SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Запасы нефти и газа.

- 08 февраля 2017, 16:12

- |

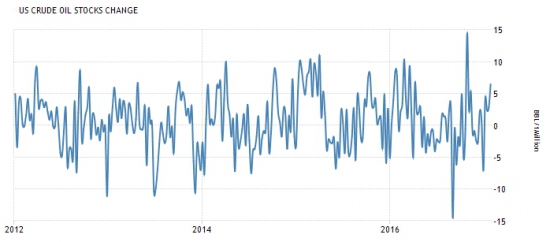

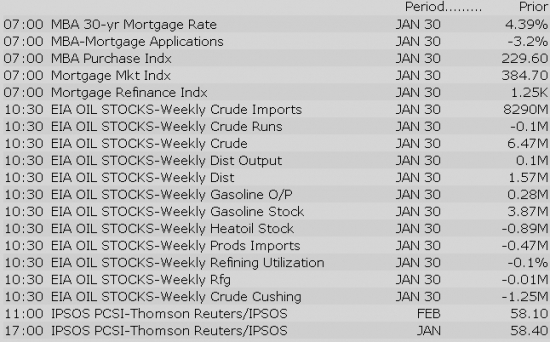

Запасы нефти и газа на складах увеличиваются уже несколько недель. В этом месяце аналитики ожидают значительное снижение темпов прироста в запасах нефти, практически к нулю:

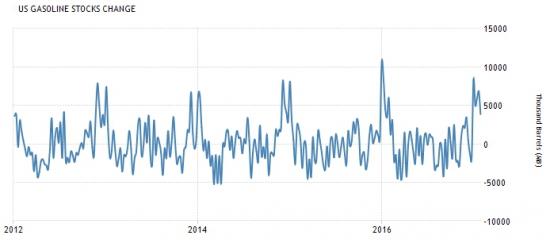

В запасах газа темпы прироста ожидаются прежние, с небольшим увеличением до 420.1 тыс. баррелей:

Пятилетняя картина показывает, что оба показателя находятся на своих максимальных значениях. В связи с этим ожидается смена тенденций ближайшие несколько недель и перевод хранилищ в режим распределения накопленных запасов основных энергоносителей:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

30

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

The global equity markets are trading slightly higher this morning. S&P Futures have skirted the flat-line for majority of the night.

Market updates:

US Econ Data

Robert W. Baird upgraded THO to Outperform from Neutral and raises their tgt to $120 from $105. Now seven years into a remarkable RV cycle, firm still sees an opportunity for investors to get ahead of a strong RV season. They like Thor as the RV market leader with a heavy investment in American workers and consumers. Although an inventory de-stocking cycle will mark the end of the trade, firm's checks suggest dealers are optimistic and willing to restock. They see LT upside to margin and like the chances that tax reform will boost consumer demand and corporate profits.

Equity indices in the Asia-Pacific region ended the midweek session on a higher note. The People's Bank of China lowered the yuan fix to a two-week low of 6.8849 and decided to forego reverse repurchase operations for the fourth consecutive day. China Information Daily commented on monetary policy, saying the PBoC has no conditions for a rate hike and will remain flexible instead. Separately, the Reserve Bank of India kept its repurchase rate at 6.25% despite calls for a 25-basis point cut.

---Equity Markets---

---FX---

Stocks with favorable mention: AMGN, BCS, CHKP, CNC, CSCO, CYBR, FI, HAS, JBL, MB, NYCB, ORCL, PANW, SAN, UNH

Stocks with unfavorable mention: BWLD, ESRX, FTNT, HBI, KORS, NWL, SHLD, TGT, UPS

Major European indices trade near their flat lines while France's CAC (+0.5%) outperforms. Bank stocks have shown relative weakness across the region while energy names also trade in the red amid a decline in crude oil. The euro (1.0650) is down 0.3% against the dollar while the pound (1.2492) has shed 0.1% versus the greenback.

---Equity Markets---

Gapping down: USNA -20.7%, GALE -17.9%, DCIX -15.7%, TDW -14.1%, SPSC -13.3%, TCX -10.6%, CHRS -10.1%, EYES -7.6%, GMLP -7.1%, DRYS -6.8%, WAIR -6.7%, ZG -6.5%, GILD -6.1%, PE -5.8%, PAA -5.6%, CG -5.5%, PVG -5%, BWLD -4.6%, ULTI -4.5%, FXCM -4.3%, AMC -3.7%, AKAM -3.7%, URBN -2.9%, AWRE -2.7%, ABB -2.6%, NE -2.1%, AI -2.1%, MDLZ -1.9%, CS -1.7%, SAN -1.5%, SHPG -1.5%, RDS.A -1.4%, BBVA -1.4%, GSK -1.4%, TTWO -1.3%, LPX -1.3%, NEWR -1.2%, RIG -1.1%, CHK -1%, DB -0.9%, HSBC -0.8%, PBR -0.7%, NTGR -0.7%, AZN -0.6%, AIZ -0.5%, PXD -0.5%

Upgrades:

Downgrades:

Miscellaneous:

Treasuries Rally as Oil Drops and Dollar Strengthens

Equity futures are flat this morning following a generally positive performance overseas. The S&P 500 futures currently trade three points below fair value.

U.S. Treasuries are in positive territory this morning, extending yesterday's gains. The benchmark 10-yr yield is two basis points lower at 2.37%.

Conversely, crude oil has continued Tuesday's downward trend. The energy component is currently down 0.8% at $51.73/bbl amid reports that indicate an uptick in U.S. production and a slump in Chinese demand.

The weekly MBA Mortgage Index, which was released earlier this morning, increased 2.3% to follow last week's 3.2% decline.

Investors will not receive any other economic data on Wednesday.

In U.S. corporate news:

Reviewing overnight developments:

Shares of Disney are trading flat in the pre-market

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

The stock market is on track to open Wednesday's session slightly lower as the S&P 500 futures trade two points below fair value.

A handful of household names reported earnings results between yesterday's close and today's open, including Walt Disney (DIS 108.95, -0.05), Zillow (ZG 34.52, -2.35), Panera Bread (PNRA 219.90, +5.63), Buffalo Wild Wings (BWLD 144.00, -5.80), Goodyear Tire & Rubber (GT 32.24, 0.00), and Time Warner (TWX 97.20, +0.98), among others.

Panera Bread and Time Warner are up 2.6% and 1.0%, respectively, after PNRA reporting better than expected earnings and TWX beat top and bottom line estimates.

On the other hand, Zillow also had a positive earnings report, beating revenue and earnings estimate, but its shares have slid 6.4% regardless. Buffalo Wild Wings is also lower, losing 3.9%, after missing top and bottom line estimates and issuing downbeat guidance.

Lastly, Walt Disney and Goodyear currently trade flat in pre-market action after the companies' better than expected earnings have been balanced by their worse than expected revenues.

European Government Bonds Jump

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select EU financial related names showing weakness:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select EU financial related names showing weakness:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade four points below fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a higher note. The People's Bank of China lowered the yuan fix to a two-week low of 6.8849 and decided to forego reverse repurchase operations for the fourth consecutive day. China Information Daily commented on monetary policy, saying the PBoC has no conditions for a rate hike and will remain flexible instead. Separately, the Reserve Bank of India kept its repurchase rate at 6.25% despite calls for a 25-basis point cut.

---Equity Markets---

Major European indices hold modest losses while France's CAC (+0.2%) outperforms. Bank stocks have shown relative weakness across the region while energy names also trade in the red amid a decline in crude oil. The euro (1.0671) is down 0.1% against the dollar while the pound (1.2510) is flat versus the greenback.

---Equity Markets---

Filings:

Offerings:

Pricings:

Upcoming IPOs:

The S&P 500 futures currently trade four points below fair value, indicating a modestly lower open for Wednesday's session.

Earnings reports have been the focal point this morning with a ream of names reporting between yesterday's close and today's open. Gilead Sciences (GILD 67.98, -5.15) has been one of the most notable movers in pre-market action, dropping 7.0%, after downbeat guidance overshadowed the company's better than expected earnings results. Goodyear Tire & Rubber (GT 31.34, -0.90) has also slipped, losing 2.8%, in reaction to worse than expected revenues.

On the flip side, Alaska Air (ALK 96.30, +2.20) has pushed 2.3% higher in pre-market trade after beating top and bottom line estimates in addition to raising its dividend. Similarly, Allergan (AGN 237.50, +4.89) and Time Warner (TWX 97.05, +0.83) have seen a nice bump, adding 2.2% and 0.9%, respectively, on the companies' better than expected earnings and revenues.

U.S. Treasuries hold solid gains this morning, continuing Tuesday's positive momentum. The benchmark 10-yr yield is lower by three basis points at 2.36%.

The weekly MBA Mortgage Index, which was released earlier this morning, increased 2.3% to follow last week's 3.2% decline. The report is the only item on today's economic calendar.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The S&P 500 opened Wednesday's session with a modest 0.2% loss as six of its eleven sectors trade in the red.

Countercyclical groups have the upper hand in early action with consumer staples, utilities, telecom services, and real estate holding gains between 0.2% and 0.4%. However, the largest defensive space by weight, health care (-0.6%), trades lower after Gilead Sciences (GILD 66.07, -7.00) issued negative guidance following yesterday's close.

On the cyclical side, five of the six spaces trade lower with energy (-1.0%) leading the retreat. The consumer discretionary sector (+0.2%) bucks the bearish trend with Walt Disney (DIS 110.69, +1.87) up 1.6% after the company's better than expected earnings per share results have overshadowed a miss on revenues.

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.14… VIX: (11.82, +0.53, +4.7%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.07%. Within the SOX index, SIMO (+4.85%) outperforms, while NVDA (-1.85%) lags. Among other major indices, the SPY is trading 0.10% lower, while the QQQ -0.02% and the NASDAQ -0.16% trade modestly lower on the session. Among tech bellwethers, VOD (+1.72%) is showing relative strength, while QCOM (-0.71%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Notable earnings/guidance:

- Trading higher following earnings/guidance: CSTE +12.8%, PNRA +5.9%, PIR 5.7% (reiterates Q4 guidance), CTRN 3.7% (reports Q4 revs of $185.5 mln vs $186.70 mln two analyst estimate; comps +3.4%), BWLD +3%, MDLZ +2.8%, ORLY +1.3%, URBN 0.9% (reports prelim Q4 sales of $1.03 bln vs. $1.05 bln Capital IQ Consensus Estimate), DIS +0.7%

- Trading lower following earnings/guidance: GRUB -7.5%, TCS -7.9%

- Near unchanged mark following earnings/guidance: TWX

In the news:- Leaders: CMG 2.2% (Pershing Square affirms unchanged active stake- discloses entry into registration rights agreement with the company pursuant to December 14 Letter Agreement), KORS 2.6% (rebounding — held support at the 36 level after missing sales estimates and cutting guidance yesterday morning: Analyst Color), DPS 0.5% (initiated with a Outperform at Credit Suisse), LOW +0.4% (Caesarstone announces collaboration with Lowe's)

- Laggards: AMC -4.9% (commences an underwritten public offering of the Co's common stock for the amount of $500.0 million), FOXA -1.4% (Fox Television Stations says anticipates receiving approximately $350 mln in proceeds resulting from the FCC's recently completed reverse auction for broadcast spectrum)

- Nearly unchanged: JWN (cautious commentary from Cleveland Research regarding Q4 SSS)

- M&A related: MDP -1.2% and TIME 0.8% (Meredith and group of investors might move ahead with acquisition of TIME, according to WSJ)

Other notable trends:Looking ahead:

Production: U.S. crude oil refinery inputs avgd 15.9 mln barrels per day during the week ending February 3, 2017, 54,000 barrels per day less than the previous week's avg. Refineries operated at 87.7% of their operable capacity last week. Gasoline production increased last week, averaging 9.8 mln barrels per day. Distillate fuel production increased last week, averaging 4.8 mln barrels per day.

Imports: U.S. crude oil imports avgd about 9.4 mln barrels per day last week, up by 1.1 mln barrels per day from the previous week. Over the last four weeks, crude oil imports avgd about 8.5 mln barrels per day, 10.0% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week avgd 811,000 barrels per day. Distillate fuel imports avgd 209,000 barrels per day last week.

Inventory: U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 13.8 mln barrels from the previous week. At 508.6 mln barrels, U.S. crude oil inventories are above the upper limit of the avg range for this time of year. Total motor gasoline inventories decreased by 0.9 mln barrels last week, but are above the upper limit of the avg range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories remained unchanged last week and are above the upper limit of the avg range for this time of year. Propane/propylene inventories fell 6.9 mln barrels last week but are in the middle of the avg range. Total commercial petroleum inventories increased by 1.4 mln barrels last week.

Demand: Total products supplied over the last four-week period avgd about 19.9 mln barrels per day, up by 0.3% from the same period last year. Over the last four weeks, motor gasoline product supplied avgd over 8.3 mln barrels per day, down by 6.0% from the same period last year. Distillate fuel product supplied avgd about 3.9 mln barrels per day over the last four weeks, up by 7.6% from the same period last year. Jet fuel product supplied is up 6.4% compared to the same four-week period last year.

Today's top 20 % gainers

- Healthcare: FMI (24.56 +12.12%), MYGN (17.08 +10.91%), PBYI (36.9 +9.01%), GBT (17.88 +6.4%)

- Materials: NGD (3.03 +7.07%), SSRI (12.14 +5.66%)

- Industrials: CSTE (33.8 +12.67%), BCO (48.15 +10.44%)

- Consumer Discretionary: PNRA (229.72 +7.21%)

- Information Technology: COHR (190.04 +17.79%), LITE (45.14 +12.29%), JIVE (4.39 +11.14%), SCSC (44.1 +9.98%), CALD (20.4 +8.22%), MCHP (74.91 +7.59%)MOMO (24.27 +6.59%), MOBL (4.55 +5.81%)

- Financials: WD (35.72 +11.28%), CHI (10.82 +8.31%)

- Consumer Staples: UVV (79.6 +12.99%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: GILD (27.15 mln -9.28%)

- Materials: FCX (13.68 mln +0.99%), VALE (10.64 mln +1.19%), GPK (9.6 mln +1.38%)

- Industrials: GE (10.72 mln -0.85%)

- Information Technology: AMD (36.66 mln +3.23%), ZNGA (19.33 mln -3.11%), NUAN (18.32 mln +4.15%), TWTR (11.56 mln +0.55%), MU (9.16 mln -1.42%), FB (8.98 mln +1.67%), CTSH (8.89 mln +3.87%)

- Financials: BAC (48.08 mln -1.4%)

- Energy: PE (21.05 mln -7.29%), CHK (20.02 mln -0.16%), SDRL (10.32 mln +0.54%), ESV (9.98 mln -1.99%), PBR (8.57 mln -0.25%), WFT (8.14 mln +0.51%)

- Telecommunication Services: S (8.28 mln +3.66%)

Today's top relative volume (current volume to 1-month average daily volume)Biggest point losers: SPSC 54.00 -12.32, AKAM 62.53 -8.59, GILD 66.02 -7.11, ULTI 192.86 -6.70, AIZ 90.53 -6.48, USNA 56.35 -6.30, ORBK 30.05 -4.68, WCG 141.63 -4.41, NTGR 53.15 -4.20, LOGM 97.65 -3.45, CHRS 23.28 -3.38, ZG 34.38 -2.78, CME 116.08 -2.65, Z 34.26 -2.61, ICE 57.38 -2.55, PE 30.88 -2.45, IBB 280.24 -2.17, GS 237.54 -2.08, CSRA 30.47 -2.08, VMC 119.86 -1.94, WAIR 13.08 -1.93, WDC 77.22 -1.83, URI 124.50 -1.74, EVR 77.30 -1.60, GWR 72.18 -1.57

Treasury Auction Preview

Rumor Activity was active today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

The broader market is split at the moment, with only the Nasdaq Composite in the green, up now less than a point (+0.00%) to 5674, the Dow Jones Industrial Average for its part declines by 41 (-0.20%) to 20049, and the S&P 500 sheds less than one point (-0.03%) to 2292. Action has come on higher than average volume (NYSE 333 vs. avg. of 321; NASDAQ 895 mln vs. avg. of 771), with decliners outpacing advancers (NYSE 1410/1560, NASDAQ 964/1755) and new highs outpacing new lows (NYSE 57/22, NASDAQ 79/37).

Relative Strength:

US Gasoline-UGA +2.8%, Turkey-TUR +2.3%, Jr. Gold Miners-GDXJ +1.9%, Copper-JJC +1.7%, China Lg. Cap-FXI +1.5%, Silver Miners-SIL +1.5%, Base Metals-DBB +1.4%, Gold Miners-GDX +1.4%, Platinum-PPLT +1.2%, Hong Kong-EWJ +0.9%, Mexico-EWW +0.9%, Indian Rupee-ICN +0.8%, India-INP +0.8%, Emrg. Mkts.-EWX +0.8%.

Relative Weakness:

Greece-GREK -2.5%, Emrg. Mkts. M. East&Africa-GAF -2.2%, Shipping-SEA -1.9%, US Broker/Dealers-IAI -1.7%, Reg. Banking-KRE -1.6%, Banking-KBE -1.6%, US Fincl. Svcs.-IYG -1.2%, Colombia-GXG -1.0%, Infrastructure-GRID -0.9%, Oil Svcs.-OIH -0.9%, Russia-RSX -0.5%, Austria-EWO -0.5%, Spain-EWP -0.4%, S. Korea-EWY -0.3%.

The Industrials sector (XLI) is trading -0.2% lower today, lower than the broader market (SPY +0.0%). In the Industrial Sector, Southwest Air (LUV -0.9%) and Air France-KLM (AFLYY +4.3%) report January preliminary traffic.

Earnings/Guidance

Additional Industrials reporting earnings/guidance: VLVLY -1.6% AMKBY -4.1% OC -1.6% GWR -1.1% HCSG -0.1% BCO +9.9% ROLL -1.8% FLOW -3.3% ESE -7.1% WAIR -12.8% LABL -2.2% ARCB -2.9% KFRC +17.2% THR -2.7% POWL -8.6% SPA -1.9% OESX +0.00%

News

Broker Research

Upgrades

Other

The major averages have recouped some of their early losses to sit just below their flat lines at midday. The S&P 500 sits 0.1% lower, while the small-cap Russell 2000 (-0.7%) underperforms.

Countercyclical sectors have had the upper hand thus far, with consumer staples (+0.3%), utilities (+1.0%), telecom services (+0.4%), and real estate (+0.8%) all trading higher. On the other hand, health care (-0.4%) is holding a modest loss as biotech names weigh.

The iShares Nasdaq Biotechnology ETF (IBB 280.04, -2.37) is lower by 0.8% due in large part to a 9.9% plunge in the shares of Gilead Sciences (GILD 65.90, -7.22). The dive has taken place in reaction to the company's negative guidance for 2017, which has overshadowed better than expected results. However, a positive earnings report and above-consensus guidance from Allergan (AGN 236.50, +3.89) has mitigated some of the health care space's loss.

On the cyclical side, financials (-1.1%) sit at the bottom of the day's leaderboard, a space once occupied by the energy sector(-0.3%). Energy has moved up from its session low in tandem with an uptick in crude oil. The commodity held solid losses this morning but counter-intuitively jumped into positive territory after data from the Energy Information Administration (EIA) showed a huge 13.8 million barrel build in oil inventories. WTI crude currently trades 0.2% higher at $52.41/bbl.

Consumer discretionary (+0.4%) and technology (+0.1%) are the only cyclical spaces to buck the cautious tone. Consumer discretionary has seen a bump from the earnings front as large-cap names Walt Disney (DIS 109.61, +0.62), Time Warner (TWX 96.55, +0.32), and O'Reilly Automotive (ORLY 273.00, +10.78) reported quarterly results between yesterday's close and today's open.

ORLY has seen the biggest jump, adding 4.0%, after beating earnings estimates. Similarly, Walt Disney and Time Warner are up 0.6% and 0.4% after both companies beat earnings expectations. In addition, TWX reported better than expected revenues.

The Treasury market currently sits at its highest level of the day as the fed funds futures market has seen a decrease in the implied probability of a March rate hike. The implied probability has declined to 4.4% from yesterday's 8.9%. The benchmark 10-yr yield is lower by seven basis points at 2.33%.

Despite the downtick in odds for March, the fed funds futures market continues pointing to June (58.4%) as the most likely window for the next hike.

Today's lone economic report, the weekly MBA Mortgage Index, increased 2.3% to follow last week's 3.2% decline.

Investors will not receive any more economic data on Wednesday.

Treasury Auction Results

Today's top 20 % gainers

- Healthcare: FMI (24.56 +12.12%), MYGN (17.08 +10.91%), PBYI (36.9 +9.01%), GBT (17.88 +6.4%)

- Materials: NGD (3.03 +7.07%), SSRI (12.14 +5.66%)

- Industrials: CSTE (33.8 +12.67%), BCO (48.15 +10.44%)

- Consumer Discretionary: PNRA (229.72 +7.21%)

- Information Technology: COHR (190.04 +17.79%), LITE (45.14 +12.29%), JIVE (4.39 +11.14%), SCSC (44.1 +9.98%), CALD (20.4 +8.22%), MCHP (74.91 +7.59%)MOMO (24.27 +6.59%), MOBL (4.55 +5.81%)

- Financials: WD (35.72 +11.28%), CHI (10.82 +8.31%)

- Consumer Staples: UVV (79.6 +12.99%)

Today's top 20 % losers