SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Вторичный рынок жилья.

- 24 января 2017, 16:29

- |

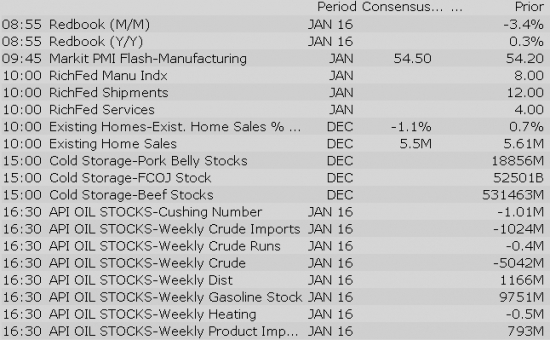

Рынок вторичного жилья америки продолжает демонстрировать оптимизм. После предыдущего значения на уровне 5.61 млн., ставшего максимальным с 2007-го года, аналитики ожидают новое значение на столь же высоком уровне в пределах 5.52 — 5.58 млн.:

При этом уже 57-й месяц подряд наблюдается рост стоимости вторичного жилья. По сравнению с прошлым годом показатель вырос почти на 7% и составляет $234900. Рост спроса наблюдается в основном в северных регионах, южные отстают в несколько раз.

Одновременно с положительной динамикой наблюдается снижение составляющей новых покупателей с 33% до 32%.

Все новости:

Данные: DTC News, Briefing, Interactive, Economics

28 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates:

US Econ Data

Equity indices in the Asia-Pacific region ended Tuesday on a mostly higher note while Japan's Nikkei (-0.6%) underperformed. Japan's Finance Minister Taro Aso said his country is prepared to cooperate with the new US administration at various levels. Elsewhere, the progress towards inclusion of Chinese equities in MSCI may be halted if the country continues cracking down on capital outflows, according to the head of MSCI.

Economic data was limited:

---Equity Markets---

---FX---

Upgrades:

Downgrades:

Miscellaneous:

Gapping down: BT -18.6%, BIOA -12.2%, PLG -9.2%, GLOP -8.6%, GLOP -8.6%, OCUL -7.9%, SIMO -7.2%, PII -5.8%, STRP -4.8%, FSM -3.6%, PHG -3.5%, CASC -2.7%, VZ -2.7%, JNJ -1.7%, PNFP -1.5%, GOLD -1.5%, GFI -1.4%, USFD -1%, T -1%, IGLD -0.9%, HMY -0.8%, SLW -0.8%, ENBL -0.7%, ABX -0.7%, AAPL -0.6%, BRKR -0.6%, HUM -0.5%, FBC -0.5%

Major European indices trade just above their flat lines while Italy's MIB (+1.4%) outperforms after two consecutive down days. In the UK, the Supreme Court ruled that a Parliamentary vote must be allowed before article 50 of the Lisbon Treaty is triggered. Also of note, Reuters reported that EU finance ministers will not sign off on Thursday's Greek bailout review, but they remain hopeful that the review will be completed soon.

---Equity Markets---

Treasuries Pull Back as Stocks and Dollar Steady

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

U.S. stock futures are relatively flat this morning as investors digest a slew of earnings reports before Tuesday's opening bell. The S&P 500 futures trade one point below fair value.

The Treasury market is under pressure early after a big advance on Monday. The benchmark 10-yr yield is up three basis points at 2.43%.

Crude oil has returned to its flat line in recent action, coming down from its overnight high. The commodity is up a modest 0.1% at $52.70/bbl as reports of lower production from key exporters have been balanced by an uptick in U.S. drilling.

Today's economic data will be limited to December Existing Home Sales (Briefing.com consensus 5.55 million), which will cross the wires at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select financial related names showing strength:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Peers: ADBE, ORCL, CRM, IBM

U.K. Supreme Court Says Triggering Article 50 Requires Act of Parliament

The equity market is on track to open Tuesday flat as the S&P 500 futures trade one point below fair value.

The morning has been all about earnings reports with a batch of high-profile companies reporting results between yesterday's close and today's open. Some of the most notable movers thus far have been Alibaba (BABA 102.40, +3.88), Yahoo! (YHOO 43.85, +1.45), and DR Horton (DHI 29.50, +0.76), all up between 2.7% and 3.9% in pre-market trade. All three companies beat top and bottom line estimates, with Alibaba also issuing positive guidance.

Influential earnings reports due after the close today include Capital One (COF 86.87, 0.00), Texas Instruments (TXN 75.95, +0.22), Canadian National Railway (CNI 70.28, 0.00), Stryker (SYK 121.41, 0.00), Seagate Technology (STX 36.37, 0.00) and Alcoa (AA 36.65, +0.36), among many others.

Filings:

Offerings:

Pricings:

Upcoming IPOs:

The S&P 500 futures trade one point above fair value.

Equity indices in the Asia-Pacific region ended Tuesday on a mostly higher note while Japan's Nikkei (-0.6%) underperformed. Japan's Finance Minister Taro Aso said his country is prepared to cooperate with the new US administration at various levels. Elsewhere, the progress towards inclusion of Chinese equities in MSCI may be halted if the country continues cracking down on capital outflows, according to the head of MSCI.

Economic data was limited:

---Equity Markets---

Major European indices trade just above their flat lines while Italy's MIB (+1.2%) outperforms after two consecutive down days. In the UK, the Supreme Court ruled that a Parliamentary vote must be allowed before article 50 of the Lisbon Treaty is triggered. Also of note, Reuters reported that EU finance ministers will not sign off on Thursday's Greek bailout review, but they remain hopeful that the review will be completed soon.

---Equity Markets---

The stock market is on track to open Tuesday slightly higher as the S&P 500 futures trade two points above fair value.

Earnings reports have been the focal point of pre-market action, with a bundle of companies reporting between yesterday's close and today's open. Thus far, the most notable losers have been, Verizon (VZ 50.54, -1.87), Lockheed Martin (LMT 248.44, -8.98), and Johnson & Johnson (JNJ 111.87, -2.02), while the most notable winners have been DR Horton (DHI 29.75, +1.01) and Yahoo! (YHOO 43.90, +1.50).

Crude oil has ticked up in recent action as the latest narrative for the commodity suggests that reports of lower production from key exporters have been offset by an uptick in U.S. drilling. The energy component is up 0.5%, near its overnight high, trading at $53.09/bbl.

Conversely, Treasuries are under pressure this morning after a big Monday advance. With the 10-yr yield up three basis point at 1.4% and the U.S. Dollar Index (100.16, +0.21) adding 0.2%, early-morning action suggests investors have somewhat of a risk-on attitude to start the day.

Today's economic data will be limited to December Existing Home Sales (Briefing.com consensus 5.55 million), which will cross the wires at 10:00 am ET.

The S&P 500 (+0.1%) opened Tuesday just above its flat line, while the Nasdaq is sporting a 0.3% gain.

Cyclical sectors have had the upper hand in early action, with all six posting gains. The advance has been led by materials (+1.3%), with energy (+0.6%), technology (+0.4%), and consumer discretionary (+0.3%) also outperforming the broader market.

On the non-cyclical side, telecom services are at the bottom of today's leaderboard, plunging 2.7%. Verizon (VZ 50.29, -2.11) has led the sector's decline, losing 4.2% after reporting worse-than-expected earnings results earlier this morning.

The tech sector — XLK — trades slightly behind the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +1.18%. Within the SOX index, MU (+4.36%) outperforms, while SIMO (-2.86%) lags. Among other major indices, the SPY is trading 0.14% higher, while the QQQ +0.14% and the NASDAQ +0.19% also trade modestly higher on the session. Among tech bellwethers, JD (+2.20%) is showing relative strength, while T (-1.57%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.97… VIX: (11.47, -0.30, -2.6%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Notable earnings/guidance:

Earnings/guidance secondary plays:

- DR Horton (DHI +5%) following earnings — leading homebuilders higher (XHB +2%, ITB +2.9%): LEN +5%, WLH +4.9%, HOV +4.1%, TPH +4.1%, PHM +4.1%, TMHC +4.1%, BZH +3.8%, MTH +3.3%, MHO +3.1%, CAA +3%, TOL +3%, MDC +3%, LGIH +2.6%, CSTE +1.6%, UCP +1.3%, KBH +1.1% (higher despite being downgraded to Underperform from Mkt Perform at Raymond James)

- ACAT -2.4% following PII earnings/guidance

In the news:- Leaders: FCAU 5.9%, F +1.6%, GM 1.1% (following meeting with President Trump), JCP 1.5% (extended its existing stockholder rights plan for an additional three years to continue protecting the valuable net operating loss carryforwards), APOL 0.5% (Higher Learning Commission approves change of control applications; expects to consummate the Merger on February 1, 2017), SUP 1.3% (GAMCO Investors lowers active stake), WHR 0.6% (began consultations with certain works councils and other regulatory agencies in connection wih its proposal to restructure its EMEA dryer manufacturing operations)

- Nearly unchanged: AMZN (European Commission seeks feedback on commitments offered by Amazon in e-book investigation), SVU (amended and restated bylaws to implement proxy access)

Other notable trends:Looking ahead:

Treasury Auction Preview

Stocks that traded to 52 week lows: ABUS, AEZS, ANTH, AOBC, AVGR, BT, CASC, CERS, COYN, DIN, DRNA, DRYS, DXLG, ECYT, EMG, EVC, EYES, FCEL, GILD, GNC, HOTR, ICLD, IFON, IPWR, ITEK, JMBA, NH, OMED, OPHT, PRGO, QURE, RNVA, RT, SCON, SSI, TGTX, TUES, TVIX, TWER, VICL, VMEMQ, WKHS, XCOMQ, XON

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ACH, BBDO, ECT, ESLT, FBZ, FLN, GFY, GSH, GULF, KEN, KFS, MILN, MMAC, NVEC, NWFL, OTEL, PBNC, PNQI, PNTR, QCLN, SPLP, TLP, TWIN

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ISIG, SPI

ETFs that traded to 52 week highs: CUT, EEB, EWG, EWO, FDN, GULF, IGV, IYM, MOO, REMX, SKYY, URA, UYM, XLB, XLK, XME

ETFs that traded to 52 week lows: SMN, VXX, VXZ

Today's top 20 % gainers

- Healthcare: RMD (69.2 +8.81%)

- Materials: ATI (21.1 +24.19%), LXU (7.99 +7.1%), HBM (7.45 +6.43%), CLF (9.33 +6.26%), CENX (15.19 +6.19%), TCK (25.62 +6.17%), AKS (9.85 +6.03%)

- Industrials: MRCY (34.75 +10.52%), GRAM (4.93 +9.56%), MTZ (39.06 +7.31%), TGH (12.45 +6.87%)

- Consumer Discretionary: HZO (21.3 +17.03%), GPRO (10.17 +8.14%), FCAU (10.93 +6.27%)

- Information Technology: IIVI (34.83 +10.91%), LITE (37.13 +7.92%), OLED (65.98 +7.1%), OCLR (9.95 +6.82%)

- Financials: PPBI (38.6 +7.22%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: PFE (10.83 mln -1.43%)

- Materials: FCX (19.15 mln +5.47%), AKS (17.73 mln +6.03%), VALE (14.63 mln +2.62%), ABX (11.07 mln +1.85%), MT (11.01 mln +1.4%), X (9.08 mln +4.27%)

- Industrials: GE (10.04 mln +0.81%)

- Consumer Discretionary: F (11.86 mln +1.71%)

- Information Technology: BABA (20.95 mln +2.31%), AMD (15.44 mln +1.72%), QCOM (14.88 mln +1.25%), MU (13.16 mln +4.46%), YHOO (12.96 mln +3.53%), NOK (9.15 mln -0.43%)

- Financials: BAC (33 mln +1.73%)

- Energy: CHK (11.11 mln +2.25%)

- Consumer Staples: RAD (10.87 mln +0.72%)

- Telecommunication Services: VZ (19.1 mln -4.36%), T (10 mln -2.01%)

Today's top relative volume (current volume to 1-month average daily volume)Gainers on news:

- GenVec (GNVC +40.53%) to be acquired by Intrexon (XON) for $7.00/share in stock + CVR

- Cellectar Biosciences (CLRB +15.94%) USPTO has granted patent covering method of use for its lead compound, CLR 131, as well as CLR 125, for the treatment of cancer

- InVivo Therapeutics (NVIV +16.67%) announces that the patient enrolled in the Inspire study of the Neuro-Spinal Scaffold has improved from a complete AIS A spinal cord injury to an incomplete AIS B spinal cord injury in the time between discharge and the one-month evaluation

Decliners on news:- Ocular Therapeutix (OCUL -12.52%) prices registered underwritten public offering of 3,571,429 shares of its common stock at $7.00/share

- Aseterias Biotherapeutics (AST -4.17%) announces 'positive' efficacy results from its SCiStar Phase 1/2a clinical trial that showed additional motor function improvement at 6 to 9 months; expects to report 12-month data during 3Q17

- Intrexon (XON -3.12%) to Acquire GenVec

Gainers on earnings:- ResMed (RMD +9.65%) beats by $0.03, beats on revs

Decliners on earnings:- Waters (WAT -3.62%) beats by $0.08, beats on revs

- Johnson & Johnson (JNJ -2.33%) sees FY17 $6.93-7.08 vs $7.12 Capital IQ Consensus Estimate; sees revs $74.1-74.8 bln vs $75.13 bln Capital IQ Consensus Estimate

Upgrades/Downgrades:Biggest point losers: REGN 347.64(-6.72), LMT 251.69(-5.79), WAT 140.19(-5.09), BT 19.41(-5.02), SAGE 47.79(-4.56), ADS 225.05(-3.51), HUM 201.64(-3.38), PII 84.25(-3.3), IBB 267.56(-3.29), DXCM 76.88(-3.1), MMM 175.64(-2.87), BIIB 273.4(-2.62), TMO 140.39(-2.4), VZ 50.02(-2.39), WATT 15.4(-2.31), JNJ 111.61(-2.3), SHW 281.74(-2.26), IONS 41.86(-2.09), AET 117.13(-2.07), LLY 74.29(-2.03), SIMO 41.31(-2.03), ALXN 129.59(-1.9), AMGN 150.94(-1.78), ILMN 159.16(-1.73), HQY 46.45(-1.61)

Rumor Activity was slow today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The broader market is near highs at the moment, led by the Dow Jones Industrial Average which gains about 93 points (+0.47%) to 19892, the S&P 500 adds about 10 (+0.44%) to 2275, and the Nasdaq Composite climbs about 23 (+0.42%) to 5576. Action has come on lower than average volume (NYSE 317 vs. avg. of 343; NASDAQ 729 mln vs. avg. of 801), with advancers outpacing decliners (NYSE 2101/850, NASDAQ 1652/1047) and new highs outpacing new lows (NYSE 131/10, NASDAQ 85/29).

Relative Strength:

Copper Miners-COPX +4.3%, US Home Constr.-ITB +3.4%, Metals&Mining-XME +3.0%, Coal-KOL +2.9%, Copper-JJC +2.5%, Homebuilders-XHB +2.5%, Materials-XLB +2.1%, Greece-GREK +1.9%, Peru-EPU +1.9%, Mexico-EWW +1.8%, Saudi Arabia-KSA +1.7%, Russia-RSX +1.6%, S. Africa-EZA +1.6%, Canada-EWC +1.6%.

Relative Weakness:

Short-Term Futures-VXX -3.4%, Cotton-BAL -2.2%, Corn-CORN -1.5%, US Telecoms-IYZ -1.2%, Pharma-PPH -1.0%, Biotech-IBB -1.0%, Grains-JJG -1.0%, Japanese Yen-FXY -0.4%, Egypt-EGPT -0.3%, Belgium-EWK -0.2%, Japan-EWJ -0.2%, France-EWQ -0.1%, Switzerland-EWL -0.1%, Swiss Franc-FXF -0.1%.

The Industrials sector (XLI) is trading +0.8% today, higher than the broader market (SPY +0.5%). In the Industrial Sector earnings kick off with big names like 3M (MMM -1.1%), Lockheed (LMT -2.3%), and Philips (PHG -2%) reporting earnings. Additionally, II-VI (IIVI +11.8%) shares hit an all-time high following the co's Q2 earnings beat.

Earnings/Guidance

Notable fiber optic names related to II-VI (IIVI +11.8%) showing notable strength: LITE +8.4%, OCLR +7.8%, ACIA +5.5%, FNSR +3.5%, FN +3.9%, AAOI +3.3%, NPTN +2.9%, CIEN +2.7%

News

Broker Research

A risk-on tone has been underlying today's session as the major averages have advanced steadily since the opening bell. All three have hit fresh session highs in recent action, and currently hold gains around 0.5% apiece.

Sector standings tell the same story as investors have favored growth-sensitive sectors over their safer, non-cyclical counterparts. All six cyclical sectors are in the green, with materials (+2.3%) pacing the advance. DuPont (DD 75.93, +3.14) set the sector's tone earlier this morning, beating earnings estimates and announcing that its merger with Dow Chemical (DOW 59.11, +1.97) is expected to close in the first half of 2017. In addition, Alcoa (AA 38.07, +1.78) has jumped 4.9% ahead of its quarterly report, which will be released after today's closing bell.

Sitting just below the top of the leaderboard are the financial (+1.2%) and energy (+1.1%) sectors. The financial sector has returned into the green for the year while energy has narrowed its January loss to 1.2%. Energy has moved in tandem with crude oil, which has added 1.3% as reports of lower production from key exporters have outweighed an uptick in U.S. drilling. Information technology has also contributed to the strong showing from the cyclical side, adding 0.7% on a big day from chipmakers; the PHLX Semiconductor Index is up 1.4%.

On the non-cyclical side, telecom services (-3.2%), health care (-0.9%), and real estate (-0.2%) are all posting losses. However, the consumer staples sector has been able to resist the trend, outperforming the broader market with a 0.5% gain. The space's uptick has stemmed from an upbeat response to Kimberly Clark's (KMB 121.37, +4.39) better than expected earnings report.

Also on the earnings front, DR Horton (DHI 29.75, +1.01) has jumped 5.5% after reporting better-than-expected earnings and revenues this morning. The name has given a boost to its homebuilding peers, evidenced by the 3.5% increase in the iShares U.S. Home Construction ETF (ITB 28.89, +0.98).

The Treasury market is the last piece to the risk-on narrative, hitting a fresh session low in recent action. The benchmark 10-yr yield is up five basis points at 2.45%.

Today's economic data was limited to December Existing Home Sales:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.88… VIX: (11.31, -0.46, -3.9%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Hess Energy is scheduled to report Q4 earnings tomorrow pre-market with a conference call to follow at 10:00 am ET the same day.

FY17 production/capex guidance:

Q3 recap

Company Background

Hess is an independent energy company engaged in the exploration and production of crude oil and natural gas. Their portfolio is evenly split between unconventionals and conventionals; U.S. and international; and onshore and offshore. Three quarters of their production is liquids versus gas.

The co's portfolio is focused in five strategic areas: the Bakken Shale in North Dakota and the Utica Shale in Ohio; the Deepwater Gulf of Mexico; Valhall Field in Norway and South Arne Field in Denmark; offshore West Africa — Equatorial Guinea and Ghana; and offshore Malaysia in the Gulf of Thailand. These specific areas represent 83% of reserves and 95% of production.

Technical Perspective

Technically, HES has been in a slump over the last 2-years, but recently emerged with some strength into the end of 2016. It's been giving back some of its December gains here to start a new year, but appears to be finding support around its 200-day and 50-day moving averages in the 56/58 vicinity. In response to earnings, Buyers are looking to resume the trend off the Nov/Dec lows with a push back over $60. Sellers will likely be quick to press back below the 54/56 zone in favor of the bigger picture slump.

Options Activity

Based on HES options, the current implied volatility stands at ~ 32%, which is 27% higher than historical volatility (over the past 30 days). Based on the HES Weekly Jan27 $58 straddle, the options market is currently pricing in a move of ~3% in either direction by weekly expiration (Friday).

Peers include: CEO, SNP, OXY, SU, EPD, CNQ, APA, CLR, CHK, CIE, DNR, KOS, STR, LPI, OAS, HK, GTE, GPOR, EEQ, CRZO, CRK, BCEI, TGA, MCF, PBT, SN, GBR, WPX, ROYL, FPP, MPET, USEG, EAC, GST

Shares of HES +1.0% ahead of tomorrow's earnings release.

Dollar Rallies as Treasury Yields Climb