SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Рынок недвижимости, данные по безработице и производственная активность.

- 16 марта 2017, 15:24

- |

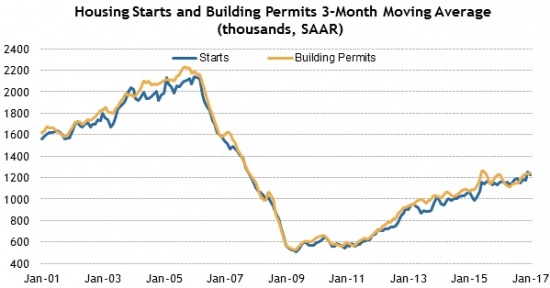

Количество новых строительств и выданных разрешений продолжают увеличиваться. Сегодня в данных аналитики ожидают значение 1,255 млн. по объему нового строительства и 1,256 млн. по выданным разрешениям:

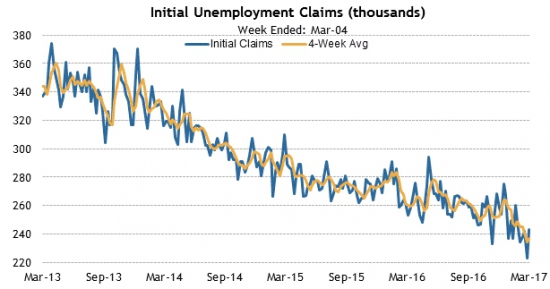

В заявках на пособие по безработице прогнозируют продолжение тенденции уменьшения и показатель на этой неделе ожидают на отметке 240 тысяч и ниже:

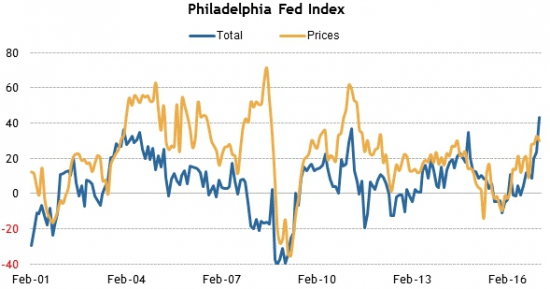

В данных по производственной активности от федерального банка Филадельфии ожидается коррекция к значению 30, показатель находится на своих максимумах:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

175

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices in the Asia-Pacific region ended Thursday on a higher note. Japan's Nikkei (+0.1%) underperformed, but still eked out a slim gain after the Bank of Japan made no changes to its policy stance. The central bank did make upbeat comments about reaching the 2.0% inflation target in the longer run. Separately, the People's Bank of China raised its short-term repurchase rates after yesterday's fed funds rate hike from the Federal Reserve.

---Equity Markets---

---FX---

WSM is currently up almost 2% around the 49 level in trading pre-market.

Gapping up:

Gapping down:

Major European indices trade higher across the board with Italy's MIB (+1.7%) showing relative strength. The upbeat disposition comes ahead of the release of the latest policy statement from the Bank of England, which is not expected to upset the current state of affairs. Elsewhere, the Swiss National Bank maintained its key rate at -0.75%, as expected. Also of note, Dutch Prime Minister Mark Rutte's People's Party for Freedom and Democracy received the most votes, but the party will now have 33 seats in the House of Representatives, down from 41 won in the 2012 election. Geert Wilders' PVV came in second, securing 20 seats. On a separate note, French BFM TV reported that one person was slightly injured in an explosion while opening an envelope at Paris offices of the International Monetary Fund. This comes after a package with explosives was found outside the German finance ministry yesterday. Greek anarchist group Conspiracy of the Cells of Fire claimed responsibility for yesterday's parcel bomb.

---Equity Markets---

Treasuries Pull Back as Central Banks Meet

The stock market looks poised to continue yesterday's afternoon rally this morning as stocks trade higher around the globe following the latest FOMC rate decision. The S&P 500 futures trade five points, or 0.2%, above fair value.

As expected, the U.S. central bank decided to raise the fed funds target range by 25 basis points to 0.75%-1.00% on Wednesday afternoon. However, the ensuing rally in the equity market was prompted by the Fed's future outlook for interest rates, which turned out to be more dovish than some investors were anticipating. The Fed stuck to its projection for two more rate hikes this year, which is in line with the market's expectation.

Crude oil looks eager to build on yesterday's bullish momentum this morning as the commodity trades 0.9% higher at $49.27/bbl. The energy component broke a seven session losing streak yesterday after the Energy Information Administration reported an unexpected draw of 200,000 barrels (+3.7 million barrels consensus).

The Treasury market jumped notably higher on Wednesday afternoon following the FOMC decision, but it has given back a portion of those gains this morning. The benchmark 10-yr yield trades three basis points higher at 2.53%.

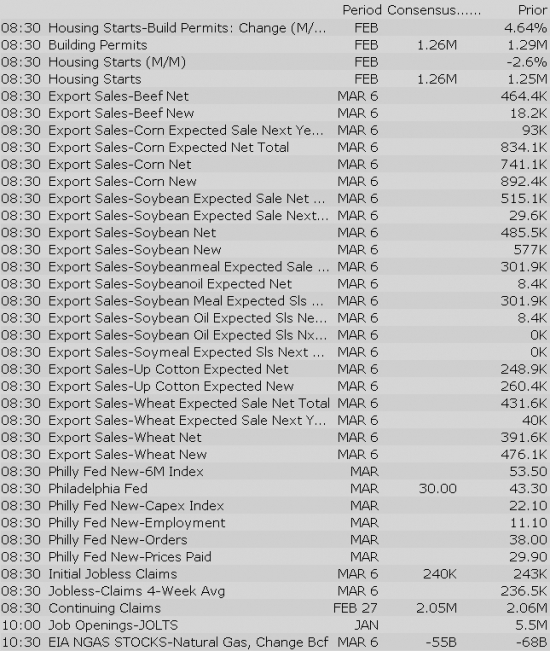

Today's economic data will include February Housing Starts (Briefing.com consensus 1.260 million), Initial Claims (Briefing.com consensus 242,000), and March Philadelphia Fed (Briefing.com consensus 25.0) at 8:30 ET, while January JOLTS will cross the wires at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Upgrades:

Downgrades:

Miscellaneous:

The S&P 500 futures trade four points above fair value.

Housing starts increased to a seasonally adjusted annualized rate of 1.288 million units in February, up from a revised 1.251 million units in January (from 1.246 million). The Briefing.com consensus expected starts to increase to 1.260 million units. Building permits decreased to a seasonally adjusted 1.213 million in February from a revised 1.293 million (from 1.285 million) for January. The Briefing.com consensus expected a reading of 1.251 million.

The latest weekly initial jobless claims count totaled 241,000 while the Briefing.com consensus expected a reading of 242,000. Today's tally was below the unrevised prior week count of 243,000. As for continuing claims, they declined to 2.030 million from the revised count of 2.060 million (from 2.058 million).

The Philadelphia Fed Survey for March declined to 32.8 from an unrevised 43.3 in February while economists polled by Briefing.com had expected a reading of 25.0.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength:

Select metals/mining stocks trading higher:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Bank of England Stays Put but Pound and Gilt Yields Jump