SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Индекс деловой активности.

- 21 февраля 2017, 16:27

- |

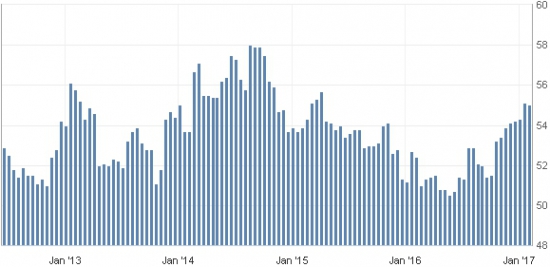

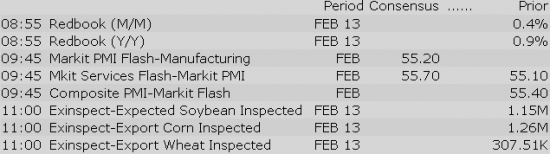

Индекс деловой активности продолжает рост, новое значение ожидается на отметке 55.2:

В обед в 12:00 и за полчаса до закрытия рынка в 15:30 ожидаются речи Харкера и Уильямса, представителей ФРС, которые могут задать движение на рынке.

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

56

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Gapping down: DRYS -21.7%, MNTA -10.5%, UL -8.4%, UN -8.2%, HSBC -6.3%, TRVN -6%, CYOU -4.2%, SOHU -3.2%, FCX -3.1%, AG -2.8%, SNY -2.3%, GFI -2.1%, HMY -1.8%, ASML -1.7%, SAN -1.6%, ING -1.4%, NVS -1.3%

Major European indices trade mostly higher while the UK's FTSE (-0.1%) has been held back by shares of HSBC after the banking giant reported disappointing results. The euro (1.0535) and the pound (1.2407) show respective losses of 0.7% and 0.4% against the greenback, having retreated after Philadelphia Fed President and FOMC voter Patrick Harker said that a March rate hike is not off the table.

---Equity Markets---

Upgrades:

Downgrades:

Miscellaneous:

Treasuries Slide to Begin Short Week

Equity futures point to a higher open following the extended Presidents' Day weekend. The S&P 500 futures trade four points above fair value.

U.S. Treasuries are under pressure this morning ahead of comments from Minneapolis Fed President Neel Kashkari (FOMC voter), Philadelphia Fed President Patrick Harker (FOMC voter), and San Francisco Fed President John Williams (non-FOMC voter). The benchmark 10-yr yield is four basis points higher at 2.45%.

Crude oil has jumped 1.7% as strong OPEC supply cut compliance has overshadowed record high U.S. inventories. The energy component trades at $54.71/bbl.

Investors will not receive any economic data on Tuesday.

In U.S. corporate news:

Reviewing overnight developments:

B. Riley Financial, Inc. (RILY) has signed a stock for stock merger agreement to acquire FBR & Co. in a transaction valued at $160.1 million based on Friday's closing price of $17.55 for B. Riley Financial's common shares and an anticipated payment of a cash dividend before closing of $8.50 per share.

Additionally, based on preliminary unaudited information, B. Riley Financial expects to report revenue for the fourth quarter of 2016 in the range of $92 million to $94 million, net income for the fourth quarter of 2016 in the range of $12.3 million to $12.8 million, and adjusted EBITDA for the fourth quarter of 2016 in the range of $24.5 million to $25.5 million.

The S&P 500 futures trade four points above fair value.

Retailers have been well represented on the earnings front this morning with Wal-Mart (WMT 71.30, +1.93), Home Depot (HD 145.90, +2.90), Macy's (M 33.10, +0.80), and Advanced Auto Parts (AAP 163.88, +2.30) reporting their quarterly results before today's opening bell.

Wal-Mart has jumped 3.1% in pre-market trade after beating earnings estimates and raising its dividend, while AAP shares have increased 1.3% as the company's better than expected revenues have overshadowed its earnings miss.

Home Depot is also up, adding 1.9%, after reporting better than expected top and bottom lines in addition to increasing its quarterly dividend. The company also authorized a $15.0 billion share repurchase program.

Macy's held a solid gain ahead of its earnings release but shares have seen some volatility after the company reported mixed results. The company beat earnings estimates but missed on the top line and issued downbeat guidance. Macy's shares are currently higher by 2.8%.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher: CLF +2.9%, AKS +2.5%, X +1.5%, MT +1.3%, HBM +1.2%, AUY +0.8%, .

Other news:

Analyst comments:

«The Glatopa 40 mg ANDA remains under regulatory review. The Company believes the application review could be completed at any time. However, under FDA policy, an approval of the application is dependent on the satisfactory resolution of the compliance observations at the Pfizer facility used to make the final product, and Momenta expects that an approval in the first quarter of 2017 is unlikely. Momenta is working with its collaboration partner Sandoz to resolve this matter in order to allow for an ANDA approval as soon as possible.»

The S&P 500 futures trade four points (0.2%) above fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mostly higher note while Hong Kong's Hang Seng (-0.8%) underperformed after HSBC reported disappointing earnings. The People's Bank of China said it is evaluating a targeted RRR cut later this month. Separately, the Chinese press reported that a third set of free trade zones may be opened before the end of February.

---Equity Markets---

Major European indices trade mostly higher while the UK's FTSE (-0.3%) has been held back by shares of HSBC after the banking giant reported disappointing results. The euro (1.0535) and the pound (1.2420) show respective losses of 0.7% and 0.3% against the greenback, having retreated after Philadelphia Fed President and FOMC voter Patrick Harker said that a March rate hike is not off the table.

---Equity Markets---

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

European Yields Jump on Strong PMI Data

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher: CLF +2.9%, AKS +2.5%, X +1.5%, MT +1.3%, HBM +1.2%, AUY +0.8%, .

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Equity futures point to a higher open on Wall Street as the S&P 500 futures trade five points (0.2%) above fair value.

U.S. Treasuries hold losses on Tuesday morning amid a speech from Minneapolis Fed President Kashkari (FOMC voter) and ahead of comments from Philadelphia Fed President Harker (FOMC voter). San Francisco Fed President Williams is also scheduled to speak on Tuesday, but his comments hold less weight given that he is not a voting member on this year's FOMC.

Also of note, the U.S. Dollar Index (101.51, +0.59) holds a solid 0.6% gain this morning as the greenback is up 0.7% and 0.5%, respectively, against the euro (1.0536) and the Japanese yen (113.68). The pound (1.0535) also trades lower against the U.S. dollar, down 0.3%.

Retailers have dominated the earnings front this morning with several large-cap names reporting their quarterly results. The reactions have been favorable so far with Wal-Mart (WMT 71.86, +2.49) adding 3.6% in pre-market trade after beating earnings estimates and raising its dividend.

Investors will not receive any notable economic data on Tuesday.

Crude futures for April delivery were up about $1.17 (+2.2%) around the $54.95/barrel level on the heels of last week's headlines that OPEC was considering deeper production cuts & may extend the coordinated output reduction effort with non-OPEC producers at the next official OPEC meeting, scheduled to take place in Vienna, Austria on May 25th. This latest rally brings crude near the top of its trading range (roughly between $50-55/barrel) so far in 2017. Other factors providing a boost to oil prices this morning include:

The S&P 500 opened Tuesday's session with a modest gain of 0.3%.

Energy (+0.6%) has shown relative strength in early action amid a 1.8% jump in crude oil, which currently trades at $54.79/bbl. The heavily-weighted financial sector (+0.5%) has also outperformed the broader market thus far.

On the flip side, the rate-sensitive utilities sector (-0.3%) trades in the red as selling pressure in the Treasury market has pushed interest rates higher. The benchmark 10-yr yield is up four basis points at 2.45%.

Upcoming Fed/Treasury Events:

Other International Events of Interest

Co states, " For 2017, we have more than doubled our drilling budget at the GMC, to 34,500 metres, and will continue our efforts to expand and further define the resource base at the Guanajuato and San Ignacio Mines, and the outlying El Horcon Project."

The tech sector — XLK — trades modestly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +1.19%. Within the SOX index, AMD (+4.22%) outperforms, while ASML (-0.71%) lags. Among other major indices, the SPY is trading 0.55% higher, while the QQQ +0.43% and the NASDAQ +0.18% trade modestly higher on the session. Among tech bellwethers, NVDA (+2.36%) is showing relative strength, while NTES (-1.54%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.71… VIX: (11.64, +0.15, +1.3%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The Energy Sector (XLE, +1.1%) leads the broader market (SPY, +0.5%) to fresh highs in early afternoon trading. Crude oil (USO, +2.1%) futures see a notable extension rally after closing modestly higher on Friday. This latest rally comes on the heels of last week's headlines regarding OPEC possibly extending or engaging in deeper oil production cuts. Other factors boosting oil prices are highlighted below. Lastly, natural gas (UNG, -6.3%) futures plummet to their lowest level in 3-months on updated warmer weather forecasts across much of the US as the winter season comes to an end.

Color on price action in oil:

Other factors providing a boost to oil prices this morning include:

Upcoming data reminders (as a result of Monday's holiday):

Notable gainers:

Notable laggards:

In current trade:

Earnings/News

Broker Calls

Rumor Activity was slow to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

- Eyegate Pharma (EYEG +54.08%) enters into exclusive, worldwide licensing agreement with Valeant Pharmaceuticals (VRX)

- Delcath (DCTH +40.89%) announces a study demonstrated that 45.7% of patients with ocular melanoma that metastasized to the liver who underwent percutaneous hepatic perfusion using investigational Melphalan/HDS experienced a complete or partial response

- Cellect Biotech (APOP +14.75%) announces 'positive' final results from its clinical trial of ApoGraft in healthy donors

Decliners on news:- Cidara Therapeutics (CDTX -39.32%) reports that the Phase 2 RADIANT clinical trial in acute vulvovaginal candidiasi did not show sufficient efficacy to justify further development

- Trevana (TRVN -33.94%) announces its Phase 3 APOLLO-1 and APOLLO-2 pivotal efficacy studies of oliceridine in moderate-to-severe acute pain following bunionectomy and abdominoplasty both achieved their primary endpoints

- Amphastar Pharma (AMPH -16.79%) receives a CRL for its NDA for for Naloxone Hydrochloride 2mg/0.5mL Nasal Spray; CRL identifies issues including user human factors study, device evaluation, and other items that need to be addressed before the NDA can be approved

Gainers on earnings:- Community Health (CYH +26.16%) beats by $0.27, beats on revs; sees FY17 EPS in-line with consensus

- EXACT Sciences (EXAS +12.46%) beats by $0.06, reports revs in-line; guides FY17 revs above consensus

- Henry Schien (HSIC +2.96%) beats by $0.04, beats on revs; reaffirms FY17 EPS guidance

Decliners on earnings:- Momenta Pharma (MNTA -15.92%) beats by $0.82, beats on revs; provides expense guidance

- Albany Molecular (AMRI -15.58%) misses by $0.14, misses on revs; guides FY17 EPS below consensus, revs below consensus

- Ardelyx (ARDX -3.07%) reports Q4 GAAP EPS ($0.66) vs ($0.65) Cap IQ consensus and details plans to initiate second phase 3 trial mid-year 2017

Upgrades/Downgrades:Stocks that traded to 52 week lows: ALQA, AXSM, CDTX, DRRX, DRWI, ENT, GALE, GBSN, GEC, GEVO, GPOR, ICLD, KONA, LN, NAO, NCMI, PMF, RTK, SABR, SAEX, SITO, SQQQ, ULTRQ, VLRS, VLTC, VMEMQ, WMIH

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AKTX, CGG, HSON, JASN, VISN

ETFs that traded to 52 week highs: DIA, DVY, EEB, EIS, EPOL, EWJ, FDN, IGN, IGV, IHI, IOO, ITA, IWF, IWM, IYF, IYG, IYJ, IYK, IYM, JNK, KCE, KIE, KRE, MDY, OEF, PHO, PIN, PPA, QQQ, REMX, SDY, SKYY, SMH, SOXX, SPY, UWM, UYG, VTI, XBI, XLF, XLI, XLK, XLY

ETFs that traded to 52 week lows: SMN

Today's top 20 % gainers

- Healthcare: CYH (8.7 +26.12%), EXAS (22.36 +12.32%)

- Materials: TROX (17.76 +23.15%), KRO (15.46 +8.57%)

- Industrials: SBLK (9.49 +14.89%), GNK (11.1 +12.46%), RBA (34.77 +12.27%), GOGL (6.46 +10.14%), SALT (7.73 +9.57%)

- Consumer Discretionary: LL (18.53 +20.64%), PLKI (78.82 +19.21%), GNC (8.63 +12.96%), SAH (25.95 +9.26%)

- Information Technology: SOHU (42.94 +9.11%), CYOU (27.24 +8.7%), SPWR (8.57 +8.61%)

- Financials: OCN (5.69 +8.59%)

- Energy: HLX (8.41 +13.5%), SDRL (2.15 +10.82%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: CYH (14.33 mln +26.12%), TEVA (13.89 mln +3.12%)

- Materials: FCX (31.42 mln -5.3%), VALE (17.26 mln +4.24%), AUY (11.95 mln -2.91%), NAK (9.13 mln -9.29%), X (8.71 mln +2.8%), AKS (8.57 mln +2.26%)

- Consumer Discretionary: F (10.87 mln +0.5%), VIPS (10.76 mln +6.62%), M (9.31 mln +1.24%)

- Information Technology: AMD (24.87 mln +4.57%), AAPL (9.5 mln +0.55%), MU (8.94 mln +1.61%)

- Financials: BAC (30.69 mln +0.79%)

- Energy: CHK (16.86 mln -0.74%), SDRL (10.34 mln +10.82%), PBR (8.16 mln +1.95%), WLL (7.9 mln +3.83%)

- Consumer Staples: WMT (12.06 mln +2.91%)

Today's top relative volume (current volume to 1-month average daily volume)Biggest point losers: CBRL 161.92(-6.78), TSRO 185.39(-4.98), WAB 82.94(-4.83), UN 44.89(-3.9), UL 44.67(-3.86), AGIO 50.24(-3.85), NTES 293.44(-3.81), KHC 93.51(-3.14), MNTA 15.93(-3.08), AMPH 15.41(-3), AMRI 15.91(-2.7), PI 28.62(-2.55), HSBC 41.51(-2.4), GPC 98.46(-2.21), IBB 292.19(-2.16), BIIB 286.84(-2.1), CLVS 63.82(-1.98), ATHN 117.24(-1.73), BLUE 75.5(-1.6), DXCM 80.31(-1.58), YY 46.52(-1.53), MAR 87.89(-1.47), DDS 56.93(-1.46), CELG 119.7(-1.46), SPH 25.98(-1.42)

Treasury Auction Preview

The Industrials sector (XLI) is trading 0.3% higher today, lower than the broader market (SPY +0.5%). In a slow day for the Industrial Sector, American Electric Technologies (AETI +5.4%) receives $6 mln of contracts to provide turnkey power delivery solutions for a North American provider of midstream energy services.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: PWR +3.5% RBA +12.6% TREX +6.7% FELE +7.1% MDR +0.3% XXIA +0.1% ASTE -0.6% GMS +0.2% PGTI -3.7%

News

Broker Research

Upgrades

Downgrades

Other

The broader market begins the week on a high note, led to the upside thus far by the S&P 500 which gains about 10 points (+0.42%) to 2361, the Dow Jones Industrial Average adds 83 (+0.40%) to 20707, and the Nasdaq Composite is up about 13 (+0.22%) to 5851. Action has come on higher than average volume (NYSE 337 vs. avg. of 316; NASDAQ 850 mln vs. avg. of 786), with advancers outpacing decliners (NYSE 1987/998, NASDAQ 1526/1268) and new highs outpacing new lows (NYSE 241/9, NASDAQ 297/23).

Relative Strength:

Poland-EPOL +2.5%, Copper Miners-COPX +2.2%, Clean Energy-PBW +2.2%, Rare Earth Metals-REMX +2.1%, Coal-KOL +2.0%, US Oil-USO +1.9%, Coffee-JO +1.9%, Steel-SLX +1.9%, Greece-GREK +1.7%, India-INP +1.7%, Emrg. Mkts. M. East&Africa-GAF +1.6%, Brazil-EWZ +1.6%, S. Korea-EWY +1.5%, Latin Am. 40-ILF +1.5%.

Relative Weakness:

US Nat Gas-UNG -7.4%, Netherlands-EWN -1.4%, Thailand-THD -1.0%, Colombia-GXG -0.9%, Saudi Arabia-KSA -0.8%, Cocoa-NIB -0.8%, Gold Miners-GDX -0.7%, Biotech-IBB -0.6%, Swiss Franc-FXF -0.6%, Platinum-PPLT -0.6%, Japanese Yen-FXY -0.5%, Silver Miners-SIL -0.5%, Austria-EWO -0.4%, Grains-JJG -0.4%.

Notable earnings/guidance:

- Trading higher following earnings/guidance: LL +15.8%, SNI +7.3%, MDLZ 4.7% (Mondelez Int'l highlights Consumer Analyst Group of New York presentation, reaffirms FY17 outlook), FDP +4%, WMT +3.3%, SEAS 2.8% (SeaWorld Entertainment expects FY16 total revs of $1.344 bln vs $1.345 bln consensus), GPC -3.8% (Genuine Parts increases quarterly dividend to $0.675/share from $0.66/share), AAP +0.5%, M +0.4%

- Trading lower following earnings/guidance: DDS -5.6%, CBRL -4.1%, GPC -3.9%

In the news:Looking ahead:

The major averages climbed to fresh record highs following Tuesday's opening bell, but squandered a portion of their early gains ahead of comments from Philadelphia Fed President Patrick Harker (FOMC voter). The S&P 500 and the Dow are both up near 0.5%, while the Nasdaq (+0.3%) lags at midday.

Mr. Harker didn't provide any new information during his speech today, reiterating his belief that three rate hikes are appropriate for 2017. Still, the event prompted investors to displayed caution in light of Mr. Harker's statements over the weekend, in which he expressed that a March rate hike is on the table.

U.S. Treasuries displayed losses in the early going, but they are now just below their flat lines. Mr. Harker's hawkish tone has been largely offset by dovish comments from Minneapolis Fed President Neel Kashkari (FOMC voter). Mr. Kashkari stated that the U.S. labor market has «more room to run,» suggesting that he believes there is no hurry for the Fed to raise rates. The benchmark 10-yr yield remains unchanged at 2.42% after showing a four basis point gain this morning.

Through all the noise, the fed funds futures market continues pointing to June as the most likely time for the next hike to be announced with an implied probability of 70.9%. The implied probability of a March rate hike did tick up slightly, to 22.1% from Friday's 17.7%.

All eleven sectors trade in the green early this afternoon with energy (+0.9%) leading the advance. The space has profited from a 1.5% rally in crude oil, which comes on the heels of last week's headlines regarding OPEC possibly extending oil production cuts or engaging in deeper ones. The news has overshadowed an increase in U.S. inventories, which hover near record highs.

Earnings news has been highlighted by retailers, which have pushed the SPDR S&P 500 Retail ETF (XRT 44.13, +0.31) higher by 0.7%. Wal-Mart (WMT 71.60, +2.23) has been the biggest post-earnings gainer, adding 3.2%, after the company beat earnings per share estimates and raised its dividend.

The consumer staples sector has responded to Wal-Mart's upbeat earnings report with a 0.7% gain. The remaining sectors show gains between 0.2% (materials) and 0.7% (real estate).

Investors did not receive any economic data on Tuesday.

Treasury Auction Results

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.81… VIX: (11.70, +0.21, +1.8%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

— The dollar index was +0.5% around the 101.40 level.

ETF Weekly Gainers of note:

ETF Weekly Losers of note:

First Solar (FSLR) is set to report Q4 results tonight after the close with a conference call to follow at 4:30pm ET. FSLR will report shortly after the bell. Current Capital IQ consensus stands at EPS of $0.98 on Revenue of $394 mln.

It has been a difficult year for the solar industry. There are two fronts that are squeezing the industry: 1) An over slow down in demand due to a draw back of some feed in tariffs and uncertainty around future government policies and 2) the miss steps in capacity growth that provided a glut of modules which would flood the market. FSLR was particularly hurt by the glut as its biggest advantage in the industry, low cost thin film modules, were under pressure by a slew of promotional sales by PV module providers in order to work down the capacity glut. How this continues to impact FSLR in 2017 will be key. The impact will be reflected in the company's guidance which will make 2017 projections and commentary key drivers.

There are some tailwinds in FSLR's favor. The company was early in recognizing the issues facing the industry and began taking steps in the middle of 2016 to combat the issue. It accepted the decline in demand as it would not chase cheap deals in order to preserve margins. It also announced that it would be pressing forward with its Line 6 production, evolving from its Line 4 and basically by-passing the Line 5 all together. FSLR viewed the move as prudent as it felt it could take advantage of the lull in demand and get Line 6 up and running. This will bring about an improved gross margin but it could also prolong the slump for FSLR as Line 6 is not expected to be up and running until mid-2018. If the co is able to convince investors that this is running on (or ahead) of target this could help offset low 2017 expectations.

Solar as a whole has been looking better as market participants look at some of the low pricing around the group. SPWR and SEDG have both posted mediocre reports but the idea that there is light at the end of the tunnel has led some people back into the names. FSLR has seen its share price rally approx 13% over the past week ahead of tonight's report. It has broken above itss 100-sma (34.64) and is attempting to break back towards $40. It faces plenty of headline risk today but a surprise showing could share a few more shorts out and lead to some additional investments.

2017 Guidance

Comments on ASPs (From 11/2)

FY16 Results