SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по автопрому.

- 04 января 2017, 17:54

- |

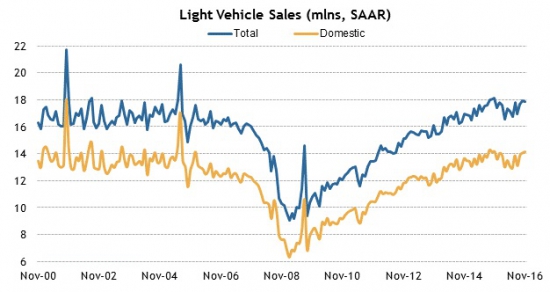

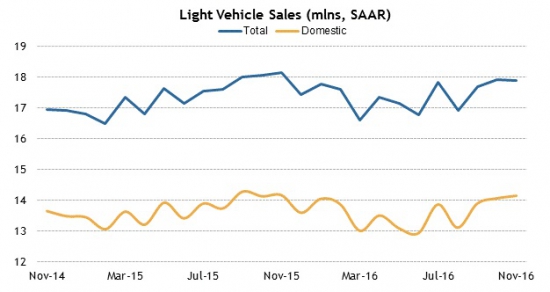

День без важных новостей. Все аналитики ожидают пятницу с данными по рынку труда. Сегодня данные по автопрому, радующему положительной динамикой. Ожидается дальнейший рост продаж.

Перед открытием рынка уже вышли данные по заявкам на кредитование недвижимости, показатель сезонно упал с 2.5% до 0.1%:

Данные: Briefing, Interactive, Economics, Public Sources

27 |

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Gainers

Analyst :

The purchase price for the interest is $5,500 per net mineral acre, or a total of $1.1 million

M&A news:

metals/mining stocks trading higher:

reaction to disappointing earnings/guidance: