SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по деловой активности, занятости и заявкам на пособия.

- 05 января 2017, 16:22

- |

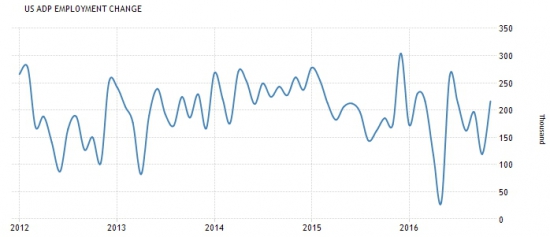

День в преддверии новостей. В качестве разминки сегодня выходит доклад о занятости населения в частном бизнесе:

Аналитики сходятся в позиции замедления роста, но вопрос состоит в скорости остановки, ожидается сокращение прироста до 180-170 тысяч новых рабочих мест:

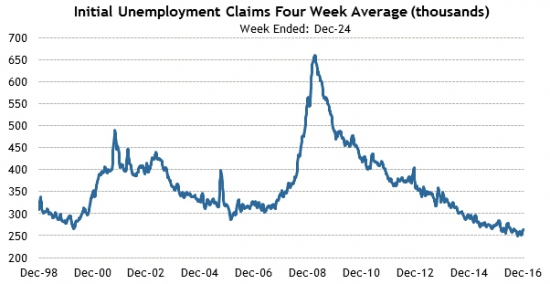

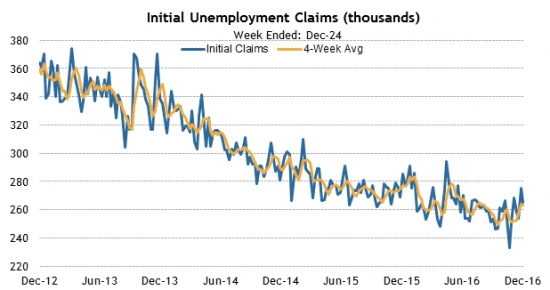

Также выходят первичные заявки на пособие по безработице, находящиеся на своих минимальных значениях:

Ожидается продолжение небольшого всплеска обращений и выход данных о количестве новых заявок выше 260 тысяч:

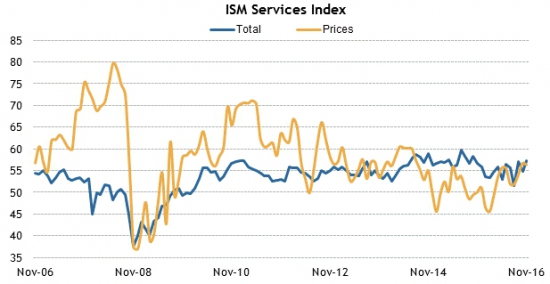

Индекс деловой активности в сфере услуг также продолжает свой рост, новое значение ожидается на уровне 57.5:

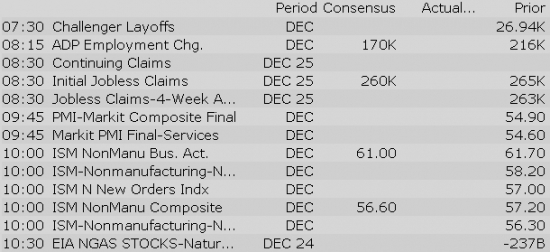

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

20 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Stocks with favorable mention: AMD, AMT, BA, COST, D, GM, KMB, LMT, MB, SBAC, SON, UTX

Stocks with unfavorable mention: CCI

Eurozone Periphery Suffers as Producer Prices Climb

Spain sold EUR813 mln of 30-year ODEs at an average yield of 2.761% with a bid-to-cover ratio of 1.43

Всем привет… если пойдут то будет круто, не пойдут ну и ладно ...