Блог компании DayTraderClub | Америка сегодня. Удивительный всплеск промпроизводства.

- 18 января 2017, 16:28

- |

Еженедельный показатель ставки по 30-тилетним ипотечным кредитам находится в среднесрочном растущем тренде. Аналитики ожидают приостановку этой тендендии и развитие коррекционного движения:

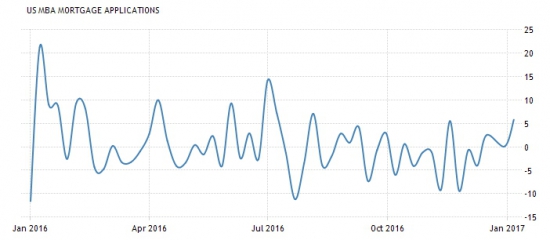

При этом количество заявок на кредиты увеличивается и подросшая ставка не пугает новых заёмщиков:

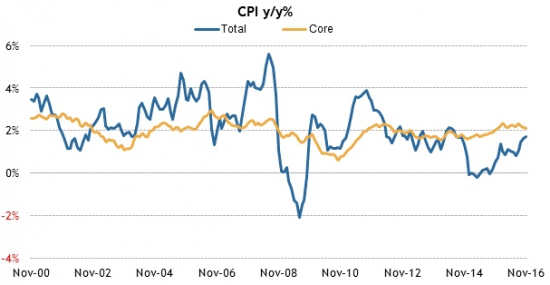

Основная новость дня — индекс потребительских цен. Показатель сохраняет растущую динамику и ожидается его дальнейший рост на 0.3%:

В годовом измерении рост составляет всего 1.7%. Ожидается, что новое значение подтянет годовой показатель инфляции к 2%:

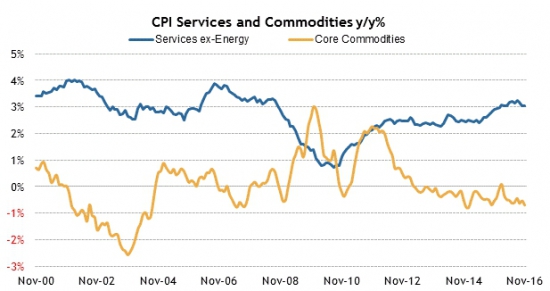

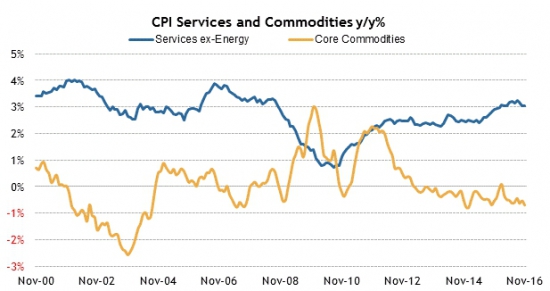

Основной рост инфляции приходится на сферу услуг. При этом товарная инфляция показывает отрицательную динамику:

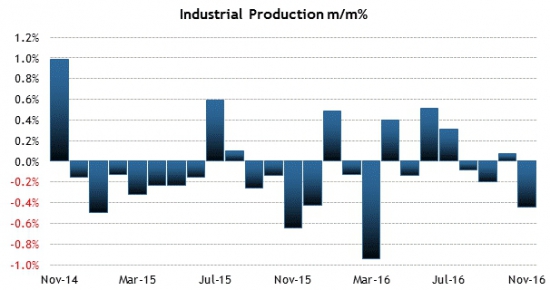

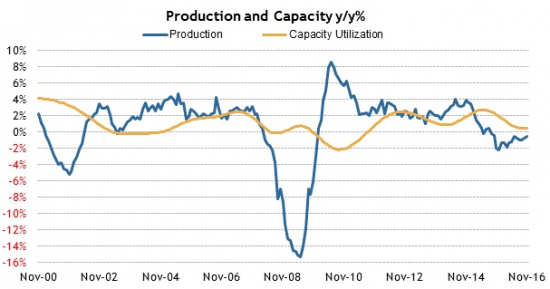

Ожидается, что промышленное производство покажет скачок с предыдущего показателя -0.4% к значению +0.8%, максимальному значению с начала 2015-го года:

На этом фоне коэффициент использования производственных мощностей выходит из понижающегося цикла и ожидается его небольшой рост к значению 75.6%:

В годовом выражении динамика производства останется нулевая:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

The global equities are generally higher today, with Asian indices catching a bid around the mid-way point of the session. This has done little to entice traders into the US futures in the premarket with the S&P sitting little changed thus far.

Market updates:

US Econ Data

Equity indices across Asia-Pacific ended the week on a mixed note, with Asian averages catching a bid around the mid-way point of the session. The Hang Seng was among the best performers of the session, with relative strength coming into the property stocks after China reported its monthly update which showed a steady rise of 12.4%.

In economic data:

---Equity Markets---

---FX---

Gapping down: GIMO -21.8%, CCJ -8%, AFAM -5.8%, NBIX -5.4%, TGT -4.4%, BCEI -4%, TDOC -3.2%, CSX -2.6%, KOPN -2.4%, TTPH -1.9%, TRCH -1.9%, GPOR -1.6%, NSC -1.3%, AMTD -0.8%, UNP -0.6%

Major bourses in Europe are flat to modestly lower, as conviction has been lacking in front of Wall Street's open. After a huge move yesterday, the British pound is backtracking some against the dollar (-0.9% to 1.2280), which is lending a measure of support to the FTSE. Otherwise, there is a wait-and-see stance developing in European markets in front of the ECB meeting on Thursday.

---Equity Markets---

---Currencies---

Treasuries Slide Ahead of CPI and Industrial Production Data

Upgrades:

Downgrades:

Miscellaneous:

Stocks with favorable mention: AAPL, BAC, CAKE, HD, HUN, JACK, JPM, MO, MPC, MS, PLKI, PM, PNRA, PVH, SLB, STZ, UNH, WFC

Stocks with unfavorable mention: EXEL, HIIQ, SDRL

U.S. equity futures are pointing to a slightly higher open this morning, following a more positive performance in Asia overnight and amid more muted market action in Europe. The S&P 500 futures trade four points above fair value.

After opening the week modestly higher, crude oil has slid 1.6% to $51.63/bbl early this morning. In addition to a strengthening U.S. dollar, the commodity's downtick has been fueled by expectations that U.S. producers will boost output.

The Treasury market is also down this morning after closing significantly higher on Tuesday. The benchmark 10-yr yield is up three basis points at 2.36%.

Today's economic data will include a host of reports, most notably of which are December CPI (Briefing.com consensus 0.3%), which will be released at 8:30 am ET, and December Industrial Production (Briefing.com consensus 0.6%) and December Capacity Utilization (Briefing.com consensus 75.4%) at 9:15 am ET.

The NAHB Housing Market Index at 10:00 am ET, the Fed's Beige Book at 2:00 pm ET, and Net Long-Term TIC Flows at 4:00 pm ET will round out the day's remaining economic data.

In U.S. corporate news of note:

Reviewing overnight developments:

European Yields Move Higher

The Company will initially add CO2 to its industrial gas line of products in the Sarasota and Ft Myers areas of Florida, with plans to expand into other retail locations in the state in the coming months.

The stock market is on track for a slightly higher open as the S&P 500 futures trade six points (+0.3%) above fair value.

Just released, total CPI rose 0.3% (Briefing.com consensus +0.3%) in December while core CPI, which excludes food and energy, increased 0.2% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.1% and core CPI has increased 2.2%.

Next on today's economic agenda is December Industrial Production (Briefing.com consensus 0.6%) and December Capacity Utilization (Briefing.com consensus 75.4%). Both reports will cross the wires at 9:15 am ET.

Filings:

Offerings:

Pricings:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select financial related names showing weakness:

Other news:

Analyst comments:

January 20: Keane Group (FRAC) — The provider of well completion services with a focus on complex oil plays is expected to price its upsized 22.3 million share IPO within a range of $17-$19. The deal was originally expected to consist of 16.7 million shares.Upcoming IPOs:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select financial related names showing weakness:

Other news:

Analyst comments:

The S&P 500 futures trade five points (+0.2%) above fair value.

Equity indices across Asia-Pacific ended the week on a mixed note, with Asian averages catching a bid around the mid-way point of the session. The Hang Seng was among the best performers of the session, with relative strength coming into the property stocks after China reported its monthly update which showed a steady rise of 12.4%.

---Equity Markets---

Major bourses in Europe are flat to modestly lower, as conviction has been lacking in front of Wall Street's open. After a huge move yesterday, the British pound is backtracking some against the dollar (-0.9% to 1.2280), which is lending a measure of support to the FTSE. Otherwise, there is a wait-and-see stance developing in European markets in front of the ECB meeting on Thursday.

---Equity Markets---

The stock market is poised for a modestly higher open as the S&P 500 futures trade four points (+0.2%) above fair value.

Just released, December Industrial Production increased 0.8% (Briefing.com consensus +0.6%) while Capacity Utilization rose to 75.5% (Briefing.com consensus 75.4%).

Earlier today, it was reported that total CPI rose 0.3% (Briefing.com consensus +0.3%) in December while core CPI, which excludes food and energy, increased 0.2% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.1% and core CPI is up 2.2%.

Financials have headlined this morning's earnings reports, with Goldman Sachs (GS 236.77, +1.03), Citigroup (C 57.96, -0.42), and U.S. Bancorp (USB 50.33, +0.02) all reporting. All three names beat earnings estimates, but revenues were mixed. Goldman Sachs is up 0.4% in pre-market trade after beating on revenues, while Citigroup is down 0.7% after missing on the same metric. U.S. Bancorp is unchanged, reporting in-line revenue results.

U.S. Treasuries have reversed yesterday's trend as they sit in negative territory this morning. The benchmark 10-yr yield is up five basis points at 2.37%.

Crude oil is also down, losing 2.2%. The energy component trades at $51.29/bbl amid concerns that U.S. producers will boost output.

The stock market opened Wednesday's session flat as the S&P 500 remains unchanged.

Financials (-0.2%) are showing modest losses in early action after Goldman Sachs (GS 236.77, +1.03), Citigroup (C 57.96, -0.42), and U.S. Bancorp (USB 50.33, +0.02) all reported before the opening bell. The three names beat earnings expectations, but came up mixed on the revenue front. Regardless, the three financial heavyweights are down between 0.1% and 1.0% as it appears that some of yesterday's sell-the-news mentality has carried over into today.

Consumer discretionary (-0.4%) is among those at the bottom of today's leaderboard after Target (TGT 67.37, -3.59) lowered its Q4 guidance following disappointing holiday sales. The company is down 5.0%, while other heavily-weighted consumer discretionary components like Amazon (AMZN 806.78, -2.94), Home Depot (HD 135.31, -0.62), and Nike (NKE 53.23, -0.45) are down between 0.3% and 0.7%.

The tech sector — XLK — trades ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +1.23%. Within the SOX index, MKSI (+2.05%) outperforms, while TSM (-0.03%) lags. Among other major indices, the SPY is trading 0.03% higher, while the QQQ +0.17% and the NASDAQ -0.13% trade opposite on the session. Among tech bellwethers, AVGO (+1.73%) is showing relative strength, while NTES (-1.66%) lags.

Notable gainers following earnings:

Gainers on news:

Laggards on news:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.15… VIX: (12.24, +0.37, +3.1%).

This Week is options expiration — Friday, January 20th is the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

- Apricus Biosciences (APRI +150.7%) announces that Mexico has granted the co's commercialization partner, Ferring Pharmaceuticals, market approval for Vitaros

- CoLucid Pharma (CLCD +32.38%) to be acquired by Eli Lilly (LLY) for $46.50/share or about $960 mln in cash

- aTyr Pharma (LIFE +27.55%) FDA grants Fast Track Designation for aTyr's Resolaris to treat limb girdle muscular dystrophy 2b and removes partial clinical hold for resolaris

Decliners on news:- EnteroMedics (ETRM -35.06%) prices $16.5 mln underwritten public offering of units at $5.31/unit

- Hemispherx Biopharma (HEB -5.98%) enters into a purchase order with Jubilant Hollister Stier pursuant to which Jubilant will manufacture a commercial batch of Ampligen for the Company

Gainers on earnings:- Corindus Vascular Robotics (CVRS +2.51%) sees FY17 (Dec) revs of $13-15 mln, prior $12 mln+ vs. $12.04 mln Capital IQ Consensus Estimate

Decliners on earnings:- iRadimed (IRMD -18.11%) sees Q4, Q1 and FY17 below consensus

Upgrades/Downgrades:Biggest point losers: GIMO 31.65(-12.4), NTES 235.79(-7.29), NTRS 83.77(-4.38), CMG 401.58(-4.29), TGT 67.46(-3.48), UNH 157.3(-3.36), DLTR 76.54(-2.97), CI 142.01(-2.76), PVH 92.8(-2.03), DG 72.35(-1.98), CRI 86.11(-1.97), CCJ 11.45(-1.82), BIDU 175.25(-1.71), STZ 152.2(-1.53), PANW 137.01(-1.44), PI 30.28(-1.43), HP 78.4(-1.4), Q 75.39(-1.4), SHPG 166.8(-1.38), VFC 50.84(-1.3), IBKR 36.81(-1.21), NFLX 131.75(-1.14), PRGO 75.42(-1.13), EFX 119.53(-1.13), CBSH 54.78(-1.12)

Stocks that traded to 52 week lows: ACUR, AMCN, AVGR, BONT, COSIQ, DRYS, ECYT, EMG, FENX, FIT, GBSND, HIMX, ICLD, IPWR, IRMD, KONA, M, MACK, MYGN, OMAB, PRGO, PSO, SMRT, TVIX, VFC, VLRS, VNCE, VSTO

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ASRV, BRT, DAX, FTAG, GGE, GILT, GRVY, GSH, GULF, KFS, LAND, MILN, MPB, NSSC, OFS, OVLY, PBBI, RMCF, SPAN

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: CGG

ETFs that traded to 52 week highs: EWG, GULF

ETFs that traded to 52 week lows: VXX

Today's top 20 % gainers

- Healthcare: JAZZ (125.75 +8.81%), ALDR (22.9 +6.26%), INSY (10.84 +5.24%), NBIX (41.89 +4.28%), RDUS (44.61 +4.21%)

- Materials: AKS (10.03 +6.18%), VALE (10.06 +5.73%), X (33.86 +5.02%), VEDL (14.43 +4.34%), CMC (20.95 +4.33%), AA (34.02 +4.23%), ATI (17.15 +3.53%),

- Industrials: FAST (50.81 +5.29%)

- Consumer Discretionary: IRBT (60.52 +3.52%)

- Information Technology: ASML (123.48 +6.53%), XTLY (12.4 +5.98%), RATE (11.65 +3.56%), CGNX (66.82 +3.39%)

- Financials: JNS (13.59 +3.82%)

- Consumer Staples: VGR (23.09 +3.5%)

Today's top 20 % losersToday's top 20 volume

- Materials: VALE (20.92 mln +5.73%), AKS (10.05 mln +6.18%), MT (9.86 mln +2.03%), X (9.09 mln +5.02%)

- Industrials: CSX (9.44 mln -2.42%), GE (9.31 mln +0.01%)

- Consumer Discretionary: F (10.23 mln -0.36%), JCP (10.05 mln -1.87%), TGT (8.89 mln -5.06%)

- Information Technology: AMD (25.9 mln +1.22%), AAPL (8.7 mln +0%)

- Financials: BAC (59.5 mln +1.45%), C (12.53 mln -1.48%), CS (9.56 mln -1.91%), JPM (9.38 mln -0.02%), RF (8.68 mln -0.07%), WFC (8.62 mln -0.46%)

- Energy: CHK (12.38 mln +0.01%)

- Consumer Staples: RAI (11.62 mln +0.33%), ABEV (8.73 mln +1.22%)

Today's top relative volume (current volume to 1-month average daily volume)The Industrials sector (XLI) is trading 0.5% higher today, higher than the broader market (SPY +0.1%). In the industrial sector, United Continental (UAL +0.4%) and CSX (CSX -2.4%) report Q4 results, Icahn Enterprises (IEP +0.5%) extends tender offer for Federal-Mogul (FDML +1.2%) to midnight tonight.

Notable airlines moving today: DAL -0.2% LUV -0.3% AAL +2% ALK -0.26% JBLU -0.3% SAVE +0.94% HA +0.8%

Earnings/Guidance

News

Broker Research

Upgrades

Downgrades

Other

Notable earnings/guidance:

Earnings/guidance secondary plays:

- Retail sector is under pressure today after disappointing guidance from TGT / ASNA / BGFV.

- A few names trading notably lower include: TUES -7% (continued weakness following guidance; also downgraded to Hold from Accumulate at Johnson Rice), PIR -3.4%, M -2.9%, COLM -2.8%, DXLG -2.8%, DLTR -2.4%, CTRN -2.3%, VRA -2.2%, HBI -2.1%, FOSL -1.7%, GPS -1.9%, GES -1.4%, TCS -1.6%, ZUMZ -2%, PVH -1.5%, PERY -1.6%, CONN -1.6%, KIRK -1.6%, BKE -1.2%, SSI -1.2%, WWW -1.4%, JCP -1.6% (downgraded to Underperform from Neutral at Credit Suisse), KSS -1.5% (downgraded to Underperform from Neutral at Credit Suisse), CROX -1.3%, SHOO -1.3%, JWN -1.1% (lower despite being upgraded to Outperform from Neutral at Credit Suisse)

In the news:- Leaders: NXST 1.1% (Nexstar completes Media General acquisition and related divestitures; increases pro-forma average annual free cash flow guidance for the 2016/2017 cycle to approx. $565 mln vs prior guidance of $540 mln), GTN 2.6% (reaches agreement in principle with Dish Network)

- Laggards: TIME -1.8% (Hearst Company not planning on purchasing publications unit, according to NY Post)

- Nearly unchanged: DPZ (Lemelson Capital Management releases 2016 performance results for The Amvona Fund; confirms 'substantially' increased its short position in Domino's Pizza)

Analyst related:The broader market is mixed into midday, with the Nasdaq Composite leading action higher, now up 6 points (+0.10%) to 5544, the S&P 500 is also in the green, higher by less than a point though (+0.02%) to 2268, and the Dow Jones Industrial Average lags, down about 47 (-0.24%) to 19779. Action has come on lower than average volume (NYSE 287 vs. avg. of 346; NASDAQ 757 mln vs. avg. of 808), with advancers outpacing decliners (NYSE 1620/1328, NASDAQ 1449/1242) and new highs outpacing new lows (NYSE 73/11, NASDAQ 56/21).

Relative Strength:

Steel-SLX +2.6%, Metals&Mining-XME +2.2%, Base Metals-DBB +1.3%, Semis-SMH +1.3%, Hong Kong-EWH +1.0%, Sugar-SGG +1.0%, China Lg.-Cap-FXI +0.8%, Insurance-KIE +0.8%, Peru-EPU +0.6%, US Basic Materials-IYM +0.6%, Vietnam-VNM +0.5%, Russia-RSX +0.5%, Turkey-TUR +0.3%, Sweden-EWD+0.2%.

Relative Weakness:

Brazil-BZF -2.5%, Egypt-EGPT -1.8%, US Nat Gas-UNG -1.6%, Cocoa-NIB -1.4%, Infrastructure-GRID -1.4%, US Gasoline-UGA -1.2%, S. Korea-EWY -1.1%, US Oil-USO -1.1%, Mexico-EWW -1.0%, Canadian Dollar-FXC -0.9%, Canada-EWC -0.9%, 20+ Yr. Treas. Bond-TLT -0.9%, Colombia-GXG -0.8%, US Healthcare Prob.-IHF -0.7%

Rumor Activity was active today.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.