SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Блок важных новостей.

- 13 января 2017, 16:45

- |

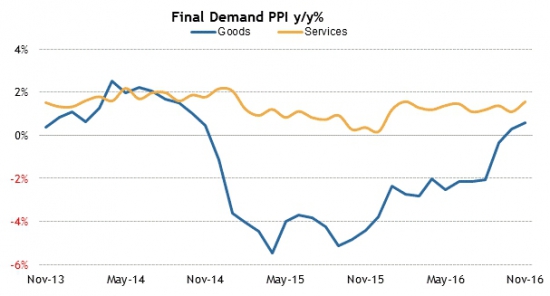

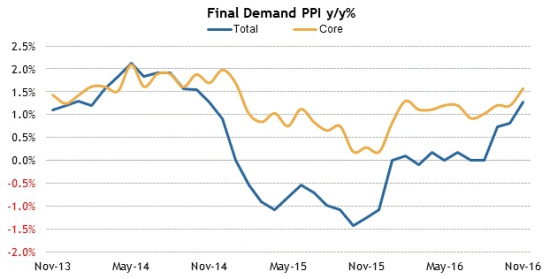

Индекс цен производителей находится в восходящем тренде.

Аналитики ожидают его разворот. Сюрпризом будет любое значение, превышающее прошлые 0.4%:

Психологическим барьером для индекса является значение 111, выступившее остановкой для восходящего цикла:

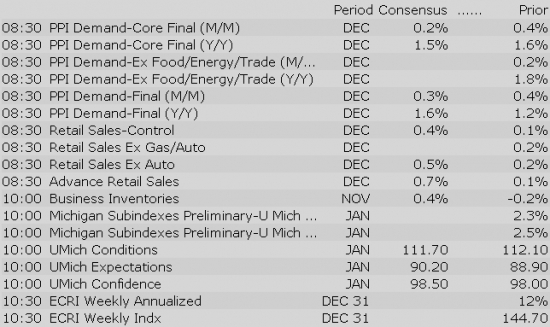

Вместе с индексом цен выходят данные по розничным продажам

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

29

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Equity indices across Asia-Pacific ended the week on a mixed note. Japan's Nikkei (+0.8%) was a pocket of relative strength after the yen retreated into overnight action. However, the yen has reclaimed its slim loss against the dollar this morning. The latest trade data from China showed a surplus, but the size of the surplus reached a nine-month low. Elsewhere, the Bank of Korea left its key interest rate unchanged at 1.25%, as expected.

---Equity Markets---

---FX---

Gapping down: URRE -22.7%, SKLN -14.9%, HMST -3.1%, INFY -3%, RBA -2.8%, FCEL -2.6%, FCAU -2.3%, OOMA -2.2%, TWO -2.2%, LYG -1.5%, CLF -1.4%, VALE -1.3%, RIO -1%, WPX -0.9%, GME -0.9%, ABT -0.7%, BCS -0.6%, BAC -0.5%, BAC -0.5%

Major European indices trade in the green with Italy's MIB (+1.4%) showing relative strength amid gains in bank stocks. Bank of France Governor Francois Villeroy de Galhau said that concerns about rising inflation are «very exaggerated.» Separately, British Prime Minister Theresa May is expected to make a «major» Brexit-related speech on Tuesday, January 17. Also of note, German Finance Minister Wolfgang Schaeuble spoke in favor of taking steps to unwind the European Central Bank's ultra-loose monetary policy this year.

---Equity Markets---

Treasuries Recover from Thursday Afternoon's Sell-Off

«short term I would say I don't think there are serious obstacles. I see the economy as doing quite well»

Upgrades:

Downgrades:

Miscellaneous:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Stocks with favorable mention: AAP, AMT, AMZN, AZO, BCS, DAL, ETFC, HAS, HP, KBH, MS, ORLY

Stocks with unfavorable mention: BEN, KMI, MAT, PLD, SAN, VC

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Panera is the first national restaurant company to make such a comprehensive commitment and, more importantly, to meet it.

The stock market is poised for a slightly higher open as the S&P 500 futures trade two points above fair value.

Banks dominated the earnings front today, with JPMorgan Chase (JPM 86.80, +0.56), Bank of America (BAC 22.84, -0.08), Wells Fargo (WFC 54.15, -0.40), BlackRock (BLK 381.00, 2.71), and PNC Financial Services (PNC 118.00, +0.07) all reporting. Bank of America and Wells Fargo are both down 0.4% and 0.7%, respectively, after disappointing results. Conversely, JPMorgan Chase, BlackRock, and PNC are all up between 0.6% and 0.8%, after reporting better-than-expected earnings.

In corporate news, Pandora Media (P 13.00, +1.00) has jumped 8.3% after saying it expects to surpass fourth-quarter guidance. In addition, the New York Post reported that Sirius XM (SIRI 4.58, 0.00) might be interested in acquiring the company.

U.S. Treasuries have seen a downtick in recent action, with the 10-yr yield up three basis points to 2.39%.

On the data front, December retail sales increased 0.6%, which compares to the Briefing.com consensus of 0.7%. The prior month's reading was revised higher to 0.2% from 0.1%. Excluding autos, retail sales rose 0.2% while the consensus expected an uptick of 0.6%. The prior month's reading was revised higher to 0.3% from 0.2%.

December producer prices increased 0.3%, which is in line with the Briefing.com consensus. Core producer prices increased 0.2% while the Briefing.com consensus expected an increase of 0.1%.

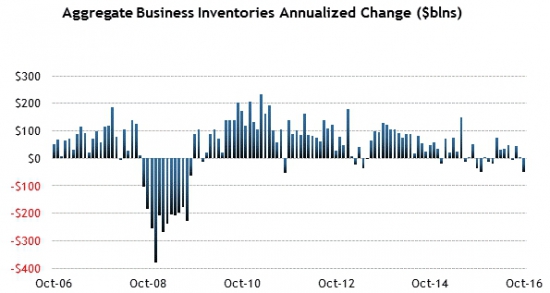

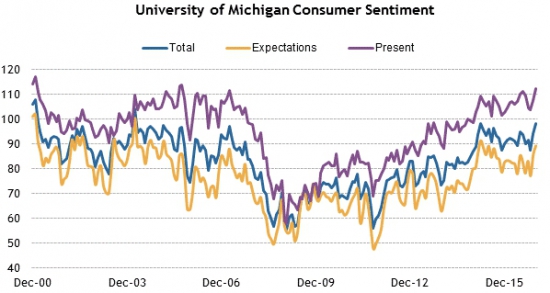

In addition to PPI and Retail Sales, today's economic data will also include November Business Inventories (Briefing.com consensus 0.6%) and the January Michigan Sentiment Index (Briefing.com consensus 98.5). The two reports will be released at 10:00 am ET.

The stock market has sprung upward out of the gate, piggybacking on the financial sector (+1.4%) after an array of banks reported their quarterly results this morning. The S&P 500 is higher by 0.3%.

Financials lead with Bank of America (BAC 23.20, +0.28), JPMorgan Chase (JPM 87.42, +1.23), and Wells Fargo (WFC 55.49, +0.99) all up between 1.4% and 1.9% despite reporting mixed earnings results. The top-weighted technology sector (+0.2%), consumer discretionary (+0.2%), and industrials (+0.3%) battle for second place while non-cyclical sectors generally sit in the red.

U.S. Treasuries continue to fall in early action, surpassing their overnight lows. The benchmark 10-yr yield is five basis points higher at 2.41%.

General Commentary: The materials sector is trading lower by 0.1% which is under-performing the S&P 500 (+0.3%). Oil is trading lower by 0.5% in today's session. Gold prices are higher by 0.2%, while copper is down -0.8%. There is no notable M&A news in the sector today.

Earnings:

Decliners:

News

Gainers

Decliners:

Analyst Actions

Decliners:

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.47%. Within the SOX index, SIMO (+2.35%) outperforms, while MU (-0.94%) lags. Among other major indices, the SPY is trading 0.31% higher, while the QQQ +0.31% and the NASDAQ +0.36% also trade slightly higher today. Among tech bellwethers, QCOM (+0.99%) is showing relative strength, while VOD (-0.84%) lags.

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings tomorrow morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Economic Data Summary:

Upcoming Economic Data:

Other International Events of INterest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.65… VIX: (11.27, -0.27, -2.3%).

January 20 is options expiration — the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Rumor activity was active to close out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The Industrials sector (XLI) is trading +0.4% today, higher than the broader market (SPY +0.3%). In a slow day in the industrial sector, Genesee & Wyoming (GWR +2.5%) reports December traffic and a transition spokesperson says that President Elect Trump will meet with Lockheed Martin's (LMT +0.8%) CEO at 12pm ET today.

Earnings

News

Broker Research

Upgrades

Downgrades

Other

Stocks that traded to 52 week lows: BF.B, BONT, COSIQ, DRYS, EMG, FESL, FTEK, GBSND, HIMX, ICLD, IFON, M, SQQQ, TVIX, TWER, VFC, YECO

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ANCX, CLRO, ENFC, FSZ, GBLI, GTWN, IPKW, ISTR, MMAC, NAKD, NVEC, ONEQ, OVLY, PBBI, PTNR, RGT, SGU, TWIN

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ATAI, CGG, MXPT

ETFs that traded to 52 week highs: EWG, EWQ, FDN, IAI, IWF, IYG, QQQ, SKYY, XLK

ETFs that traded to 52 week lows: VXX

Today's top 20 % gainers

- Healthcare: DXCM (86.38 +27.76%), FOLD (6.15 +10.02%), ARRY (11.01 +8.9%), PODD (43.08 +7.35%), TSRO (157.34 +7.05%), SGMO (4.2 +6.33%), CLVS (56.55 +5.72%), ALDR (22 +5.52%), CYH (6.93 +5.31%)

- Materials: CENX (11.03 +6.47%)

- Industrials: GRAM (4.74 +7.48%), YRCW (14.37 +5.66%), CFX (38.97 +5.61%)

- Consumer Discretionary: ENT (6.71 +6.51%), THRM (35.28 +6.41%)

- Information Technology: RUBI (8.57 +12.11%), P (12.83 +6.92%), SSNI (13.38 +5.77%), ATHM (30.18 +5.49%)

- Energy: SN (10.94 +25.69%)

Today's top 20 % losersToday's top 20 volume

- Materials: FCX (19.79 mln -0.39%), VALE (17.02 mln +2.7%)

- Consumer Discretionary: FCAU (17.51 mln -3.81%), JCP (12.28 mln -1.74%), F (11.91 mln -0.48%), SIRI (11.54 mln +0.51%)

- Information Technology: AMD (17.32 mln -1.15%), FB (12.15 mln +2%), P (11.47 mln +6.92%), INFY (11.15 mln -6.46%), AAPL (9.94 mln -0.09%), NOK (9.69 mln +1.49%)

- Financials: BAC (95.47 mln +0.92%), WFC (18.77 mln +2.2%), JPM (14.83 mln +0.86%), RF (14.43 mln +2.63%), C (11.62 mln +1.42%)

- Energy: WPX (34.13 mln +1.38%), CHK (11.12 mln -0.43%)

- Consumer Staples: RAD (23.08 mln -0.06%)

Today's top relative volume (current volume to 1-month average daily volume)The broader market displays relative strength at the moment, rebounding off yesterday's losing affair with the Nasdaq Composite leading up 33 points (+0.59%) to 5580, the S&P 500 is higher by 5 (+0.22%) to 2275, and the Dow Jones Industrial Average gains 8 (+0.04%) to 19898. Action has come on mixed average volume (NYSE 278 vs. avg. of 348; NASDAQ 813 mln vs. avg. of 802), with advancers outpacing decliners (NYSE 1854/1091, NASDAQ 1999/747) and new highs outpacing new lows (NYSE 114/7, NASDAQ 127/11).

Relative Strength:

Mexico-EWW +2.1%, Egypt-EGPT +1.8%, Turkey-TUR +1.7%, Semis-SMH +1.5%, Clean Energy-PBW +1.3%, Reg. Banking-KRE +1.3%, US Nat Gas-UNG +1.2%, Saudi Arabia-KSA +1.2%, S. Africa-EZA +1.2%, Biotech-IBB +1.2%, Coal-KOL +1.2%, Banking-KBE +1.2%, Sweden-EWD +1.1%, Nordic 30-GXF +0.8%.

Relative Weakness:

Greece-GREK -1.7%, Russia-RSX -1.3%, Brazil-EWZ -1.3%, US Diesel/Heating Oil-UHN -1.3%, India-INP -1.0%, Colombia-GXG -0.9%, Malaysia-EWM -0.9%, US Oil-USO -0.9%, Philippines-EPHE -0.8%, Cocoa-NIB -0.8%, 20+ Yr. Treas. Bond-TLT -0.8%, Short-Term Futures-VXX -0.8%, Jr. Gold Miners-GDXJ -0.7%, Oil Svcs-OIH -0.6%.

- Dexcom (DXCM +29.73%) Centers for Medicare & Medicaid Services (CMS) Classify Therapeutic Continuous Glucose Monitors (CGM) as «Durable Medical Equipment» under Medicare Part B

- Rxi Pharma (RXII +15.6%) OPKO Health (OPK) increases stake to 5.11% (Prior 3.43%), changes shareholding position to passive from active

- Titan Pharma (TTNP +7.93%) announces that the CMC has granted a permanent J-code for Probuphine; the new J-code became effective January 1, 2017

Decliners on news:- Skyline Medical (SKLN -14.57%) announces the pricing of a firm commitment underwritten public offering of 1,750,000 units at an offering price of $2.25/unit

Upgrades/Downgrades:Biggest point losers: PVH 90.02(-3.11), PSA 214.64(-2.66), GNRC 38.51(-2.4), GME 22.63(-2.09), HUM 203.23(-2.02), ATHN 121.24(-1.84), HMST 29.5(-1.45), FANG 102.15(-1.42), NEE 118.17(-1.33), BLL 75.8(-1.25), TDG 252.49(-1.13), AAOI 28.8(-1.06), BHI 61.41(-1.01), TLT 120.88(-1.01), INFY 14.3(-0.96), CF 33.58(-0.93), EGN 54.61(-0.91), BURL 84.43(-0.88), EXR 72.93(-0.88), RCL 85.04(-0.85), SM 33.44(-0.81), WGL 79.45(-0.81), MSM 98.83(-0.8), TSO 79.89(-0.79), K 71.13(-0.79)

Notable earnings/guidance:

- Trading higher following earnings/guidance:

- P 7.9% (issued upside guidance, NYPost also reported potential Sirius M&A interest)

- MNST 3% (following presentation last night showing sales trends)

- MTN 1.9% (management sticks by FY17 guidance despite slow start to ski season)

- Trading lower following earnings/guidance:

- GME -8.8% (reaffirms Q4 $2.23-2.38 vs $2.33 Capital IQ Consensus Estimate; holiday comps -19%; downgraded to Neutral at Macquarie)

In the news:- National Retail Federation says holiday retail sales increased 4% in 2016 to $658.3 billion.

- Leaders:

- PENN 0.2% (Penn Natl Gaming prices $400 mln of 5.625% Senior Notes due 2027)

- Laggards:

- KODK -0.2% (announces action to streamline costs in its Prosper business while the sale process continues, sees restructuring and related charges of $12-$17 mln)

- K -0.8% (names Fareed Khan as CFO effective February 17)

Other notable trends:- For profit education names are higher: UTI +4.2%, EDU +2.1%, CPLA +1.8%, APEI +1%, LOPE +0.7%, DV +0.6%, NORD +0.6%, CECO +0.6%, LINC +0.5%, STRA +0.5%, GHC +0.3%, BPI +0.2%, APOL +0.1%

Analyst related:The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.86… VIX: (11.27, -0.27, -2.3%).

January 20 is options expiration — the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Dollar Drifts Lower, Lira and Peso Recover