SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. gtcapital

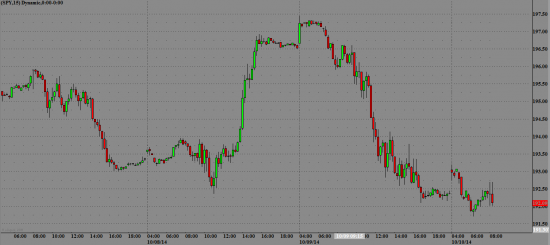

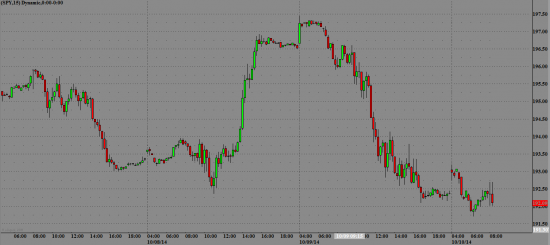

SPY продолжает вчерашнее падение

- 10 октября 2014, 16:38

- |

Ближайший уровень поддержки по SPY – 191.75 уровень сопротивления – 192.50

LAKE следим за недавним IPO

SRTY покупка выше 48

ERY покупка при удержании 20

SCO покупка выше 35.50

ERX смотрим на дальнейшее падение

APC ждем разворот выше 52

FSLR ниже 56 продажа, выше покупка

GPS продажа ниже 65.50

URI следим на открытии, возможен откат вверх

ROK покупка при удержании 103

CXO продажа ниже 109.50

EXP покупка при удержании 87

Gapping up/down: INFY +5% after earnings, EXAX +36% after positive CMS determination over Cologuard; MCHP -11%, MTW -9%, and JNPR -7% after earnings, Semis, oil and gold stocks trading lower Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: INFY +5.6%, HELE +3%, PLUG +2.7%

Other news: EXAS +35.8% (positive CMS determination over Cologuard), APT +26% (following 27% move higher yesterday with ongoing Ebola fears), SCMP +19.2% (Sucampo Announces Settlement Agreement That Resolves Patent Litigation in U.S. Related to AMITIZA), ALXA +16.8% (provided update on ADASUVE U.S. Commercial Progress; Alexza shipped 32,278 units in the third quarter, completing the ADASUVE initial product inventory stocking), CVEO +12.6% (Greenlight capital discloses 9.99% active stake in 13D filing), STV +6.9% (cont volatility pre-mkt), ISIS +5.3% (reports data from ISIS-SMN Rx Phase 2 studies in infants and children with spinal muscular atrophy), VNET +4.7% (establishes joint venture with Foxconn (FXCNY)), ARIA +3.7% (announced that Pharmacovigilance Risk Assessment Committee of EMA concluded review of Iclusig and has recommended that Iclusig continue to be used in Europe in accordance with its already approved indication), BX +2.7% (planning advisory spin-off, according to reports), ECOL +2.5% (to replace MEAS in the S&P SmallCap 600), OXLC +2.1% (adopted repurchase program of up to $35 mln worth of common stock), KGJI +1.6% (announces initial shipment of 24-karat gold jewelry product samples to Middle East)

Analyst comments: NDLS +0.9% (initiated with an Outperform at BMO Capital Mkts ), WDC +0.7% (initiated with a Buy at Jefferies), NRP +0.7% (upgraded to Outperform from Market Perform at Wells Fargo), BUD +0.5% (added to Conviction Buy List at Goldman)

Gapping down

In reaction to disappointing earnings/guidance: PKT -25.1%, VOXX -16.4%, SZMK -13.9%, MCHP -11.1%, KN -10.8%, MTW -8.9%, JNPR -7%, JOEZ -5%, FDO -1%

Select Semi names showing weakness: NXPI -4.4%, ATML -4.1%, STM -3.9%, LLTC -3.1%, ALTR -2.7%, ASML -2.1%, AVGO -2%, MU -1.9%

Select metals/mining stocks trading lower: CVE -3.3%, RIO -2.2%, GOLD -1.9%, AU -1.2%, GFI -1%

Select oil/gas related names showing early weakness: SDRL -2.5%, STO -2.2%, BHP -2.1%, TOT -1.7%, RIG -1.6%, HAL -0.4%

Other news: GTAT -29.5% (reportedly looking to close down its saphire business, according to court documents), TSLA -6.2% (following run-up into Model D event, also neg mention on Mad Money), MBLY -4.8% (news that new Tesla (TSLA) Model D will have self driving features), TKMR -3.4% (cont volatility), THLD -2.3% (disclosed that it has licensed rights to a development program from the University of Auckland based on the clinical-stage oncology compound Hypoxin; co expects to initiate a Phase 2 study of Hypoxin), RDS.A -2.3% (still checking), PTCT -2.3% (prices 3 mln shares of common stock at $36.25), SM -1.9% (sees Q3 production of 13.1 MMBOE, or 142.5 MBOE/d, at low end of previously provided guidance), SYMC -1.6% (announces new strategy to fuel growth and plans to separate into two public companies), GPRO -1.3% (founder Silicon Valley Community Foundation filed 13D), YHOO -1.2% (still checking), AMGN -1.1% (BiTE Immunotherapy Blinatumomab receives FDA Priority Review designation in acute lymphoblastic leukemia)

Analyst comments: BDSI -3.4% (downgraded to Hold from Buy at ROTH Capital), NDSN -3.4% (downgraded to Hold from Buy at BB&T Capital Mkts), GRPN -3.1% (downgraded to Sell from Equal Weight at Evercore), JCP -2.5% (downgraded to Sell at Maxim Group), ICLR -1.8% (downgraded to Neutral from Buy at ISI Group), BTI -1.2% (downgraded to Sell from Neutral at Goldman)

Оригинал статьи: gtstocks.com/analytics-10-10-2014.html

LAKE следим за недавним IPO

SRTY покупка выше 48

ERY покупка при удержании 20

SCO покупка выше 35.50

ERX смотрим на дальнейшее падение

APC ждем разворот выше 52

FSLR ниже 56 продажа, выше покупка

GPS продажа ниже 65.50

URI следим на открытии, возможен откат вверх

ROK покупка при удержании 103

CXO продажа ниже 109.50

EXP покупка при удержании 87

Gapping up/down: INFY +5% after earnings, EXAX +36% after positive CMS determination over Cologuard; MCHP -11%, MTW -9%, and JNPR -7% after earnings, Semis, oil and gold stocks trading lower Price: null Change: null

Gapping up

In reaction to strong earnings/guidance: INFY +5.6%, HELE +3%, PLUG +2.7%

Other news: EXAS +35.8% (positive CMS determination over Cologuard), APT +26% (following 27% move higher yesterday with ongoing Ebola fears), SCMP +19.2% (Sucampo Announces Settlement Agreement That Resolves Patent Litigation in U.S. Related to AMITIZA), ALXA +16.8% (provided update on ADASUVE U.S. Commercial Progress; Alexza shipped 32,278 units in the third quarter, completing the ADASUVE initial product inventory stocking), CVEO +12.6% (Greenlight capital discloses 9.99% active stake in 13D filing), STV +6.9% (cont volatility pre-mkt), ISIS +5.3% (reports data from ISIS-SMN Rx Phase 2 studies in infants and children with spinal muscular atrophy), VNET +4.7% (establishes joint venture with Foxconn (FXCNY)), ARIA +3.7% (announced that Pharmacovigilance Risk Assessment Committee of EMA concluded review of Iclusig and has recommended that Iclusig continue to be used in Europe in accordance with its already approved indication), BX +2.7% (planning advisory spin-off, according to reports), ECOL +2.5% (to replace MEAS in the S&P SmallCap 600), OXLC +2.1% (adopted repurchase program of up to $35 mln worth of common stock), KGJI +1.6% (announces initial shipment of 24-karat gold jewelry product samples to Middle East)

Analyst comments: NDLS +0.9% (initiated with an Outperform at BMO Capital Mkts ), WDC +0.7% (initiated with a Buy at Jefferies), NRP +0.7% (upgraded to Outperform from Market Perform at Wells Fargo), BUD +0.5% (added to Conviction Buy List at Goldman)

Gapping down

In reaction to disappointing earnings/guidance: PKT -25.1%, VOXX -16.4%, SZMK -13.9%, MCHP -11.1%, KN -10.8%, MTW -8.9%, JNPR -7%, JOEZ -5%, FDO -1%

Select Semi names showing weakness: NXPI -4.4%, ATML -4.1%, STM -3.9%, LLTC -3.1%, ALTR -2.7%, ASML -2.1%, AVGO -2%, MU -1.9%

Select metals/mining stocks trading lower: CVE -3.3%, RIO -2.2%, GOLD -1.9%, AU -1.2%, GFI -1%

Select oil/gas related names showing early weakness: SDRL -2.5%, STO -2.2%, BHP -2.1%, TOT -1.7%, RIG -1.6%, HAL -0.4%

Other news: GTAT -29.5% (reportedly looking to close down its saphire business, according to court documents), TSLA -6.2% (following run-up into Model D event, also neg mention on Mad Money), MBLY -4.8% (news that new Tesla (TSLA) Model D will have self driving features), TKMR -3.4% (cont volatility), THLD -2.3% (disclosed that it has licensed rights to a development program from the University of Auckland based on the clinical-stage oncology compound Hypoxin; co expects to initiate a Phase 2 study of Hypoxin), RDS.A -2.3% (still checking), PTCT -2.3% (prices 3 mln shares of common stock at $36.25), SM -1.9% (sees Q3 production of 13.1 MMBOE, or 142.5 MBOE/d, at low end of previously provided guidance), SYMC -1.6% (announces new strategy to fuel growth and plans to separate into two public companies), GPRO -1.3% (founder Silicon Valley Community Foundation filed 13D), YHOO -1.2% (still checking), AMGN -1.1% (BiTE Immunotherapy Blinatumomab receives FDA Priority Review designation in acute lymphoblastic leukemia)

Analyst comments: BDSI -3.4% (downgraded to Hold from Buy at ROTH Capital), NDSN -3.4% (downgraded to Hold from Buy at BB&T Capital Mkts), GRPN -3.1% (downgraded to Sell from Equal Weight at Evercore), JCP -2.5% (downgraded to Sell at Maxim Group), ICLR -1.8% (downgraded to Neutral from Buy at ISI Group), BTI -1.2% (downgraded to Sell from Neutral at Goldman)

Оригинал статьи: gtstocks.com/analytics-10-10-2014.html

теги блога GT Capital

- alibaba

- amex

- DAS

- DAS Trader PRO

- DAX

- etf

- good_trade

- gt capital

- HFT

- iLearney

- ipo

- JPMorgan

- nasdaq

- nyse

- online

- Russel 2000

- smb capital

- sterling trader pro

- takion

- traanan

- акция

- аналитика

- анонс

- бесплатное обучение

- бонус

- брокер

- брокеры

- вебинар

- видео

- Вопросы от трейдеров

- выставка

- дейтрейдинг

- дилинговый зал

- запись

- Казахстан

- комиссия

- конкурс трейдеров

- лекции

- манипуляции

- ММВБ

- наушники

- новичкам

- Новости

- обзор рынка

- обучающий курс

- обучение

- обучение трейдингу

- опрос

- отчёт

- оффтоп

- психология

- риски

- роботы

- рынок США

- сделки

- сервис

- скальпинг

- статистика

- сша

- технический анализ

- торговая платформа

- торговые роботы

- трейдинг

- фильтр

- фильтр новостей

- фондовый рынок

- чат

- электронные деньги

ВАм +