -15.8%, ESND -14.4%, THC -12.3%, TGT -11.9%, PRGO -11.7%, KONA -9.9%, FTR -9.1%, CEMP -8.3%, NVAX -8%, TTNP -7.9%, HTGM -7.2%, OPHT -7.2%, AAC -6.5%, EXEL -5.6%, WDAY -5.1%, KRA -5%, KTOS -4.9%, ZTO -4.3%, ORA -4.2%, IPWR -4.2%, CPE -4.2%, TCAP -3.8%, VRX -3.1%, PULM -2.8%, FSLR -2.6%, O -2.5%, TRIP -2.3%, GPL -2.1%, STM -2%, SQ -1.8%, BHP -1.8%, ASML -1.8%, TZOO -1.6%, ING -1.5%, KR -1.5%, I -1.4%, APLE -1.2%, WMT -1.1%, JPM -1.1%, HPP -1%, RDS.A -1%, C -0.9%, RIO -0.9%

Treasuries Edge Higher Ahead of GDP and Trump Speech

Upgrades:

Downgrades:

Miscellaneous:

Stocks with favorable mention: AAPL, CBG, CELG, CHRW, FB, HON, MLM, NXPI, PVH, PYPL, REGN, TXN, UTX, VAC, WDAY

Stocks with unfavorable mention: ARRY, ESPR, FSLR, QCOM, SLCA, WB

Equity futures point to a slightly lower open on Tuesday morning as investors eye President Trump's first address to Congress, which will occur tonight at 9:00 pm ET. The S&P 500 futures currently trade three points below fair value.

U.S. Treasuries trade relatively flat this morning after suffering heavy losses on Monday. The benchmark 10-yr yield is one basis point lower at 2.36%.

Crude oil has given back yesterday's slim gain by losing 0.2% in early action. WTI crude trades at $53.91/bbl, staying true to the $5.00 trading range it's held since OPEC's production cut announcement on November 30.

Tuesday will see a slew of economic reports, including the second estimate of fourth quarter GDP (Briefing.com consensus 2.1%) and January International Trade in Goods at 8:30 ET, February Chicago PMI (Briefing.com consensus 53.0%) at 9:45 ET, and February Consumer Confidence (Briefing.com consensus 111.5) at 10:00 ET.

Additionally, there will be several Fed speakers on Tuesday, including Kansas City Fed President George at 12:45 ET, San Francisco Fed President Williams at 15:30 ET, and St. Louis Fed President Bullard at 18:30 ET. None of today's Fed speakers are voting members on this year's FOMC.

In U.S. corporate news:

Reviewing overnight developments:

European Sovereign Debt Mixed

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

The S&P 500 futures trade three points below fair value.

Just in, the second reading of fourth quarter GDP pointed to an expansion of 1.9%, while the Briefing.com consensus expected a reading of 2.1%. The second estimate of fourth quarter GDP Deflator came in at 2.0%, while the Briefing.com consensus expected a reading of 2.1%.

Separately, the Advance report for International Trade in Goods for January showed a deficit of $69.2 billion, up from a revised deficit of $64.4 billion for December (from $65.0 billion). The Advance report for January Wholesale Inventories decreased 0.1%. The prior month's reading was revised to 0.9% from 1.0%.

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade four points below fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mixed note, but once again, trading ranges were fairly narrow as participants awaited U.S. President Donald Trump's first address to Congress, which will take place tonight. China's Vice Premier Wang Yang called on his country to maintain non-confrontational principle with the U.S. despite recent reports of increased military spending on both sides.

---Equity Markets---

Major European indices trade near their flat lines while Spain's IBEX (+0.7%) outperforms. New Bank of England deputy governor, Charlotte Hogg, said her tolerance for above-target inflation would depend on events. Ms. Hogg acknowledged that inflation is squeezing household incomes. In Greece, government officials are expected to meet with auditors, putting together a list of policies that need to be implemented before additional bailout funds are unlocked.

---Equity Markets---

Filings:

Offerings:

Pricings:

Shares of PCLN are trading approx 4% higher in reaction to earnings.

Investors display a modicum of caution this morning ahead of President Trump's first address to Congress, which will take place tonight at 9:00 pm ET. The S&P 500 futures point to a lower open on Wall Street as they trade three points below fair value.

Target (TGT 58.40, -8.59) has dominated the corporate headlines this morning following the company's worse than expected earnings results and guidance that was well below expectations. TGT shares are down 12.7% in pre-market trade.

The Treasury market holds a modest gain this morning but trades solidly in the red for the week following big losses on Monday. The benchmark 10-yr yield is one basis point lower at 2.36%.

Crude oil dove even deeper into negative territory in recent action after holding only a modest loss throughout the overnight session. The energy component currently trades 1.1% lower at $53.44/bbl.

Released earlier this morning, the second reading of fourth quarter GDP pointed to an expansion of 1.9%, while the Briefing.com consensus expected a reading of 2.1%. The second estimate of fourth quarter GDP Deflator came in at 2.0%, while the Briefing.com consensus expected a reading of 2.1%.

Separately, the Advance report for International Trade in Goods for January showed a deficit of $69.2 billion, up from a revised deficit of $64.4 billion for December (from $65.0 billion). The Advance report for January Wholesale Inventories decreased 0.1%. The prior month's reading was revised to 0.9% from 1.0%.

Tuesday will also see February Chicago PMI (Briefing.com consensus 53.0%) at 9:45 ET and February Consumer Confidence (Briefing.com consensus 111.5) at 10:00 ET.

Additionally, there will be several Fed speakers on Tuesday, including Kansas City Fed President George at 12:45 ET, San Francisco Fed President Williams at 15:30 ET, and St. Louis Fed President Bullard at 18:30 ET. None of today's Fed speakers are voting members on this year's FOMC.

— Shares of THC -12% pre-market.

The S&P 500 opened Tuesday's session with a modest loss of 0.2%.

A few sectors trade just above their flat lines while the majority hold modest losses between 0.1% and 0.4%. Financials (-0.4%) have shown relative weakness while materials (+0.2%) and utilities (+0.2%) have demonstrated relative strength.

Just reported, Chicago PMI for February increased to 57.4 from 50.3 in January while the Briefing.com consensus expected a reading of 53.0.

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.44%. Within the SOX index, CY (+2.82%) outperforms, while IDTI (-1.59%) lags. Among other major indices, the SPY is trading 0.15% lower, while the QQQ -0.11% and the NASDAQ -0.03% also trade with modest losses thus far on the session. Among tech bellwethers, IBM (+0.52%) is showing relative strength, while NVDA (-1.02%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning: