SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Индекс стоимости рабочей силы и доверие потребителей.

- 31 января 2017, 17:02

- |

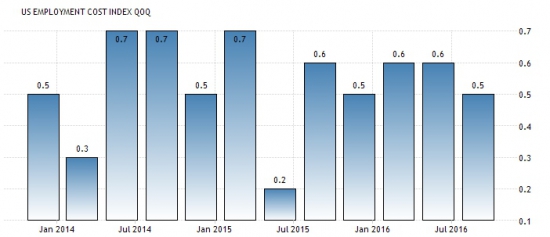

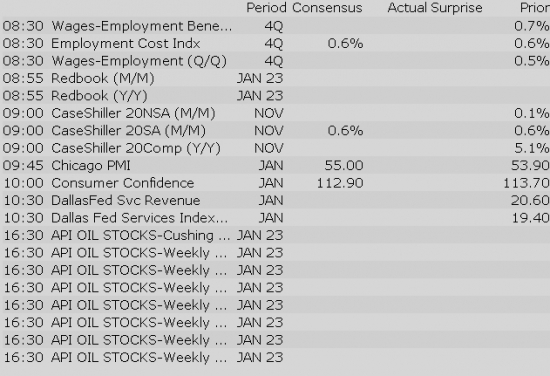

За четвертый квартал 2016-го года данные по индексу стоимости рабочей силы ожидаются аналитиками на отметке 0,6% без каких-либо сюрпризов:

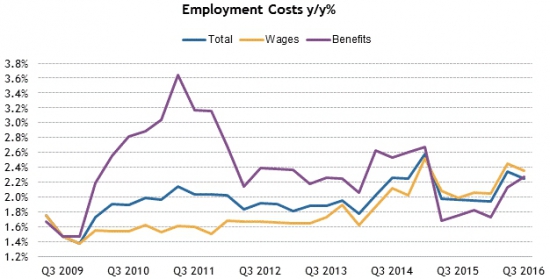

На общей картине стоимость рабочей силы планово повышается, колебания показателя затухают:

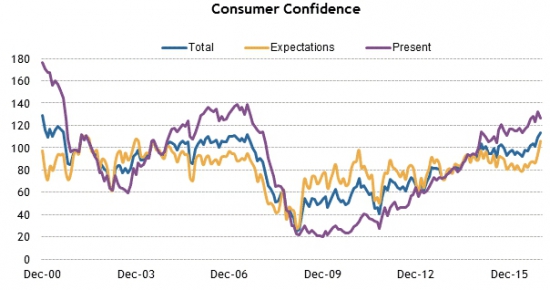

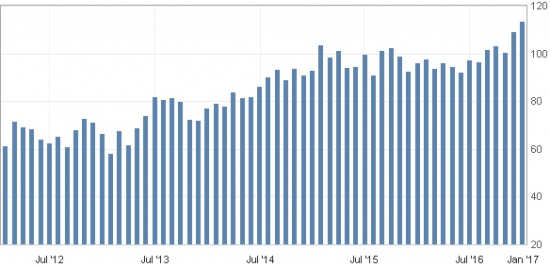

Индекс доверия потребителей находится на своих максимальных отметках:

В данных по последнему месяцу ожидается небольшая интрига, смогут ли они достигнуть максимальной отметки 114 или выйдут немногим меньше последнего показателя 113,7:

Оптимистичную картину дополняет ожидаемый на достаточно высоком уровне 55,5 чикагский индекс деловой активности:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

31

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Macro Related

Stock Specific

Upgrades:

Downgrades:

Miscellaneous:

Major European indices trade in the green, but gains have been limited so far. The UK's FTSE (+0.6%) trades ahead of other indices while the pound (1.2478) is down 0.1% against the dollar. For its part, the euro (1.0756) has picked up 0.6% against the greenback, hitting a session high after President Donald Trump's adviser Peter Navarro said the single currency is «grossly undervalued.» In France, the parliamentary office of presidential candidate Francois Fillon was raided as part of a probe into allegations that Mr. Fillon's wife received salary from state funds for performing phantom work.

---Equity Markets---

Gapping down: RRTS -25.5%, UAA -22.7%, SDRL -17.3%, SMLP -7.5%, IDTI -7%, TEVA -6.8%, RMBS -5.4%, GBX -4.6%, RIGL -3.8%, PULM -3.8%, FIT -2.6%, CGI -2.5%, NKE -2.5%, VFC -2.4%, ABC -2.4%, GLBL -2.3%, HOG -2.3%, XRX -2.2%, CNXC -2.1%, CNXC -2.1%, M -1.6%, FL -1.5%, TMHC -1.5%, FHB -1.3%, ANF -1%, CR -0.8%, VRAY -0.7%, PFE -0.7%

Euro Jumps as Trump Administration Calls it «Grossly Undervalued»

Upcoming IPOs:

Equity futures trade lower amid mixed trade overseas and after several notable earnings reports since yesterday's close. The S&P 500 futures currently trade seven points (0.3%) below fair value.

Crude oil sits just below its flat line as an increase in U.S. production has undermined the supply cut efforts of OPEC and non-OPEC producers. The commodity is down 0.2% at $52.53/bbl.

Conversely, U.S. Treasuries have seen an uptick in buying interest this morning after opening the week flat on Monday. The benchmark 10-yr yield is two basis points lower at 2.47%.

Today's economic data will include the fourth quarter Employment Cost Index (Briefing.com consensus 0.6%) at 8:30 am ET, the November S&P Case Schiller Home Price Index (Briefing.com consensus 5.0%) at 9:00 am ET, January Chicago PMI (Briefing.com consensus 55.0) at 9:45 am ET, and January Consumer Confidence (Briefing.com consensus 112.5) at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

European Yields Mixed, Eurozone Growth Beats Forecasts

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

The stock market remains poised for a lower open as the S&P 500 futures trade five points (0.2%) below fair value.

Just in, the fourth quarter Employment Cost Index rose 0.5%, while the Briefing.com consensus expected an uptick of 0.6%.

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade six points (0.3%) below fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mostly lower note, responding to the cautious tone on Wall Street. Markets in China and Hong Kong remained closed for Lunar New Year while Japan's Nikkei (-1.7%) retreated as the yen held its ground just below yesterday's session high. The Bank of Japan made no changes to its policy stance, but did raise its GDP targets for fiscal year 2016, 2017, and 2018 to 1.4%, 1.5%, and 1.1%, respectively. The central bank made no changes to its inflation outlook.

---Equity Markets---

Major European indices trade in the green, but gains have been limited so far. The UK's FTSE (+0.6%) trades ahead of other indices while the pound (1.2478) is down 0.1% against the dollar. For its part, the euro (1.0756) has picked up 0.6% against the greenback, hitting a session high after President Donald Trump's adviser Peter Navarro said the single currency is «grossly undervalued.» In France, the parliamentary office of presidential candidate Francois Fillon was raided as part of a probe into allegations that Mr. Fillon's wife received salary from state funds for performing phantom work.

---Equity Markets---

Filings:

Offerings:

Pricings:

The S&P 500 futures trade five points (0.2%) below fair value.

Just released, the Case-Shiller 20-city Home Price Index for November rose 5.3%, which was above the Briefing.com consensus of 5.0%. This followed the previous month's unrevised reading of 5.1%.

The stock market is on track to open Tuesday lower as the S&P 500 futures trade five points below fair value.

This morning saw a batch of earnings reports from high-profile companies like Exxon Mobil (XOM 85.10, +0.24), Pfizer (PFE 31.01, -0.30), MasterCard (MA 107.00, -2.30), and United Parcel Service (UPS 117.03, -1.06), among others. Investors' responses have been generally negative with the four names down between 0.4% and 0.9% in pre-market trade.

Under Armour (UAA 21.51, -7.43) also reported quarterly results this morning and its stock has plunged 26.0% in reaction to disappointing results and downbeat guidance. Also of note, Under Armour's CFO will be leaving the company for personal reasons.

Treasuries have returned to their flat lines this morning after posting modest gains a short while ago. The benchmark 10-yr yield is unchanged at 2.48%.

On the economic front, investors have received the fourth quarter Employment Cost Index and the November Case-Shiller 20-city Home Price Index thus far. The fourth quarter Employment Cost Index rose 0.5% (Briefing.com consensus 0.6%), while the Case-Shiller 20-city Home Price Index for November rose 5.3% (Briefing.com consensus 5.0%).

January Chicago PMI (Briefing.com consensus 55.0) and January Consumer Confidence (Briefing.com consensus 112.5) will round out today's economic data. The two reports will be released at 9:45 am ET and 10:00 am ET, respectively.

The S&P 500 opened Tuesday's trading session with a modest 0.2% loss.

Real estate (+0.7%) has emerged as the day's early leader, with financials (+0.2%), utilities (+0.4%), consumer staples (+0.1%), telecom services (unch), and energy (unch) also outperforming the benchmark index. Crude oil has given the energy sector a boost despite trading in negative territory throughout the overnight session. The commodity is currently up 1.0% at $53.14/bbl.

U.S. Treasuries opened the day slightly above their flat lines, with the 10-yr yield one basis point lower at 2.48%.

Just reported, Chicago PMI for January decreased to 50.3 from 54.6 in December while the Briefing.com consensus expected a reading of 55.0.

Metrics:

iPhone 8:

Analyst Notes

Options Activity

Technical Perspective

Arbo Holdings Limited is a provider of sealants, coatings and membrane systems used by architects and contractors for waterproofing and sealing buildings and other structures.

— Shares of XOM -1.2% as the earnings call's Q & A session winds down.

The tech sector — XLK — trades below the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -1.42%. Within the SOX index, SIMO (-0.01%) outperforms the sector yet clings to modest losses, while CRUS (-2.46%) lags. Among other major indices, the SPY is trading 0.31% lower, while the QQQ -0.37% and the NASDAQ +1.54% trade opposite on the session. Among tech bellwethers, NTT (+1.84%) is showing relative strength, while TXN (-1.87%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Fed/Treasury Events Summary:

Upcoming Economic Data:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.14… VIX: (12.80, +0.82, +7.7%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Select accessory and high(er) end retail names are higher following Coach (COH +3.4%) earnings results. KORS +0.7%, KATE +0.8%, TIF +0.2%

- Athletic apparel related names are Under [Armour] pressure: NKE -1.3% FL -0.6% LULU -0.6%

In the news:- Leaders: SHOO +3.3% (acquires Schwartz & Benjamin for undisclosed sum; transaction is expected to be approximately neutral to EPS in fiscal 2017 and to be accretive thereafter; upgraded to Buy from Neutral at Citigroup), FRGI+1% (confirms receipt of director nominations notice from JCP Investment Partnership; will review the nomination and present its recommendations to stockholders in its proxy statement)

- Laggards: WMT -0.5% and AMZN -1% (both lower after WMT announced free two-day shipping to home and stores on more than two million items, without a membership fee), ANF -1.3% (names Will Smith as Chief Marketing Officer)

- Nearly unchanged: FRED (Fred's comments on extension to WBA / RAD merger agreement — affirms that the asset purchase agreement remains in effect)

- Nevada Gaming Board reports December gaming win -1.7% YoY to $590.71 mln on the Las Vegas Strip; -2.7% YoY to $956.1 mln statewide

Other notable trends:- Dept store names are under pressure. SHLD -3.5% (continued weakness), M -2.3% (downgraded to Neutral from Buy at Buckingham Research), KSS -2.3%, JCP -2%

Analyst related:Looking ahead:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Rumor Activity was slower than average today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

Stocks that traded to 52 week lows: ADPT, AMDA, ANF, ANTH, ASNA, ATRA, CATO, CBR, CRAY, DMTX, DRNA, DRWI, ECYT, ENT, EXPR, FINL, FLKS, FNBC, GALE, GBSN, GEC, ICLD, INFY, INNL, ITEK, JASO, LB, MFIN, MIK, NH, NK, OCRX, OHRP, ONCS, PLUG, RAD, RT, SBH, SHOS, SITO, SMRT, SOL, TENX, TRIL, TST, UAA, USEG, VFC, VMEMQ, VRA, XON

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: BANX, CEE, CEL, CLBH, ELEC, ESLT, FCE.B, GGM, HBMD, KYO, MMAC, NBN, PBHC, PBNC, PVBC, UPLD

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AGLE, AXSM, CGG, EDUC, ISIG, LRAD, LUB, SBSAA, SRSC

Today's top 20 % gainers

- Healthcare: MNTA (18.13 +20.03%), GKOS (41.04 +7.86%), BLCM (12.8 +7.83%), CYNO (51.05 +7.47%), KERX (4.91 +6.97%), PTLA (27.25 +6.69%), MCRB (9.99 +6.16%), ITCI (14.09 +5.7%), BLUE (72.26 +5.34%)

- Materials: RIC (8.3 +12.16%), AU (12.72 +5.97%), SA (9.88 +5.71%), AG (9.59 +5.5%), SBGL (9.04 +5.18%)

- Consumer Discretionary: TLYS (13.08 +9.92%), AOBC (21.69 +7.38%)

- Information Technology: NTCT (33.3 +5.88%)

- Financials: KRNY (15.35 +6.23%)

- Telecommunication Services: STRP (36.8 +10.84%), I (3.56 +5.64%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: TEVA (20.33 mln -3.86%), PFE (16.36 mln +0.35%)

- Materials: NGD (25.16 mln -8.14%), VALE (12.22 mln -0.91%), FCX (11.67 mln +1.54%)

- Industrials: GE (10 mln -1.39%)

- Consumer Discretionary: UA (36.22 mln -21.2%), UAA (35.09 mln -24.83%), F (16.9 mln -0.35%)

- Information Technology: AMD (16.18 mln -1.89%), AAPL (14.14 mln -0.48%), XRX (13.67 mln -3.31%), MU (10.45 mln -1.45%), INTC (9.66 mln -1.71%)

- Financials: BAC (41.81 mln -1.44%), NRZ (35.59 mln -2.36%)

- Energy: SDRL (30.89 mln -27.44%), CHK (12.11 mln -1.47%)

- Consumer Staples: RAD (15.91 mln -1.66%)

- Telecommunication Services: S (20.66 mln +4.71%)

Today's top relative volume (current volume to 1-month average daily volume)- Jaguar Animal Health (JAGX +54.72%) enters agreement with Eli Lilly (LLY) to license, develop, and commercialize Canalevia

- Aeterna Zentaris (AEZS +24.08%) completed Zoptrex pivotal phase 3 clinical trial in advanced endometrial cancer; expects to report top-line results in April 2017

- Momenta Pharma (MNTA +21%) announces a US District Court ruling against Teva (TEVA) that 'further bolsters our confidence in the potential for us to offer multiple sclerosis patients a more affordable generic version of COPAXONE 40 mg following regulatory approval'

Decliners on news:- Tenax Therapeutics (TENX -76.35%) announces top-line results from its Phase 3 LEVO-CTS trial; study did not achieve statistically significant reductions in dual or quad primary endpoints

- Dimension Therapeutics (DMTX -49.41%) announces preliminary topline safety and early efficacy results of the multi-center phase 1/2 study of DTX101 for the treatment of adult patients with moderate/severe to severe hemophilia B

- ViewRay (VRAY -8.17%) files for $75 mln mixed securities shelf offering

Gainers on earnings:- AmerisourceBergen (ABC +3.9%) beats by $0.13, misses on revs; raises FY17 EPS, reaffirms FY17 rev guidance

- Thermo Fisher (TMO +4.6%) guides FY17 adj. EPS of $9.06-9.24 vs $9.14 Capital IQ Consensus Estimate; sees revs $19.38-19.62 bln vs $19.56 bln Capital IQ Consensus Estimate

- Zimmer Biomet (ZBH +2.18%) beats by $0.03, reports revs in-line; guides FY17 EPS in-line, revs in-line

Decliners on earnings:- Corcept Therapeutics (CORT -4.05%) reports EPS in-line, beats on revs; guides FY17 revs in-line

Upgrades/Downgrades:Biggest point losers: PMD 15.82(-9.8), UPS 109.89(-7.14), UAA 21.88(-7.06), MLM 228.41(-6.9), BWLD 149.9(-6.56), FDX 187.74(-5.51), UA 19.76(-5.33), GS 229.04(-4.86), CR 69.6(-4.3), AVGO 199.17(-4.05), UVV 69.48(-3.68), URI 125.17(-3.61), TSO 79.95(-3.47), SHW 301.44(-3.39), VLO 64.92(-3.31), GWW 251.44(-3.22), GBX 42.15(-3.2), BIIB 272.92(-3.15), VMC 127.6(-3.14), MA 106.41(-2.89), SIG 76.38(-2.78), RYAM 14.02(-2.76), CHTR 322.21(-2.59), PPG 99.55(-2.48), TXN 75.47(-2.43)

The markets post another session of declines at the moment, led lower by the Dow Jones Industrial Average which sheds about 143 points (-0.71%) to 19828, the Nasdaq Composite is down 33 (-0.58%) to 5580, and the S&P 500 loses 10 (-0.45%) to 2270. Action has come on higher than average volume (NYSE 335 vs. avg. of 324; NASDAQ 794 mln vs. avg. of 772), with decliners outpacing advancers (NYSE 1476/1500, NASDAQ 1186/1530) and new highs outpacing new lows (NYSE 49/18, NASDAQ 50/37).

Relative Strength:

Silver Miners-SIL +3.0%, Gold Miners-GDX +2.8%, Copper-JJC +2.4%, Silver-SLV +2.3%, US Gasoline-UGA +2.0%, Jr. Gold Miners-GDXJ +2.0%, Copper Miners-COPX +1.7%, S. Korea-EWY +1.2%, Poland-EPOL +1.1%, Peru-EPU +1.0%, Sweden-EWD +1.0%, Japanese Yen-FXY +0.8%, British Pound-FXB +0.8%, Canadian Dollar-FXC +0.7%.

Relative Weakness:

Coffee-JO -3.0%, US Nat Gas-UNG -2.7%, Transportation-IYT -1.9%, Semis-SMH -1.6%, Russia-RSX -1.5%, Philippines-EPHE -1.2%, Industrials-XLI -1.2%, US Home Constr.-ITB -1.2%, Retail-XRT -1.1%, India-INP -0.9%, Greece-GREK -0.7%, Thailand-THD -0.6%, Mexico-EWW -0.6%, Bric-EEB -0.5%.