SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Запасы сырой нефти.

- 25 января 2017, 16:06

- |

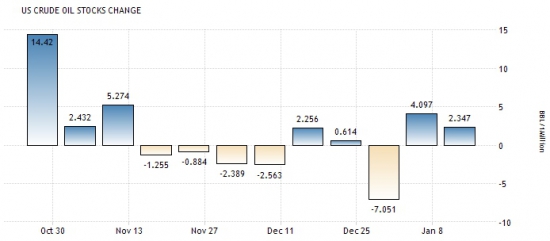

Еженедельные данные по запасам сырой нефти аналитики ожидают в отрицательной зоне, -0.342М:

Волатильность этого показателя в новогодний сезон пониженная. Сюрпризом будут являться любые крупные сделки, которые приведут к значительному увеличению или уменьшению запасов:

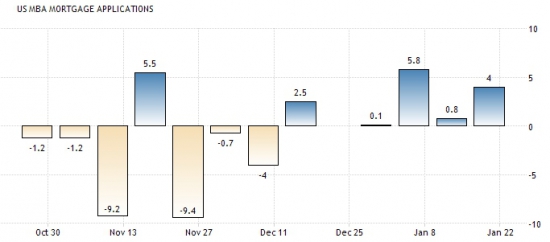

Менее значительными новостями является индекс цен на жилье, ожидаемый без изменений на уровне 0.4%:

И уже вышедшая на уровне 4% ставка по ипотечным кредитам от MBA:

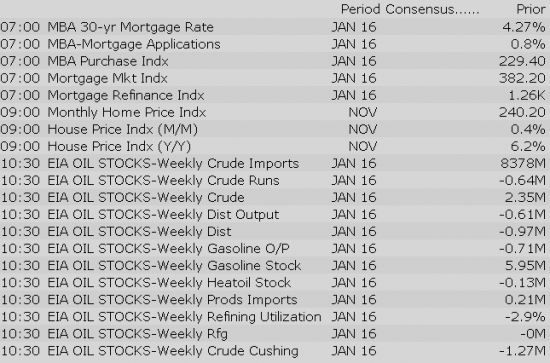

Все новости:

Данные: DTC News, Briefing, Interactive, Investing, Economics, Public Sources

30

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices across the Asia-Pacific region ended the midweek session on a higher note, taking a cue from Tuesday's Wall Street rally. Australia's ‘AAA' rating was affirmed by Moody's and the rating agency expects Australia's GDP will grow between 2.5% and 3.0% in 2017. The Australian dollar is down 0.4% at 0.7550 against the US dollar after cooler than expected Australian inflation data was released overnight.

---Equity Markets---

---FX---

Upgrades:

Downgrades:

Miscellaneous:

Gapping down: HZN -9%, FMBI -6.3%, NCIT -5.9%, NAK -5.7%, MRCY -4.6%, NEWT -4.6%, VOD -2.6%, CA -2.6%, HA -2.5%, VALE -2.3%, MIK -2.2%, AKS -2.1%, RIO -1.5%, OKSB -1.5%, AGN -1.3%, BBL -1.3%, AUY -1.2%, YRCW -1.2%, CLF -1%, SYT -1%, SSI -0.9%, SLV -0.9%, BHP -0.9%, COF -0.9%, DFS -0.9%, TXT -0.8%, ASYS -0.7%, GOLD -0.7%, STLD -0.7%, SC -0.7%, RES -0.7%, ABX -0.6%, HOPE -0.6%, BKU -0.6%, PAA -0.5%, CNI -0.5%

Major European indices trade higher across the board with Spain's IBEX (+1.6%) showing relative strength. Regional indices have shrugged off comments from European Central Bank member Sabine Lautenschlaeger, who said the central bank may soon start discussing a reduction in stimulus. Elsewhere, Germany's Economic Ministry updated its GDP forecast, but the overall outlook was little changed, calling for 1.4% growth in 2017. The Federation of German Industry expects growth of 1.5% in 2017.

---Equity Markets---

CREE +3% at 5 month high premarket.

Treasuries Steady Themselves as Dollar Sinks

Upcoming IPOs:

U.S. equity futures are extending yesterday's gains this morning amid broad-based strength overseas and some positive earnings reports. The S&P 500 futures trade nine points above fair value.

Crude oil has slipped 0.9% to $52.69/bbl despite a weaker U.S. dollar. The U.S. Dollar Index (99.95, -0.32) is down 0.3%, residing at its lowest level in over two months. The greenback is under pressure from both the euro (1.0754) and the Japanese yen (113.25) as the two currencies climb 0.2% and 0.5%, respectively, against the dollar.

After squandering all of Monday's huge gain on Tuesday, U.S. Treasuries sit just below their flat lines early this morning. The benchmark 10-yr yield is up one basis point at 2.48%.

Today's economic data will be limited to the November FHFA Housing Price Index. The report will cross the wires at 9:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

European Yields Jump

The stock market is on track to extend yesterday's gain as the S&P 500 futures trade eight points above fair value.

There have been a batch of earnings reports between yesterday's close and this morning's open with Seagate Technology (STX 42.00, +4.56) and Textron (TXT 46.25, -3.13) being the most notable pre-market movers. Seagate Technology has spiked 12.2% after reporting better than expected top and bottom lines and issuing upbeat guidance, while Textron has slipped 8.0% after missing earnings and revenue estimates and providing disappointing guidance.

Also of note on the earnings front, Dow components Boeing (BA 161.66, +1.11) and United Technologies (UTX 111.00, -0.61) also reported earnings earlier this morning. Boeing has added 1.7% after beating earnings per share estimates. On the other hand, United Technologies has fallen 0.6% despite reporting in-line results and guidance as it appears that investors may be taking a sell-the-news response after the company's big post-election run.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength following SAN earnings:

Select STX/industry peers showing strength after STX earnings:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength following SAN earnings:

Select STX/industry peers showing strength after STX earnings:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

The S&P 500 futures trade ten points (0.4%) above fair value.

Equity indices across the Asia-Pacific region ended the midweek session on a higher note, taking a cue from Tuesday's Wall Street rally. Australia's ‘AAA' rating was affirmed by Moody's and the rating agency expects Australia's GDP will grow between 2.5% and 3.0% in 2017. The Australian dollar is down 0.4% at 0.7550 against the US dollar after cooler than expected Australian inflation data was released overnight.

---Equity Markets---

Major European indices trade higher across the board with Spain's IBEX (+1.8%) showing relative strength. Regional indices have shrugged off comments from European Central Bank member Sabine Lautenschlaeger, who said the central bank may soon start discussing a reduction in stimulus. Elsewhere, Germany's Economic Ministry updated its GDP forecast, but the overall outlook was little changed, calling for 1.4% growth in 2017. The Federation of German Industry expects growth of 1.5% in 2017.

---Equity Markets---

Total Machines (December 2016 vs November 2016)

Total Energy & Transportation (December 2016 vs November 2016)

The equity market is on track to begin Wednesday's session higher as the S&P 500 futures trade nine points (0.4%) above fair value.

Earnings have been this morning's focal point as a bundle of companies have reported quarterly results between yesterday's close and today's open. Boeing (BA 163.00, +2.45), Novartis AG (NVS 71.19, +1.16), Texas Instruments (TXN 77.57, +0.49), Seagate Technology (STX 42.70, +5.26), and Alcoa (AA 38.35, +0.85) have been some of the most notable pre-market advancers, while United Technologies (UTX 111.00, -0.61) and Textron (TXT 45.25, -4.13) have retreated after reporting disappointing results.

The Treasury market is under some selling pressure early this morning, with the 10-yr yield up two basis points at 2.49%. For the week, Treasuries sit just below their flat lines after Tuesday's big loss erased Monday's sizable gain.

Similarly, crude oil has ticked down, losing 0.6% despite a 0.2% retreat in the U.S. Dollar Index (100.06, -0.21). The energy component trades at $52.82/bbl.

Released earlier this morning, the FHFA Housing Price Index for November rose 0.5%, which followed a revised increase of 0.3% in October (from 0.4%).

The stock market opened Wednesday's session higher with the Dow finally crossing the elusive 20,000 milestone. The index performs in line with its peers, up 0.5%.

The financial sector (+1.0%) has taken the early lead, with its cyclical peers following closely. Technology, industrials, materials, and energy hold gains between 0.2% and 0.7%, while the consumer discretionary sector sits just below its flat line.

On the countercyclical side, consumer staples (+0.2%) and health care (+0.2%) sport modest gains, while the remaining sectors post modest losses.

Treasuries have slipped past their overnight lows, with the 10-yr yield up three basis points at 2.50%.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The tech sector — XLK — trades mostly in-line with the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.85%. Within the SOX index, ADI (+2.67%) outperforms, while AMD (-1.20%) lags. Among other major indices, the SPY is trading 0.61% higher, while the QQQ +0.71% and the NASDAQ +0.09% trade modestly higher on the session. Among tech bellwethers, IBM (+1.47%) is showing relative strength, while NTES (-0.96%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.47… VIX: (10.81, -0.26, -2.4%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

- Esperion (ESPR +2.77%) Completes Enrollment of Pivotal Phase 3 Long-Term Safety and Tolerability Study of Bempedoic Acid in Patients with Hypercholesterolemia

Decliners on news:- Asterias Biotherapeutics (AST -5.96%) provides update to milestone objectives for AST-OPC1; projects trial in early 2018

- Aethlon Medical (AEMD -2.11%) subsidiary plans to initiate a clinical study involving retired NFL players and a data-supported biomarker candidate to detect and monitor CTE

Gainers on earnings:- Intuitive Surgical (ISRG +3.19%) beats by $0.10, reports revs in-line with prior guidance; enters into $2.0 bln accelerated share repurchase program

Decliners on earnings:- Meridian Bioscience (VIVO -21.96%) misses by $0.05, misses on revs; lowers FY17 EPS & rev guidance; reduces annual indicated dividend rate

- Sharps Compliance (SMED -3.16%) misses by $0.06, misses on revs

- Abbott Labs (ABT -0.79%) provides additional Q1, FY17 guidance on conference call

Upgrades/Downgrades:Biggest point losers: CVLT 50.95(-5.85), TXT 44.5(-4.89), VIVO 12.6(-3.85), TDG 221.75(-3.46), STT 77.2(-3.32), HZN 17.93(-2.95), LN 33.34(-2.86), EAT 44.49(-2.67), LMT 250.64(-2.27), UTX 109.57(-2.04), LTXB 40.08(-1.9), CA 31.07(-1.88), STLD 34.58(-1.67), ACIA 65.96(-1.65), CHKP 97.27(-1.62), ITW 125.57(-1.49), APH 67.46(-1.31), CONE 49.62(-1.31), GOLD 83.71(-1.28), CRUS 60.52(-1.22), MIK 20.58(-1.2), X 32.09(-1.13), NYCB 15.02(-1.13), SYT 85.59(-1.12)

Notable earnings/guidance:

- Trading higher following earnings/guidance: MDP +8.6% (also CBS and Meredith announced long-term deal that renews station affiliation agreements for four of its owned-and-operated stations), CAT +1.9% (December 2016 retail data: total machines worldwide fell 12% YoY vs 17% decline in the prior month), MKC +1.6%

- Trading lower following earnings/guidance: MIK -5.5% (sees Q4 EPS of $0.94-0.96 vs $0.96 CapIQ Consensus and comps down 0.9-1.5%; announces 18 mln share secondary offering by stockholders — 8 mln will be repurchased by company), EAT -4.9%, ITW -1%

In the news:- Leaders: ACAT 41.3% (Arctic Cat to be acquired by Textron (TXT) for $18.50/share in cash, or approximately $247 mln), BOBE 24.8% (Bob Evans to sell Bob Evans Restaurants, will acquire Pineland Farms Potato Company; reaffirms FY17 guidance), HBI 5% (increases quarterly cash dividend to $0.15 per share, up from $0.11 per share), SPB 1.9% (authorizes new 3-year, $500 mln common stock repurchase program and increases quarterly dividend of $0.42/share from $0.38/share prior quarter), RH 1.7% (Bioverativ will replace RH in the S&P 400, and RH will replace Ciber in the S&P 600), SPLS 1.3% (Staples details changes to its governance practices and Board), CCL 1.3% (enters strategic partnership with Wartsila), PVH 1% (PVH to acquire the licensed Tommy Hilfiger men's tailored clothing business for North America from Marcraft Clothes; terms not disclosed), ADDYY 0.4% (Tiger Woods chooses Adidas-owned TaylorMade golf clubs after Nike exited the golf equipment market last week)

- Laggards: SSI -3.1% (making new all-time lows — Varex Imaging will replace Stage Stores in the S&P Small Cap 600) and leading discount retail names lower (SMRT -3%, FRED -2.1%, CATO -0.3%)

- Nearly unchanged: GPS (Gap announces that Andi Owen, global brand president of Banana Republic, will leave the company in late February)

Other notable trends:- Nearly every restaurant / QSR is higher (along with broader market) despite EAT earnings related weakness. RT +4%, HABT +3.9%, FRSH +3.8%, ZOES +3.7%, BWLD +3.7%, PBPB +3.1%, GRUB +2.7%, SAUC +2.7%, TACO +1.9%, TXRH +1.9%, DFRG +1.7%, CMG +1.5%, FOGO +1.4%, SONC +1.4%, RUTH +1.3%, WING +1.3%, NDLS +0.6%, TAST +1.2%, SHAK +1%, YUM +1%, BJRI +1%, PLKI +0.9%, WEN +0.9%, LOCO +0.8%, BLMN +0.8%, DIN +0.6%, JACK +0.6%

- Homebuilders are higher across the board — along with other materials / infrastructure related names amid anticipated Trump order to begin Mexico border construction (ITB +2.2% / XHB +1.4%). UCP +5%, HOV +4.6%, WLH +3.1%, LGIH +3%, TMHC +2.6%, DHI +2.4%, CAA +2.4%, BZH +2.1%, MTH +1.9%, MHO +1.9%, MDC +1.8%, TOL +1.7%, LEN +1.5%, TPH +1.5%, KBH +1.5%, CSTE +1.1%, PHM +1%, CHCI +0.4%

Analyst related:Looking ahead:

On the earnings front: CCI, EBAY, ETH report today after the close; F, CMCSA, HGG, LEA, PHM, RCL, SPB, WHR report tomorrow before the open.Rumor Activity was average today

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.